How to Earn Up to 26% APR with the stETH-ETH LP on Camelot on Arbitrum

Before we get started, this is not a recommendation or endorsement to buy any token mentioned.

Another week, another new DeFi protocol showing strength on Arbitrum! Camelot is a new "ecosystem-focused and community-driven DEX built on Arbitrum” designed to allow “both builders and users to leverage our custom infrastructure for deep, sustainable, and adaptable liquidity.”

Camelot’s mission is to become the go-to native DEX on Arbitrum, with new and improved flexibility and control tools to bootstrap and sustain their own liquidity. I would compare Camelot’s ambitions on Arbitrum to what we’ve seen Velodrome achieving on Optimism.

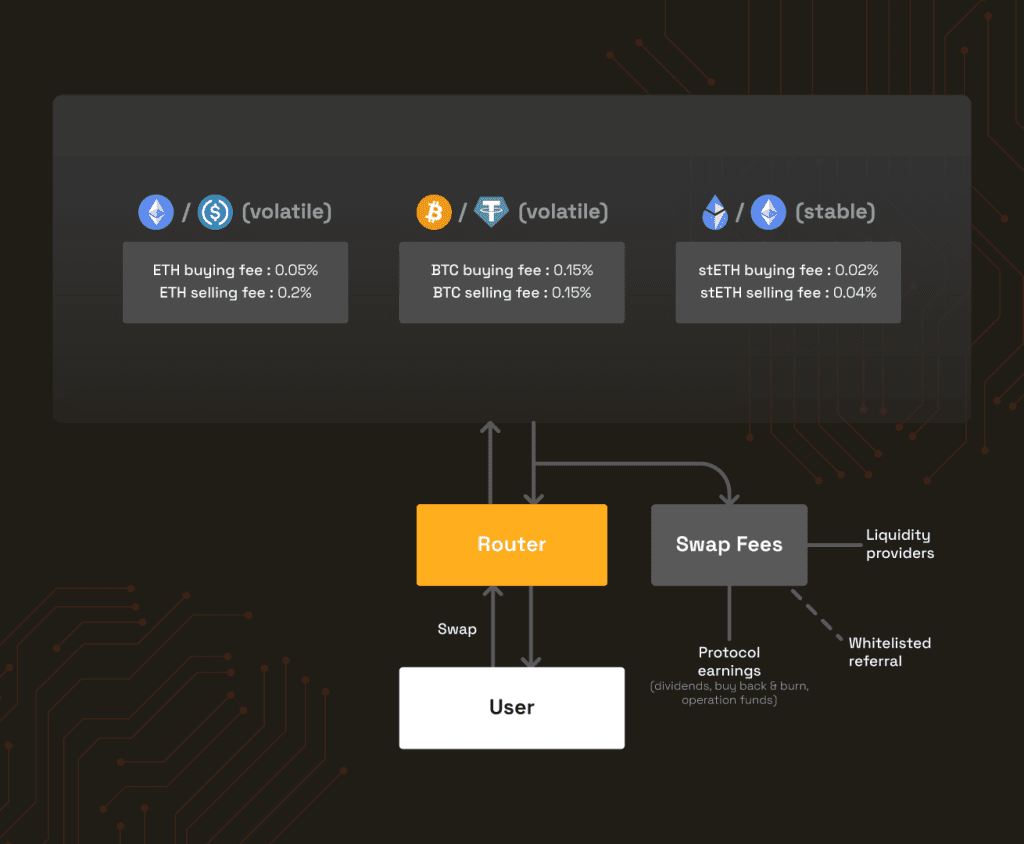

Similar to Velodrome, Camelot is based on a dual-liquidity model for LPs, meaning that both volatile (uncorrelated pairs like ETH-FRAX) and stable (correlated pairs like FRAX-DAI) assets can be traded with optimal slippage (see examples below).

Camelot also introduces the concept of dynamic directional swap fees that can be based on market conditions and protocols’ specifics. Here’s how it works!