Ethena Airdrop Strategy: DeFi’s Next Big Stablecoin with Double-Digit Yield

Before we get started, this is not a recommendation or endorsement to buy any token(s) mentioned.

This week, we cover the mainnet launch of Ethena–the new protocol powering a delta-neutral synthetic dollar USDe, backed by ETH staking yield and automated, programmatic delta-neutral hedges.

USDe represents a crypto-native stablecoin made possible by long term ETH LST yield combined with the fees earned for shorting ETH on centralized and decentralized perps exchanges.

As DeFi attempts to create a new parallel financial system, stablecoins are the most important financial instrument but they remain tethered to, and reliant upon the dollar and the related banking system.

Ethena is aiming to provide a more scalable crypto-native form of money to power DeFi by introducing a dollar denominated savings instrument in USDe, a basic product we can all enjoy permissionless access to on-chain.

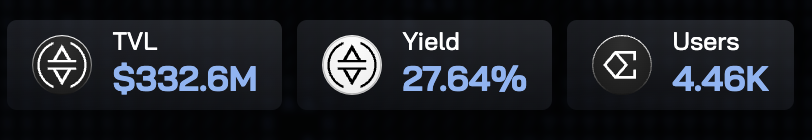

The current USDe yield, a weekly average of funding yield and LST yield divided by staked USDe supply, annualized with weekly compounding is a staggering 27%! By now, you’re probably wondering how on earth are they generating 27% APY?!

The yield originates from two places:

- Staked ETH yield

- Funding and basis spread earned from the delta hedging derivatives positions from shorting ETH

When minters deposit stETH to mint USDe, Ethena Labs opens corresponding short derivatives positions to hedge the delta of the received assets. Historically, there has been a positive funding rate and basis spread earned

Responses