New Omnipool Strategies: How to Earn Maximum Passive LP Yields with Opal

Before we get started, this is not a recommendation or endorsement to buy any token(s) mentioned.

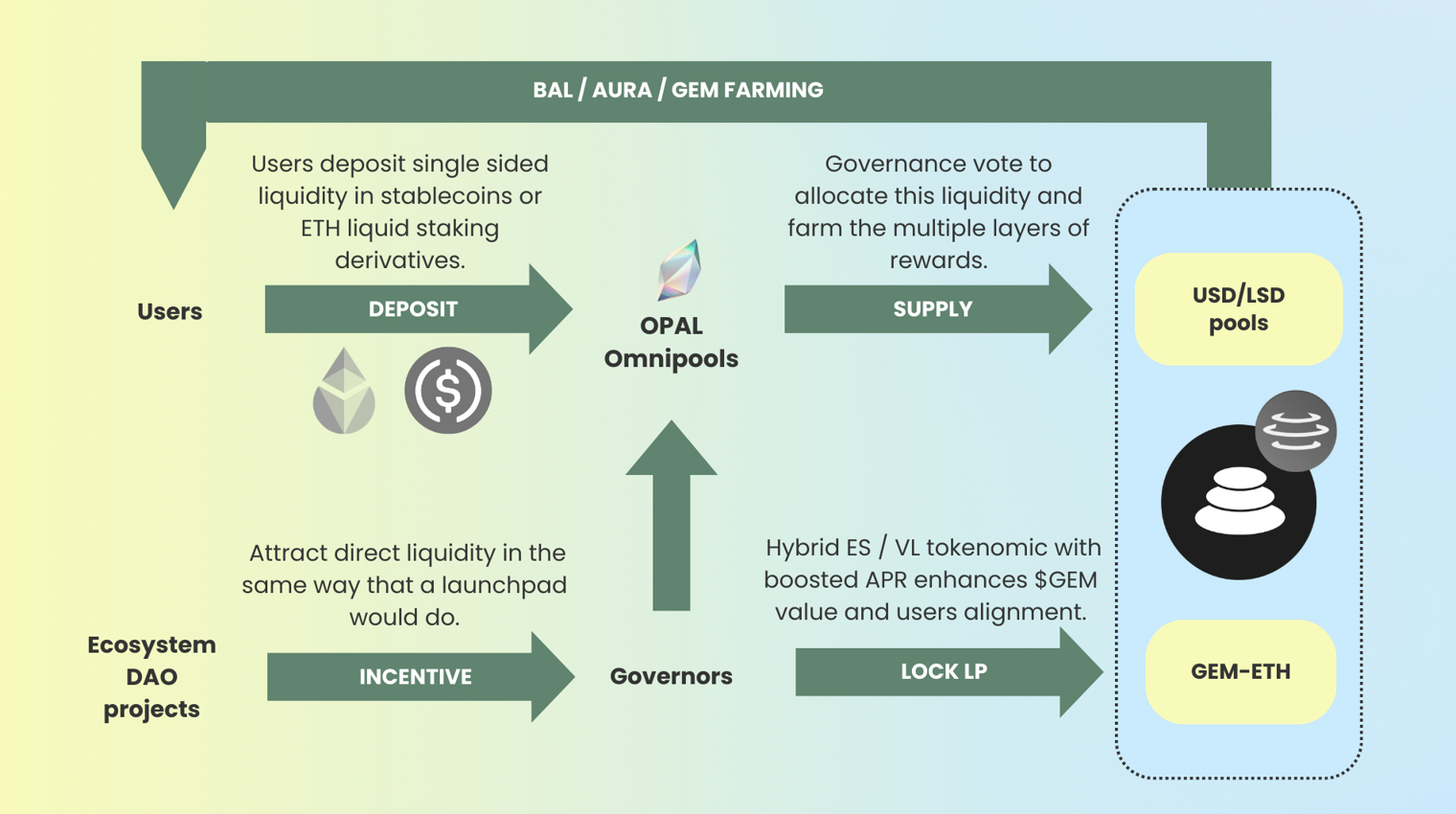

This week, we cover a newly launched omnipool protocol built on top of Aura and Balancer called Opal.

Similar to Conic Finance built for Curve, Opal provides liquidity pools where users can deposit a single asset and the omnipool then allocates liquidity to a set of whitelisted Balancer pools.

This protocol is designed to offer set-and-forget, gas efficient, diversified and less time-consuming access to farming opportunities.

Opal is a protocol built on Ethereum Mainnet but likely to expand to L2s with DEX protocols such as Maverick in the future.

Currently, Opal is aiming to enhance the DEX liquidity flywheel for the Balancer ecosystem. With Aura Finance, liquidity providers (LPs) enjoy boosted Balancer LP yields thanks to protocol-owned veBAL which allows Aura to earn maximum yields.

Aura’s design is very similar to what many LPs have enjoyed in Convex Finance.

However, there are 2 major drawbacks for users of Aura Finance. One is the need to continually monitor and seek out the highest boosted yields for LPs, and two is the need to create an LP by pairing multiple tokens vs depositing a single asset.

Until now! Having just launched on March 9th, Opal makes it possible for users to deposit single assets such as ETH, while Opal governance auto-allocates the liquidity towards various underlying DEX pools, to farm multiple rewards denominated in AURA, BAL, trading fees,

Responses