NFT Crash: What Happens Next?

TL;DR

PFP floor prices have crashed, and while the badly received Azuki Elementals launch appears to have been the trigger, token-farming activity and risky loans on the Blur trading platform, along with a trading environment dominated by whales, all appear to have created a highly unstable NFT market.

Amid a huge NFT crash, the space seems to be approaching some kind of capitulation. If you’re thinking, what, again, that’s understandable: it’s true that NFTs are fraught with drama and volatility all the time. However, the past week or so has been especially brutal, so let’s analyze the key triggers and consider what happens next.

Did Azuki Crash the Market?

This was mentioned last week so I won’t go into details again, but the TLDR is that Azuki launched a disastrous new PFP companion collection, which expanded supply on the project by 20,000 and crashed prices on all Azuki NFTs, just as almost the entire PFP market also went into freefall. But could the collapse in sentiment around Azuki really have spilled out that badly across all PFP collections?

Blur, Blend and Blood on the Floor

Azuki looks like the trigger, but there had to be cracks already for a collapse to happen, and one factor seems to be token incentives on NFT trading platform Blur, which have resulted in a small number of whales endlessly churning through NFT trades at a loss, in order to farm token rewards.

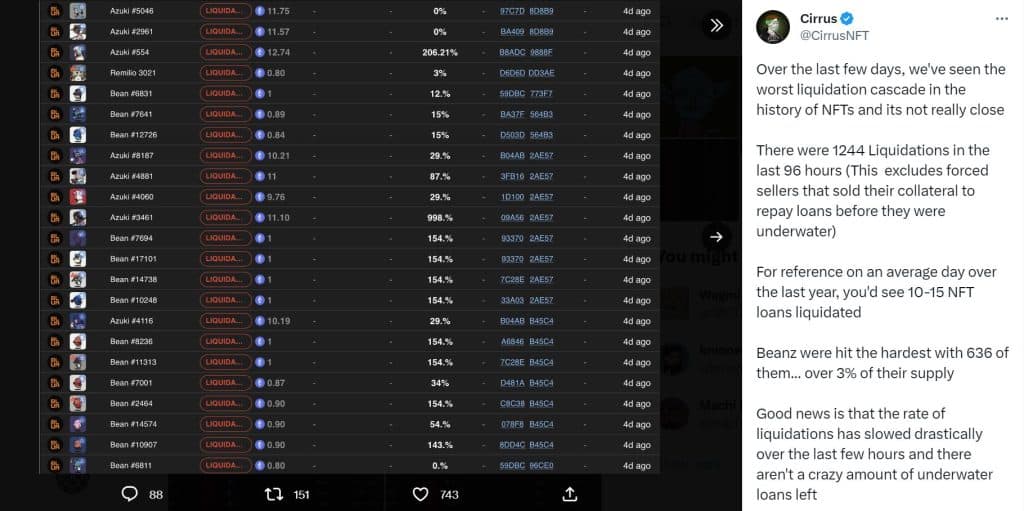

After Blur token farming took effect, the Blend loan protocol (also part of Blur) then enabled a Buy Now Pay Later feature, along with facilitating loans against highly volatile assets (as in, NFTs), and as a result created the possibility–in the worst circumstances–of huge liquidation cascades. And a huge liquidation cascade is, in fact, what just happened.

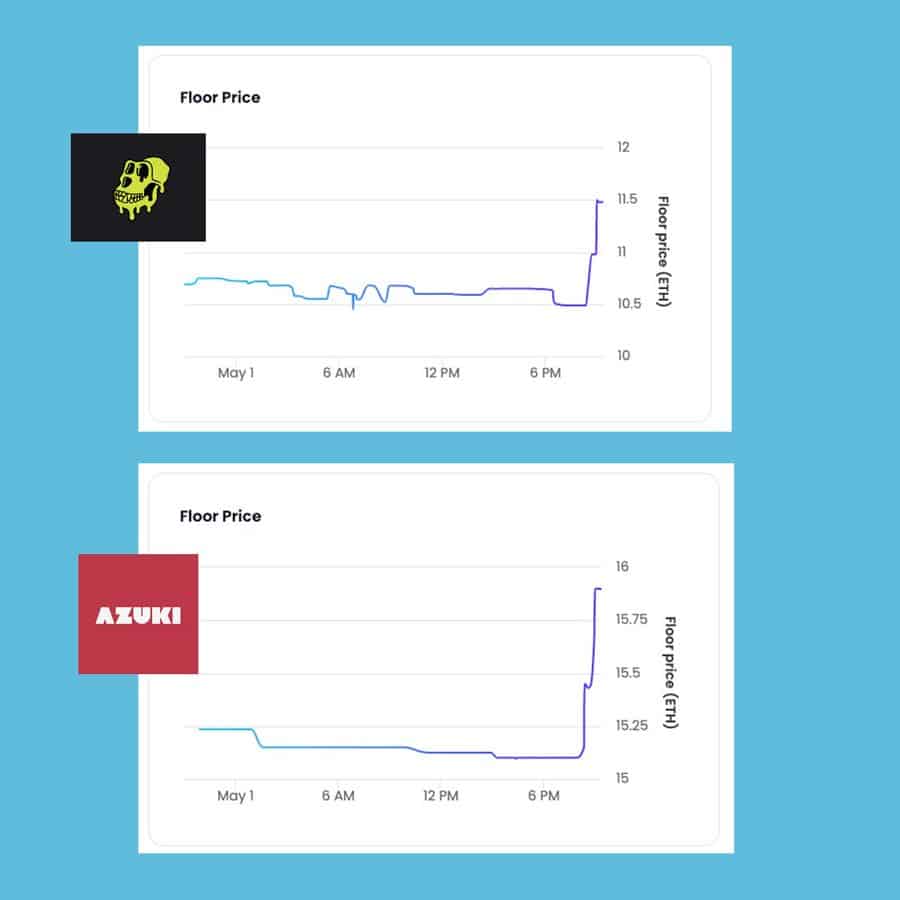

By the way, there’s also an argument that Blur and Blend have actually propped up NFT prices and had been delaying the inevitable post-bubble PFP floor being discovered. Blend launched on May 1st, and floor prices on supported collections did immediately rise, which makes sense. But those floor prices couldn’t rise forever.

The question now is whether we’re really at the bottom for big PFP collections. For that to be the case, longer-term holders rather than token-farming whales need to step in and buy and, over time, new participants need to join. But let’s be honest, taking a glance at the market right now, does it look inviting?

Apes Down Bad

Bored Ape Yacht Club are blue chip PFPs, with one caveat: there’s no such thing as a blue chip PFP. Here’s a stock-related definition of blue chip:

Ok, we’re not talking about stocks and shares here, but even by a more casual definition, no NFT project has been around for long enough to have a dependable track record, which is key to any blue chip status.

Back to the point at hand, Bored Apes and Mutant Apes are both down by a lot, so what’s the problem here? Again, we have dilution, as multiple new collections have been added to the project, and again we have the Blur and Blend effect.

But another issue runs deeper and gets to why some buyers ever wanted an Ape at all. When they’re expensive, these PFPs signal wealth and people can flex online, which makes them still more expensive, and so on. But if the price drops, the opposite spiral can occur and prices spin lower and lower as people start thinking Apes were only valuable because enough people believed they should be valuable, which is kind of true, but if that belief evaporates, then… you know how it goes.

Memeland’s FUDed Reveal

The Memeland Captainz collection took some of the heat off Azuki by executing what was initially greeted as a disastrous reveal, with the main complaints that many items were identical or overly similar to each other, and that there were artwork bugs.

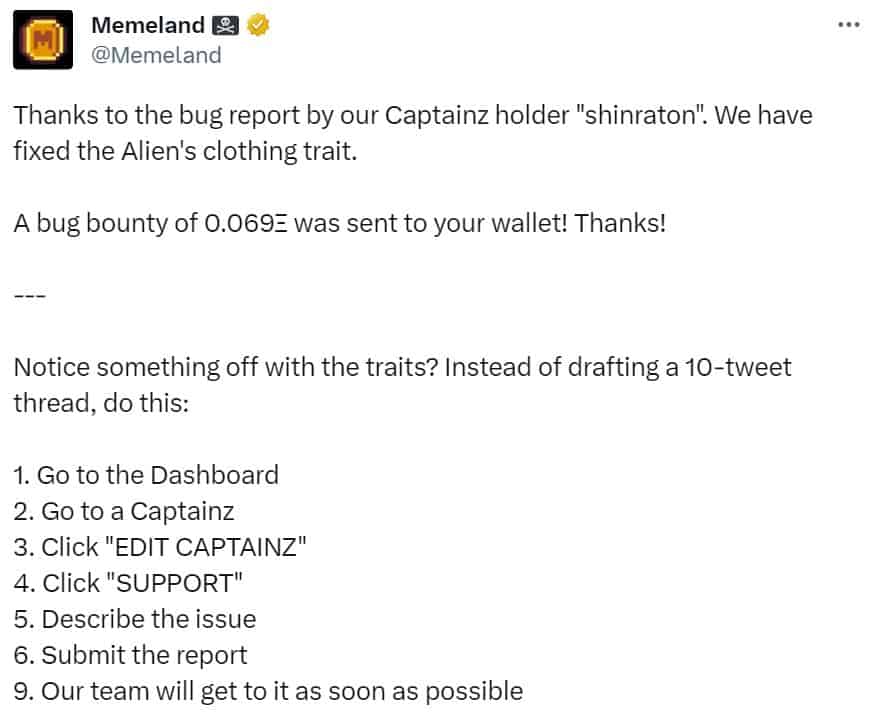

This fed into the overall sense of doom in the NFT space, but in this case, the FUD wasn’t fair. The bugs in the artwork on a few items were real, but have been fixed and appear to have been a clever way of drawing attention to the project’s bug reporting feature.

And as for complaints about similar-looking PFPs, this overlooked that Captainz are customizable, with the NFT providing a base template for owners to play around with, and reportedly utilizing the ERC-6551 standard (meaning NFTs act as their own wallets to hold further tokens.)

All in all then, the negative reaction to Captainz, which potentially take PFPs in a more flexible direction, looks unjustified.

The Bigger Picture

When it comes down to it, enormous crashes after a huge speculative bubble are nothing new in the world of crypto. Throw in the token farming and leverage offered by Blur/Blend and the mechanisms were in place to both delay and then amplify a PFP price collapse, and we end up with blood on the floor.

That said, I’d be surprised if some of the collections that were dumped don’t survive in the long term, particularly considering those from teams with funds to deploy and various developments in progress.

Recovery might take a long time and previous all-time highs might not be reached again, but on the whole, anyone picking through the wreckage might now be cautiously wondering which PFPs can stick around and recover. At the same time though, without new participants coming in to create a healthier balance in the market, and with Blur now expanding its token-reward mechanisms to include bidding on specific traits, further shocks are entirely possible.