Spool on Arbitrum: Earn Stablecoin Real Yields Up to 9% APY

Launched on Ethereum Mainnet in spring 2022, Spool Protocol is a decentralized middleware to create custom, diversified, and automated DeFi strategies. I commonly use the term “1-click DeFi” to describe Spool, given it offers vaults (aka spools) similar to the popular protocol Yearn Finance. In DeFi, we often require multiple transactions to execute even the simplest of strategies, but in order to truly democratize finance, DeFi developers have worked to further automate these strategies into vaults, which pool deposits and automate yield-earning strategies. One of the earliest and most popular Yearn vaults deposited stablecoins into Curve liquidity pools, staked the LP, and auto-harvested the CRV rewards, which were sold for more stablecoins and redeposited into the Curve pool.

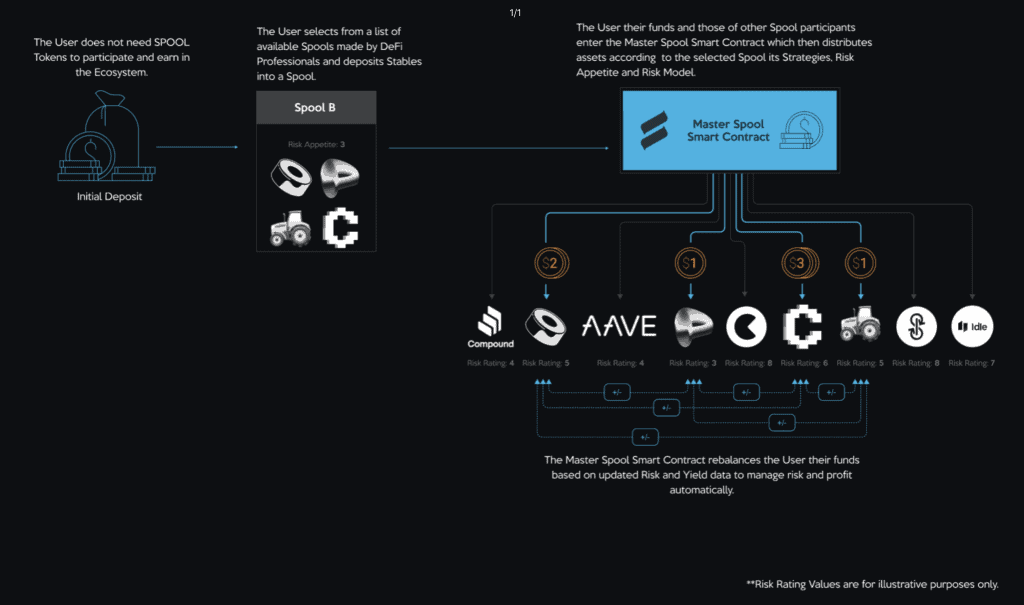

Spool offers a custom vault creator which allows users to select multiple strategies from a list of supported protocols, with a risk model to assign risk scores, and then set their risk appetite on a scale ranging from 0 to 10. Spool Protocol then deploys a smart contract that represents the strategies the user has chosen. Spool Protocol regularly rebalances portfolios while adhering to individual terms to ensure each individual Spool is optimized at all times in terms of risk-adjusted yield.

Responses