Coinbase Q1’23 Earnings: More Than a Survival Story

The crypto giant Coinbase is on the stage with some staggering stats to flaunt. 🚀

Prepare to be amazed, and proud… Because the most important company in web3 is carrying the industry on its sturdy shoulders.

Unfortunately, we can’t look onchain to get Coinbase’s earnings results, instead, we’ll have to review the old-fashioned way (for now).

- A towering $145B in quarterly volume traded.

- A cool $130B in assets on the platform.

- Operations spanning across 100+ countries worldwide.

- A strong and diversified team of 3500+ employees.

These aren’t just numbers; they’re a testament to the powerhouse that is Coinbase.

As we dive deeper, you’ll see just how robust this crypto giant truly is and why that’s important for YOU and the wider industry. Let’s go!

Crunching the Q1 Numbers

In the world of business, numbers speak louder than words.

And boy, do Coinbase’s Q1’23 numbers have a story to tell!

We’ll dissect this crypto behemoth’s earnings, not just to marvel at the figures, but to understand what they mean for the web3 space as a whole.

After all, Coinbase’s success is like a weather vane for the direction of our entire industry.

Now, let’s unravel the numbers one by one:

- $736M in net revenue, up 22% Q/Q. That’s not just growth; that’s a rocket ship taking off! 🚀

- 24% decrease Q/Q in total operating expenses. Remember the January layoffs? Sad as they were, it seems they paid off in terms of leaner operations.

- $284M in adjusted EBITDA. If you’re scratching your head, EBITDA stands for Earnings Before Interest, Taxes, Depreciation, and Amortization.

It’s a measure of a company’s overall financial performance and is often used as an alternative to simple earnings or net income in some circumstances.

TL;DR: It’s looking healthy!

- $362M in subscription and services revenue, up 28% Q/Q. Yes, folks, Coinbase is not just about transaction fees. They’ve diversified, and it’s paying dividends.

- $375M in total transaction revenue, up 16% Q/Q. While trading volume is important, it’s the revenue that fills the coffers, and Coinbase is filling them up nicely!

- $130B in Assets on the platform, up 62% 🤯 Q/Q. Clearly, users aren’t just trading; they’re storing their assets with Coinbase. Trust much?

- $5.3B in USD resources. That’s the kind of cash reserve that could weather any storm.

With these numbers, it’s evident Coinbase is not just surviving; it’s thriving.

But that’s not highlighted in the stock price

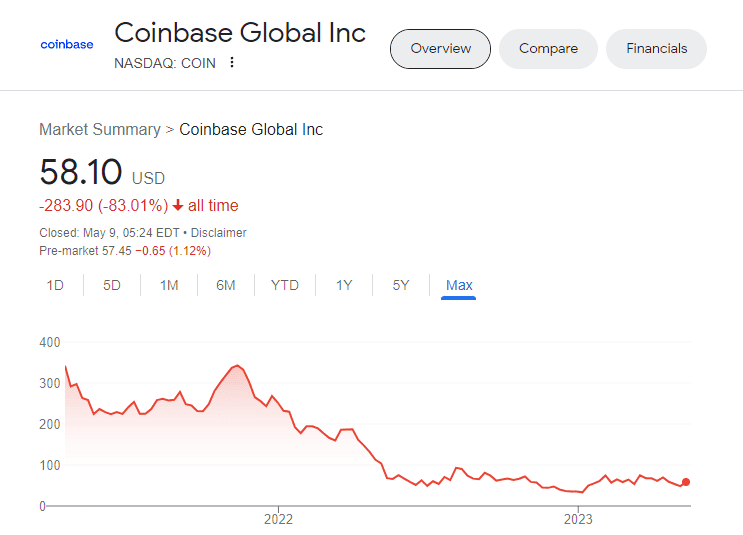

Despite being up 70% YTD, $COIN is still down 83% from when it started to trade.

At Web3 Academy, we’re here to help you build and invest. Let’s talk investing for a second.

Now, we’re not saying you should re-mortgage your house or take a loan from Blend to buy Coinbase stocks, but let’s just say it wouldn’t be the worst idea to pay more attention to it.

Just to be crystal clear: this is NOT financial advice! We’re just pointing out that the chicken seems to be laying some pretty golden eggs right now. 🐔💰

In the next section, we’ll delve into what this success means for you, and the broader web3 community. So stick around.

The Big Picture: Coinbase’s Impact 🌍

Why should you, as an investor, builder or early tech adopter, care about these numbers?

The answer is simple and profound: Coinbase’s success is a proxy for the entire industry.

When Coinbase thrives, it underscores that web3 is more than just a trend – it’s a sustainable, profitable industry that’s here to stay. 🚀

And Coinbase isn’t just about profits and market dominance – it has a noble cause.

The company aims to bring crypto to emerging countries struggling with their banking systems.

Think of nations like South Africa, where 1 in 4 people are unbanked:

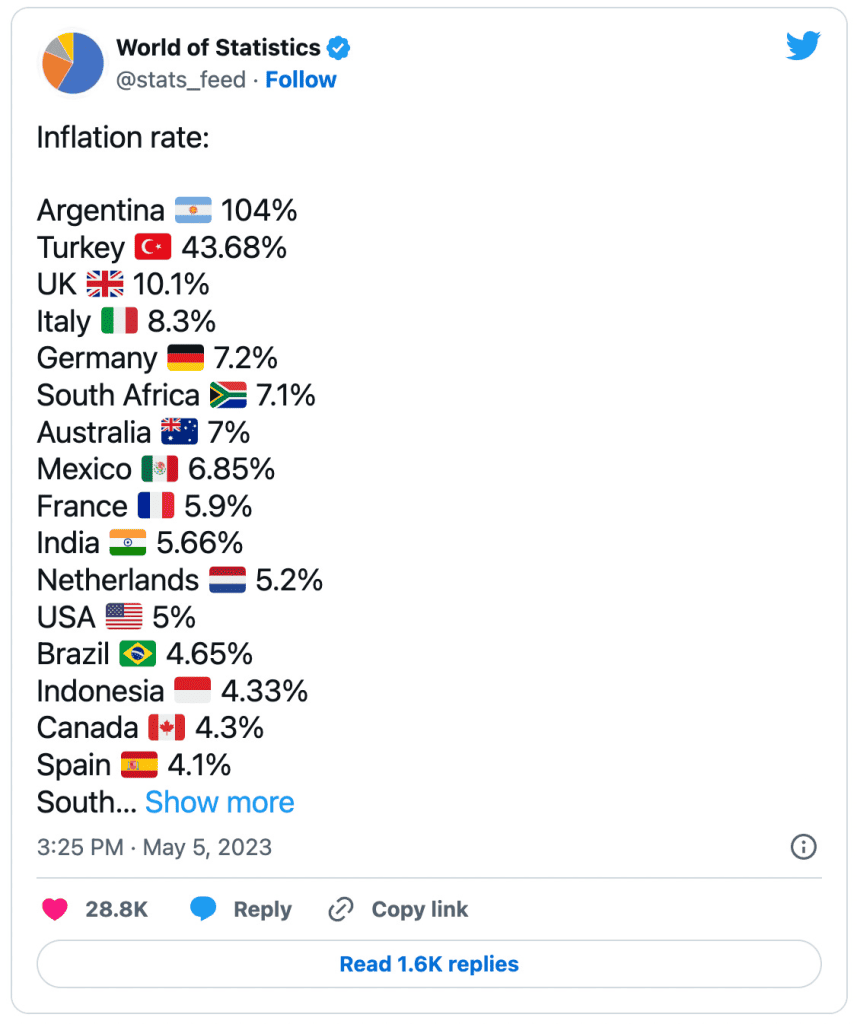

Or Argentina, grappling with 3-digit inflation:

Or Lebanon, seeing their food prices triple every year:

These are places where people need crypto, and Coinbase is stepping up to meet that need.

It’s not just about providing a service; it’s about facilitating mass adoption, one small country at a time.

Time to Update the System! ⌛

Coinbase isn’t just a crypto exchange or the pack leader in earnings; it’s also at the forefront of the fight for regulatory clarity.

This giant is tangling with the likes of the SEC and advocating for clear crypto regulations.

An example of their initiative is the “Crypto 435” campaign, a grassroots movement aimed at educating policymakers about the benefits of digital assets.

To commemorate this fight, Coinbase has launched the “Stand With Crypto” NFT. It’s not just a digital token; it’s a symbol of the broader movement for crypto acceptance and a more inclusive financial system.

Because that’s what this is all about: ‘It’s time to update the system.’

At Web3 Academy, we’ve minted the #102946 NFT. Have you? 🤨

If not, head here to mint yours and share it with us on Twitter.

It’ll only cost you around $10 and all of the money is donated to vetted organizations through a Crypto Advocacy Round with Gitcoin.

PS: If you enjoyed today’s edition, you’ll really like the Web3 Academy Newsletter & Podcast where we’re carving a path for DOers to confidently build and invest in web3.