zkSync Airdrop Strategy: Earn as an LP on SyncSwap

Before we get started, this is not a recommendation or endorsement to buy any token(s) mentioned or future tokens by SyncSwap or zkSync. This tutorial is for informational purposes only and should not be the basis for any investment decisions. DeFi Dad is not an investor in SyncSwap.

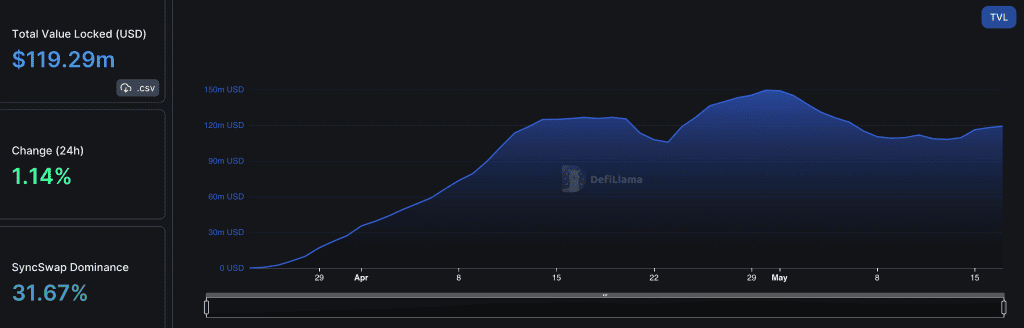

Having recently launched, zkSync Era, the world’s first ever zkEVM, is quickly attracting a new class of DeFi dApps and builders with over $119M of liquidity deposited. We know from the launch of Optimism and Arbitrum, DEXs are critical infrastructure for a thriving Ethereum L2. One protocol leading the pack in terms of trade volume and liquidity is the decentralized exchange SyncSwap. SyncSwap has impressively dominated liquidity on zkSync Era with ~30% or more of total TVL on zkSync Era on any given day.

Like other AMMs, SyncSwap relies on 2 major products: Swaps (traders) vs Pools (liquidity providers). SyncSwap supports 2 styles of pools–Classic which is a 50/50 ratio of 2 tokens, similar to Uniswap V2, and Stable, which is optimized for stablecoin trading and utilizes a hybrid algorithm of both the constant product and the constant sum. SyncSwap docs indicate they will offer “Concentrated” Pools soon, which will concentrate liquidity around the market price dynamically and provide a tighter spread around the market price. It’s also worth noting that unlike other AMMs on L1, SyncSwap allows for low cost, fast transactions thanks to the L2 tech underpinning zkSync Era.

As

Responses