The Genesis Book: the Innovations that Made Bitcoin Possible

TL;DR

The recently published The Genesis Book will become a reference work in Bitcoin literature. It gives the reader a glimpse into the lives of the pioneering computer scientists, monetary theorists, and cryptographers who paved the way for Bitcoin. In this article, I will single out three key innovations that made Bitcoin possible, as highlighted in the book. For example, the invention of public key cryptograhpy in the 1970s and the idea to hash documents with their timestamps to create a chronological order of records that can’t be tampered with.

The history of Bitcoin’s predecessors is laid out in The Genesis Book, by Dutch historian and journalist for Bitcoin Magazine Aaron van Wirdum. It is an inspiration to read and makes one nostalgic for a time long gone. Who wouldn’t want to have a time machine and be a fly on the wall of the first meetings of the early ‘Cypherpunks’, in the 80s and 90s?

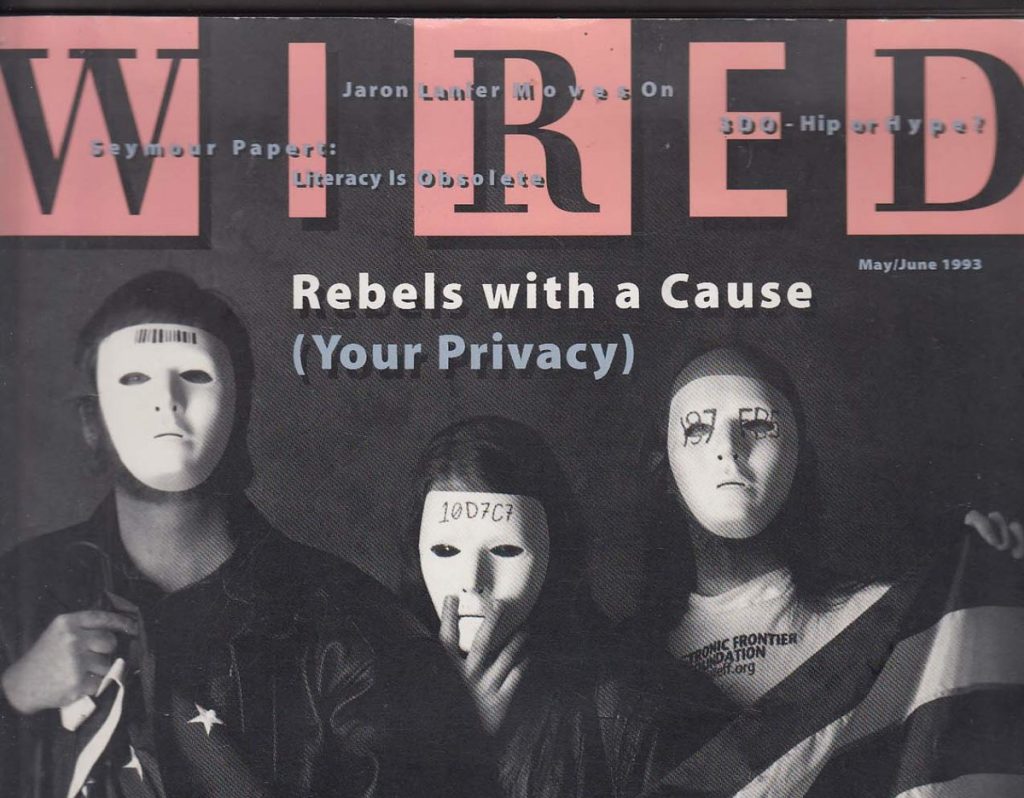

The Cypherpunks

The shared sense of purpose of fighting for online privacy, the sense of pioneering an entirely new field, what a blast it must have been. It was what united the group of computer scientists and cryptographers who called themselves the Cypherpunks. They bonded in the seventies and eighties on the shared realisation that the nascent internet would gain in importance and would bring pressing issues with online privacy.

They realised that the tools to solve these privacy problems had already been invented – but hadn’t been implemented in software yet. Hence their battle cry:

Cypherpunks write code.

They were activists, but not of the type that just shit on an existing order: they wanted to build a new order.

Ironically, some early Cypherpunks would leave the group in the following decade, disillusioned by the fact that they had built the early incarnations of privacy-preserving electronic cash, but the general public didn’t seem to care: adoption was low.

It would take until the launch of Bitcoin in 2009 when they would find out that people did care about electronic cash but for a mostly different reason than privacy. As the saying goes, they came for the gains and stayed for the revolution. After the 2008 Great Financial Crisis, the realization that fiat currencies get devalued and cripple our purchasing power, made alternatives attractive. This ties in with the second big narrative of the book: monetary theory developed by Friedrich Hayek and his compadres.

How Hayek Got Vindicated Posthumously

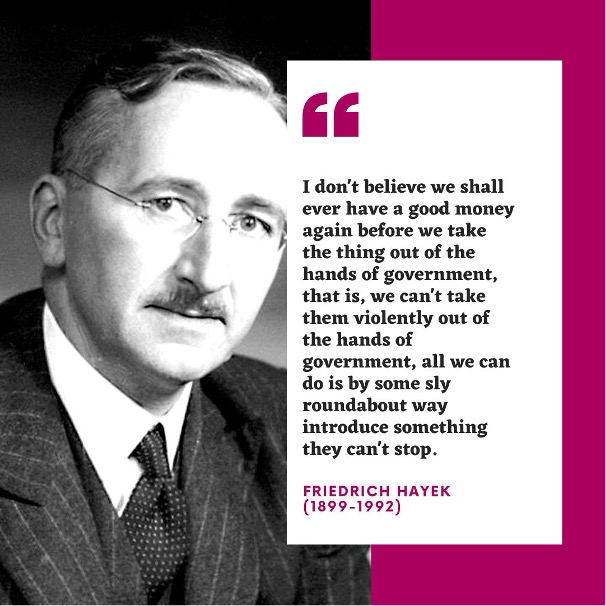

It’s a universal type of satisfaction: seeing people vindicated years after they introduced their theories that were at first dismissed. In this case, it’s ‘Austrian’ economist Friedrich Hayek, proven right many decades after seeing his ideas lose out against the rival Keynesian idea of economic planning, which states that governments should dictate monetary policy.

On the contrary, argued Hayek: money should be a technology of the free market: government manipulation only creates instability and leads to extra wealth inequality: those closest to the printing press get wealthier and wealthier, whereas those at a distance suffer most from the inflation created this way.

Hayek remarked in a 1984 interview that “we can’t take money violently out of the hands of the government, all we can do is by some sly roundabout way introduce something they can’t stop.”

It’s not a stretch to believe that Hayek would have championed Bitcoin. He feared that the nationalization of money would lead to totalitarianism and he envisioned money as spontaneous order and envisioned a parallel system to the established financial sector.

Discoveries that Preceded Bitcoin

Satoshi was pretty smart, we can give him/her/them that. Still, it’s not like he invented Bitcoin out of thin air. Let’s turn our attention to a few key innovations and insights that preceded the Orange Coin.

1 Public Key Cryptography

Before the invention of private-public keypairs, two parties – yes, the ever-present Alice and Bob – who wanted to exchange a message that they only could read, would need to share a key first. In the internet age, this would be highly impractical, to say the least. Would you want to email your private key to someone?

In the 1970s, cryptographers Diffie and Hellman came up with the idea of key pairs. Instead of just one secret key, Alice and Bob would have two keys: a private key which they would keep to themselves, and a public key that they could freely share online. These keys are mathematically linked.

Bob can then decrypt a message with Alices’ public key, which would prove that it had been encrypted by her private key. This makes this type of cryptography a form of authentication: the encrypted version of the message is like a signature.

Public key cryptography is a necessary ingredient of the Bitcoin protocol. The public key serves as a user’s wallet address. When the user makes a transaction, they create a signature with their private key. Everyone can verify that the transaction is legitimate without having to know the private key.

2. Blockchain – Invented as a Solution to Forgery of Digital Documents

This was eye-opening to me. It’s maybe the biggest contribution of all, but the inventors are lesser-known.

in the late 1980s/early 90s, researchers Stornetta and Haber realized that forgery of digital documents posed a specific problem for the coming internet age. Whereas in a written contract, you could detect if someone overwrote certain lines with different ink (for example), how can you tell a new binary zero or one from an old one? How could you detect forgery in cyberspace?

Stornetta and Haber’s solution was to add a timestamp to a file and to let a hashing function loose on such a file. This would keep a document forever tied to the moment in time it was stamped.

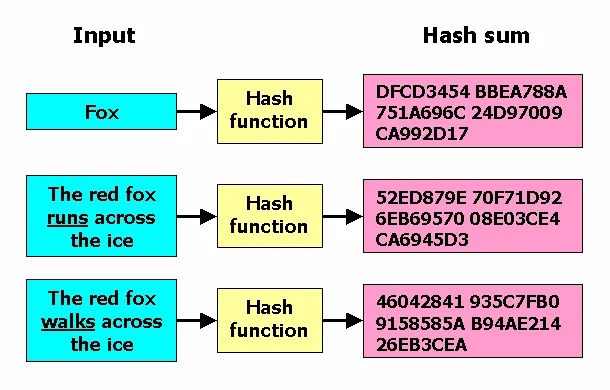

A hashing function is like a magic box that takes in any kind of information (like a number, word, or even a whole file) and spits out a fixed-size string of characters or numbers. This output is a jumbled-up mess that looks random. But it is far from it: a hashing function is as deterministic as can be: the same input will always produce the same output. It preserves the privacy of the input, as you can’t go back from the hash to the document.

An insight that the two researchers had was that you could create a ‘hash chain’: each new document would not only be hashed together with a timecode but also with the hash of the previous document. The resulting chain of hashes could prove which documents were time-stamped in what order.

This would settle disputes about what version of a document came earlier. And, because hashing functions are one-way streets, there would be no way to tamper with an older document and still keep the chain intact. Changing one letter in a previous document would totally mess up the hashing chain outputs.

This is a brilliant solution, provided that… we can trust the time stamp server, the ‘digital postal office’ that does the stamping. Who tells you they don’t mess with the chain?

First idea: let someone audit the post office. But, but. Who tells you the auditor and the post office aren’t colluding? Stornetta and Haber at first thought the problem was insolvable until it struck them: just make the hash chain public and let everyone audit it. Then there’s no one left to collude against!

We recognize two essential elements of Bitcoin’s protocol here. First, what was originally meant to be called time chain and later blockchain. And second, an early version of the concept of a distributed network of nodes keeping tabs on the blockchain.

It would take more than fifteen years before these two core ideas would be implemented in a running Bitcoin implementation. You could call it a time chain, which was indeed the term that Satoshi considered before settling on blockchain. And second, the idea of every node running a copy of the entire blockchain.

3. Electronic Cash Does Not Need to be Backed by Real-world Assets

The introduction of the Genesis Book relates the story of a Bitcoin predecessor called E-Gold, a quite successful form of electronic cash from the early 2000s. Each E-Gold virtual coin was backed by physical gold. The project was shut down by the IRS and FBI, and the founder of the project sentenced to jail time in his own home. The American government didn’t like competition in the business of issuing money… It’s a story that Satoshi must have taken to heart in his determination to decentralize his own network – nothing to shut down, in that case – and in his purposeful pseudonymity.

But the point here is to distinguish between electronic cash that is backed by real-world assets and coins that aren’t. E-Gold was backed by something from the real world, Bitcoin isn’t.

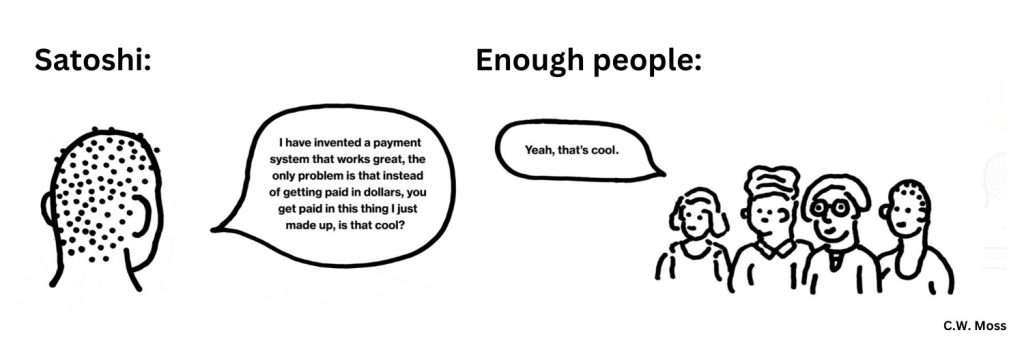

One of the first cryptographers/computer scientists to realize that digital money doesn’t need to be backed by gold, dollars, etc to have value, was David Chaum.

His Digicash was the earliest successful electronic payment system that introduced a digital currency not backed by a physical currency or good. He developed it in the late 1980s and allowed users to make electronic payments and transfers using a cryptographic digital currency.

DigiCash’s currency was the CyberBuck. it wasn’t backed by dollars or gold, it was a totally ‘made up’ currency and people did occasionally use it to pay for low-cost services. This was a pioneering realization and crucial for the next generation cypto coins, one of which was Bitcoin. DigiCash didn’t survive. After a promising start, the company went under – and with it its central server and the coins. Another important lesson…

But other projects had taken note: the coins of an online monetary system that could safeguard privacy and fend off centralization and debasement of the currency would have intrinsic value. It’s a mental hurdle that took the cypherpunks a few years to take, and it is still taking skeptics forever to grasp.

Conclusion

What a great book this is. I singled out three key innovations, but there are at least a handful more. It’s worth reading as an origin story. Along the way, it will explain to you what Bitcoin is in terms that go far beyond the technical. You leave the book with the realization that Bitcoin (and its predecessors and offspring) was designed as a solution to pressing privacy problems that the internet posed, and equally pressing problems of government monetary policy. At the same time, you realize it wasn’t inevitable… it took decades of great innovations and failed projects to find one that clicked.