Will the Upcoming Wealth Transfer to Millennials Pump Our Bags?

TL;DR

In the coming twenty years, the generation of Millennials will be the primary recipients of what is called the ‘Great Wealth Transfer’. Trillions in wealth will be passed on from the Boomer generation to their children. Guess the market cap of which asset class will benefit most. It’s the asset class that Boomers don’t understand but Millennials are fond of. You guessed it right.

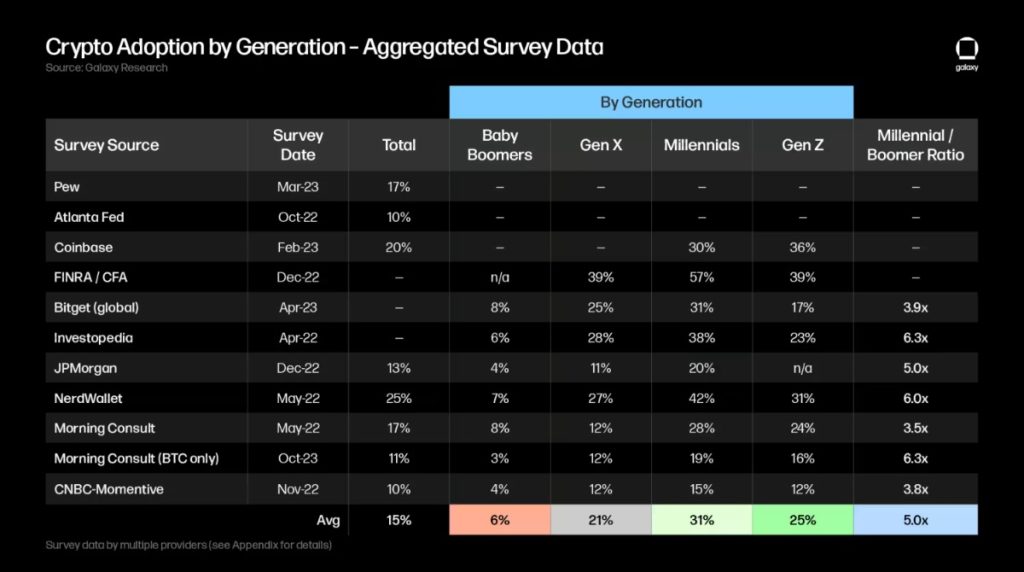

Venture Capital Firm Galaxy Digital looked at generational trends in crypto investing. How will wealth flow between generations? And how do investment tendencies differ between generations?

First, let’s look at how the US generations are often defined.

- Silent Generation (circa 1925 to 1945)

- Baby Boomers (circa 1946 to 1960)

- Gen X (circa 1961 to 1980)

- Millennials (circa 1981 to 1996)

- Gen Z (circa 1997 to 2012)

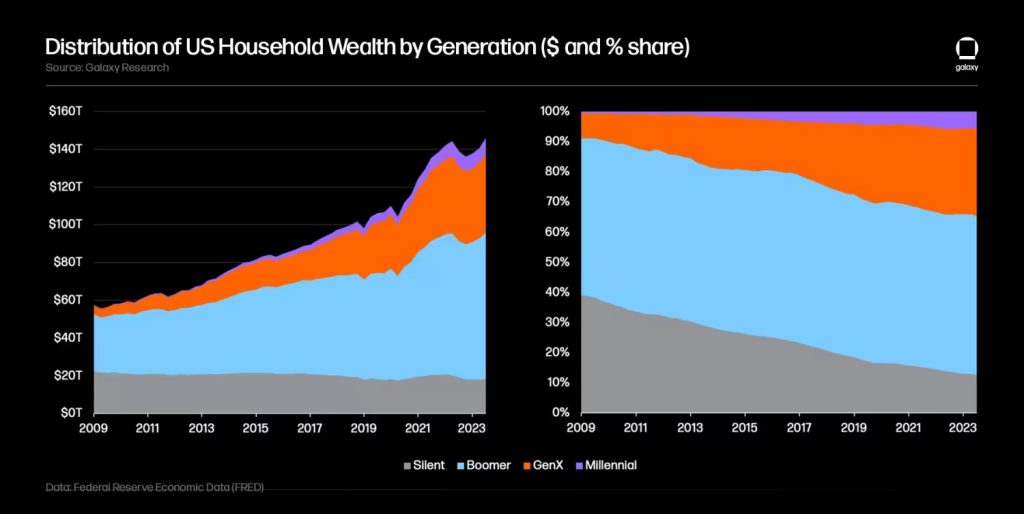

As a teaser, observe how wealth is distributed among generations. See that blue wave coming, dear Millennial reader?

These generations are more or less the same size: roughly 70 million people in the US. Note how the Boomers basically own half of the pile of assets.

Millennials in Generational Theory

But wait, why do we talk about ‘generations’? Does it even make sense to cluster individuals in groups like this? How could being born in let’s say 1982 make me part of a different generation compared to someone being born in 1980?

According to the authors Strauss and Howe of the seminal The Fourth Turning, we can. The author’s core thesis is that history isn’t linear, nor random, but cyclical. We can divide recent American history into cycles of roughly 80 years (a saeculum), each divided into four seasons or ‘turnings’.

There is a High (spring) period, an “Awakening” (summer). The Awakening occurs when the next generation turns against its parents. Then comes the “Unraveling” (fall) when institutions start to decay. The Crisis (winter)concludes the cycle. Everything falls apart, making space for a new saeculum.

We are currently in the Fourth Turning after the cycle that began after World War II.

Each Turning produces its own generational character type: the “Prophet,” “Nomad,” “Hero,” “Artist” respectively.

The Boomers are the Prophets, the Millennials the Heroes.

How can this be that generations have different character traits (on average, of course)? Well, think of what it would mean to grow up as a youngster amidst a raging world war. This would shape your character in profound ways. And now imagine one generation later, which grows up in a rebuilt and stable society.

Millennials are the Hero generation. This generation is raised by protective parents. They come of age during a time of great crisis. The authors of The Fourth Turning call this generation heroes because they resolve that crisis…

What crisis will Millennials resolve?

Let’s cycle back to the topic of this newsletter: finance. The Fourth Turning has a large following among lovers of crypto. They have noted that the financial systems of the past have gone through cycles as well, of similar length (roughly 80 years), and ending in debt crises.

The start of the current saeculum in Strauss’ and Howe’s classification coincides with the reset of the financial system. Post-World War 2, the world went onto a gold-backed dollar system, agreed upon in Bretton Woods.

This monetary system has been unravelling for decades and the process of decay is only accelerating. While the purchasing power of a dollar has of course been in decline since Bretton Woods, this process is only speeding up.

Heavy federal money printing can cause home and asset prices (stocks, homes) to go up 20% in a year. This means that buying a home or basket of stocks won’t really make you richer: it will only protect you against monetary debasement. This is the reality Millennials are faced with that their parents weren’t.

How Different Generations Hold Different Beliefs About Money

Writer Morgan Housel (The Psychology of Money) takes the above generational theory to the monetary domain. The financial background we grow up against will determine our attitude towards money and investing, he argues.

‘The person who grew up in poverty thinks about risk and reward in ways the child of a wealthy banker cannot fathom if he tried. The person who grew up when inflation was high experienced something the person who grew up with stable prices never had to. The stock broker who lost everything during the Great Depression experienced something the tech worker basking in the glory of the late 1990s can’t imagine.’

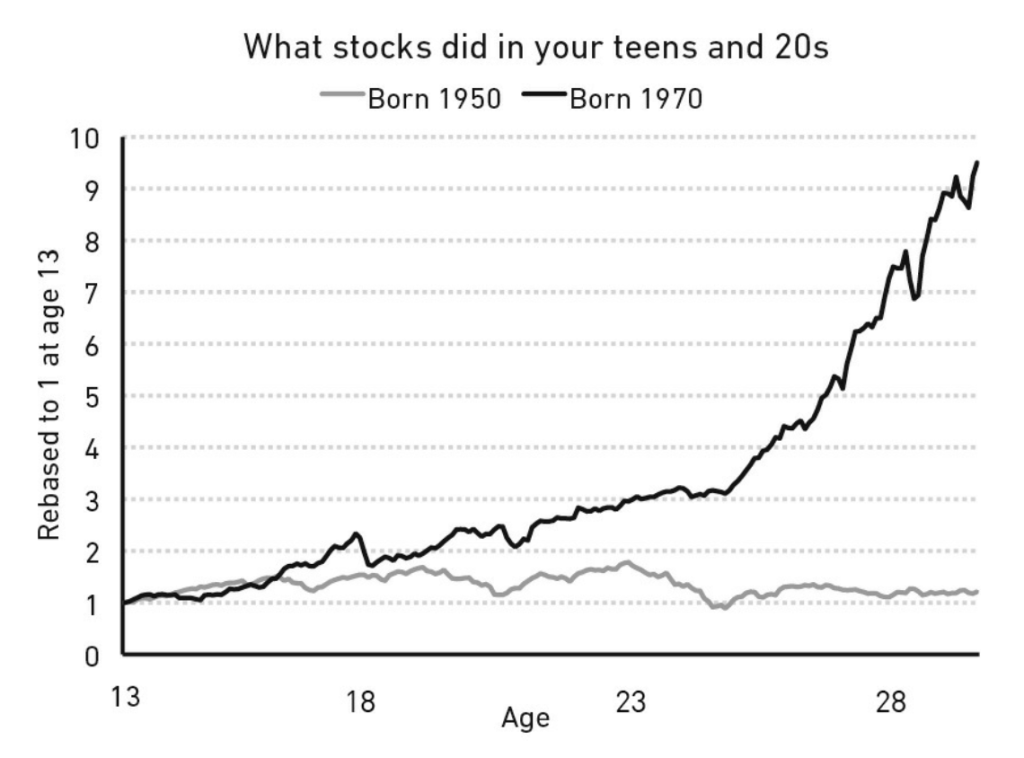

The economist Malmendier found that people’s lifetime investment decisions are heavily anchored to the experiences they had early in their adult life. If you grew up when the stock market was strong, you were found to invest more in stocks later in life compared to those who grew up when stocks were weak.

See this graph. It’s quite stunning. Stocks went nowhere from roughly 1963 to 1980. From 1983 to 2000 they went bananas – (and then dot.com bust, of course). It’s hard to imagine how these different climates would NOT influence someone’s investment outlook and behavior.

Millennials Face Recessions and Debt

Younger generations who are into crypto like to make fun of boomers, who famously don’t understand crypto.

And that’s ok, as long as you realize equally smart people can disagree about how and why you should invest your money. It’s not the boomers are wrong per se. They experienced a booming housing market and stock market. They would advise their children and grandchildren to invest in these assets.

But these children and grandchildren won’t necessarily agree. Sure, tech stocks will probably keep performing well. And owning a home will give you financial security, as long as the mortgage doesn’t cripple you. Also, a home is just so frigging pricey! A boomer couple in the early 1970s could buy a comfy home on a single modest income. Try that now…

So it’s no surprise that Millennials are trailing older generations’ rates of homeownership. At age 30, 43% of Millennials owned their home in 2022. Boomers at the same were 52%. Add to that that Millennials not only started their early adulthood with two major recessions, but they also face higher student debt and education costs.

As a consequence, Millennials and the generations that followed (Gen Z), are pretty fed up with the traditional financial system. It just hasn’t been working for them like it did for their parents and grandparents. Remember the mess of 2008? The Great Financial Crisis didn’t exactly boost trust in tradfi institutions.

A Digitally Native Generation Will Buy the Coins

Imagine a Millennial girl born around 1998. She grew up with internet access in her parents’ home. When she turned 13, she got her first smartphone. It had Instagram, which has shaped her social life (for better or for worse, ask Jonathan Haidt).

For this girl it won’t feel so counterintuitive that things of value can be digitally native. She has ‘traded’ photos and other social experiences online for her entire teen and adult life.So indeed, why would digitally native money not be a very natural thing in her world? Boomers will scratch their heads, but the younger “digital native” generations will shrug their shoulders and buy the coins and the NFTs.

The numbers back up this idea. Research from Coinbase has shown that the crypto adoption levels are five times higher when comparing Millennials with Boomers.

Show me the Money

That’s all well and good. But what will this mean for our bags? Galaxy asserts:

‘If the Great Wealth Transfer were to occur today, we estimate an incremental $160bn – $225bn would flow into crypto markets just as wealth moves into the crypto-friendlier hands of the younger generations.’ It will result in… ‘$20m – $28m of daily incremental buying pressure for crypto markets over the next 20 years.’

Wowzers.

And this is a conservative estimate, as, according to Galaxy’s analysts, it is likely there will ‘be an additional multiplier effect as Millennials & younger generations typically allocate a greater % of investable wealth towards crypto assets’.

Conclusion

It’s no wonder that Millennials, who’ve grown up with things digital, are open to new ways of managing money and investing. Feeling (rightly) left behind by the tradfi system, the idea of a totally new kind of financial system clicked. Millennials are the ‘heroes’ who buy into (literally) crypto and help shape it. Because, sure, a wealth transfer is upcoming and trillions of dollars will pump crypto prices. But it’s about more than buying coins with your parents’ inheritance. It’s also about building this new digital system!