What is Acala? (ACA) | The DeFi Hub of Polkadot

What is Acala?

Simply put, Acala is a DeFi smart contract platform that operates as a Polkadot parachain.

Acala brands itself as the “DeFi Hub of Polkadot”. Founded by two Polkadot developer teams, Laminar and Polkawallet, the platform officially launched in January 2022.

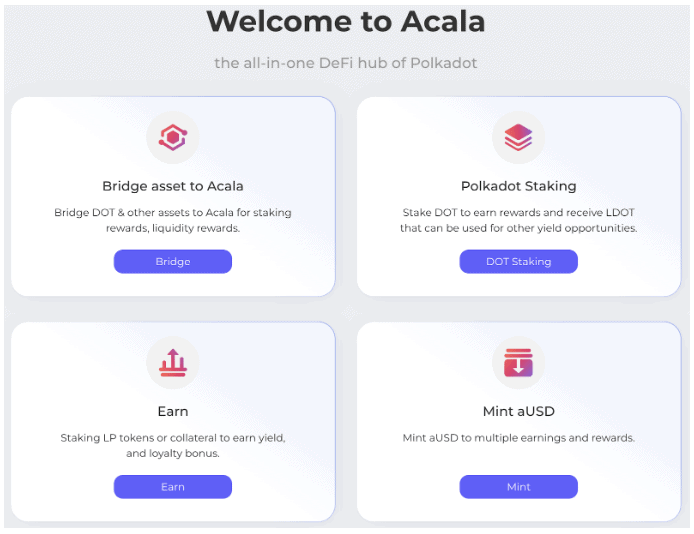

As a layer-1 smart contract platform, Acala is built to host an ever-expanding array of financial products and services. Given its nascence, Acala’s available financial products at this time look a bit limited. But hopefully, product offerings will continue to grow as it appears many teams and projects are working with the platform. The approximate total value locked in Acala stands at $450M.

Currently, the platform offers a decentralized exchange (Acala Swap), earning yield via staking, liquidity pool provider opportunities, and a use-case menu for DOT liquid derivatives (LDOT). However, the life-blood of Acala is its stablecoin — aUSD.

Let’s dive into the specifics.

What is Acala’s aUSD?

aUSD is Acala’s “decentralized, multi-collateralized stablecoin backed by cross-chain assets.” Acala’s goal is to make aUSD the primary stablecoin for the Polkadot ecosystem. And they seem to be on their way — on May 19th, Acala and Polkadex announced that aUSD will be Polkadex’s default stablecoin.

At this point, you’ll be forgiven for any sensations of panic, given the very recent and total demolition of Terra’ UST. And although aUSD is certainly not risk-free, it doesn’t fit the definition of an algorithmic stablecoin. Rather, aUSD is an over-collateralized, crypto-backed stablecoin.

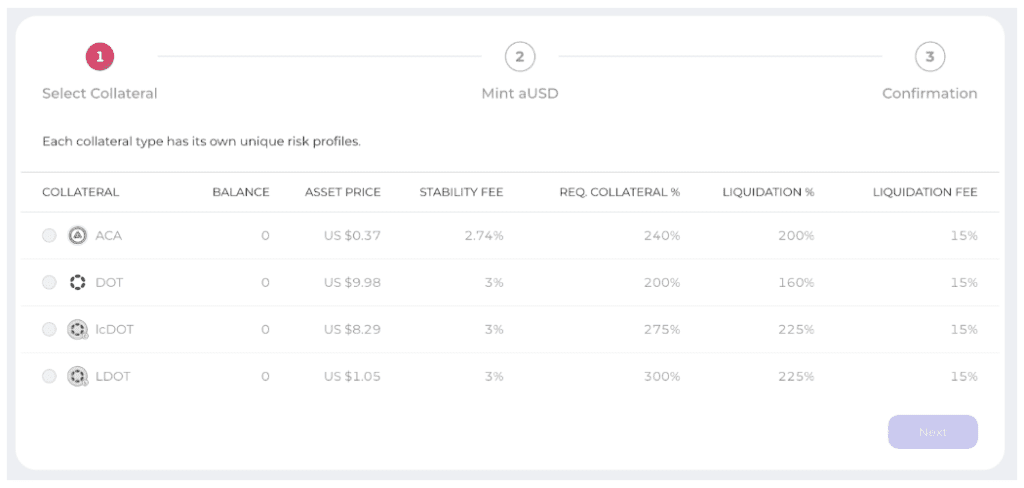

Acala docs explain that aUSD is “backed by a surplus-value of reserve assets”. These assets currently are Acala’s native token (ACA), DOT, KAR, KSM, and their respective derivatives. The docs further state that BTC and ETH can be used in the future pending acceptance by Acala’s governance process.

Specifically, users create aUSD by minting it — users deposit the reserve assets into the platform, and receive in return newly minted aUSD. Effectively, users take out an over-collateralized debt position. And aUSD is indeed over-collateralized. Depending on the reserve asset used, anywhere from 200% to 300% collateral-to-loan value must be deposited to mint aUST. Currently, $85M worth of these assets have been locked into the protocol for minting.

What Can aUSD Be Used For?

aUSD can be used for trading, hedging, liquidity pool provision, and more high-risk DeFi strategies like looping (taking aUSD to purchase additional reserve assets, and depositing those for further collateral for the minting of even more aUSD). The docs indicate an aspirational goal for aUSD as a medium of exchange for goods and services.

Please note that none of the statements above are recommendations or financial advice! aUSD minters can be liquidated if the value of their collateral falls below a 160% to 225% loan-to-value ratio, depending on the asset. Looping is probably a terrible idea! Please consider the potential consequences to aUSD in a cascading market event of aUST’s reserve assets. Do your own research and be smart!

Acala’s DOT Liquid Derivatives

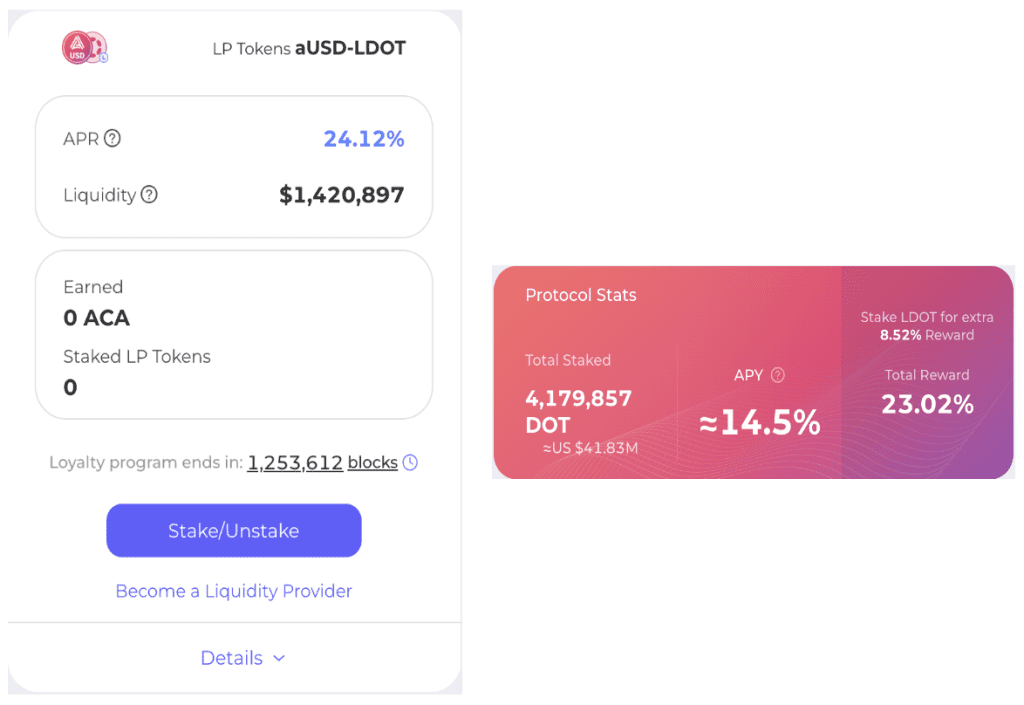

One particularly interesting use case of Acala concerns DOT liquid derivatives. Basically, users are able to compound the value of their DOT inside the ecosystem. When users stake DOT, they receive an APY in return (currently 14.5%). But the protocol also gives them a liquid derivative in return — LDOT. Think of LDOT as a receipt that has a secondary market value, similar to bonds on the secondary market.

Users have a few different options with LDOT: (1) use it as collateral to mint aUSD; (2) swap it for other assets on the exchange; (3) stake it for further reward payments (staked DOT + staked LDOT = 22.93%), or (4) deploy it into a liquidity pool. Clearly, savvy users can get creative with these options and build complex portfolios.

Ethereum Compatibility

Acala is Ethereum compatible. The Acala team built an Acala EVM (Ethereum Virtual Machine). This means developers can build applications to connect cross-chain assets between the Ethereum and Acala blockchains.

So for practical purposes, users will be able to deploy ERC-20 tokens onto Acala for trading, collateral, and gas fee payments.

ACA – What is it, Where, and How to Buy It

ACA is Acala’s native “utility” token that powers the platform. ACA can be used for transaction fees, governance influence, and collateral for minting aUSD. According to Coinmarketcap, ACA’s market cap is $161M, with a 408M token circulating supply, out of a max supply of 1B. More details regarding ACA’s tokenomics can be found here.

ACA can be bought on multiple centralized exchanges, including Binance, MEXC Global, KuCoin, and Kraken. But if you’re interested in the Acala network, I recommend setting up a web-extension wallet and buying it directly off the platform. This will get your hands dirty and expose you to the platform’s menu of products.

To get started, go to https://acala.network/ and click “APPS” at the top right of your screen. Download either Polkadot{.js}, Talisman, or SubWallet. All three are Chrome web-extension wallets. After your wallet is set up, you can utilize one of the multiple funding ramps onto the platform to get started.