ZeroLend Multi-Airdrop Strategy for EigenLayer, zkSync, Blast, and Linea

Before we get started, this is not a recommendation or endorsement to buy any token(s) mentioned.

This week, we cover an emerging multichain money market that offers multiple airdrop strategies to play aside from its own upcoming $ZERO launch.

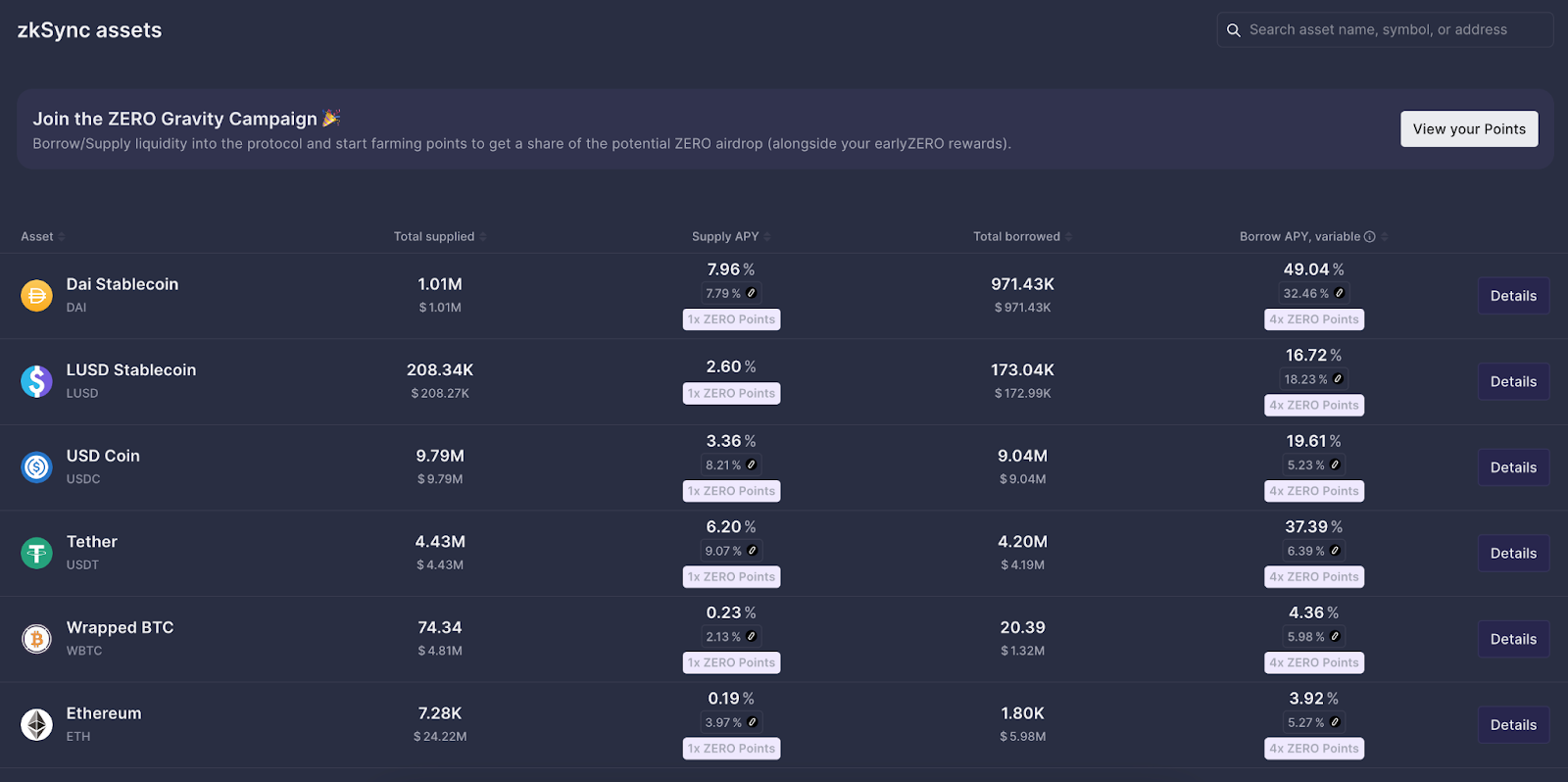

ZeroLend is a fork of Aave V3, known mainly for being the top ranked protocol by TVL to lend and borrow on zkSync but also supports Blast, Linea, Manta, and now Ethereum Mainnet with a growing focus on LRTs such as eETH by ether.fi and pufETH by Puffer Finance.

If you’ve ever used Aave, ZeroLend is very familiar thanks to features like isolation mode (lending isolated assets for yield), e-mode (high efficiency mode for borrowing like-assets), and a UI similar to Aave’s popular dApp for lending and borrowing.

With ZeroLend, we have lenders supplying stablecoins, ETH, LRTs, WBTC, and more for overcollateralized borrowers to borrow and pay interest based on the utilization of those pools.

What’s different is ZeroLend’s focus on newer emerging L2s such as zkSync. To date, ZeroLend has accrued just under $250M TVL since launching in March 2023 with a reported 322k unique active addresses.

ZeroLend has quite a few exciting developments in its roadmap to differentiate itself from being just another lending and borrowing protocol on L2s including:

Account Abstraction: This live feature allows for gas-less transactions, social logins, delegated transactions, etc.

Support for RWAs (coming Q2 2024): ZeroLend is looking to integrate these assets

Responses