Bitcoin is Ripping North

GM friends.

We’re still 50 days away from the halving, but signs indicate the supply shock has already begun.

But before we hop into the mid-week crypto update, it’s that time of the month again…

End of month = Crypto Alpha Report 🚀

It will be released tomorrow for Premium Wealth Mastery subs only, the report will highlight the most important upcoming crypto opportunities for the upcoming month.

It will provide you with:

- An overlook of the crypto markets

- The top airdrops of the month

- The top altcoins to watch

- The best DeFi farms

- The most exciting NFT mints

My team and I analyze the crypto markets for countless hours and we put all of our findings into THIS report.

Value-packed & exclusive for the Premium Subscribers of the Wealth Mastery Newsletter!

Want a taste of the report? You can now start a 7 day free trial!

Here’s what’s in today’s issue:

- David shares his thoughts on Bitcoin passing 60k, Benchmark recommending buy on MSTR, Kraken launching institutional services, Strike expanding to Africa & Arweave launching testnet for AO blockchain.

- Rekt Capital has the latest technical analysis for you on the market.

- Erik has an article on airdrop points.

- In case you missed it by Rebecca.

Ready to take your crypto journey to new heights? Look no further – Bitget is your ticket to seamless and rewarding trading experiences!

- User Friendly

- Advanced Tools For Traders

- Huge range of top coins to trade

💰 Sign Up Now for Exclusive Bonuses Up To $30,000! 💰

Bitcoin Passes $60K

Ladies and Gentlemen. This is crazy.

On Monday, bitcoin broke north from its side-ways consolidation between $50.5K and $53K and hit $55K. On Tuesday, it hit $57.5K. And on Wednesday morning, just before U.S. markets opened, bitcoin reached above $60K.

We need to discuss why this is happening, and what it means for the future of bitcoin.

Huge ETF Inflows on Monday and Tuesday

Make no mistake about it, this price pump is a direct result of the net inflows into the US spot BTC ETFs from earlier this week. On Monday and Tuesday alone, the ETFs pulled in $1.09B in cash.

These early week numbers indicate we’re going to have another $2B+ week as happened on the week of Feb. 12th.

Is the BTC Supply Shock Happening Now?

I think so.

I want you to think about what $1.09B in net inflows means for bitcoin’s supply and demand dynamics. Miners produced a total of 1,872 new bitcoin on Monday and Tuesday. Assuming the miners sell 100% of all that newly minted bitcoin (they don’t), that means the ETFs alone pulled in more than 10X of the amount produced by the miners in those two days (i.e. 1,872 BTC x $55K = 102M).

Numbers like this can only lead me to the conclusion that the bitcoin supply shock is happening right now.

The Price Models are Breaking

These ETFs are breaking our existing price models. And that means we’re in uncharted waters.

If you go back and look at bitcoin’s price action in the few months before and after bitcoin’s last three halvings, what you’ll find is that bitcoin ranged sideways for two to three months before the halvings and then for another five months after. We’ve never had a hard price pump immediately before a halving event.

To put it another way, the price of bitcoin was about 40% to 50% of its previous ATHs when the 2016 and 2020 halvings occurred. Right now, bitcoin’s price is 86% of the 2021 ATH.

We don’t know what will happen with price from here, but we do know two things. First, we know that bitcoin’s supply will be cut in half in 50 days. And second, we know that if the ETF inflows remain constant post halving, then there will be massive fireworks.

Benchmark Recommends Buy on MSTR

On Tuesday, the investment banking firm Benchmark issued a “buy” for MicroStrategy’s MSTR, with a price target at $990 per share. MSTR is currently trading at $871.

The bank derived their $990 price target based on the assumption that bitcoin will reach $125K by the end of 2025.

We’ve discussed previously that Saylor is transforming MicroStrategy to be a direct competitor against the US spot bitcoin ETFs by making MSTR a value proxy for bitcoin. Saylor’s selling point is that MicroStrategy has more flexibility than the ETFs due to its positive cash flow business and ability to leverage debt.

It appears that this angle is working. Benchmark noted in their report that MSTR acts as a “ballast to [bitcoin’s] valuation” and that the company’s enhanced optionalities to acquire bitcoin are a strength.

MicroStrategy currently holds 193K bitcoin. The company disclosed on Monday that it acquired an additional 3K bitcoin at an average price of $51.8K.

Kraken Launches Institutional Services

On Tuesday, Kraken, which is arguably the U.S.’ second most prominent crypto exchange, announced the launch of a new division focused on services for institutions.

The high level idea here is that Kraken sees a wave of institutional adoption coming for crypto, and they want to get in on the action.

Headed by Tim Ogilvie, who previously co-founded the company Staked, Kraken’s institutional services are targeted at asset managers, hedge funds, and high net worth individuals.

In a blog statement, Ogilvie said that the new division “brings together Kraken’s existing products and services tailored specifically for institutions to trade, stake, and custody crypto.” Ogilvie further said that a qualified custody solution for institutions will be launching soon.

Strike Expands to Africa

Jack Maller’s Strike is expanding to the African continent. That’s according to a company blog post on Tuesday.

In the post, Mallers stated that Strike’s full suite of bitcoin services will soon be available to Gabon, Ivory Coast, Malawi, Nigeria, South Africa, Uganda, and Zambia, with other African markets to be announced soon.

Founded in 2020, Strike is a mobile payment app similar to Cash App, except that it uses bitcoin’s lightning network to allow users to send cash and bitcoin peer-to-peer.

Strike’s timing with regards to entering Africa is opportune given record inflation across the continent, as well as bitcoin hitting all time highs in multiple countries (i.e. Congo, Ghana, Nigeria, Sierra Leone).

Arweave Launches Testnet for Arweave AO Blockchain

Arweave, the decentralized data storage platform, has just launched a testnet for a new blockchain called Arweave AO.

Arweave AO is said to be a high performance blockchain built on top of Arweave’s data storage platform. According to the development team, the differentiator that separates Arweave AO from any other blockchain in existence is the claim that it can store large amounts of data, like AI models and social media platforms.

If this claim becomes a reality, then it’s thought that Arweave AO could bring next generation computing software and platforms to decentralized and permissionless networks.

The development team has further said that Arweave AO is “absurdly scalable”, in part due to the modular separation of its blockchain infrastructure.

Arweave’s mainnet launch is anticipated for this year.

In today’s edition of the Newsletter, the following cryptocurrencies will be analysed & discussed:

- VeChain (VET)

- UniSwap (UNI)

- Theta Token (THETA)

- Coti (COTI)

- Chiliz (CHZ)

- Ethereum (ETH)

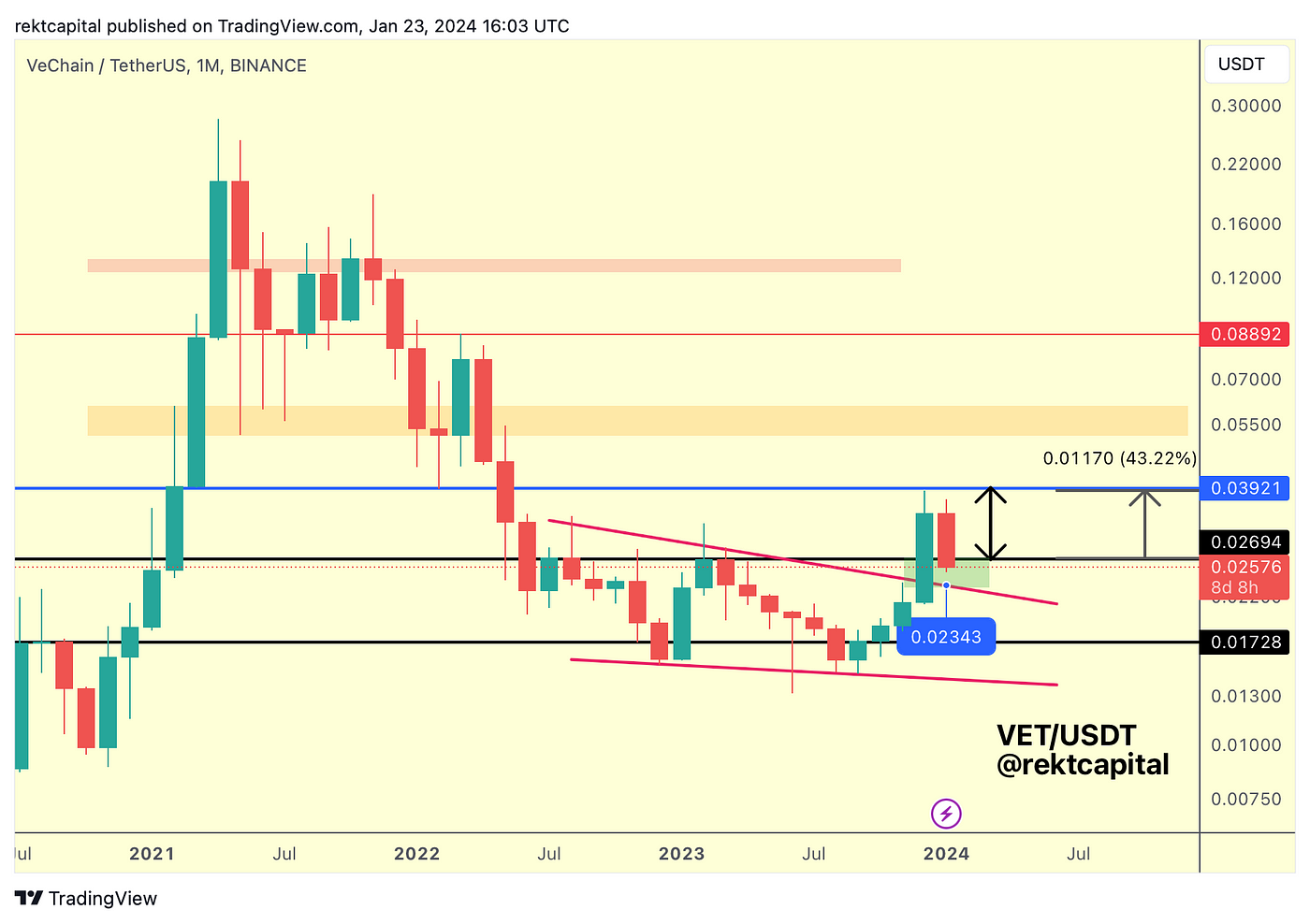

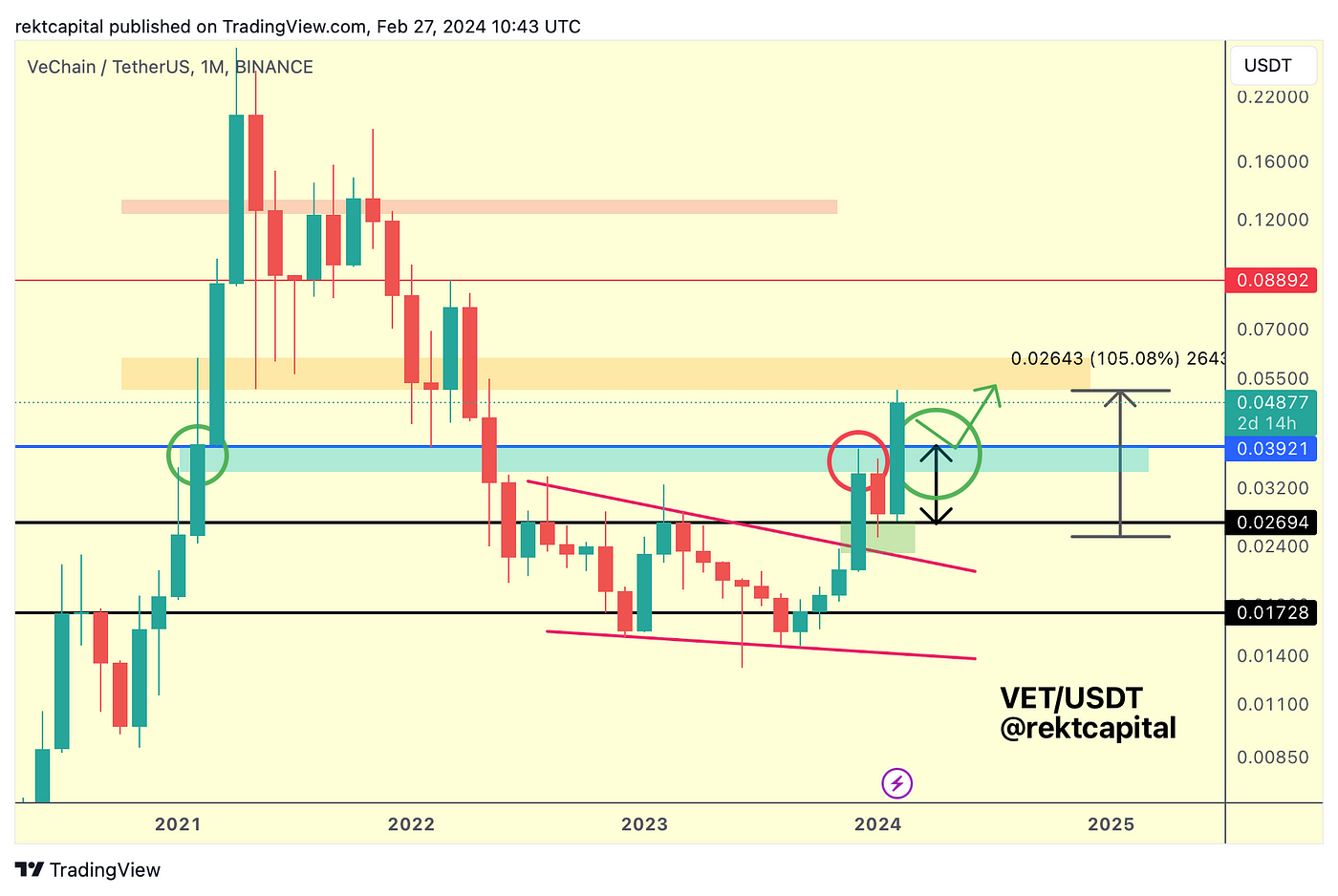

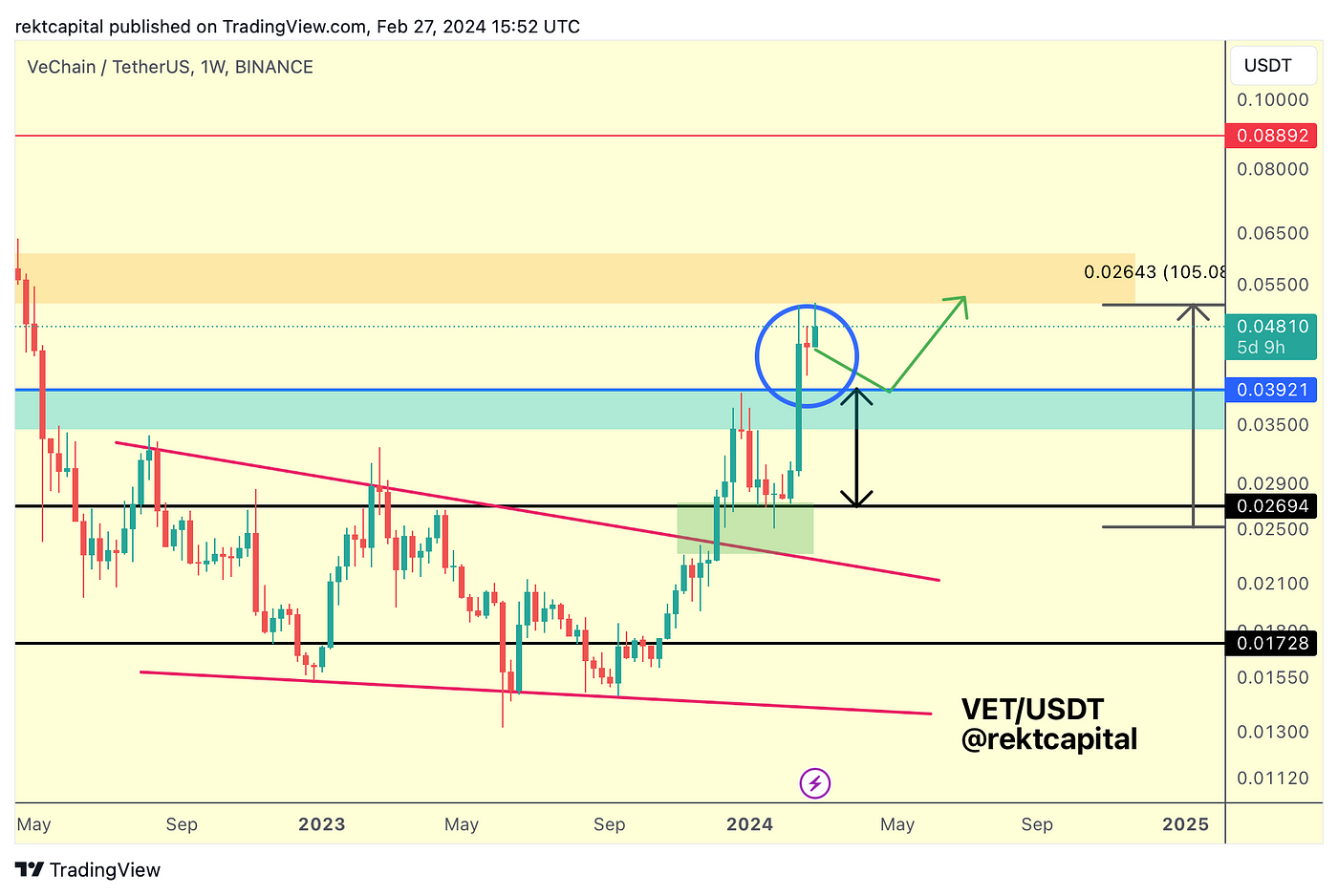

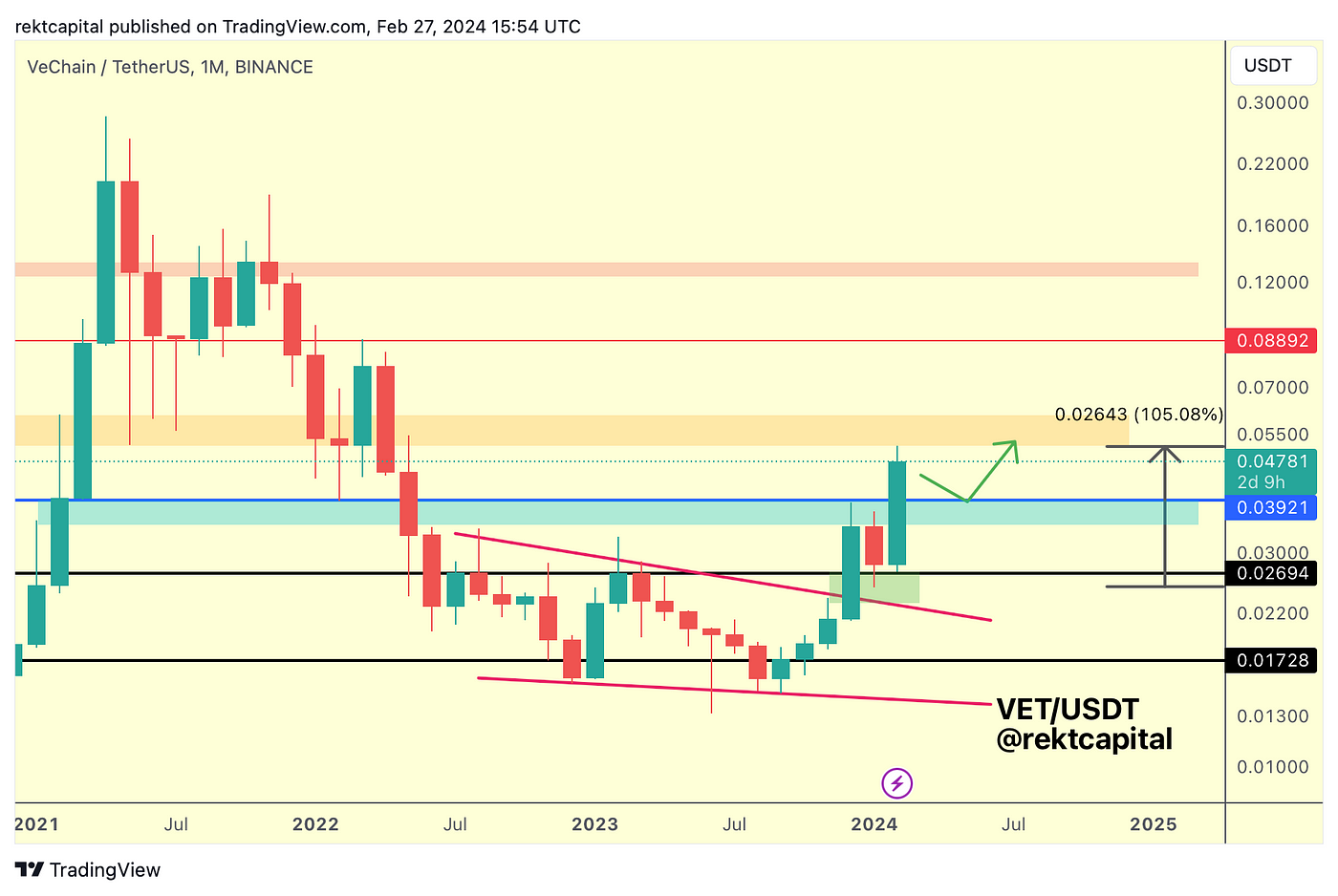

VeChain — VET/USDT

We’ve been covering VeChain for several weeks now.

So let’s sum up the key technical moments that took place up to today.

Firstly, the slight deviation below the black Range Low into the buy area:

Then price-strength confirmation and stability at the Range Low:

Followed by a breakout from the macro range, finally:

Before talking about a pullback so as to successfully retest the Range High resistance as new support to confirm a breakout to the orange resistance above:

Here’s today’s update:

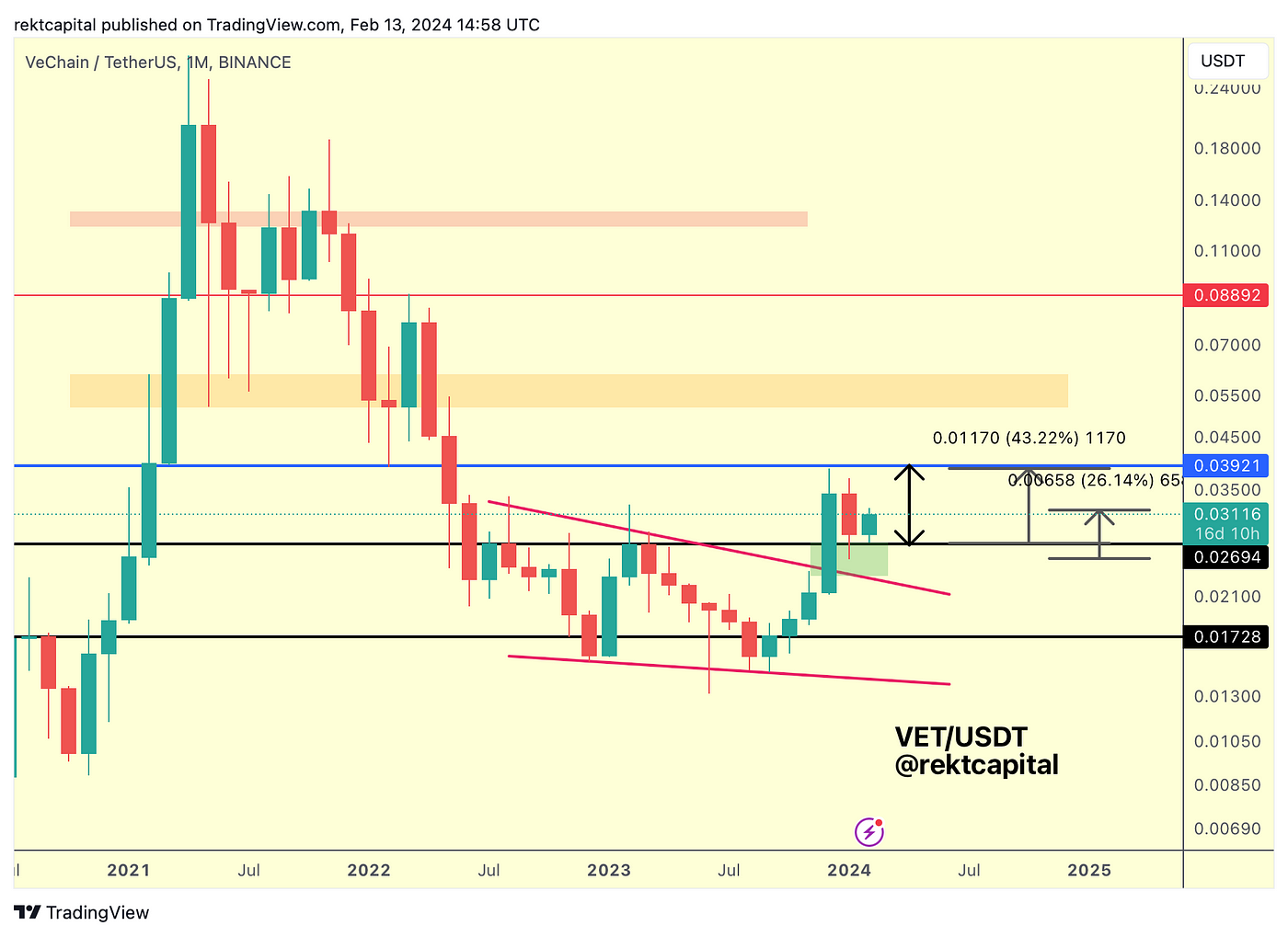

VET indeed dipped with the intent to retest the Range High, however there was no picture-perfect retest, narrowly, very narrowly missing out on that picture-perfect contact.

Nonetheless, technically that is the retest satisfied and it preceded further upside to revisit the orange resistance as per the outlined green path.

In retesting this Range High, VET not only confirmed further upside towards the next immediate resistance area (orange box) but positioned itself for a very positive Monthly Close as well:

Of course, the bullish scenario would be for VET to Monthly Close inside the orange area of resistance; that would be the easy option.

For the time being however, let’s assume it won’t do that and VET will instead Monthly Close below the orange resistance.

In this case, VET may very well have confirmed a new macro range; this time however, this Range Low of this range would be the old Range High from the previous range (light blue area).

In essence, VET would’ve broken out from one macro range to enter another.

In this case, there would technically be scope for downside into the Range Low area as part of normal, range-bound consolidation.

In the event that VET doesn’t pullback into the old Range Low but happens to reclaim the orange resistance as support, then VET would skip this consolidation and ascend higher.

The way I see it is if VET offers another pullback into the light blue area, it would be part of setting up the next uptrend, in the same way that it did before this recent breakout.

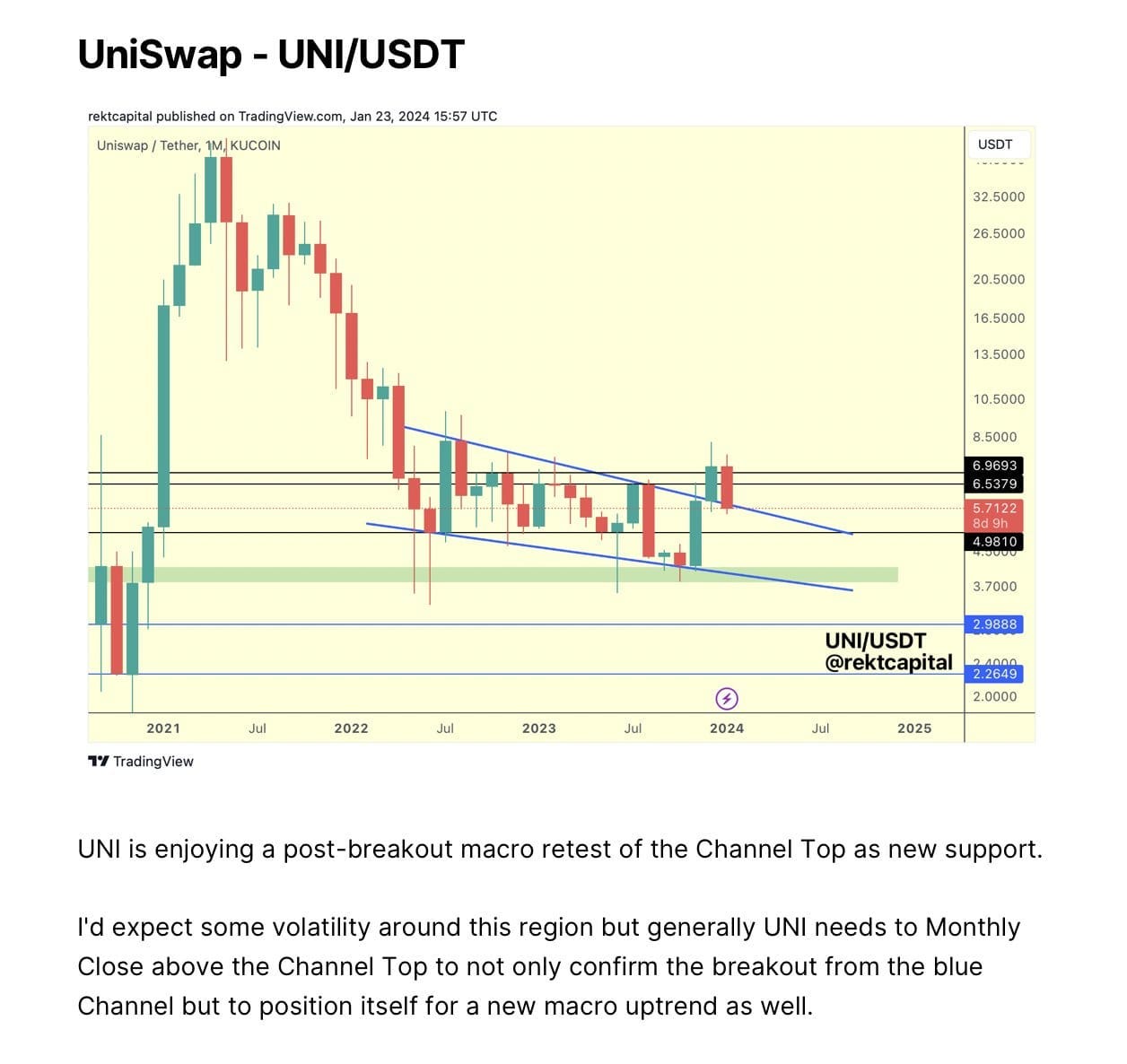

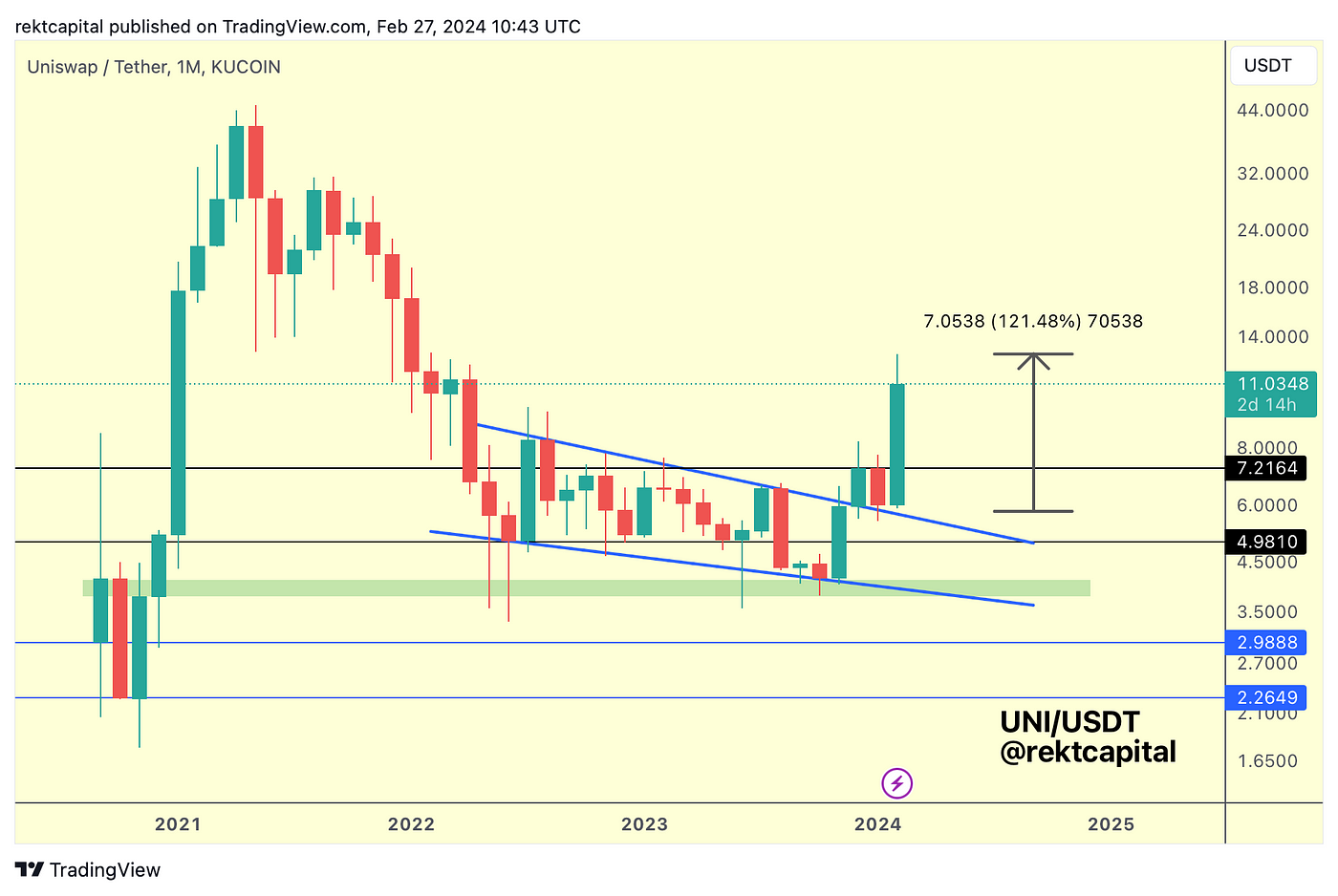

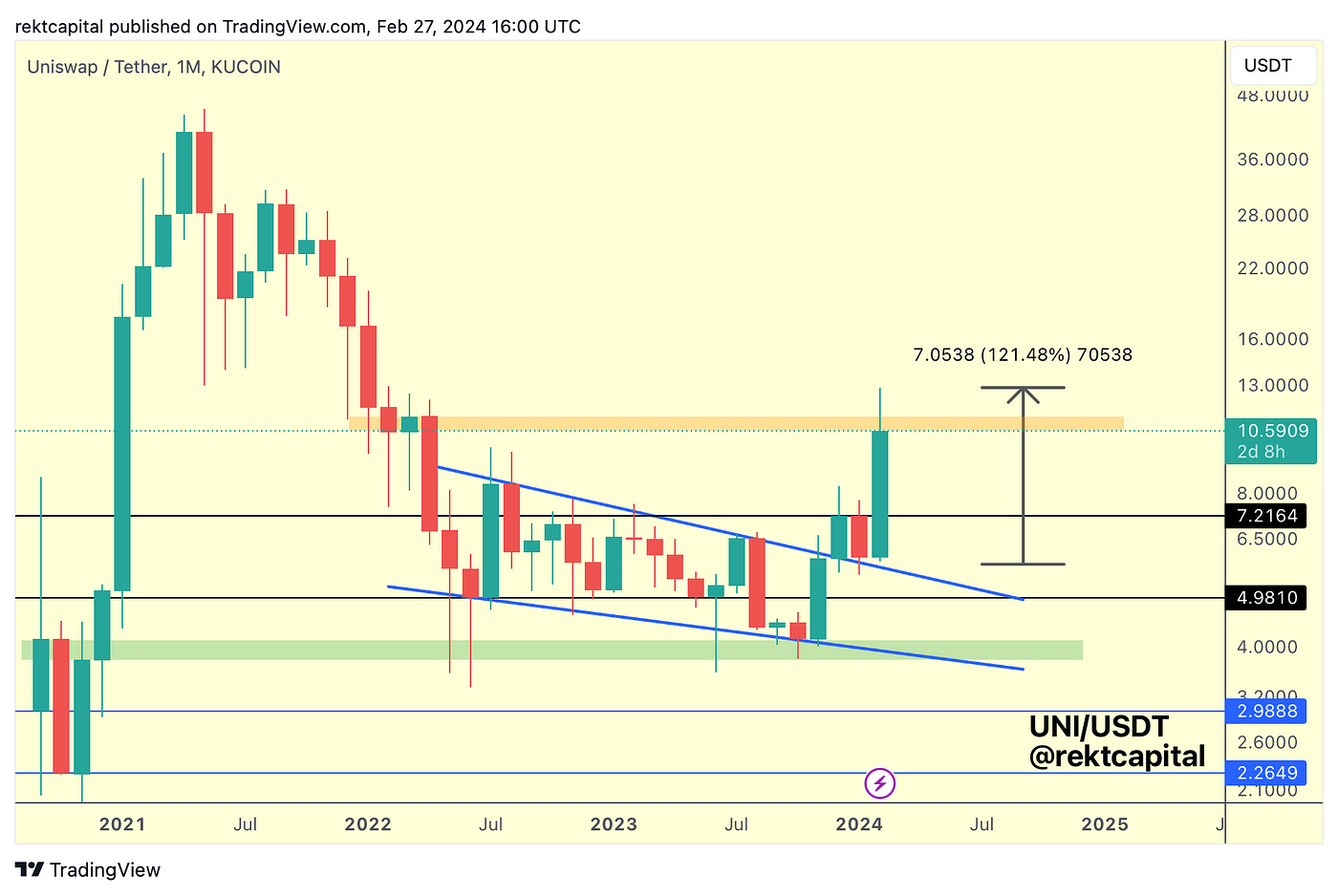

UniSwap — UNI/USDT

UniSwap is an Altcoin we’ve been covering for several weeks and we’ve often compared it to THETA which has shared an technical identical setup.

Let’s first start with UNI where we discussed the post-breakout retest:

UNI had broken out from its blue Falling Wedge and since that time, we were preparing for its retest attempt and the trend continuation that would come after it.

UNI has since rallied a phenomenal amount, fully confirming its new macro uptrend upon breakout from the macro pattern:

Now that UNI has confirmed its new macro uptrend, the direction over time is simply going to be up.

That being said, it’s worth considering possibilities for short-term fluctuations.

On this breakout, UNI has rallied into a previous area of historical demand (orange):

However this area hasn’t acted as strong support in the past, preceding a breakdown that would see price drop into Bear Market Bottom levels.

Since it wasn’t a support, it’s easy to think that this region won’t act as an equally strong resistance.

After all — in early 2021 UNI broke to new highs beyond this region without even a slight disruption.

This time of course there is additional price history but the benefit here is that this region of old support could be reclaimed as one and this would be the next trigger UNI would need to offer to confirm additional upside from here.

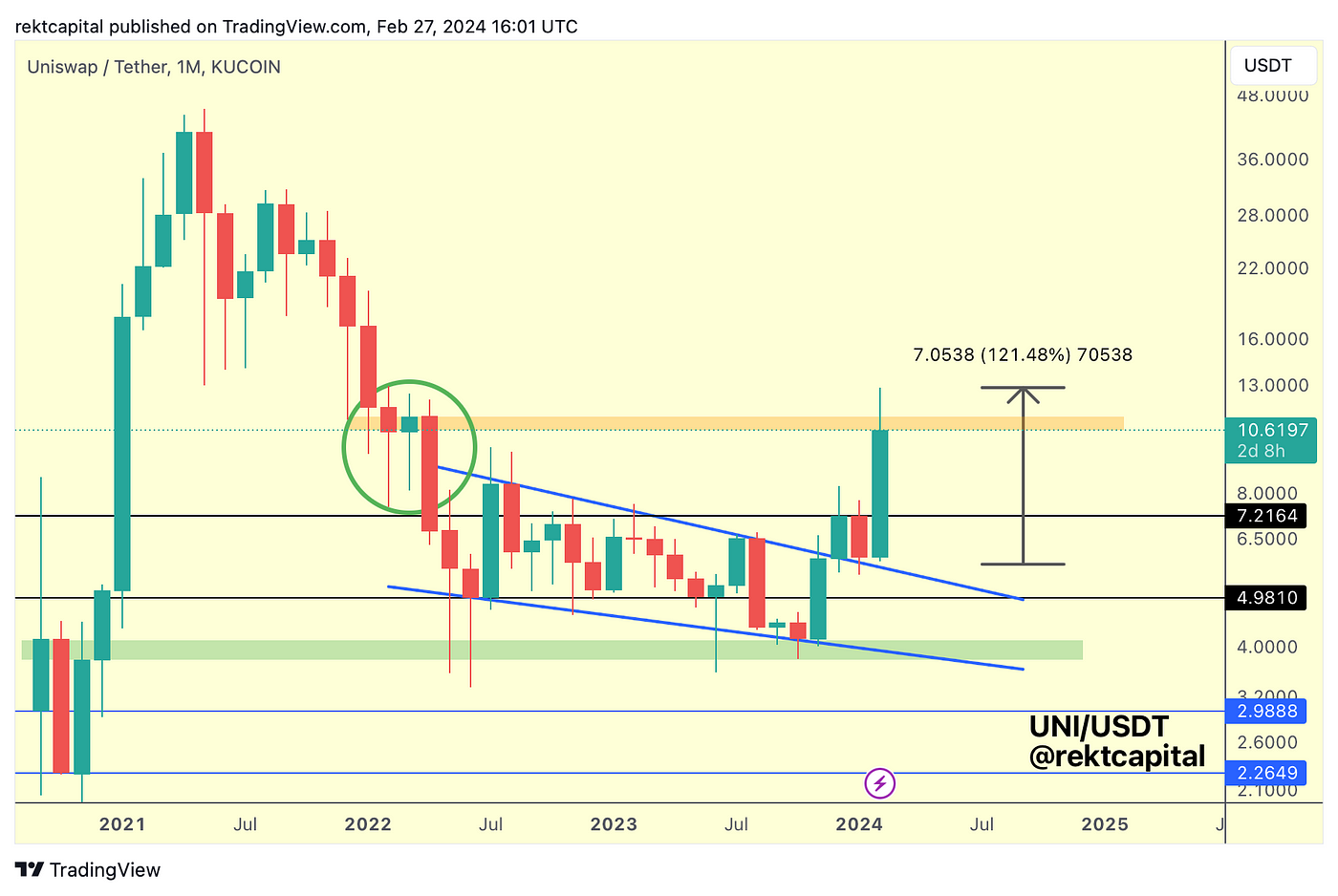

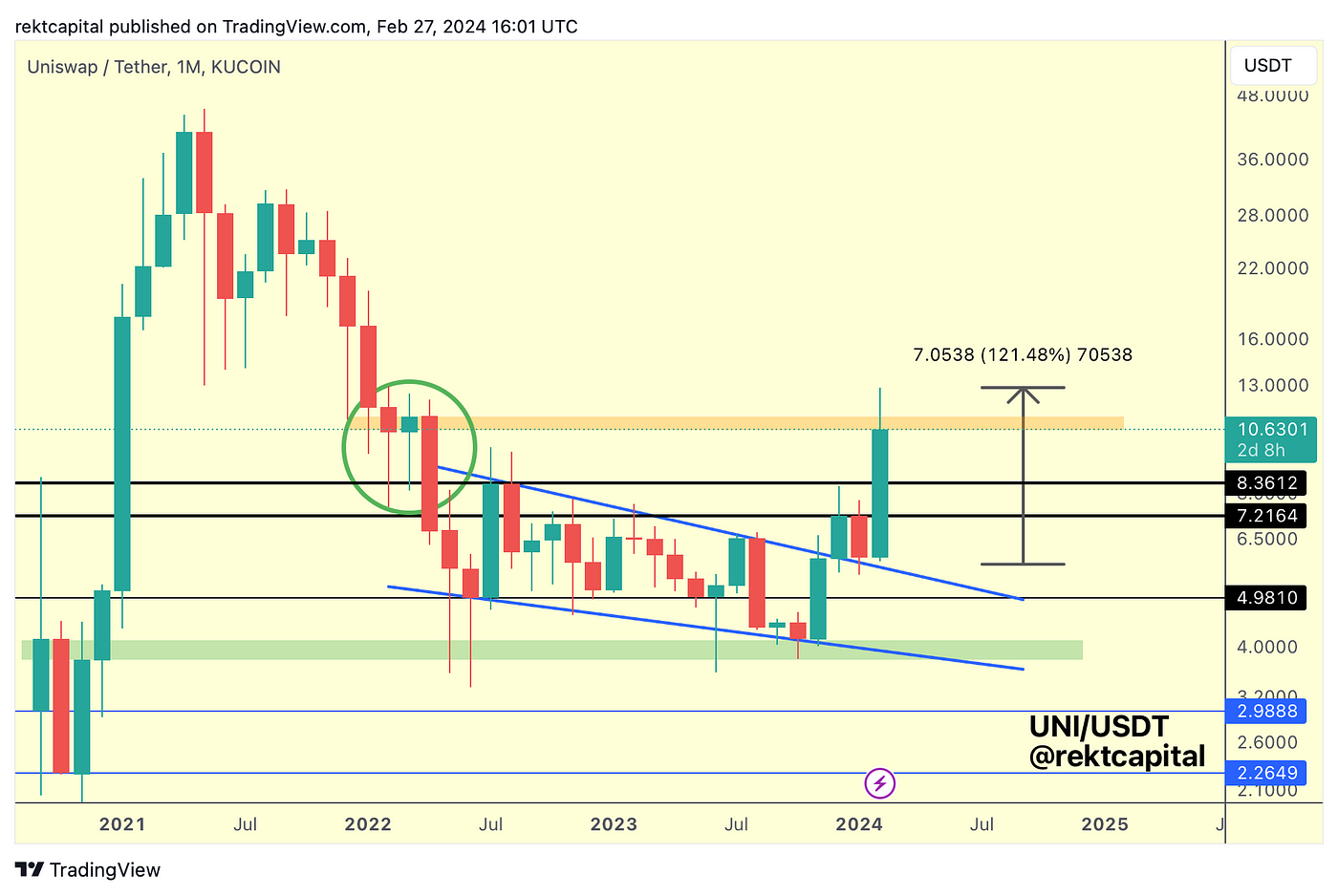

That being said, in terms of dipping opportunities, that old historical support showcases that volatile downside wicking tends to occur here (green circle):

Should UNI display that same level of volatility upon trying to retest this region as new support, there would be scope for dips into the low $8.00s (e.g. $8.36) and if UNI really overextends to the downside, maybe even closer to the $7.21 level:

Generally, those two thick black Monthly levels will be areas to watch for and downside wicking during a retest attempt of the orange resistance area at current price levels.

CLICK HERE to go Premium and read the rest of this week’s Market Analysis – Premium subs can read Rekt capital’s full report.

Points: Airdrop Farmers No Longer in the Dark

Collecting points has become a dominant ‘game’ in crypto in the past half year. Collecting points is to airdrop hunters what collecting air miles is to frequent flyers: it keeps a tab on their activity.

Airdrop hopefuls get a sense of how much they might collect when the drop drops. Let’s discuss some pros and cons of this approach.

TO READ THE REST OF THIS ARTICLE, CLICK HERE – “Points: Airdrop Farmers No Longer in the Dark”

Crypto Market News

- Peter Brandt has significantly increased his September 2025 Bitcoin prediction from $120K to $200K after its 15-month channel breakout. Source

- Crypto investment funds saw total inflows of $570M last week according to CoinShares. Source

- The stablecoin market value has hit $140 billion which is its highest level since late 2022. Source

- MicroStrategy has bought 3,000 more Bitcoins to bring its total holdings to 193,000. Source

- Valkyrie has launched a 2x leveraged Bitcoin Futures fund listed on the Nasdaq. Source

- Bitcoin miner Hut 8 is to finance its new Texas mining operations with Bitcoin reserves. Source

- Terraform Labs co-founder Do Kwon is reportedly set to be extradited to the US to face fraud charges. Source

- Coinbase is backing Grayscale’s application to convert its Ethereum Trust to a spot ETF despite analysts warning of “concentration risk.” Source

- Grayscale’s Bitcoin ETF has seen its lowest daily outflows on February 23 after $44.2 million left the fund. Source

- Bitcoin could reach $150K this year according to Fundstrat’s Tom Lee. Source

- Bitcoin miner Riot and the Texas Blockchain Council have secured a win against US energy officials mandating the sharing of crypto mining data. Source

- Riot recorded a 19% increase in its Bitcoin mining production in 2023. Source

- Reddit has revealed it has bought Bitcoin and Ethereum with excess cash. Source

- US-based crypto brokerage OANDA will launch crypto trading services in the UK. Source

- Crypto.com will list a stablecoin issued by one of Latin America’s largest banking institutions, BTG Pactual. Source

- OKX has officially launched its crypto exchange services in Turkey as part of its European expansion plans. Source

Coins and Projects

- Bitcoin has hit new all-time highs in 14 countries but not the US just yet. Source

- Bitcoin spot ETFs have seen the highest trading volume since mid-January. Source

- Michael Saylor has confirmed he is not selling any Bitcoin as it’s the “exit strategy.” Source

- Newly released emails from Satoshi bring new insights into the early days of Bitcoin. Source

- Bulgaria’s soccer club Botev Plovdiv has adopted Bitcoin Lightning and Liquid wallet. Source

- Bitcoin zk rollup Citrea has raised $2.7M in a seed funding round led by Galaxy Ventures. Source

- Marathon Digital has unveiled a new direct Bitcoin transaction submission service called “Slipstream” to speed up large and/or non-standard transactions. Source

- Ethereum has become the largest single asset held by institutions according to Bybit research. Source

- Ethereum Layer-2 called Layer N has welcomed the Former Fidelity Digital Assets Head Luc Froehlich to its Advisory Board. Source

- Ethereum liquid staking protocol Lido has reached $30 billion in total value locked (TVL). Source

- Peter Thiel’s Founders Fund has co-led a $27 million funding round for modular blockchain project Avail. Source

- a16z has announced a $100M funding round for Ethereum’s restaking protocol called EigenLayer. Source

- EigenLayer has partnered with AI network Ritual to build AI-powered dApps. Source

- Lido has added 1inch for faster withdrawals of staked ETH and wrapped staked ETH. Source

- Optimism has distributed 10.3M OP tokens worth around $40.8M in its fourth airdrop. Source

- Aave has launched on Binance’s BNB Chain to boost its DeFi ecosystem. Source

- Starknet has changed its token unlock schedule after the backlash from the community Source

- Ethereum Layer-2 Blast has reached $2 billion in TVL ahead of its mainnet launch on February 29. Source

- Uniswap jumped 50% in minutes after a proposal was published to create a fee mechanism for rewarding UNI stakers and delegators. Source

- Binance Labs has invested an undisclosed amount in Babylon, a Bitcoin staking protocol. Source

- Solana NFTs have hit $5 billion in all-time sales volume after recording the second-highest month of sales in December 2023. Source

- Avalanche stopped block production which co-founder Kevin Sekniqi believes to be related to a recently launched inscription wave. Source

- Circle is to stop minting USDC on the Tron network immediately “to ensure that USDC remains trusted.” Source

- Chiliz Chain has gained a new validator in the French soccer team Paris Saint-Germain (PSG). Source

- Arweave has released the testnet for Arweave AO, a scalable blockchain network built on its data storage platform. Source

- Social media platform Farcaster has added support for Solana. Source

- Memecoins on Ethereum and Solana such as PEPE and WIF have gained up to 51% in 24 hours. Source

Macro News

- Donald Trump is no longer anti-Bitcoin and now takes the approach that he can “live with it.” Source

- Five US Senators have joined forces to oppose plans for a US CBDC. Source

- Europe’s CBDC will be for payments only, not investment or holding, says the European Central Bank (ECB). Source

- The ECB has reiterated its disliking for Bitcoin in a blog post that says despite the ETF approvals in the US, there is no “proof-of-price.” Source

- Nvidia sees AI reaching a tipping point as it beats earnings projections for Q4 and crypto AI tokens rally. Source

Thank you so much for your support, and I truly hope that today’s issue will give you insights needed to help you master your wealth.

If you are reading this it means you are on the free version of the Wealth Mastery Investor Report, which is great for news and tips on the crypto markets.

If you really want to take advantage of fastest growing asset class EVER, I highly recommend that you check out my new altcoin course: Mastering Altcoin Investing

In this course we’ll teach you all about how to spot, choose and acquire the winning altcoins of the next bull market.

Learn how to build your portfolio so that growth is ensured and risk is mitigated. Let me help you build a strategy that’ll change your life forever in the upcoming bull run.

See you next time!

Lark and the Wealth Mastery Team

💰 BINANCE: BEST EXCHANGE FOR BUYING CRYPTO IN THE WORLD 👉 10% OFF FEES & $600 BONUS

🚀 BYBIT: #1 EXCHANGE FOR TRADING 👉 GET EXCLUSIVE FEE DISCOUNTS & BONUSES

🔒 BEST CRYPTO WALLET TO KEEP YOUR ASSETS SAFE 👉 BUY LEDGER WALLET HERE

📈 TRADING VIEW: BEST CHARTING SOFTWARE ON THE INTERNET 👉 JOIN NOW

1️⃣ COINLEDGER: #1 CRYPTO TAX SOFTWARE 👉 IF YOU OWN OR TRADE CRYPTO YOU NEED THIS

Wealth Mastery (Lark Davis, and the Wealth Mastery writing team) are not providing you individually tailored investment advice. Nor is Wealth Mastery registered to provide investment advice, is not a financial adviser, and is not a broker-dealer. The material provided is for educational purposes only. Wealth Mastery is not responsible for any gains or losses that result from your cryptocurrency investments. Investing in cryptocurrency involves a high degree of risk and should be considered only by persons who can afford to sustain a loss of their entire investment. Investors should consult their financial adviser before investing in cryptocurrency.

You can find a full disclosure of all my crypto & venture investments here.