Monthly Crypto Alpha Report – April 2024

February’s holy-crap-green-candle was followed by another nice green one, BTC’s seventh green successive monthly close.

Let’s see what is going on.

Is this time different? Seven months in a row BTC has closed higher. This hasn’t happened before.

Granted, it’s a bit of a lucky streak, as January was only 200 dollars removed from closing lower than December. But still. We’re still in a solid Bitcoin ETF rally.

Another sign that market structure is interesting is that the (healthy) pullback of the current bull run – The March 14 – March 19 pullback – was roughly 18% deep and the previous ones of 2023/2024 were in a similar 20% ballpark.

Anyone who witnessed the 2020/21 bull run, knows that these are pullbacks for ants. Of course, bigger pullbacks can and probably will come…

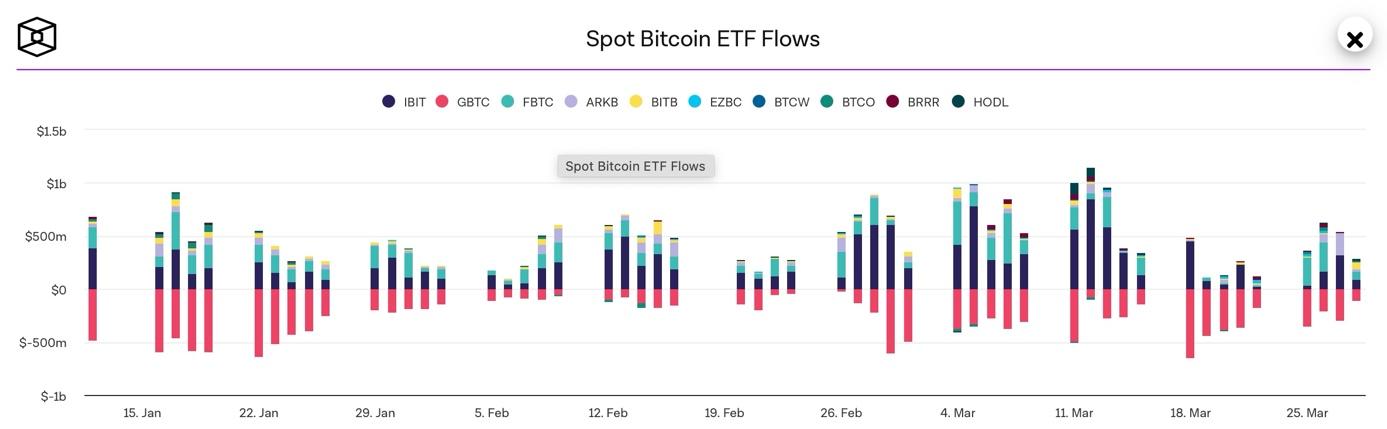

It’s interesting to see how the inflows for the Bitcoin ETFs behaved during this pullback. Here’s a plot from The Block.

The red bars are Grayscale Bitcoin Trust outflows, the other colors are the 9 new ETFs. It’s remarkable that they have seen consistent net inflows, even during the price correction. The ETF holders aren’t as paper-handed as we might have thought. This continuous inflow is not normal, in fact the current streak is apparently a record in ETF history.

The ETFs are breaking records. ETF analysts like Balchunas keep stressing what a breakout success these ETFs are. Larry Fink on CNBC called the launch the most successful launch in ETF history. You could say he is talking about his book (IBIT ETF) but then again, he has hundreds of ETFs on his book.

In the meantime, in Hong Kong… spot bitcoin ETFs seem to be imminent. The list of companies that have applied for spot bitcoin ETFs in Hong Kong keeps growing to ten. Local reporting suggests that as many as ten firms have or plan to file applications with the local securities commission.

This agency will probably begin approving ETF applications in Q2 of this year. Expect some serious price action madness. These ETFs will open the floodgates to funds within the larger Chinese region, and it will all be happening post-halving.

What’s next for BTC prise-wise? If the Fib levels are any indication, we could see a move to the 1.618 level of the recent retracement we had, around $82.000.

Further evidence for this is that the weekly and monthly close were above the $69.000 level, indicating that the bulls are back in charge. However keep in mind that we will need to cross the 74k level to leave this correction behind us.

Could we see a pull-back? Of course, and if history is any guide, such a pullback could go to around the level of the recent correction, so around 60k. The weeks around the halving are traditionally weeks to accumulate or buy sharp pullbacks.

Maybe the price will consolidate in a triangle, with the apex around the halving.

Let’s talk Ethereum. Poor Ethereum faced a deeper pullback than BTC. But you know what the nice thing is about deep pullbacks? They set the stage for a big swing to the upside. That’s not just frivolous talk, it’s what historical patterns show. Again, using the Fibonacci levels, we see that the 1.618 extension would bring ETH to around 4700-4800 region, roughly the previous all-time high. It might take some time to get there, though.

The problem is Ethereum is now facing a headwind, or rather a lack of tailwind: it is deemed highly likely by analysts that the ETH spot ETFs won’t be approved this coming May. So Ether will likely have to wait a bit longer before it will have that extra kick of institutional demand and narrative leading up to it.

In the meantime, there has been TONS of bullish news for Ethereum. The mid-March Dencun upgrade (‘Blobs’) went flawless, paving the way for more affordable activity on Ethereum Layer 2s. Layer 2 network activity has exploded and value will in time accrue to ETH the asset.

Then there was the remarkable announcement by the largest investment firm in the world, BlackRock. Their BUIDL will be a tokenized money market fund for institutionals. The yield is paid in new BUIDL tokens each month. It shows that Blackrock wasn’t kidding when they claimed they want to tokenize everything. And they launched on

Enjoy the Bitcoin halving in a few weeks. Maybe celebrate it with your bear market buddies, you’ve all earned a drink. Or heck, gift a crypto-curious friend a hardware wallet and show them how to send and receive some sats.

💰 BINANCE: BEST EXCHANGE FOR BUYING CRYPTO IN THE WORLD 👉 10% OFF FEES & $600 BONUS

🚀 BYBIT: #1 EXCHANGE FOR TRADING 👉 GET EXCLUSIVE FEE DISCOUNTS & BONUSES

🔒 BEST CRYPTO WALLET TO KEEP YOUR ASSETS SAFE 👉 BUY LEDGER WALLET HERE

📈 TRADING VIEW: BEST CHARTING SOFTWARE ON THE INTERNET 👉 JOIN NOW

1️⃣ COINLEDGER: #1 CRYPTO TAX SOFTWARE 👉 IF YOU OWN OR TRADE CRYPTO YOU NEED THIS

TCL Publishing ltd (director Lark Davis, owner of Wealth Mastery) is not providing you individually tailored investment advice. Nor is TCL Publishing registered to provide investment advice, is not a financial adviser, and is not a broker-dealer. The material provided is for educational purposes only. TCL Publishing is not responsible for any gains or losses that result from your cryptocurrency investments. Investing in cryptocurrency involves a high degree of risk and should be considered only by persons who can afford to sustain a loss of their entire investment. Investors should consult their financial adviser before investing in cryptocurrency.

You can find a full disclosure of all my crypto & venture investments here.

Responses