Monthly Crypto Alpha Report – June 2024

Many times, I have opened newsletters with the statement that the past month was the craziest, most consequential month in crypto.

But crypto proves it can be even wackier. Crypto has outdone itself… again.

SEC’s Gensler approving the Ethereum ETF…

Trump smelling blood and suddenly standing up for the right of self-custody of the American people…

The Democratic party scrambling to appease the US pro-crypto army…

Wow (still, Biden himself didn’t bend the knee and went against his Democratic Senators’ votes, vetoing a bill that would overturn a controversial bulletin that will prevent banks from custodying crypto).

This is bullish of course, as we’re now moving deeper in an election year in which both parties want to appease the tens of millions of Americans who hold crypto. In the background, the money printer is being loaded up with fresh paper and ink.

The pro-crypto army has proven to be stronger than the anti-crypto army.

The older generation Dems were slow to realize that you better not kick a nest of cyber hornets. We crypto maniacs have the energy and money to fight, and maybe even more importantly… the memes!

Considering all this crazy backdrop, the price of BTC has been relatively flat, just consolidating.

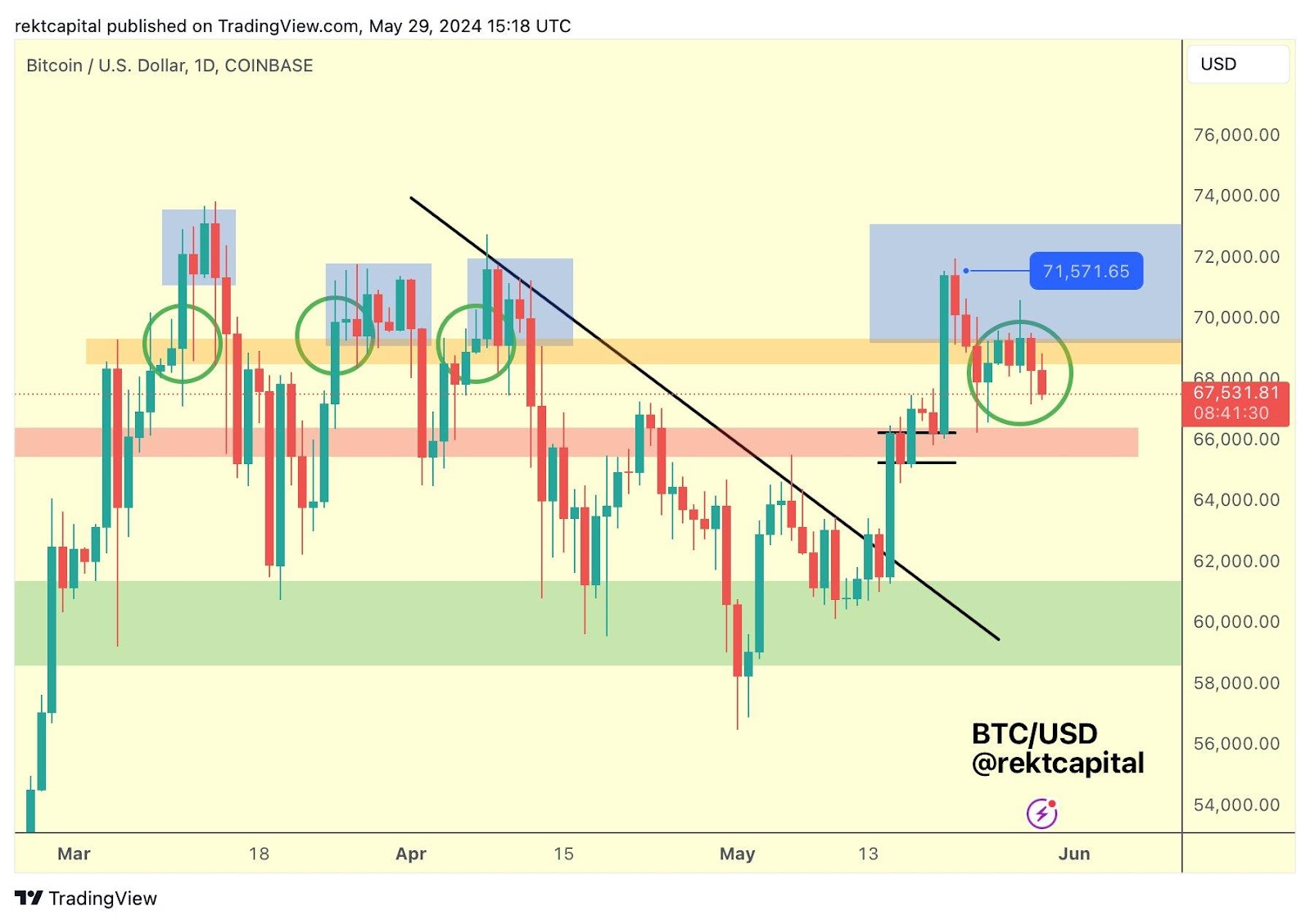

BTC continues to slide down after failing to reclaim the orange area as support. In fact, Bitcoin is showing signs that it has turned this orange area into new resistance.

BTC needs a weekly close above ~$71.500 to potentially kickstart the breakout from the Re-Accumulation Range into the parabolic phase. We might just consolidate a bit more before hopefully breaking out.

It has been a healthy period of cooling down, as the current bull run is slowly but surely getting back on schedule compared to previous bull runs. It’s still 180 days ahead of schedule though.

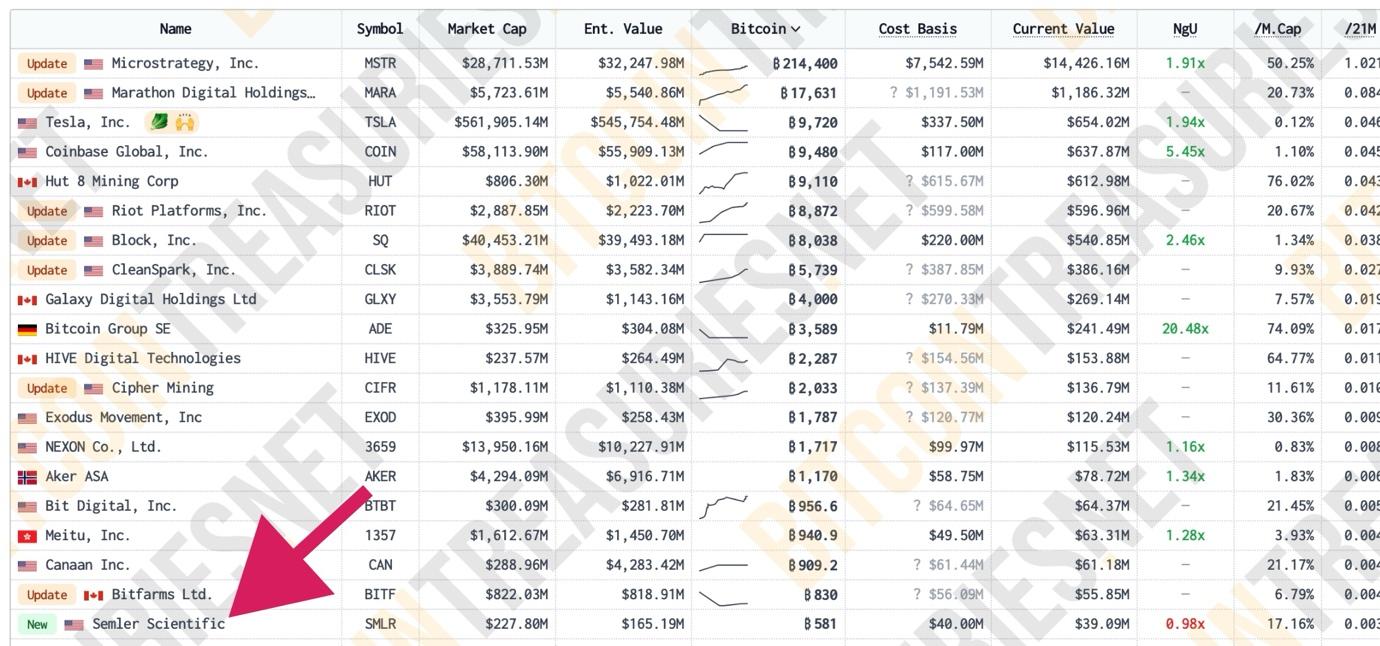

An interesting narrative from 2020/21 has sprung back to life: companies allocating BTC to their treasury. Medical device maker Semler Scientific announced it had added 40 million dollars of BTC to its corporate treasury. Its stock price pumped, which other companies will take note of.

The list of Bitcoin treasuries is getting quite long: more than 30 companies hold more than 100 BTC. Many are Bitcoin-related or finance companies, so a fresh entrant from the health technology world was a nice surprise. It shows us that the narrative and reality of corporate treasury adoption is not dead.

For our Bitcoin bags to pump. we don’t need every company in the world to put half of their cash into Bitcoin. A few percent of the companies allocating a few percent of their wealth will go a long way.

Oh, and did you hear that the state of Wisconsin’s pension fund bought $164 million worth of Bitcoin ETFs? The badger state loves the ‘honey badger’…

Ethereum: How Popular Will the Upcoming ETFs Become?

Let’s all take a moment and enjoy the beautiful sight of the biggest daily candle for Ether in its history, almost 600 dollars.

Of course, it happened on the day of the spot ETF approval in the US. ETH’s price had been pushing up its nose against the 50-day exponential moving average on many occasions since mid-April. The approval did the trick.

Within a few weeks to months, ten or so Ethereum ETFs will launch. What will it mean for price? The same dynamic as with the Bitcoin ETFs is at play. A few opposing forces will drive the price. As with Bitcoin, there is a large Grayscale Ethereum ETF that investors can finally exit – and they will. This happened with Bitcoin too, but the selling pressure it created was easily offset by the new demand generated from the new ETFs.

I saw an interview with the CIO of BitWise, who predicted that they will be a big success. He based this on his recent conversations with wealth allocators, who show a lot of interest. His reasoning is: they want to diversify and many investors who have allocated to the Bitcoin ETF will also allocate to ETH as well. There are plenty of narratives to sell Ethereum on next to Bitcoin’s digital gold: the ‘app store of blockchain’ for example.

But there is also a case to be made that the demand for the Ethereum ETF will be underwhelming. When we compare the demand for the already existing ETH futures ETFs, we see that the trading volume is roughly 60 times lower compared to BTC futures ETFs.

A final data point comes from Hong Kong, where both Ethereum and Bitcoin spot ETFs are traded. The Hong Kong Ether ETFs account for roughly 15% of the volume of the Bitcoin ETFs.

We’ll have to see, but obviously this approval is bullish for Ethereum. It will unlock a new floodgate, a new pipeline of funds. If you’re underweight ETH but believe in the asset, there isn’t much time left to load up.

In the meantime, ETH has weekly-closed below the $3956 level which means that this level is still acting as resistance. What ETH needs to do is to weekly-close above the green level, like it did in mid-2021, to continue its upward path.

It looks like we’re all going on a summer holiday. It’s time to pack your bags before lift-off…

💰 BINANCE: BEST EXCHANGE FOR BUYING CRYPTO IN THE WORLD 👉 10% OFF FEES & $600 BONUS

🚀 BYBIT: #1 EXCHANGE FOR TRADING 👉 GET EXCLUSIVE FEE DISCOUNTS & BONUSES

🔒 BEST CRYPTO WALLET TO KEEP YOUR ASSETS SAFE 👉 BUY LEDGER WALLET HERE

1️⃣ COINLEDGER: #1 CRYPTO TAX SOFTWARE 👉 IF YOU OWN OR TRADE CRYPTO YOU NEED THIS

TCL Publishing ltd (director Lark Davis, owner of Wealth Mastery) is not providing you individually tailored investment advice. Nor is TCL Publishing registered to provide investment advice, is not a financial adviser, and is not a broker-dealer. The material provided is for educational purposes only. TCL Publishing is not responsible for any gains or losses that result from your cryptocurrency investments. Investing in cryptocurrency involves a high degree of risk and should be considered only by persons who can afford to sustain a loss of their entire investment. Investors should consult their financial adviser before investing in cryptocurrency.

You can find a full disclosure of all my crypto & venture investments here.

Responses