Monthly Crypto Alpha Report – June

Market Roundup

I’m still waiting for a boring month in crypto, but it seems we’ll have to wait forever. Even with prices pretty much flat, plenty of incidents kept us entertained. A company like Ledger suddenly entered its midlife crisis… Bitcoin maxi’s clashing with the Taproot Wizards at Bitcoin Miami, right after a US presidential candidate vowed his support for Bitcoin. Who would have thought a few years ago that Bitcoin would be an issue for many presidential candidates. Beneath the flat surface of the price, things are shifting…

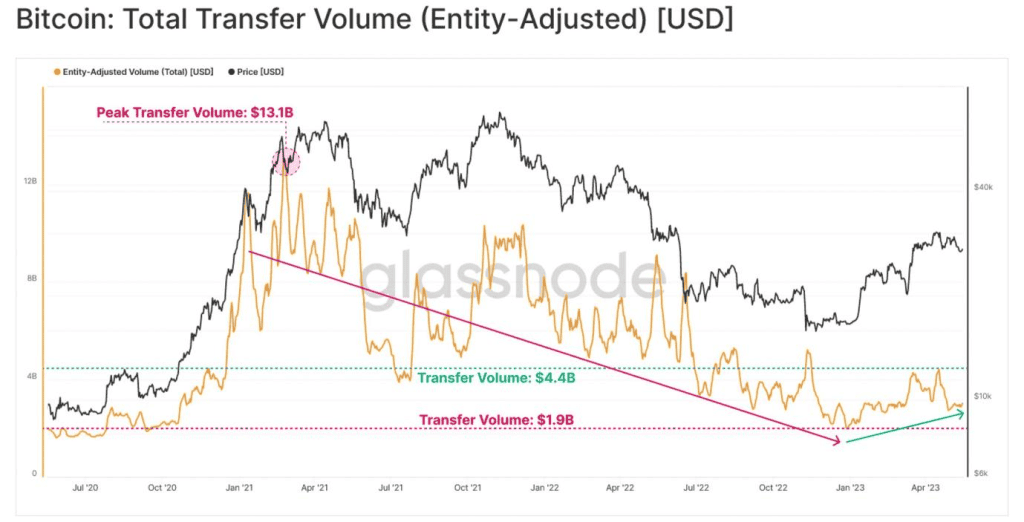

For traders, it was a boring month. Total crypto trading volumes are at record lows. According to below Glassnode chart, Bitcoin’s transfer volume has dropped a staggering 79% since early 2021. There aren’t a lot of sellers. Everyone who wanted to sell has already long done so, so I’m pretty confident the bottom is in. But there are also not many buyers yet. Low volumes mean we have less certainty about the current value of an asset. Historically, low volumes in crypto have often preceded big price movements.

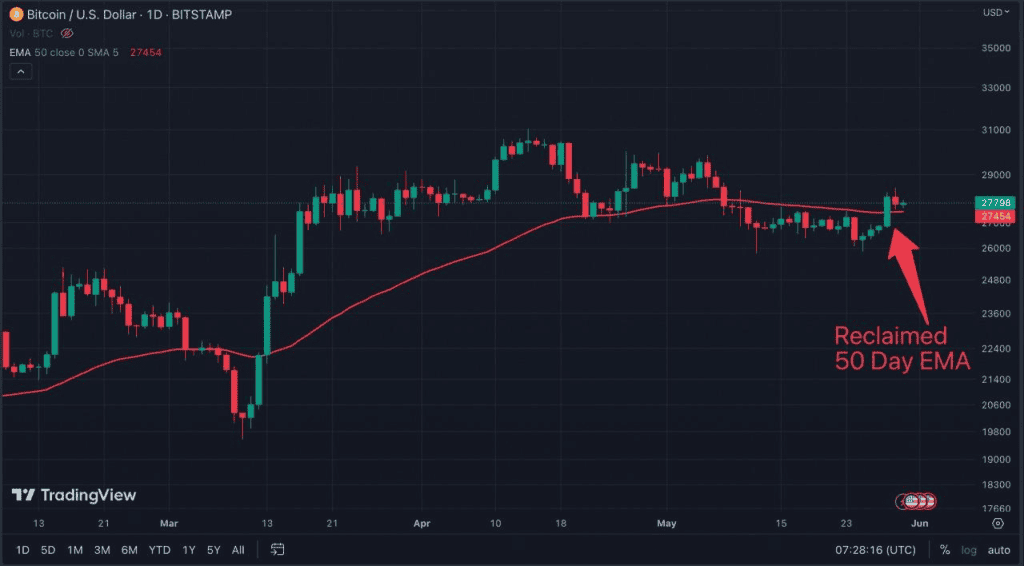

Looking at the price, not much has happened since a month ago. But it was cool to see that last week, BTC reclaimed the 50-day EMA.

At the time of writing BTC is struggling to hold this 50-day EMA line.

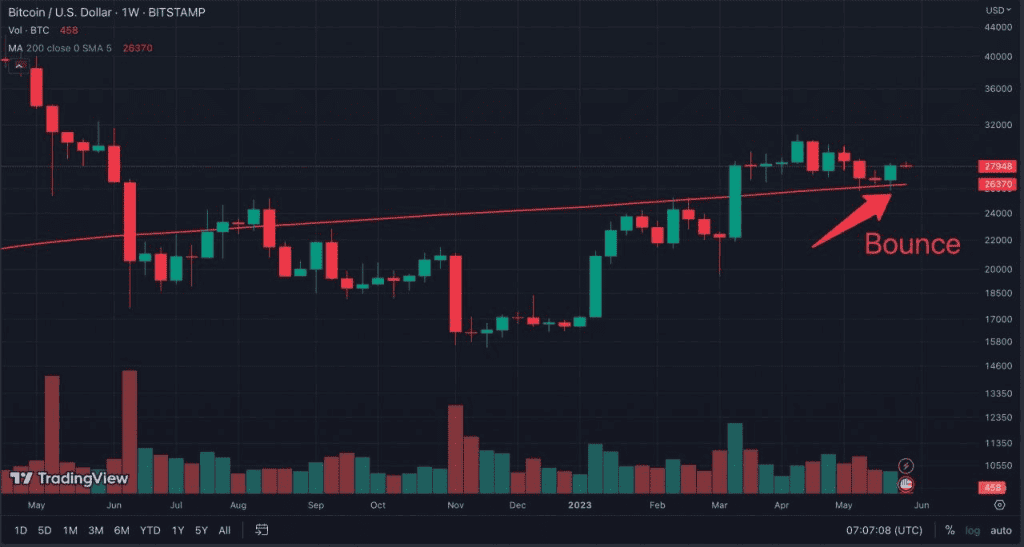

A few days earlier, BTC price bounced off the 200-week moving average around $26.200.

It’s the kind of retest you want to see after the break we had in March.

Below this $26.200 level, around $25.300 is another support level: the price post Terra/Luna crash.

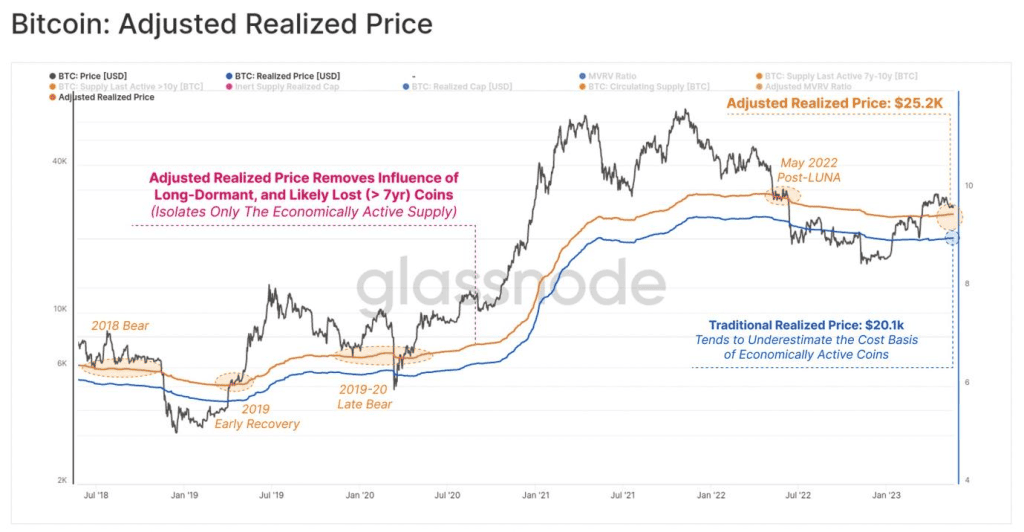

It’s interesting that this level has confluence with a metric Glassnode recently introduced called the Adjusted Realized Price. A rough definition of the realized price is the dollar value that Bitcoin holders on average paid for their coins. Comparing this price to the current Bitcoin price tells us if the market as a whole is in profit or loss.

What Glassnode analyst Checkmate has dubbed the Adjusted Realized Price removes old coins from the equation. The idea is that the older coins distort the metric, for example, Satoshi era coins, many of which are lost and/or won’t move anymore. In this Adjusted Realized Price metric, the giga unrealized profits of these old coins are not factored in. The result is a higher adjusted realized price: $25.200 instead of around $20.000.

As Glassnode points out in below graph, this adjusted realized price metric has interacted better with price than traditional realized price.

All this to say that the level around $25.200 is an interesting one to watch. It seems to be serious resistance if it were tested. Let’s see but there is a decent probability it will hold when tested. Long-term hodlers keep hodling at current prices. And current short-term holders – often identified with the weak hands – are the ones who bought since the January lows. It’s hard to imagine these believers panic selling when price drops a bit.

Liquidity and Our Bags

Global liquidity – the amount of money floating around available for trading – is mega important for crypto prices – and stock prices for that matter.

A looming issue that causes uncertainty for US liquidity is the US debt ceiling. Last weekend, the President and the Speaker reached a deal to raise it. This looks good, but it’s not certain that the deal will go through the House. Even if it did, a raised debt ceiling could have temporary negative effects on liquidity and hence our bags. Why? Because the US Treasury’s General Account has been drained over the past period. Refilling it will suck liquidity out of the market. Then again, there are also scenarios surrounding this debt ceiling which are good for liquidity. Long story short, the situation is hard to predict, markets are a bit nervous, and liquidity may get messy.

Will China Pump Our Bags?

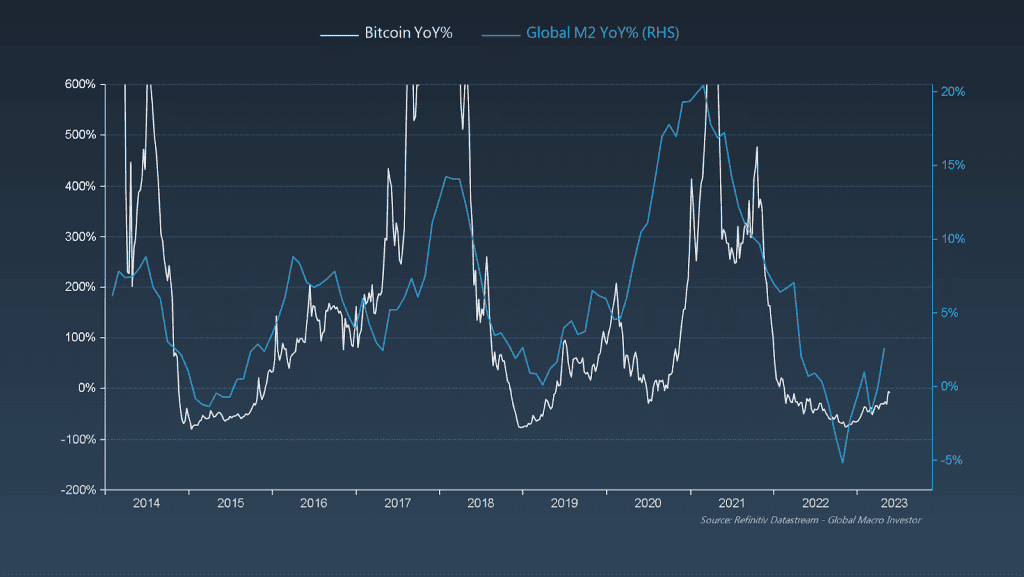

As we keep repeating at nauseam, the world is bigger than the US. China, man! In the below chart from Global Macro Investor we see the global money supply (M2) change compared to the change in the BTC price. There is for sure a correlation here.

As you can see, M2 has broken above the 0% year-on-year change, even though liquidity in the US has been rather flat. That’s largely because of China, which has pumped money in their economy.

Also bullish: Hong Kong retail investors can start trading fifteen major cryptocurrency tokens from June 1st as a new virtual-assets regime kicks off. Interestingly, on the 24th of May, China state television aired a positive item about crypto. Only days later, the Chinese government issued a friggin whitepaper talking positively about crypto! For better or worse, China is one of the biggest players in crypto markets. These recent developments are once again confirmation that China is pivoting from its staunch anti-crypto stance. Bullish.

Top Airdrops of the Month

Top Altcoins to Watch

Top NFT Mints of the Month

Best DeFi Farm of the Month

Recommended Services

🔥🔥🔥 TOP RECOMMENDED CRYPTO SERVICES 🔥🔥🔥

💰 BINANCE: BEST EXCHANGE FOR BUYING CRYPTO IN THE WORLD 👉 10% OFF FEES & $600 BONUS

🚀 BYBIT: #1 EXCHANGE FOR TRADING 👉 GET EXCLUSIVE FEE DISCOUNTS & BONUSES

🔒 BEST CRYPTO WALLET TO KEEP YOUR ASSETS SAFE 👉 BUY LEDGER WALLET HERE

Legal Disclaimer

TCL Publishing ltd (director Lark Davis, owner of Wealth Mastery) is not providing you individually tailored investment advice. Nor is TCL Publishing registered to provide investment advice, is not a financial adviser, and is not a broker-dealer. The material provided is for educational purposes only. TCL Publishing is not responsible for any gains or losses that result from your cryptocurrency investments. Investing in cryptocurrency involves a high degree of risk and should be considered only by persons who can afford to sustain a loss of their entire investment. Investors should consult their financial adviser before investing in cryptocurrency.

You can find a full disclosure of all my crypto & venture investments here.

Responses