The Team from Synthetix, Shiba Inu Report & Polygon vs. Solana

In This Issue

- The team from The team from Synthetix discusses how they provide deep liquidity for synthetic assets.

- Erik has a report for you on Shiba Inu.

- David compares Polygon vs Solana

Premium members also get the following:

- My latest portfolio updates

- Rekt Capital has the latest technical analysis for you on the market.

- Rebecca has all of the latest news for you.

- Upcoming NFT drops

- Defi Dad has a tutorial for you on how to earn up to 70% APY lending ETH during The Merge.

- Jesse has a ton of hot new airdrops for you.

- Hot new token sales.

- Rebecca breaks down this week’s trending coins.

- Jesse has a deep dive for you on VeChain.

And much more!

Synthetix Interview

For anyone not familiar, what is Synthetix?

Synthetix is a decentralized finance protocol that provides deep liquidity for synthetic assets on the Ethereum blockchain. This enables other protocols to build fully decentralized and composable financial dapps for price exposure to spot and perps cryptocurrencies, commodities like gold and silver, forex, and eventually a wide range of exotic financials. From this, Synthetix powers an extensive ecosystem of protocols built on top of it including:

- Kwenta: Perpetual futures

- Lyra: Options AMM

- Thales: Parimutuel options

- Overtime Markets: Sports betting

- Polynomial Finance: Structured product vaults

- dHedge: Decentralized hedge funds

- 1inch and other aggregators: Atomic Swaps

If you want to learn more about Kain, the founder, who is one of the most influential voices in crypto and defi then check this out.

What is the use case for the SNX token?

The SNX token provides collateral for the Synthetix platform, enabling users to mint sUSD to use within the ecosystem and on other DeFi protocols like Aave, Curve, etc. By staking SNX users earn a proportion of weekly fees generated by the exchange and any inflationary rewards. Stakers also have the ability to vote in quarterly elections for various councils that comprise the Synthetix DAO.

How much can SNX stakers earn?

Stakers receive two kinds of rewards for staking SNX: sUSD fees generated from traders interacting with Synthetix ecosystem protocols (Kwenta Futures, Lyra options, Curve cross-asset swaps, etc) and SNX inflationary rewards (for now).

Currently, the annual percentage yield for stakers from SNX rewards and sUSD fees is around 67%, with an average APY of ~10% coming directly from fees. Synthetix is one of the only DeFi protocols where 100% fees go directly to stakers.

What is SNX v3?

Synthetix V3 aims to accomplish what Synthetix set out to do many years ago – transforming the protocol into a permissionless derivatives platform. Below is the high level long-term vision for V3:

- V3 aims to solve one of DeFi’s biggest problems for new protocols: The cold start liquidity problem. New protocols can’t attract liquidity to gain users, and users don’t have enough liquidity to use the protocol. Protocols resort to giving out large amounts of tokens to grow liquidity.

- These incentives don’t work in the long term, which is where Synthetix comes in.

- Protocols will use Synthetix to grow liquidity. Spin up whatever derivative your protocol is building, then lobby for stakers to direct capital to it.

- Synthetix V3 is a complete rebuild of the protocol from the ground up. Many DeFi architecture standards weren’t standards when Synthetix was built. This rebuild will set Synthetix up with a much more efficient architecture to develop novel DeFi applications on top of. Synthetix will become a protocol for protocols. Anyone will be able to build on top of Synthetix and put its deep liquidity to use for any sort of derivative they’re trying to build.

- Why will builders love V3:

- Create a pool to support (nearly) any financial derivative you want to build

- From traditional financial markets to more exotic markets such as no-loss lotteries or even wholly separate protocols

- Current (perceived) competitors could source and route liquidity through Synthetix to increase markets

- Solves the Cold Start liquidity problem – simplifying the provisioning of liquidity for early markets

- Integrating will take days, not weeks

Synthetix V3 builds on years of research and development and will transform the protocol into a permissionless derivatives platform. Granted, Synthetix V3 hasn’t been approved by governance yet. It continues to evolve based on governance and community input. The Synthetix Improvement Proposals (SIPs) that define V3 can be found here.

It was recently proposed to cap SNX emissions, what was the logic behind that?

SNX reward inflation was initially intended to bootstrap the network. However Kain, Synthetix’ founder who submitted the SIP for the change, believes it’s no longer necessary as Synthetix can generate sustainable fee yields from atomic swaps while maintaining a healthy level of staked SNX to backstop the liquidity of sUSD.

A rise in fee revenue has been a result of a combination of more users of our perps product through Kwenta.io as well as DeFi protocols 1inch and Curve starting to use the Synthetix platform for atomic swaps. These two catalysts have vaulted Synthetix into the top fee generating protocols as tracked by cryptofees.info.

What are the pros and cons of synthetic assets?

Synthetic assets, and the basis on which Synthetix is built allows for the creation of almost any financial tool or market on-chain. All you need is a reliable price feed. This enables immediate, deep liquidity with minimal slippage when trading, without having to build up liquidity in each new market over time.

The drawback of this system is that latency from price feeds opens up a vector of attack from HFTs that will attempt to arbitrage the price update from the oracle, resulting in higher fees passed onto traders for some markets.

What backs the Synthetic assets?

Synthetix has an overcollateralized system with each synthetic asset collateralized by more value than it represents to help ensure a robust, stable protocol. Synths are created by users staking SNX as collateral, taking loans against ETH, or wrapping ETH or LUSD, and minting a sUSD against it. At a given time roughly 30% of the network debt is backed by ETH and LUSD. Each Synth is effectively debt against the posted collateral. Each staker’s debt position needs to be maintained at a certain collateralization ratio, which is determined by Synthetix governance (currently 400%). This helps make sure Synths are sufficiently collateralized and there is no deficit in the system, protecting both the system and stakers even during volatile bear market conditions. Stakers need to manually manage their ratio by minting and burning each week to ensure they can continue to earn staking rewards.

Who are some of your biggest partners and how do they contribute to your success?

- Kwenta is a decentralized derivatives trading platform on Optimism, offering real-world and on-chain synthetic assets using the power of Synthetix. It was initially Synthetix.exchange before being spun out into its own independent protocol. Despite being in beta, Kwenta perps have generated $3.85 billion USD in trading volume through organic use with no trading incentives. Synthetix Stakers have received over $13.5 million in trading fees from Kwenta this year.

- Lyra is an options automated market maker (AMM) that allows traders to buy and sell options on cryptocurrencies (currently $ETH and $BTC) against a pool of liquidity. Synthetix stakers receive sUSD fees generated from traders interacting with Lyra, and Lyra utilises Synthetix in three different ways:

- As a settlement currency (All options are quoted, paid for, and settled with Synthetic USD or sUSD).

- As collateral for calls (The AMM collateralizes the calls it sells with the relevant synth. For example, when the AMM sells an sETH call it will purchase 1 sETH from Synthetix. On expiry (or when the option is sold) the AMM will sell the sETH for sUSD and allow the option holder to settle).

- For delta hedging (The protocol aims to keep the exposure of liquidity providers close to delta-neutral. It does this either by longing or short selling the underlying asset on Synthetix. For example, if the AMM is long 500 sETH deltas, it may short sell 500 sETH using Synthetix’s short-selling functionality).

- Curve: Curve’s synth pools enable deep liquidity for like-asset trades and provide the foundation for atomic swaps, enabling traders to efficiently move in and out of synths through ETH/sETH and USDC/sUSD pairs. From this, aggregators like 1inch, Paraswap and 0x can tap into synth exchanges to allow for low-slippage trades between stables and ETH by routing users through Synthetix and Curve pools. For example, a user looking to make a large trade from USDC to ETH might face significant slippage. But by using atomic swaps they will be routed like so: USDC > sUSD > sETH > ETH.

- Chainlink: Accurate and secure price feeds are critical for the DeFi ecosystem. Chainlink is the most trusted Oracle network in Defi, which is why Synthetix has relied on them to provide this critical infrastructure since 2019. With their launch of CCIP later in the year, Chainlink will enable the next phase of Synthetix as a cross-chain protocol.

What comes next for Synthetix?

Perpetual futures V2: Users can look forward to improvements to the underlying architecture, a more efficient funding rate algorithm, off-chain signing mechanism for price updates and a modified price function.

Staking V2: New designs, UI components and tooling to make the staking experience simpler and more streamlined – expecting to go live in a few weeks

V3: The completely re-architected system described earlier that, we believe, will lead to a massive increase in protocols tapping into the network for liquidity. V3 will be built for cross-chain natively. Focused on ETH mainnet and Optimism to start.

V3GM: The new Synthetix governance module. V3GM is a flexible architecture that allows for both on-chain governance as well as elections without requiring direct token voting or poorly conceived vote delegation systems.

If you want to learn more about Synthetix follow us on Twitter or join our Discord.

Shiba Keeps Shipping by Erik

Shiba Inu may be a meme coin but it’s not just relying on the meme to do the work. While not taking itself too seriously, Shiba is continuously shipping products. It has rolled out a dex: Shibaswap. Soon, a Layer 2 of its own making will be released: Shibarium. And there’s much more, including a game.

It’s been only a year since the launch of its decentralized exchange Shibaswap, but Shiba Inu is making it clear that it wants to leverage its meme and community in many ways by actually giving them tools.

For example, Shiba has its collection of NFTs, and a Hollywood design studio is set to work to build its metaverse. There are plans for a stablecoin (SHI), and the Shiba Inu game is in the pilot phase.

What is Shibarium?

Shibarium will tie many of the above products together. The testnet of this Layer 2 is expected to launch in the coming months, and a public beta soon thereafter. Shiba Inu will then have its own blockchain. Not quite though, as Shibarium will be a Layer 2 and SHIB (an ERC20-token) will remain connected to Ethereum. As with other Layer 2’s, Shibarium is a solution to route transaction volume from expensive Ethereum to an additional layer. It will enable rapid, low-cost transactions optimized for gaming.

According to the foundation and development team, hard work is being done in the background. Devs are in the process of deploying the second private Shibarium Alpha TestNet. Also, tools for end-user interaction such as wallets, block explorers, and token transfer bridges are developed. Trusted testers will then get private invitations. The team will use all the feedback to improve the network and tools, before finally releasing a public Beta TestNet.

Rumors about a September release

Rumors about a September 2022 Shibarium release started circulating after Unification xFund, the firm behind Shibarium, revealed in a blog post that Shibarium public beta testnet will be released in Q3 of 2022. One moderator tweeted the date of September 30 but later deleted the tweet. The Shiba Inu team came up with a declaration that the release of Shibarium won’t take place in September.

Impression of the to-be-released Shibarium bridge. Source

Shiba Inu wants to build a whole ecosystem of applications using Shibarium. The following are the most prominent ones.

ShibaSwap

Shibaswap is a decentralized exchange (dex) on which SHIB can be exchanged for other coins. The value locked of Shibaswap is around 50 million. That’s of course not much compared to dexes like Uniswap, where the value is in the billions.

To get a feeling for the playful way in which the Shiba Inu team communicates, we quote them explaining ShibaSwap:

“SHIB, LEASH, and BONE, come together to create ShibaSwap, the next evolution in DeFi platforms. ShibaSwap gives users the ability to DIG (provide liquidity), BURY (stake), and SWAP tokens to gain WOOF Returns through our sophisticated and innovative passive income reward system.”

The role of BONE in Shibarium

BONE is the governance token of the ShibaSwap ecosystem. It allows holders to vote on proposals. Also, after the so-called Bone proposal got accepted by a large majority, BONE is destined to become the ‘gas’ of the Shibarium Protocol. In other words, BONE will enable executing smart contracts and transactions.

Also, in Shibarium, validators will be rewarded in BONE for their work. A minimum amount of 20 million BONE will be needed to become a validator.

The Bone proposal vote has also resulted in a decision about the supply cap of BONE. No more than 250 million will be in existence. With this supply cap set and a strong use case added, BONE might gain traction. Of course, the price action will depend on the total number of users of Shibarium and therefore by the broader adoption of Shiba Inu and Shibarium.

The price of BONE has been increasing at a nice rate, especially since Aug 22 of 2022.

The price of BONE in recent months

Shiboshi NFTs

Released in the fall of 2021, the ten thousand Shiboshi’s sold out in 35 minutes. The NFTs will play a large role in the Shiba Inu game (see below). The Shiba Inu metaverse will also have an integration with the NFTs. The floor price on OpenSea is currently around 0.9 ETH.

SHIB The Metaverse

The Shiba Metaverse is a project featuring virtual real estate – Shiba Inu Lands – that can also give users a passive income. Holders of Shiboshi NFTs get land in this Metaverse.

In July 2022, the lead developer of ShibaSwap, Shytoshi Kusama, announced that SHIB: The Metaverse will be produced by renowned Hollywood studio The Third Floor. It’s a top studio, which has worked with Marvel. It will design and build SHIB the Metaverse.

The Shiba Inu Game

The Shiba Inu Games is now called Shiba Eternity. It will be a multiplayer collectible card game, with 1000 SHIB-inspired cards. Testing has started in Vietnam, for the mobile version. Here’s an impression posted by a player. There will also be an NFT game, which will also use Shiboshi NFTs.

Still from a pilot game of Shiba Eternity

In the works: Stablecoin SHI

SHI is the proposed stablecoin for the Shiba Ecosystem. It is still in the works and scheduled to be released in 2022. According to lead developer ‘Shytoshi Kusama’, it will be an experimental stablecoin. From his blog post, we can gather that the SHI stablecoin would use a new token, called TREAT, as one of the mechanisms to maintain the peg. It sounds a bit like the Terra/Luna design but, to be fair, the exact mechanics are still not known.

Conclusion

The advancement of Shiba Inu ecosystem – like that of its fellow canine coins Floki and Doge (see here for a comparison between Shiba Inu and Doge) – goes to show that meme coins (which many crypto influencers scoffed at during the previous bull run) are probably here to stay. Their developer teams have just reversed the usual order of crypto development. First, they launch the meme and build a community. Second, they start building and shipping products for that community. Shiba seems to be perfecting that particular roadmap. It remains to be seen, of course, if these products will actually get traction.

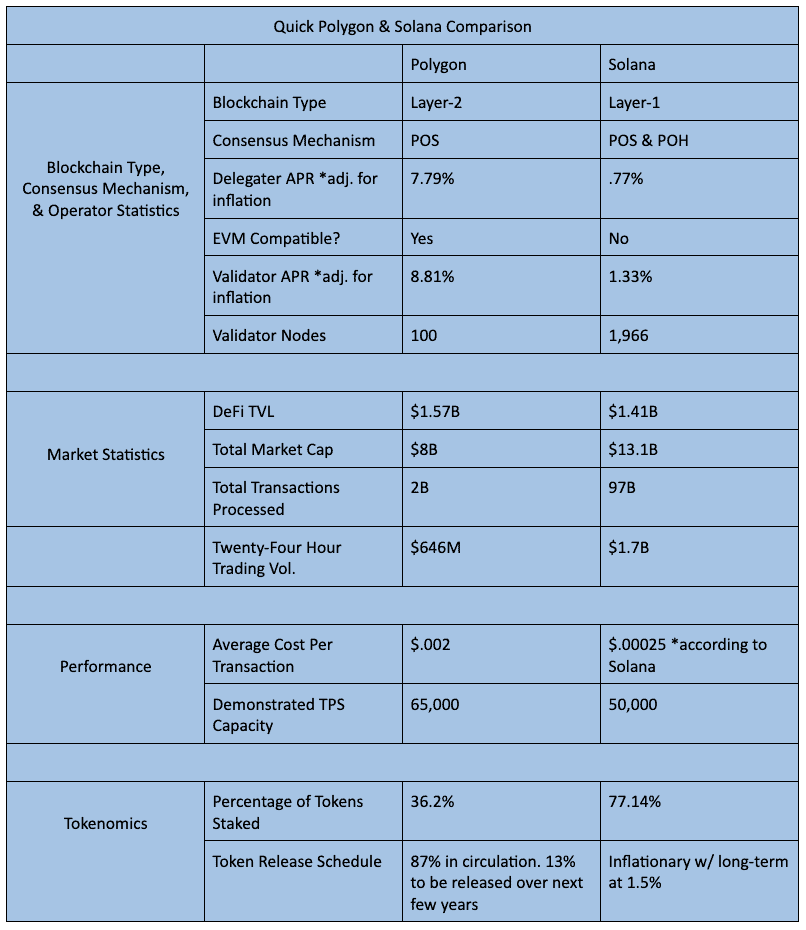

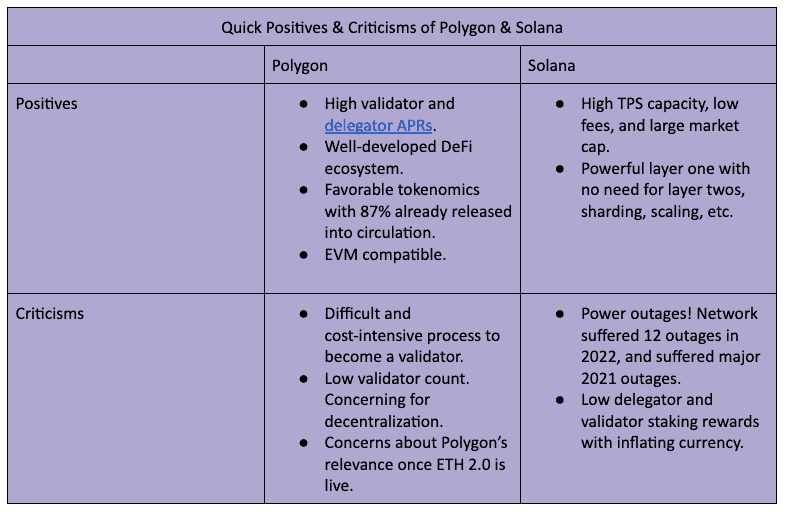

Polygon vs. Solana by David

Bitcoin is the gold 2.0 digital store of value, but it’s the other Layer-1 protocols (and Layer-2s built on top) that will facilitate the vast majority of tomorrow’s digital economic transactions.

And concerning these L1s and L2s, the future is likely multi-chain. Various use-cases and economies will develop within a select basket of protocols. Savvy investors will benefit by performing due-diligence on the protocols best positioned to become the powerhouse economic chains of tomorrow.

This article will be exploring two such contenders: Polygon vs Solana. Below, investors, stakers, and validators will find helpful comparison perspectives, data, and high-level positives and criticisms of both projects. So LFG!

What Are Polygon and Solana

Polygon and Solana are both decentralized, proof-of-stake (POS) blockchain networks. Both support diverse economic ecosystems. Both are in the top 12 crypto projects by market cap and provide users with fast transactions and low fees. However, there are major conceptual and technical differences between the two.

- Polygon is a decentralized, POS, L2 multi-blockchain network for Ethereum. Polygon has a POS main-chain, but it also has a software framework that allows third-party developers to create new L2 chains that work with its main-chain and Ethereum chain. Polygon’s core mission is to bolster Ethereum by reducing the latter’s gas fees and increasing its transaction output. Polygon is EVM compatible, and its native token is MATIC.

- Solana is a decentralized, hybrid POS and proof of history (POH), L1 blockchain protocol. Solana is considered one of the most technically advanced in the industry due to this hybrid nature. Solana has a single global state – meaning there is only one working blockchain – with no need for additional scaling solutions or sharding. Solana was engineered to dramatically improve transaction output and fees over other POS competitors. Solana’s native token is SOL.

How Do Polygon and Solana Work

Polygon and Solana use differing macro-schemes and technologies to achieve diverse economic ecosystems, high scaling, low fees, and fast transactions. Let’s examine the details.

Polygon Technicals

- As a POS, L2 multi-blockchain network, Polygon was built for the purpose of supporting Ethereum. With its high TPS and fees at a fraction of a penny, the system is clearly fulfilling its mission for Ethereum.

- Proof of Stake: Polygon’s main-chain uses a decentralized network of 100 permissionless POS validators to secure the network. With a set of staking management contracts deployed on Ethereum, anyone can stake MATIC on these contracts and join as a validator. However, one must currently stake approximately $20K of MATIC in order to become a top 100 validator. So entry is difficult. Validators are subject to rewards and slashing.

- Layer-2: L2s are built “on top” of the underlying L1 for the purpose of improving the latter’s scalability and efficiency. Polygon achieves lower gas fees and increased TPS for Ethereum by processing transactions on the Polygon chain, and then batching over in bulk the synthesized transaction data onto the Ethereum chain.

- Multi-Blockchain Network: The core of Polygon is the Polygon software development kit (SDK). The SDK allows third-party developers to create Ethereum-compatible side-chains and dApps that connect to Polygon’s main-chain and the larger Ethereum chain behind it. The amount of innovation happening with Polygon side chains is staggering. Polygon Edge (a particular software development kit iteration) is live. And multiple zk-rollups, optimistic rollups, and other scaling solutions are under development.

Solana Technicals

- Solana’s hybrid POS and POH consensus mechanism is what enables the protocol to achieve a 50,000 TPS capacity with average fees at $.00025 per transaction. See here for an in-depth technical analysis of this innovative consensus mechanism.

- Proof of Stake: Solana implements a fairly standard POS. Solana’s 1,966 validators are randomly selected to propose the next block. A validator’s chances of being selected are proportional to the amount of SOL staked. The other validators either accept or reject the proposed block; and if verified, the chosen validator receives a reward. Delegators (anyone who holds SOL) are free to stake with any validator they like.

- Proof of History: Solana produces fast transactions because POH allows validators to efficiently and quickly verify the proper ordering of transactions with each other. Every validator runs a “cryptographic clock” that runs in unison with every other cryptographic clock on the network. These clocks are synchronized because every validator must commit only one CPU to run the SHA-256 algorithm continually to keep time.

- Single Global State: Solana’s hybrid approach creates a blockchain with no need for additional layer two or sharding solutions. Solana states that this single global state creates efficient and seamless communication across the blockchain with no fragmentation.

Polygon vs. Solana: Product Statistics

Polygon and Solana both support NFT and DeFi marketplaces, decentralized exchanges, gaming, metaverse, and payment dApps.

Polygon Product Statistics

- NFT Marketplaces: $287M in USD transactions since the beginning of 2022. Current daily USD transactions averaging at $200K. Polygon NFTs hosted on OpenSea.

- DeFi and Lending: Market cap of $1.57B locked across 302 DeFi projects, with fees ranging between $0.01 to $0.1. Polygon hosts the DeFi heavy-weights AAVE, Curve, and Uniswap.

- Decentralized Exchanges: $3.86B in USD volume over the past 30 days. Large selection of DEXs including Quickswap, Sushiswap, Firebird Finance, Polycat Finance, and Polydex.

- Web3 Gaming: Top three games with the highest user volume within the past 30 days are Benji Bananas (165K users), Sunflower Land (72K users), and Arc8 (68K users).

- EVM Compatibility: From a user experience perspective, Polygon benefits by being compatible with Ethereum, and thus having access (realized or potential) to Ethereum’s rich dApp ecosystem.

Solana Product Statistics

- NFT Marketplaces: Current daily USD transactions averaging between $50K to $150K. Solana NFTs hosted on OpenSea.

- DeFi and Lending: Market cap of $1.41B locked across 81 DeFi projects, with an $.18 average transaction fee.

- Decentralized Exchanges: Hosts multiple decentralized exchanges including Solanium, ALF Protocol, and Enrex.

- Web3 Gaming: Top three games with the highest user volume within the past 30 days are Gameta (164K users), Tap Fantasy (2K users), and Defi Land (585 users).

MATIC and SOL: Tokenomics

MATIC and SOL are the native tokens for Polygon and Solana, respectively. Both are used for transactions, network fees, staking, and governance.

MATIC Tokenomics

- Max supply of 10B tokens, all of which have technically been issued. 8.7B are currently in circulation, while the remaining 1.3B will be unlocked over the next few years via staking rewards.

- 36.2% of MATIC tokens are currently locked up in staking contracts.

SOL Tokenomics

- Inflationary token with no fixed max supply. Current circulating supply of 352M. Although no max supply, SOL’s inflation rate operates on a fixed schedule. As of late 2020, SOL’s inflation rate is 8% annually, decreasing by 15% every year, until SOL hits a 1.5% inflation per year, which it will maintain for the long term. The newly minted SOL are dispersed into the ecosystem via staking rewards to validators, delegators, and general stakers.

- 77.14% of SOL tokens are currently locked up in staking contracts.

Conclusion

Most signs indicate that both Polygon and Solana will have a bright future in the Cryptoverse. But each chain does have fundamentally different use cases: Polygon works to bolster Ethereum while Solana stands as its competitor. Both chains employ innovative (but different) technologies.

Polygon’s strongest positive is its EVM compatibility. This feature significantly opens Polygon’s use-case potential. Conversely, it’s not clear exactly how Polygon fits into the broader picture, assuming all goes well with ETH 2.0.

Solana’s strongest positive might be its single global state. This feature brings a refreshing simplicity to the project. But Solana’s biggest strike is its recurring power-outages. Each one takes a toll on Solana’s credibility and the token’s price. This is a must-fix for the project’s care-takers.

Final Notes

Thank you so much for your support, and I truly hope that today’s issue will give you insights needed to help you master your wealth.

If you are reading this it means you are on the free version of the Wealth Mastery Investor Report, which is great for news and tips on the crypto markets.

If you really want to take advantage of fastest growing asset class EVER, I highly recommend you join us in the Premium Investor Report.

You’ll immediately get access to:

- Deep dive Altcoin report & The Trending Coin Report

- Technical Analysis on the crypto large caps and overall market

- Token sales, Airdrops and DeFi Tutorials

- Updates on the NFT Ecosystem and new mints

- My Investment Portfolio Updates

- Monthly Crypto Alpha Report

See you next time!

Lark and the Wealth Mastery Team

Legal Disclaimer

TCL Publishing ltd (director Lark Davis, owner of Wealth Mastery) is not providing you individually tailored investment advice. Nor is TCL Publishing registered to provide investment advice, is not a financial adviser, and is not a broker-dealer. The material provided is for educational purposes only. TCL Publishing is not responsible for any gains or losses that result from your cryptocurrency investments. Investing in cryptocurrency involves a high degree of risk and should be considered only by persons who can afford to sustain a loss of their entire investment. Investors should consult their financial adviser before investing in cryptocurrency.

Responses