How to Earn Up to 44% APR on Solana’s Crema Finance

Before we get started, this is not a recommendation or endorsement to buy the future CRM token or any token mentioned.

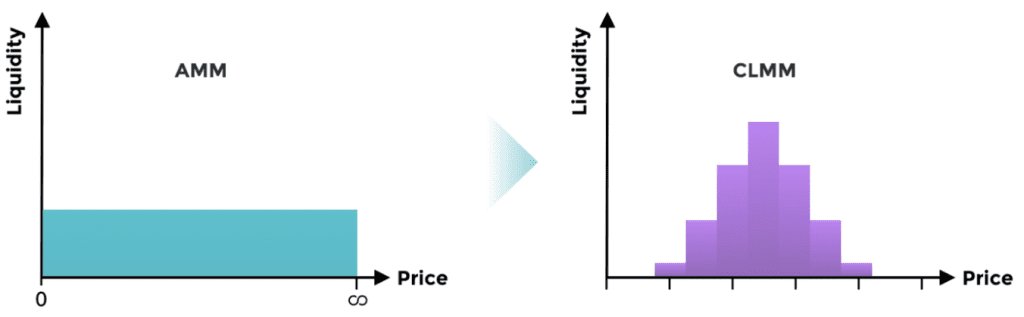

Concentrated Liquidity

In March 2021, Uniswap launched v3, introducing the world of DeFi to Concentrated Liquidity, which gives LPs (liquidity providers) more granular control over what price ranges their capital is allocated to. Individual positions are aggregated together into a single pool, forming one combined curve for users to trade against. Up until Uniswap v3, the classic 50/50 LPs ruled DeFi, partially due to the trailblazing by Uniswap launched back in 2018.

Fast forward to today and we’re witnessing many of the most successful DeFi protocols getting forked on EVM-compatible chains or rebuilt on non-EVM chains like Solana. Crema Finance is one of the first teams to launch a concentrated liquidity market-maker. Crema has copied and recorded the innovative design of Uniswap v3 but on Solana Mainnet. I would like to think that Crema will be warmly received by DeFi users on Solana because as traders, it should enable less price slippage compared to traditional 50/50 style AMMs. For LPs, they can choose the price range and hence control the amount of impermanent loss incurred, while maximizing the fees earned on their liquidity.

Additionally, LPs can open as many positions as they desire to meet their different strategic goals. They can inject liquidity within a narrow range and control their liquidity costs.

Enter Crema Finance

One drawback to this new CLMM vs the traditional AMM is the fee distribution. In Uniswap v2 style AMMs (ie SushiSwap, Raydium), fees generated in the AMM pools are directly deposited into the same