Hong Kong Approves BTC & ETH ETFs

GM friends.

Who says legacy media is all but dead. Reuters dangled the Hong Kong ETF in front of us last week, and they didn’t fail to deliver!

And in case you forgot… Time’s almost up!

The Bitcoin halving is here and the 33% discount to Wealth Mastery Premium is expiring today!

This is your LAST CHANCE to lock in the lowest price possible—only 24h left. ⏳

👉Curious about Bitcoin’s journey post-halving?

👉Eager to see Altcoins’ responses following the halving?

👉Interested in discovering my personal investment choices?

Dive into Wealth Mastery Premium and navigate the next cycle with my team and me by your side!

To truly capitalize on what lies ahead, you’ll want the Wealth Mastery Premium Report in your toolkit.

Now, brew a fresh pot, and kick up those feet. Here comes your mid-week crypto update. ☕️📰

Here’s what’s in today’s issue:

- David shares his thoughts on Honk Kong approving BTC and ETH ETFs, why BTC miner stocks are crashing, Crypto Mom introducing new US stable coin legislation & OKX’s L2 goes mainnet.

- Rekt Capital has the latest technical analysis for you on the market.

- Erik has an article on the Bitcoin halving: Meme value, price effect, and death spiral myth.

- In case you missed it by Rebecca.

Hong Kong Bitcoin & Ethereum ETFs Approved

Last week, Reuters reported that the Hong Kong Securities and Futures Commission (SFC) would this week likely approve spot bitcoin ETFs for the jurisdiction.

Well this past Monday, that appears to be exactly what happened. That’s because three of the applicants – China Asset Management, Harvest Fund Management, and Bosera Asset Management – are stating that regulators gave them either full or conditional approval for the launch of their spot bitcoin ETFs.

But apparently the regulators aren’t stopping at just bitcoin. The applicants are also saying that they’ve received the green light for the launch of spot ETH ETFs too.

Wow. We did not see that coming.

It is important to note that the SFC has not officially made any announcements about the approvals. However, given what the applicants are saying, you can pretty much take it to the bank that the spot ETFs in Hong Kong are a done deal. Moreover, it’s thought that we could see the first ETFs go live in either late April or May.

As we’ve discussed several times, Hong Kong ETFs will open the door to retail and institutional funds both within the city and from mainland China. However, given that Hong Kong is the first Asian jurisdiction to make such an approval, don’t be surprised if we start seeing indications that South Korea, Japan, or Singapore will soon follow their lead.

With regards to the spot ETH ETFs, Hong Kong will be the world’s first jurisdiction to launch such a product.

Why are BTC Miner Stocks Crashing Before the Halving?

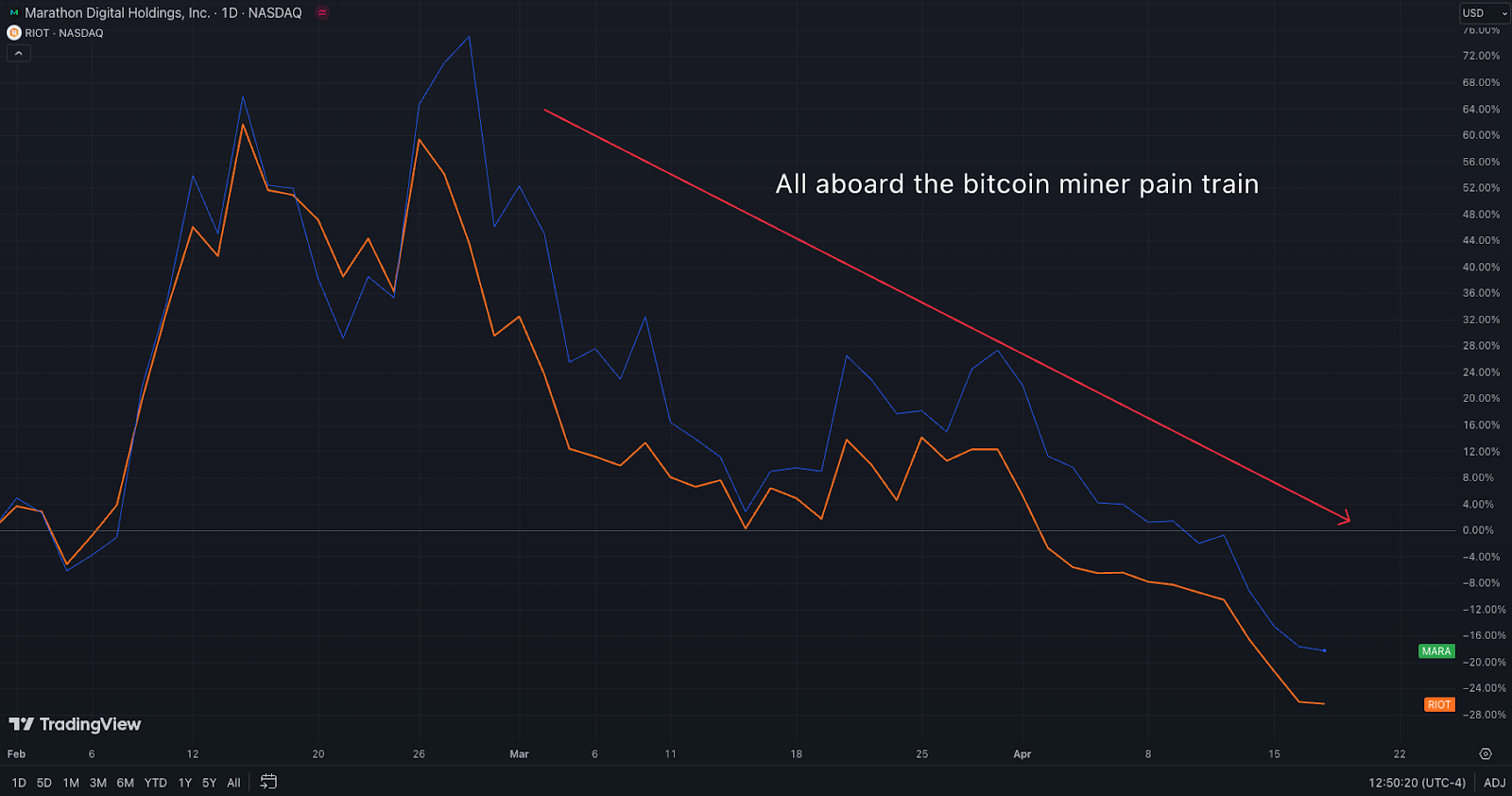

It’s been a bloodbath for bitcoin miner stocks over the past six weeks.

Since late February, MARA is down 52%. RIOT is down 53%. Core Scientific is down. And so is CleanSpark. As are all the other non-U.S. publicly traded miners. So what the heck is going on?

Although multiple factors are at play, analysts think one of major reasons are investor concerns around miner profitability, post-halving.

In less than two days, bitcoin will experience its fourth halving. When this happens, the protocol’s block reward will be reduced from 6.25 new BTC every ten minutes, to 3.125 BTC every ten minutes. So, assuming prices remain constant, half the bitcoin available for miner rewards equals half the available money for miners.

So unless bitcoin’s price doubles relatively quickly after the halving, then all the miners will feel the economic squeeze. And generally, the smaller the mining operation, the rougher the storm they’ll need to survive.

So, as the 2024 halving comes and goes, expect plenty of volatility and change in the bitcoin mining sector. We’re talking things like huge stock price swings, miners relocating to the cheapest energy sources, mergers, bankruptcies, it’s all on the table.

But just remember that it all depends on bitcoin’s price, post-halving. So keep an eye on that, and then watch the sector accordingly.

Crypto Mom Introduces New U.S. Stablecoin Legislation

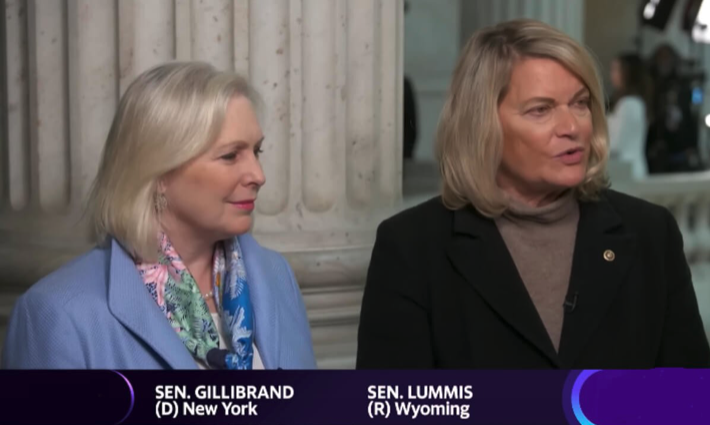

On Wednesday, “Crypto Mom” Senator Lummis (R-Wyo.) and Senator Gillibrand (D-N.Y.) introduced new, bi-partisian stablecoin legislation to the U.S. Congress.

Here’s what we know about the bill. At a high level, it works to define who can issue stablecoins in the U.S., and then sets up a framework for how the issuers must operate.

Specifically, the bill requires that “payment stablecoin issuers” (i.e. Circle, Tether, etc.) must fully back their stablecoins with reserve assets, and they must release routine public disclosures as to the specifics of the reserve assets. The issuers can only deal in U.S. dollar-denominated stablecoins (USA! USA!), and no algorithmic stablecoins are allowed (sorry UST).

The bill also mandates that issuers segregate their operations into multiple subsidiaries, and defines when issuers would be classified as a non-depository trust or a depository institution. Regarding this latter part, this basically fits issuers into the U.S.’ larger banking rules and regulations.

What’s interesting is that when the senators released the bill, both mentioned how it works to help maintain the dollar’s dominance, while also increasing investor protections. We agree on both points.

Crypto and stablecoins aren’t going anywhere. So the sooner the U.S. embraces dollar-backed stablecoins, the better it will be for the dollar. And having reasonable rules around the public disclosures of reserve assets does remove an element of risk from the crypto markets, as well as a major piece of FUD.

OKX’s Layer-2 Goes Mainnet; Big Win for Polygon

OKX, the world’s fourth largest crypto exchange, has just launched their new L2 – X-Layer – on mainnet.

X-Layer is an Ethereum L2 built with Polygon’s Chain Development Kit (CDK). The native token is OKB, which is used to pay transaction fees on the L2. X-Layer has been in testnet since November, but developers say that 170 dApps are already rolled out and ready for use.

OKX has about 50 million global users, so X-Layer could be a big deal if the exchange is successful in getting their users to adopt it.

Big Boost for Polygon

While the X-Layer story is by itself big news, it’s perhaps even bigger for Polygon.

Polygon is currently transitioning to Polygon 2.0, which will basically be an interconnected network of ETH L2s that will all connect to one “AggLayer”. Polygon’s AggLayer works to provide a unified proof-of-stake mechanism and source of liquidity for all the L2s, including X-Layer.

Polygon 2.0 will grow naturally via Polygon CDK. So X-Layer is a prime example of this growth. Clearly, this all looks very bullish for Polygon, given the massive number of OKX users that will be exposed to X-Layer, and by consequence, be exposed to the Polygon 2.0 ecosystem.

Moreover, OKX developers are saying that they’ll be active contributors to Polygon CDK’s codebase, which means Polygon’s bench of technical talent just got a little deeper.

Ready to take your crypto journey to new heights? Look no further – Bitget is your ticket to seamless and rewarding trading experiences!

- User Friendly

- Advanced Tools For Traders

- Huge range of top coins to trade

💰 Sign Up Now for Exclusive Bonuses Up To $30,000! 💰

Welcome back to the Wealth Mastery Newsletter.

In today’s edition of the Wealth Mastery Newsletter, the following cryptocurrencies will be analysed & discussed:

- Ethereum (ETH)

- Dogecoin (DOGE)

- UniSwap (UNI)

- Polkadot (DOT)

- VeChain (VET)

- Crypto Com (CRO)

- Kyber Network (KNC)

- Thorchain (RUNE)

Ethereum — ETH/USD

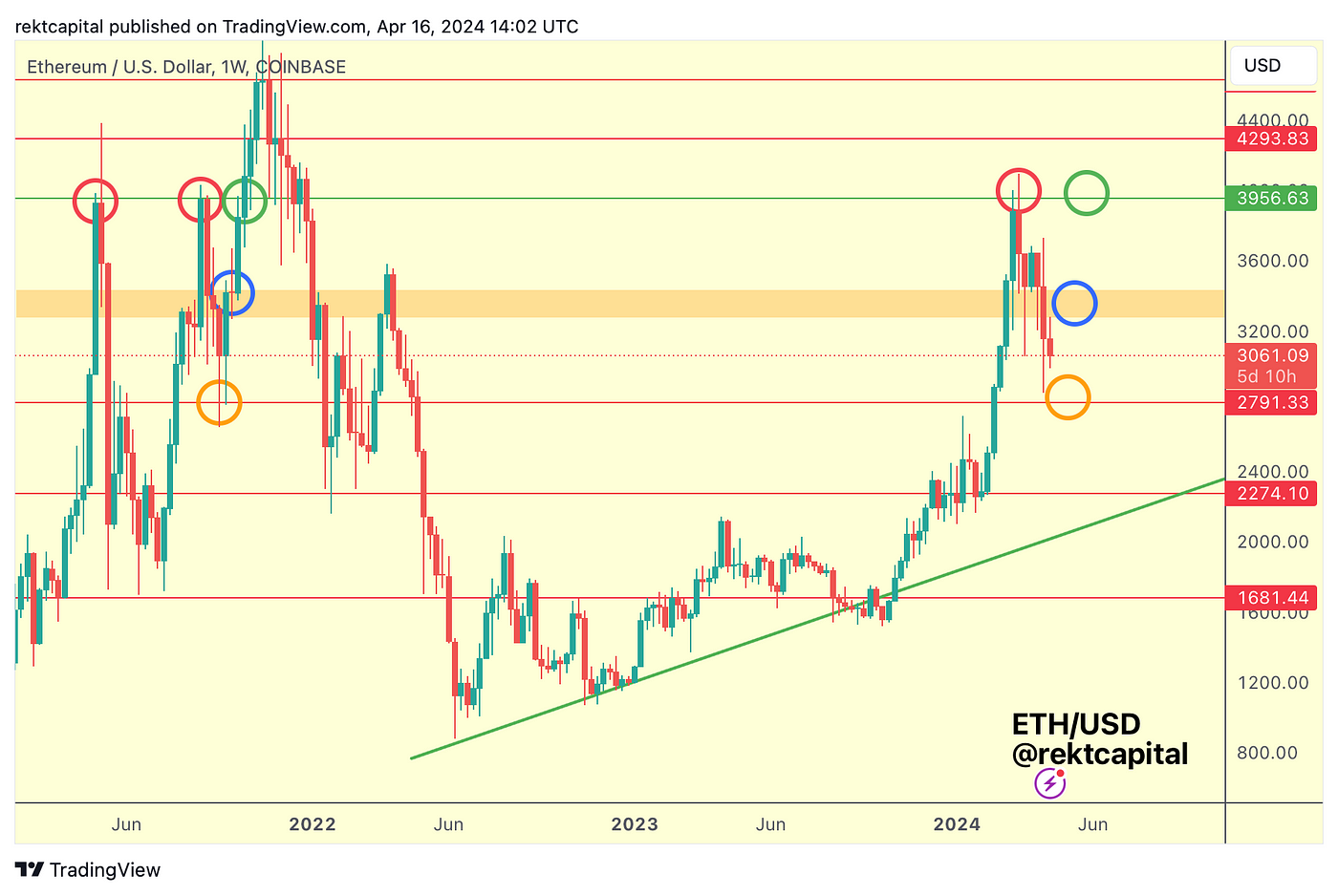

Last week, we spoke about scenarios for Etheneum’s price action:

In short, it was all about whether price could hold the blue circled retest because if not, ETH would probably downside wick into the $2800 level (orange circle).

Here’s today’s update:

ETH downside wicked towards this orange circled region last week, Weekly Closed below the orange area, and this week ETH upside wicked into this same orange area, seemingly flipping it into new resistance.

ETH is as a result positioned for downside continuation; the only thing missing now is that follow-through for price to drop lower and closer to the orange circled area once again.

Generally though, ETH is now located in the $2800-$3300 range until further notice, with scope for downside within this range.

Until ETH is able to reclaim the orange area as support (blue circle), a bearish stance is a more reasonable one to adopt in the interim.

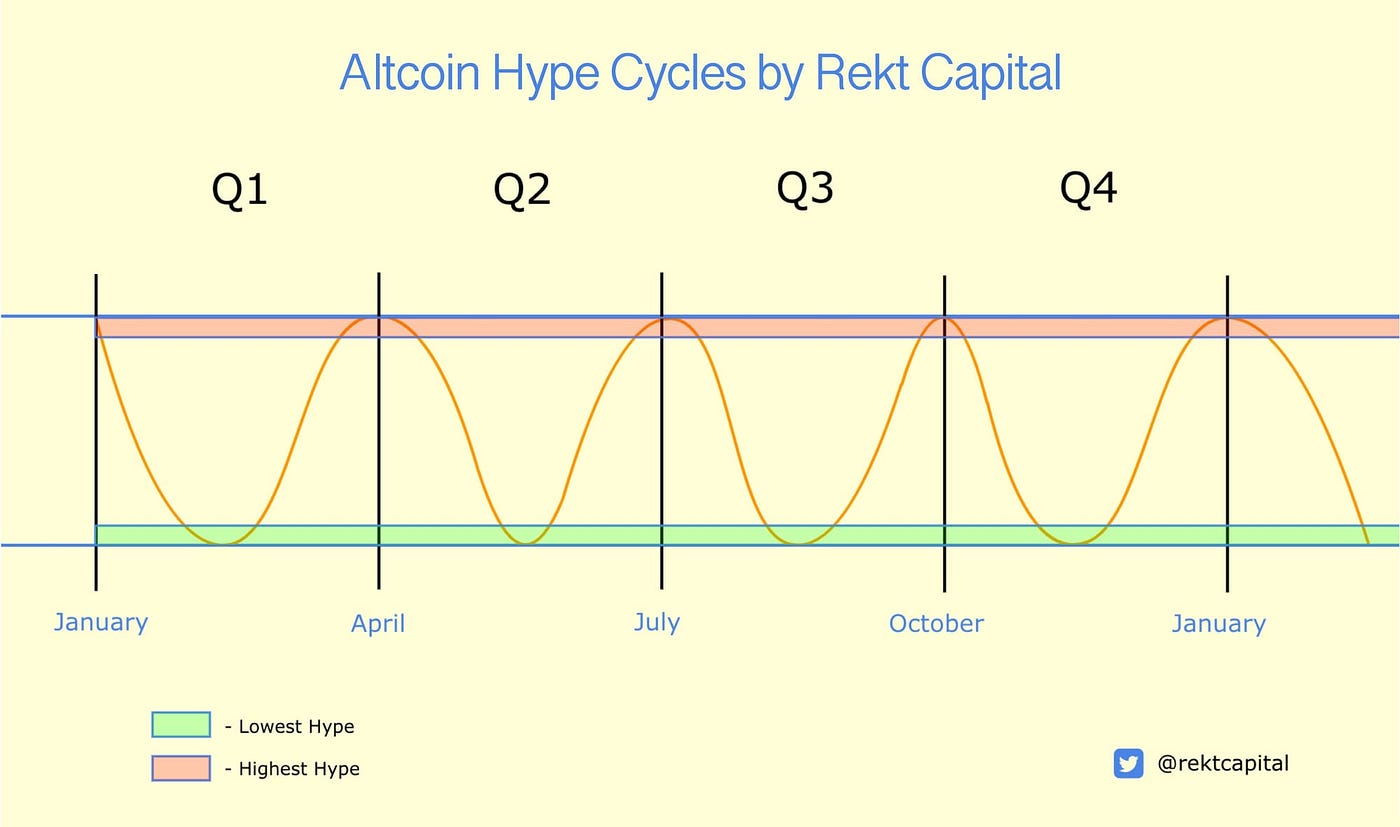

That being said, it’s important to underscore how Altcoins tend to generally behave around the Halving event and it’s historically been bearish, especially since this Halving event also coincides with the end of the Q1 Altcoin Hype Cycle:

Altcoins have followed this graphic to perfection in this Bull Market and I expect the same going forward.

Which means that Altcoins should bottom out on their retraces in the coming several weeks in preparation for the new Q2 Altcoin Hype Cycle.

This would translate into Altcoin bottoming in as early as mid-May, more realistically end of May, early June.

Dogecoin — DOGE/USDT

The goal for DOGE is to perform a retest of the red $0.20 level as new support following a positive Monthly Close above that same level in March.

Technically, there was scope for downside volatility as part of that retrace — and we got that — but DOGE actually retraced even deeper than was occurred in mid-2021 on a similar retrace (green circle).

In fact, DOGE dropped closer to the black $0.12 Range Low, as if breaking back down into the black-red range ($0.12-$0.20) despite briefly breaking out from it.

In addition, this downside volatility actually got DOGE very close to retesting the Macro Downtrend it broke out from last month, in a way turning an old multi-year resistance into new multi-year support.

Essentially, in performing this retest, DOGE has fully confirmed its new Macro Uptrend.

And technically, DOGE could still recover in time for the April Monthly Close to occur above the $0.20 level.

However, if this doesn’t occur, DOGE will likely continue to behave between this black-red range ($0.12-$0.20) until it is ready to breakout from it again.

In any case, it’s this confluent support of the Range Low at $0.12 and the Macro Downtrend is the absolute crucial support to supporting a new Macro Uptrend and DOGE is successful in retesting this area thus far.

And with plenty of time left in the current Monthly Candle, perhaps there’s still a chance DOGE will manage to reclaim the $0.20 level as support before the month is done.

CLICK HERE to go Premium and read the rest of this week’s Market Analysis – Premium subs can read Rekt capital’s full report.

The Bitcoin Halving: Meme Value, Price Effect, and Death Spiral Myth

The Bitcoin halving is a monumental event that reminds us each time of the immutability of the Bitcoin protocol.

Despite its memetic significance to Bitcoin’s essence, it usually doesn’t cause any significant price action – at least in the short term.

Doomsday scenarios like a miner death spiral have always been refuted.

Crypto Market News

- Bitcoin’s supply on exchanges could run out in 9 months according to Bybit. Source

- Hong Kong has approved spot Bitcoin and Ethereum ETFs for trading. Source

- BlackRock’s spot Bitcoin ETF has surpassed $15 billion in total inflows. Source

- Grayscale’s GBTC is down 50% in Bitcoin holdings since the spot ETFs launched. Source

- Hans Zimmer has collaborated with Tron to create a theme song called the Tron Anthem. Source

- Germany’s largest federal bank will start offering crypto custody services in the second half of this year. Source

- The Winklevoss twins have become co-owners of podcaster Peter McCormack’s British football club, Real Bedford FC, and have injected $4.5M in BTC. Source

- Coinbase users in the UK can now buy crypto with Apple Pay. Source

- Norway wants to restrict crypto mining by regulating data centers. Source

- The UK will issue new legislation for stablecoins and crypto staking by June or July this year. Source

- Ark Invest has sold another $20M in Coinbase shares and added OpenAI to its Venture Fund. Source

- JP Morgan analysts give the spot Ethereum ETFs a 50/50 chance of being rejected next month by the SEC. Source

- PayPal will be removing buyer and seller protections for NFT purchases from May 20. Source

Coins and Projects

- Bitcoin mining difficulty has increased 4% in the final adjustment before the halving. Source

- Bitcoin miner Bitfarms completed upgrades to its mining facilities that have expanded its hashrate to 7 EH/s. Source

- Bitcoin dominance has hit a 3-year high following the crypto market sell-off in response to Iran’s attack on Israel. Source

- Bitcoin leads the NFT market with sales reaching $19.08 million beating out Ethereum and Solana. Source

- Bitcoin Runes will help “close the gap” on DeFi competition according to ETF issuer Franklin Templeton. Source

- Paraguay has paused progress on its proposed Bitcoin mining ban and instead approved a resolution supporting selling surplus energy to miners instead. Source

- Bitcoin Ordinals has seen increased demand and has hit 65 million inscriptions ahead of the halving. Source

- Ethereum is teasing its next upgrade called Pectra which will bring smart contracts functionality to wallets. Source

- Ethereum’s validator queue has hit its highest level since September 2023. Source

- MetaMask has integrated with Daylight to allow users to check for airdrops and NFT claims. Source

- Uniswap has received a Wells notice from the US SEC over issues with securities laws. Source

- OKX’s Layer-2 network called X Layer has launched on Polygon’s mainnet. Source

- Circle has enabled transfers of shares in BlackRock’s tokenized fund BUIDL into USDC. Source

- Binance US has appointed a former New York Fed officer to its board of directors. Source

- Solana has released a network update to fix the recent congestion issues. Source

- Solana DEX Drift will airdrop 100M tokens in the coming weeks. Source

- Sui has unveiled its upcoming handheld device for playing crypto games called SuiPlayerox1. Source

- Chainlink is launching Transporter, a cross-chain app for bridging tokens built on the network’s Cross-Chain Interoperability Protocol (CCIP). Source

- Theta has partnered with Aethir to launch the largest GPU marketplace for developers and enterprises in AI and DePIN. Source

- Ethena has integrated with centralized exchange wallets such as Binance, Bybit, OKX, and Bitget. Source

- Google Cloud and Coinbase have joined EigenLayer as operators. Source

- Polkadot is exploring an $8.8M sponsorship with Lionel Messi’s soccer team, Inter Miami. Source

- Wilder World has partnered with Samsung to integrate its metaverse into smart TVs. Source

- Stepn is airdropping bonus points worth $30M in GMT tokens. Source

- Adidas has partnered with Stepn to launch an upcoming NFT collection and merch. Source

- VeChain will tokenize the gloves worn by fighters during UFC 300 which took place on April 13. Source

- Worldcoin’s app has hit 10 million users across 160+ countries and has 2 million daily active users. Source

- Worldcoin has been charged with consumer law violations by Buenos Aires and could face a $1.2M fine. Source

- Bored Ape NFTs have hit their lowest floor price since 2021, after dropping more than 90% from the all-time high. Source

Macro News

- The US annual inflation rate continues to rise after coming in at 3.5% in March. Source

- A London mayor candidate in the UK wants to give every Londoner £100 worth of LONDON tokens paid for by the banks. Source

- Tesla plans to lay off over 10% of its global workforce which is at least 14,000 workers. Source

- Microsoft is investing $1.5 billion in UAE-based AI company, G42. Source

- Rising oil prices is still a big market risk due to the ongoing conflict in the Middle East. Source

- Fiji’s central bank has issued a public warning against using crypto for payment or investment. Source

Thank you so much for your support, and I truly hope that today’s issue will give you insights needed to help you master your wealth.

If you are reading this it means you are on the free version of the Wealth Mastery Investor Report, which is great for news and tips on the crypto markets.

If you really want to take advantage of fastest growing asset class EVER, I highly recommend that you check out my new altcoin course: Mastering Altcoin Investing

In this course we’ll teach you all about how to spot, choose and acquire the winning altcoins of the next bull market.

Learn how to build your portfolio so that growth is ensured and risk is mitigated. Let me help you build a strategy that’ll change your life forever in the upcoming bull run.

See you next time!

Lark and the Wealth Mastery Team

💰 BINANCE: BEST EXCHANGE FOR BUYING CRYPTO IN THE WORLD 👉 10% OFF FEES & $600 BONUS

🚀 BYBIT: #1 EXCHANGE FOR TRADING 👉 GET EXCLUSIVE FEE DISCOUNTS & BONUSES

🔒 BEST CRYPTO WALLET TO KEEP YOUR ASSETS SAFE 👉 BUY LEDGER WALLET HERE

📈 TRADING VIEW: BEST CHARTING SOFTWARE ON THE INTERNET 👉 JOIN NOW

1️⃣ COINLEDGER: #1 CRYPTO TAX SOFTWARE 👉 IF YOU OWN OR TRADE CRYPTO YOU NEED THIS

Wealth Mastery (Lark Davis, and the Wealth Mastery writing team) are not providing you individually tailored investment advice. Nor is Wealth Mastery registered to provide investment advice, is not a financial adviser, and is not a broker-dealer. The material provided is for educational purposes only. Wealth Mastery is not responsible for any gains or losses that result from your cryptocurrency investments. Investing in cryptocurrency involves a high degree of risk and should be considered only by persons who can afford to sustain a loss of their entire investment. Investors should consult their financial adviser before investing in cryptocurrency.

You can find a full disclosure of all my crypto & venture investments here.