You Will Miss Out On Bitcoin’s Gains If…

Bitcoin just missed out on its highest monthly close ever.

It’s only the third time in its history that it’s closed 6 consecutive green monthly candles.

Welcome to the bull market…the FOMO is only just kicking in!

Here is your weekend crypto update…

Thanks to Masterworks for sponsoring today’s newsletter

A Banksy got everyday investors 32% returns?

Mm-hmm, sure. So, what’s the catch?

It may sound too good to be true, but thousands of investors are already smiling all the way to the bank, thanks to the art investing platform Masterworks.

These results aren’t cherry-picking. This is the whole bushel. Masterworks has sold 21 paintings, each of them profitable, including net returns of 13.9%, 14.6%, and 17.8%.

But art? Really? Okay, skeptics, here are the numbers. Contemporary art prices outpaced the S&P 500 by 136% over the last 27 years

Got your attention yet? Wealth Mastery readers can skip the waitlist with this exclusive link.

Here’s what’s in today’s issue:

- Rebecca shares her thoughts on Bitcoin FOMO continuing, Marathon announcing Bitcoin L2, ARK Invest’s proof of ETF reserves, Shido getting hacked & Blast finally going live.

- Altcoin alpha by David.

- This week’s airdrop by Jesse.

- Sam has an NFT report on the top Bitcoin PFP collections.

Bitcoin FOMO Continues

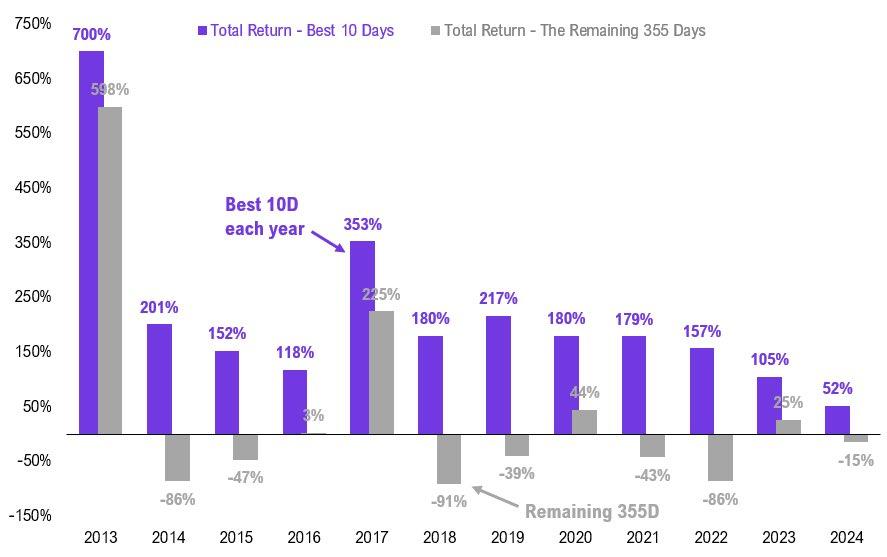

Did you know that if you miss Bitcoin’s top 10 days, you will miss all of Bitcoin’s annual gains? WOW!

That’s according to Fundstrat and it’s a pattern that has remained consistent since 2013.

In the 2021 bull market, the top 10 days saw a return of 179%, but if you missed them, you would see returns of -43% during the other 355 days.

We’re coming into the easy part of the Bitcoin cycle–buy, hold and ride the wave.

So the Bitcoin FOMO is real and it’s not showing any signs of slowing down…not this close to the halving.

This is who is FOMO’ing into Bitcoin right now…

Bitcoin ETFs See Record Volume

Daily trading volume for the spot Bitcoin ETFs hit a record $7.6 billion on February 28. BlackRock’s IBIT accounted for 56.5% of the total. The previous record for ETF trading volume was $4.6 billion on the launch day.

Institutions Are Jumping Onboard The ETFs

Bank of America’s Merrill Lynch and Wells Fargo have been offering Bitcoin ETFs to certain wealth management clients. Morgan Stanley is currently deliberating whether it should offer the ETFs to clients. And BlackRock has launched its spot Bitcoin ETF on Brazil’s stock market under the ticker, IBIT39.

Now that the Vanguard CEO is stepping down, maybe they will be next?

Retail Is Back As Coinbase Crashes

Two things signal that retail investors are back: crypto exchanges move up the app store charts, and an exchange suffers an outage. We’ve already witnessed both.

According to The Milk Road, the Coinbase app has moved from 422 in the charts on February 26 to 128 on February 29.

The sudden surge of popularity led to Coinbase crashing when Bitcoin pumped to $64K.

Coinbase CEO Brian Armstrong confirmed the outage was due to a “large surge in traffic.” We’re so back!

Marathon Announces Bitcoin Layer-2

Bitcoin miner Marathon Digital just announced a record-breaking 2023.

In its Q4 earnings call, Marathon celebrated mining a record 12,852 BTC throughout 2023 and a record net income of $261.2 million compared to a net loss of $694 million in 2022.

Marathon also grew its revenue by 229% year on year to $387.5 million. But the most exciting announcement came in the form of a Bitcoin Layer-2 network called Anduro.

Anduro will allow multiple Bitcoin sidechains to be created and Marathon is working on these too.

Marathon currently has the first two Anduro sidechains in development. Coordinate will be Ordinals focused and Alys will be an Ethereum-compatible chain for institutional asset tokenization.

Anduro sidechains will open up a new revenue stream for participating miners through the use of “merge mining.” It means miners will be able to simultaneously earn revenue from Bitcoin-denominated transactions whilst mining on Bitcoin’s base layer.

The big Bitcoin Layer-2 announcement comes only a week after Marathon announced its Slipstream service.

Slipstream is designed to specifically process large and non-standard Bitcoin transactions.

Marathon is in the perfect position to launch a service like this given it’s the largest Bitcoin miner by market cap with a rather large mining pool.

With a big chunk of the market share, it can give niche users with complex transactions a simple and trusted way to transact.

First, Michael Saylor rebranded MicroStrategy to a Bitcoin development company. Now, Marathon is too.

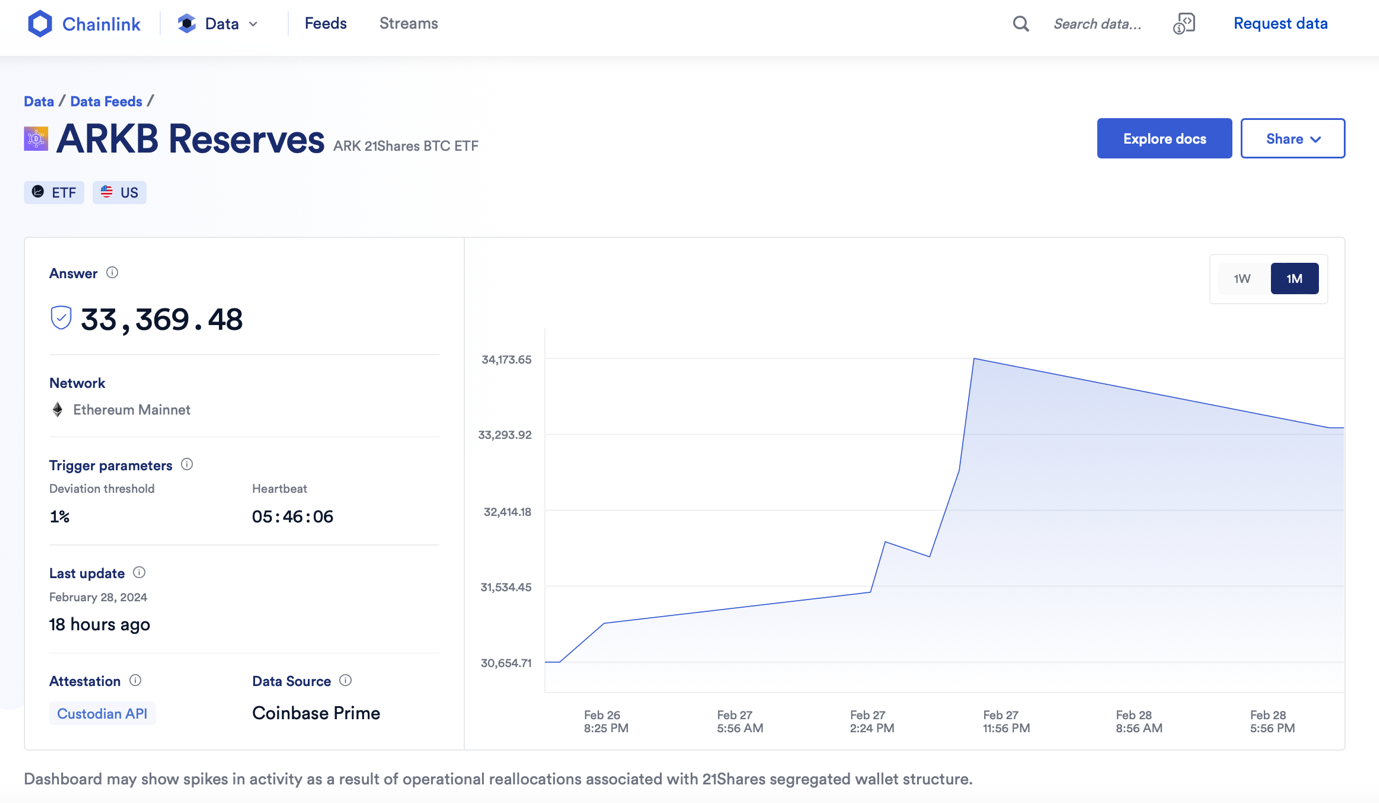

Chainlink Helps Ark Invest Share Proof Of ETF Reserves

Ark and 21Shares have become the second spot Bitcoin ETF to provide proof of reserves.

Bitwise published the Bitcoin address for its spot ETF back on January 24. It’s the ultimate test of transparency allowing investors to verify anytime that the amount of Bitcoin they say they own is there.

This bold move from Bitwise didn’t exactly open the floodgates with the rest following all at once, but a month later we have another one.

Only this time, Ark and 21Shares have done so by integrating with Chainlink’s Proof of Reserve on the Ethereum mainnet.

It’s powered by off-chain reserves data directly from Coinbase and allows on-chain reporting of Bitcoin reserves using Chainlink’s oracles.

It’s not just the fund’s current Bitcoin reserves that will be publicly available in real-time, but its reserve history too. That’s the power of crypto!

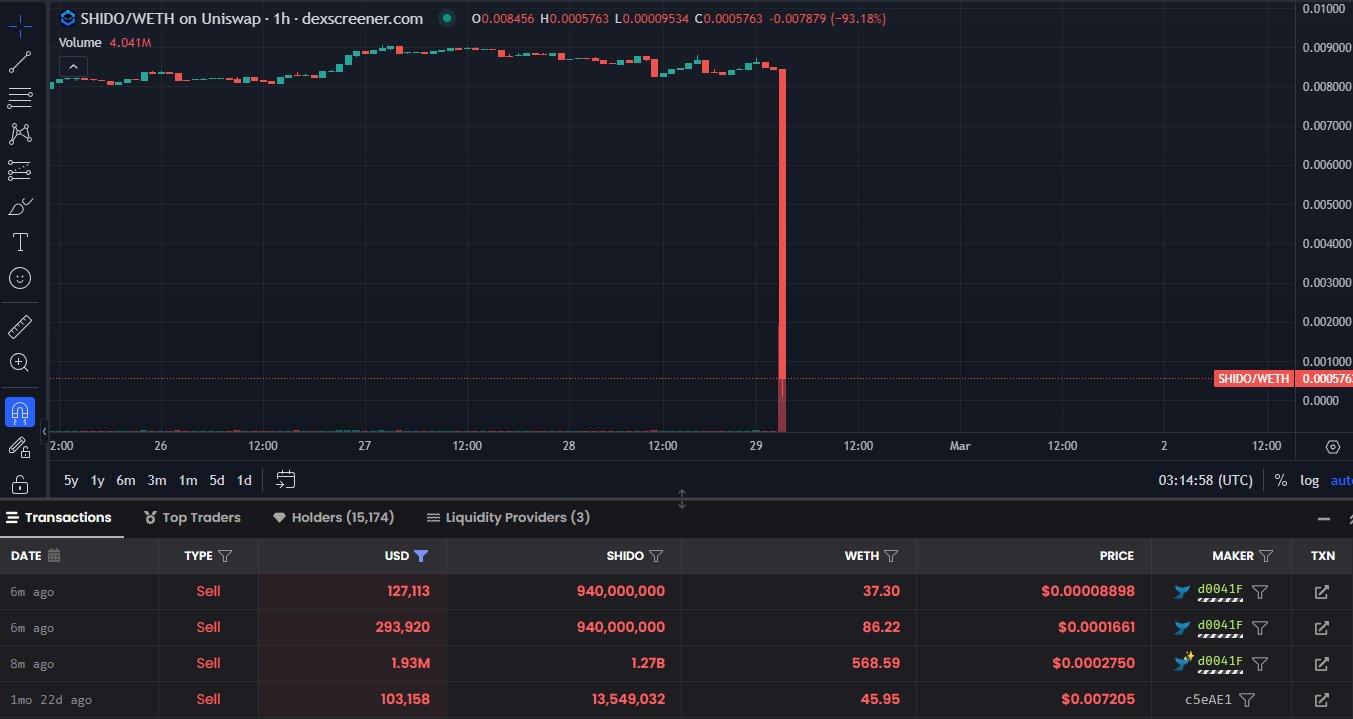

Shido Hacked And Token Dumps 94%

Just days before its upcoming mainnet launch, Layer-1 blockchain Shido suffered a hack.

On February 29, its Ethereum-based staking contract was exploited. The hacker found a way to transfer ownership of the staking contract to another address. Then, upgraded the contract with a hidden feature. Then, they were able to withdraw staked tokens.

Over 4.3 billion Shido tokens were withdrawn, making up almost half of the circulating supply.

In a bid to track down the hacker, it’s been revealed that the hacker’s address was first funded using crypto bridged from Layerswap before being moved to Arbitrum via Across.

But in a bizarre twist of events, the address that funded the hack belongs to Markus Waas, the lead developer at Injective Labs.

So, either the hacker hacked Markus to get the crypto needed to fund the Shido hack or this could have been an inside job.

Blast Finally Goes Live

Ethereum Layer-2 Blast has launched its mainnet with over 180,000 early-access users adding $2.3 billion to the protocol.

Blast was created by the founder of NFT marketplace, Blur. The protocol is designed to give users exposure to a native yield model for ETH and stablecoins. But let’s just say the build-up to Blast’s launch has been rocky at best.

There have already been several controversies surrounding Blast since its early access started in late November last year:

- November 21: Blast launched a bridge before the network went live meaning users were unable to withdraw funds until the mainnet launch

- November 30: a user staking on the protocol saw $100K disappear

- January 31: accused of forking Optimism’s code with minimal changes

- February 26: accused of rug-pulling the gambling protocol “RiskOnBlast”

Alongside the mainnet launch, SynFutures is a derivatives exchange that’s launched its V3 on Blast. The good news is, V3 users will also qualify for the upcoming Blast airdrop that’s expected to drop in May.

The Monthly Crypto Alpha Report was released Yesterday!

Today is your final chance to get your hands on the Monthly Crypto Alpha Report with a 7-day free trial!

The entire goal of our Monthly Crypto Alpha Report is to provide you with the necessary insights you need to make the most of the opportunities arising in the crypto space this month.

Here’s what’s inside:

- A macro overlook of the crypto markets to help you navigate the market trends

- The top airdrops of the month for potential quick gains

- The top altcoins to watch, selected based on in-depth analysis

- The best DeFi farms to maximize your passive income

- The most exciting NFT mints for those looking to explore the NFT space

Are you ready to embrace the wealth making opportunities that will arise in this month? Then get your hands on the Monthly Crypto Alpha Report with a 7-day free trial today!

Existing Projects / Tokens

- Aerodrome [AERO] has been purchased by Coinbase’s Base Ecosystem Fund. It’s not clear how much AERO was purchased by Coinbase. Aerodrome is marketed as the premier trading and liquidity marketplace for the Base L2 network.

- FLOKI has received a $10M investment from DWF Labs. FLOKI developers say the investment is for the purpose of supporting the Floki ecosystem. Floki is a meme-coin developed by members of the Shiba Inu community.

- Frax Finance’s [FXS] CEO, Sam Kazemian, is planning to propose a protocol revenue sharing system for veFXS stakers. Kazemain has indicated that the system would function similarly to that of Uniswap’s revenue sharing proposal.

- Uniswap [UNI] has a live proposal to switch the UNI token from governance only to a governance plus fee accruing token. If approved, UNI stakers will accrue a proportion of trading fees from the exchange in proportion to their amount staked.

- XAI v1 staking went live this past Wednesday. The development team says $30M in tokens have already been staked to the network. XAI is an L3 built on Arbirtrum that enables open trade within next-gen video games.

Upcoming Projects / Tokens

- Blast’s [BLUR] mainnet launch happened this past Thursday. Blast is a new Ethereum L2 that offers native yield on ETH and stablecoins because the L2 stakes assets to various decentralized protocols and then passes the yield back to Blast users.

- Fjord Foundry [FJO] tweeted earlier this week that its new token – FJO – will be “coming soon”. Fjord Foundry is a platform that connects blockchain projects with investment backers by using transparent liquidity bootstrapping pools and token generation events.

Level Up Your Altcoin Investing Game

Explore the new Mastering Altcoin Investing Course. In this value-packed course, we’ll teach you all about how to spot, choose and acquire the winning altcoins of the next bull market.

Tea Incentivized Testnet

Tea is a new project launched to solve a fundamental funding issue with open-source development. In case you weren’t aware, some of the most downloaded blockchain software like core-js has little to no direct funding. But is downloaded more than 30 million times a week and is essential to countless projects. Tea wants to change that by allowing us to directly support important software development.

We mentioned Tea at the beginning of the new year in our Premium Weekly Airdrop. Giving additional time to farm early rewards. But, with recent updates to the reward system and only a few weeks left. It’s time for everyone to check out the Tea Incentivized Testnet.

The Tea Testnet won’t even require you to have a blockchain wallet to participate. During the event you can earn Airdrop points for creating an account, adding your email, and connecting a GitHub account. Tea is using this points system to incentivize eligible developers and non-developers to experiment ahead of the Mainnet launch. Check out the full guidelines for the Testnet.

To get started head over to https://github.com and create an account. Once that’s done, go to the Tea Testnet by choosing “Launch App”. This will prompt you to create a new account using Google, Discord, or Email. Once you do, you’ll be prompted to link your GitHub account. After linking your account by signing in, access the settings menu in the top right. Add an email and update the profile settings. This will give you a total of 1,000 Points and 10,000 TEA Testnet Tokens. New challenges will be made available every week so be sure to check back often. This will help you accumulate more Airdrop Points and test out the Stake & Earn Feature once it’s released.

What Is the Top Bitcoin PFP Collection?

Some Bitcoin Ordinals collections have been making significant gains, and PFPs are a major part of the space. Important Bitcoin PFP collections include NodeMonkes, Ordinal Maxi Biz, Bitcoin Frogs, Taproot Wizards, Quantum Cats, and Natcats, although the Ordinals space is developing fast, and it remains to be seen how these collections will perform long-term.

TO READ THE REST OF THIS ARTICLE, CLICK HERE – “What Is the Top Bitcoin PFP Collection?”

Go Premium To See This Weeks Top 3 NFT Mints

Subscribe to the Wealth Mastery Premium Investor Report to get this weeks top 3 NFT mints AND gain full access to the premium archives.

Thank you so much for your support, and I truly hope that today’s issue will give you insights needed to help you master your wealth.

If you are reading this it means you are on the free version of the Wealth Mastery Investor Report, which is great for news and tips on the crypto markets.

If you really want to take advantage of fastest growing asset class EVER, then the Premium subscription is for you.

Premium Members get access to:

- My updated portfolio

- Technical Analysis from Rekt Capital

- Deep dives on altcoins

- DeFi tutorials

- Airdrop reports

- NFT drop reports

The time to build your portfolio is now. Don’t get left behind.

See you next time!

Lark and the Wealth Mastery Team

💰 BINANCE: BEST EXCHANGE FOR BUYING CRYPTO IN THE WORLD 👉 10% OFF FEES & $600 BONUS

🚀 BYBIT: #1 EXCHANGE FOR TRADING 👉 GET EXCLUSIVE FEE DISCOUNTS & BONUSES

🔒 BEST CRYPTO WALLET TO KEEP YOUR ASSETS SAFE 👉 BUY LEDGER WALLET HERE

📈 TRADING VIEW: BEST CHARTING SOFTWARE ON THE INTERNET 👉 JOIN NOW

1️⃣ COINLEDGER: #1 CRYPTO TAX SOFTWARE 👉 IF YOU OWN OR TRADE CRYPTO YOU NEED THIS

Wealth Mastery (Lark Davis, and the Wealth Mastery writing team) are not providing you individually tailored investment advice. Nor is Wealth Mastery registered to provide investment advice, is not a financial adviser, and is not a broker-dealer. The material provided is for educational purposes only. Wealth Mastery is not responsible for any gains or losses that result from your cryptocurrency investments. Investing in cryptocurrency involves a high degree of risk and should be considered only by persons who can afford to sustain a loss of their entire investment. Investors should consult their financial adviser before investing in cryptocurrency.

You can find a full disclosure of all my crypto & venture investments here.