Arbitrum vs Optimism: Ethereum’s Largest Optimistic Rollups Compared

Arbitrum vs Optimism: 2 of the largest layer 2 (L2) optimistic rollup solutions for Ethereum. Launched in 2021, both sit at number one and two, respectively, in terms of total value locked (TVL) for all L2 chains that derive their security from Ethereum.

Given that Arbitrum and Optimism compose significant parts of the broader Ethereum ecosystem, today’s article will offer a deep-dive comparative analysis of both L2s. Specifically:

- What are they;

- How do they work;

- How do they compare in terms of market, performance, and product statistics; and,

- How do they compare in terms of tokenomics and governance?

Let’s get started.

What Are Arbitrum and Optimism

Arbitrum and Optimism are both L2 optimistic rollups for Ethereum.

L2s: L2s are blockchain networks built “on top” of underlying L1 blockchain networks – all for the purpose of improving the L1’s scalability and efficiency. Like a new highway stacked directly above a congested one, L2s execute transactions on separate network infrastructure, and then batch over compressed, synthesized transaction data onto the L1 for validation. Ethereum is the congested highway, and Arbitrum and Optimism are new highways stacked on top.

Optimistic Rollups: Hence the name – optimistic rollups assume that most economic actors, most of the time, are acting with honesty. Thus, optimistic rollups are L2 solutions which assume that the executed transactions on the L2 are valid and correct. This optimism creates efficiency – optimistic rollups do not expend energy resources to prove the validity of every transaction.

How Do Arbitrum and Optimism Work

Arbitrum and Optimism use L2 nodes (referred to as “sequencers”) to send over batched transaction data to Ethereum for validation. One prerequisite for sequencers is the requirement to post a bond on Ethereum. This bond economically disincentivizes sequencers to commit fraud or abuse.

After a sequencer sends transaction data to the L1, that data must first pass through a 7 day challenge “window” before validation. During the challenge window, anyone (referred to as “challengers”) can dispute a transaction they believe to be incorrect. To dispute a transaction, challengers must post a bond onto the L1, and submit a “fraud-proof”. The fraud-proof ultimately indicates the honest party, the liar, and the correct state of the blockchain.

Thus, whenever transaction data is sent from the L2 to the L1, there are three possible outcomes:

- The transaction data is not challenged during the challenge window. Thus, the transactions are deemed accurate and are validated on the L1.

- The transaction data is challenged, and the fraud proof contradicts the sequencer’s submission. Here, the L2 will re-execute the transactions and update the blockchain state accordingly. The sequencer is penalized and the challenger is rewarded.

- The transaction data is challenged, and the fraud proof corroborates the sequencer’s submission. Here, the transactions are deemed accurate and are validated on the L1. The sequencer is rewarded and the challenger is penalized.

The main difference between Arbitrum and Optimism is their respective utilized fraud-proofs. Each uses different types, which in turn has separate implications for each system.

Arbitrum = Multi-Round Fraud Proofs

Arbitrium’s multi-round dispute resolution process requires cooperation between both the sequencer and the challenger. After a challenge is submitted, the sequencer bisects their assertion, and then the challenger must identify which section has the problem. This process repeats until the dispute centers on one contentious step. This step is then re-executed on Ethereum to determine the correct blockchain state.

This reprocessing is extremely lean in terms of computational requirements, which has two second order effects:

- Lower fees for Arbitrum’s users; and,

- Arbitrum computations can exceed the limits of Ethereum (because the full Arbitrum transactions are never executed on Ethereum – worst case scenario is only micro-step must be re-executed).

Optimism = Single-Round Fraud Proofs

Optimism’s single-round fraud proof requires the challenger to re-process the submitted transactions on the L1 with a special fraud-proof contract. Essentially, this fraud proof contract re-processes the transactions on the L1. The reprocessing will either contradict or corroborate the sequencer, as the L1 outcome can be compared to what was sent over by the sequencer.

This single round-fraud proofing is more data intensive, which therefore means:

- Higher gas fees which create higher transaction fees for Optimism users; and,

- Optimism computations are capped by the limits of Ethereum (because all transactions might need to be reprocessed on Ethereum in the event of a dispute).

Arbitrum vs Optimism: Market, Performance, and Product Statistics

The primary market purpose for using Arbitrum and Optimism is to transact on Ethereum while saving on gas fees. Thus, a good way to gauge and compare the performance of these platforms is to compare transaction costs.

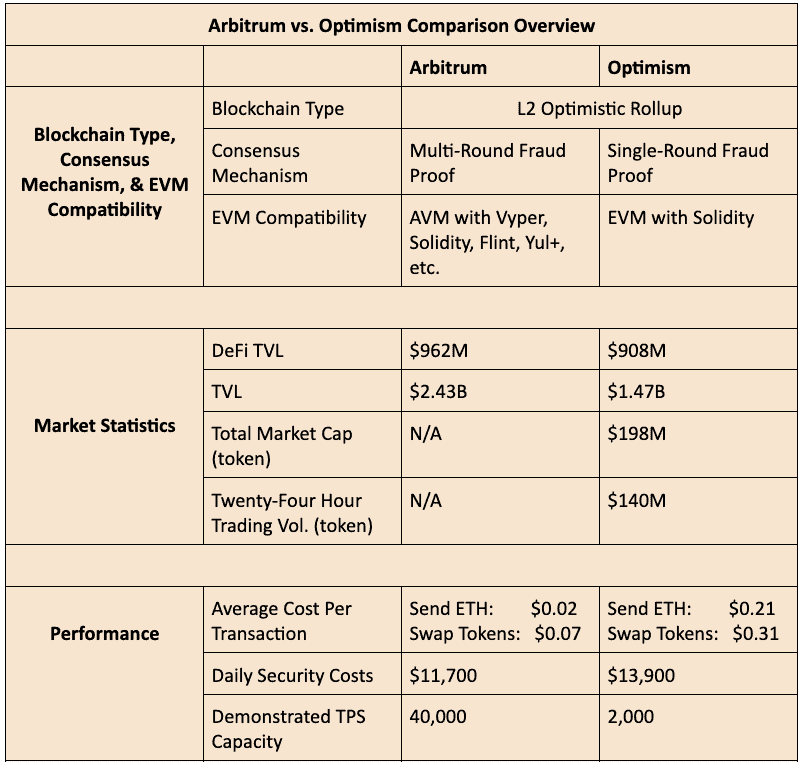

Data from L2Fees indicates that Arbitrum has the edge over Optimism in terms of fees. This is logical and expected given the computational implications of single-round and multi-round fraud proofs.

With regards to a DeFi TVL 2022 market-share comparison for all chains, Arbitrum and Optimism have been steadily growing while Avalanche, Solana, and Polygon have been shrinking.

With regards to a DeFi TVL 2022 market-share comparison for all rollups, Arbitrum and Optimism dominate.

Arbitrum Statistics

- DeFi TVL stands at $962 million.

- Demonstrated TPS capacity of 40,000.

- Protocols and dApps developed on the chain: 128

- TVL stands at $2.43 billion.

Notable dApps include GMX and Stargate, which are numbers 1 and 2, respectively, in terms of TVL on Arbitrum. GMX is a decentralized spot and derivatives exchange with an Arbitrum TVL of $393 million. Stargate is a cross-chain exchange and transport protocol with an Arbitrum TVL of $89 million.

Optimism Statistics

- DeFi TVL stands at $908 million.

- Demonstrated TPS capacity of 2,000.

- Protocols and dApps developed on the chain: 82

- TVL stands at $1.47 billion.

Notable dApps include AAVE V3 and Synthetix, which are numbers 1 and 2, respectively, in terms of TVL on Optimism. AAVE V3 is a lending protocol with an Optimism TVL of $417 million. Synthetix is a derivatives trading protocol with an Optimism TVL of $127 million.

Arbitrum vs Optimism: Tokenomics and Governance

Arbitrum and Optimism diverge significantly in terms of tokenomics and governance.

Arbitrum has no native token as the protocol can use any Ethereum-based currency for transactions and fees. Arbitrum was developed by Off-Chain Labs, a New York-based blockchain company.

In contrast, Optimism’s native token, OP, is used for governance, incentives, and development. OP was airdropped in May of 2022 to members of the “Optimism Collective”, which comprises various companies, institutions, and private investors working to sustainably develop Optimism and Ethereum. The following shows OP’s current token allocation.

A group of Ethereum developers created Optimism and the protocol appears to be currently governed by the Optimism Foundation, a non-profit entity dedicated to scaling the Optimism Collective. The Optimism Foundation states that their ultimate goal is to make Optimism fully decentralized.

Final Thoughts

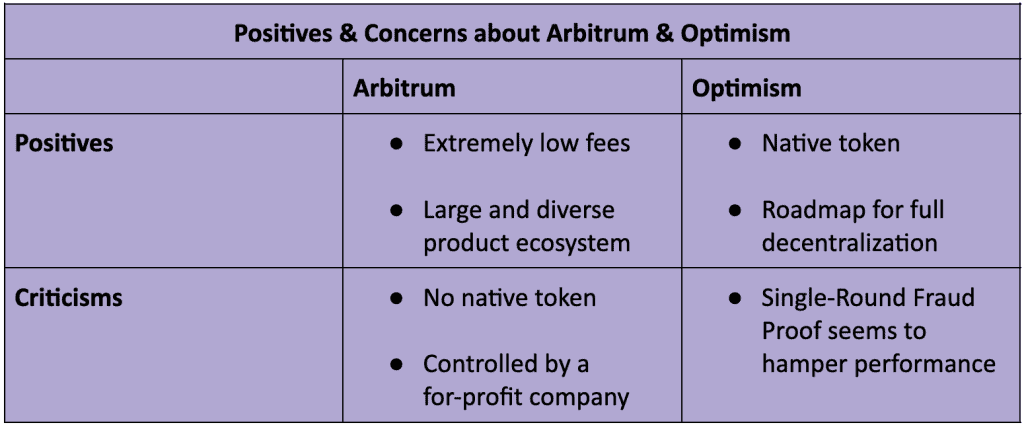

Arbitrum and Optimism have both experienced significant market success as L2 rollups for Ethereum. It’s difficult to assess which is “better”, but there are some qualitative differences between the two blockchains.

Arbitrum seems to have persistently lower fees than Optimism. This probably explains why Arbiturm has a larger TVL and ecosystem than Optimism. It appears that Arbitrum’s edge in terms of fees stems from its utilization of multi-round fraud proofs.

However, Optimism was developed by a group of dedicated Ethereum developers, and there is a clear commitment for the protocol to become fully decentralized. Anyone can have a stake in the protocol via the OP token. So far, there is no indication from Arbitrum that the project will take a similar path with regards to tokenization and full decentralization.