Monthly Crypto Alpha Report – April 2023

Market Roundup

On April 1st the BTC price was around 28.4k. While we haven't moved much, volatility has been impressive on some days. Mid-April, price shot up to 31k and people started posting bullish predictions and memes. A deserved moment of celebration after BTC posted its first 100% gain since the November low of 15.5k.

Then BTC corrected to 27k. Bears started putting on sports gear for their victory laps but were caught with their pants down when the price bounced back sharply. A crazy day was the 26th, with price zig-zagging and taking out big short and long positions in the span of a few hours. A good month for traders!

For hodlers, it was nice to see the price bouncing back strongly from an area of price support of around 27,000 and the 50-day simple moving average. A line to watch if we want to stay short/mid-term bullish.

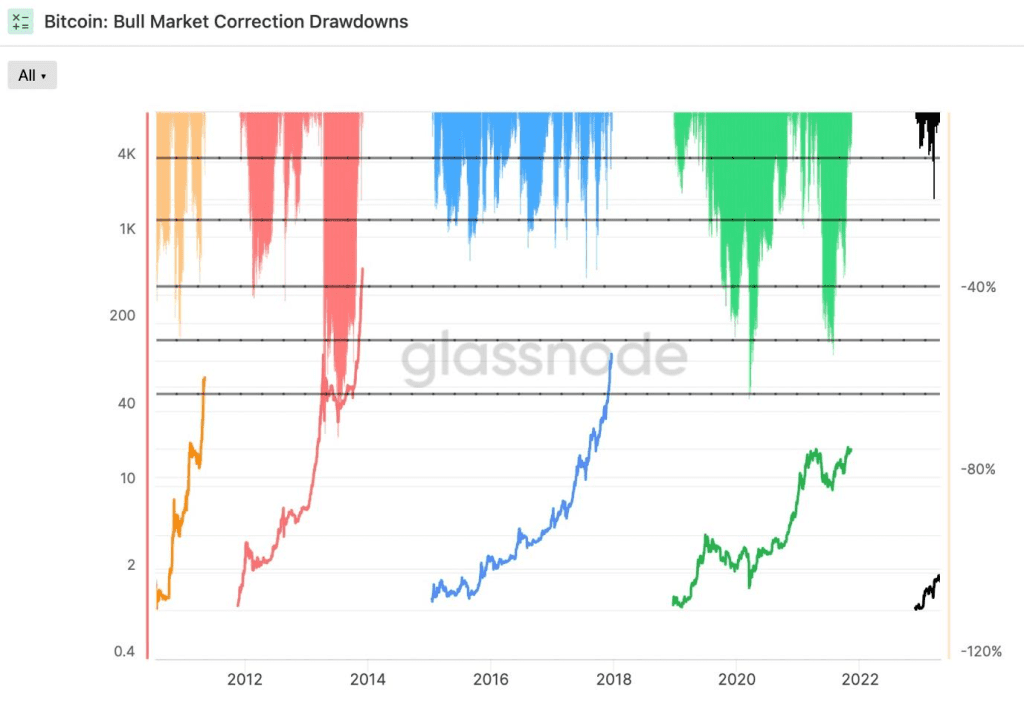

In the current post-bear market upswing, we haven't seen the usual corrections of over 20%. While these corrections are standard for Bitcoin in an uptrend. See the below Glassnode chart, comparing the current upswing (right line, in black) to those of prior cycles.

We could say we're in an 'upswing for ants'. Should a bigger upswing come, then be prepared for some more serious pullbacks.

Bitcoin Dominance Flirting with Resistance

In mid-April Bitcoin dominance was rejected from the multi-year 49% resistance. It has been creeping back up though, marking the highest monthly close in 2 years. It

Responses