Monthly Crypto Alpha Report – March 2023

Market Roundup

The markets have been crazy on all fronts. Bank runs, USDC temporarily depegging, lawsuits against crypto firms, bitcoin pumping… quite possibly the craziest month I’ve seen in the six years that I cover this space!

Mid-March, bitcoin experienced one of the best-performing weeks of price action in history, closing 35% up on the week. This has only happened a handful of times in bitcoin’s history. The Orange Coin managed to finally break above the important 200-week moving average, which it failed to cross in February. The bump turned into a nice pump but the 28.3k level has proven tough resistance.

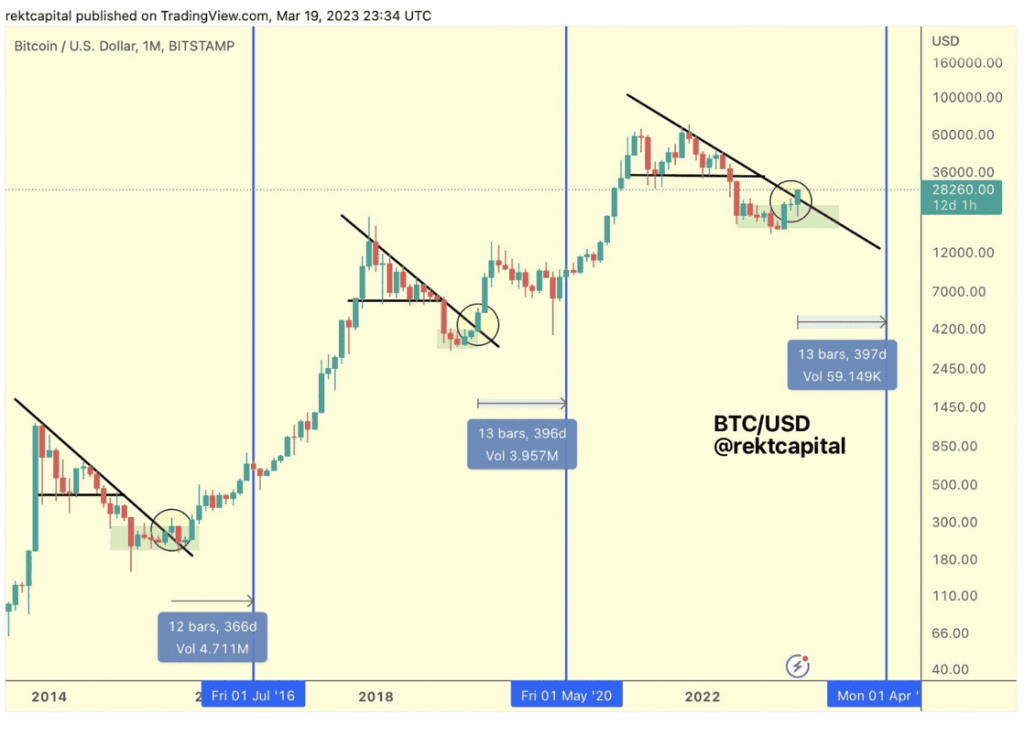

In February’s roundup report, I pulled up Rekt Capital’s chart that suggested March could become the breakout month. It has proven to be just that: see the chart below.

Steady lads

As bitcoin believers, we can’t help but smile that this pump is happening against the backdrop of an unfolding banking crisis. In March’s Fed meeting, Jerome Powell assured us that the bank failures were incidents and contained. From every higher-up, we hear that the banking system is ‘sound and resilient’, ‘safe and sound’, ‘resilient, with strong capital and liquidity positions’ (Lagarde of the ECB). It’s central bankers’ speak for ‘steady lads’. It’s when depositors start shifting in their seats a bit.

To be sure, there are currently no bank runs. But according to The Economist, depositors have drained 500 billion dollars from commercial banks over the past 12 months. People realize they can get better rates at money market funds. And withdrawals can in this age of social media quickly turn into a bank run, and drain a bank within 24 hours.

Decoupling?

So, is this indeed a case of ‘Long bitcoin, short the banks’? To be fair, the situation with the banks doesn’t appear to be nearly as bad as in 2008. The Fed could likely solve current banking issues by lowering interest rates.

If the banking crisis will continue unfolding, the Fed will be forced to pivot and lower interest rates, fast. But if you’re an investor in stocks, that’s not the pivot you want: if the Fed has to pivot because banks will have to stop lending, the economy suffers. Not great for stocks.

And as a crypto investor? Well, we saw in the march rally a clear signal that BTC decoupled from stocks. And that’s good news. After all, we don’t want bitcoin (and crypto) to be a levered bet on the existing system. We want it to be an alternative system.

Fresh Money

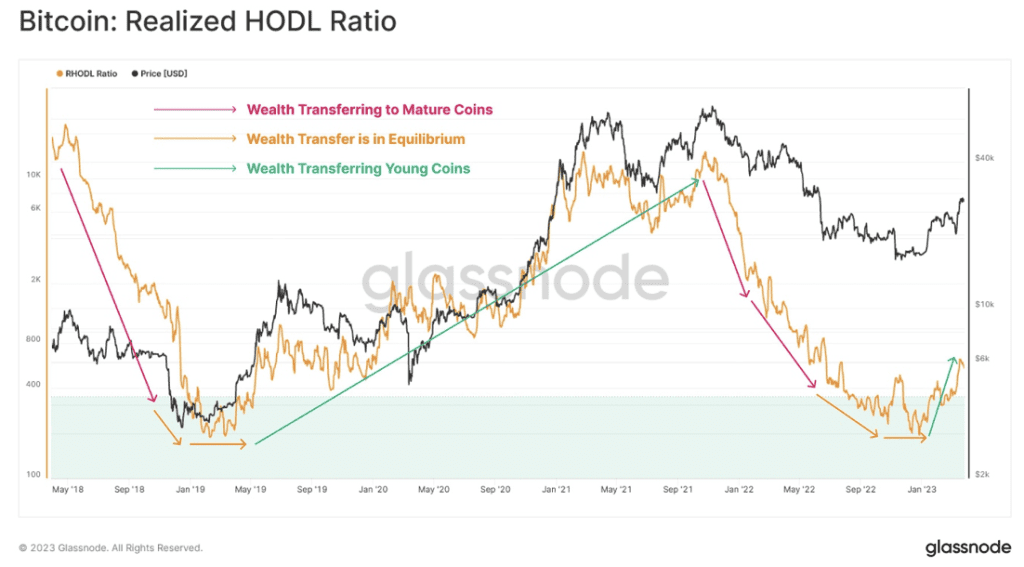

So why is bitcoin pumping? Is this because moms and pops are finally seeing the light and moving their bank deposits into BTC? Indeed, Glassnode sees a move from mature coins to young coins (see chart below). Also, it has charted a rise in new entities in Bitcoin higher than the level of the past 18 months.

Still, this doesn’t tell us that these coins are bought with tradfi money. The fact that Bitcoin dominance has also been on the rise, suggests that altcoins are being converted into BTC. Another sign that we are nowhere close to a raging bull market is that liquidity is low. But, as mentioned last month, spring is here!

In the meantime, financial watchdogs SEC and FDIC seem to be outbidding each other. Which will be the most aggressive anti-crypto regulator? The prize seems to be regulatory authority over the markets. Fortunately, there are other countries in the world but the US.

As I said, a crazy month on all fronts! And I didn’t even dive into the launch of ChatGPT-4, which in retrospect might even turn out to be the biggest event of all.

Top Airdrops of the Month

Top Altcoins to Watch

Top NFT Mints of the Month

Best DeFi Farm of the Month

Recommended Services

💰 BINANCE: BEST EXCHANGE FOR BUYING CRYPTO IN THE WORLD 👉 10% OFF FEES & $600 BONUS

🚀 BYBIT: #1 EXCHANGE FOR TRADIN 👉 0% SPOT FEES AND $4,450 IN BONUSES

🔒 BEST CRYPTO WALLET TO KEEP YOUR ASSETS SAFE 👉 BUY LEDGER WALLET HERE

Legal Disclaimer

TCL Publishing ltd (director Lark Davis, owner of Wealth Mastery) is not providing you individually tailored investment advice. Nor is TCL Publishing registered to provide investment advice, is not a financial adviser, and is not a broker-dealer. The material provided is for educational purposes only. TCL Publishing is not responsible for any gains or losses that result from your cryptocurrency investments. Investing in cryptocurrency involves a high degree of risk and should be considered only by persons who can afford to sustain a loss of their entire investment. Investors should consult their financial adviser before investing in cryptocurrency.

You can find a full disclosure of all my crypto & venture investments here.

Responses