4 Tokenless ZK-Layer 2s Compared

TL;DR

We already discussed ZkSync Era, a Layer 2 on Ethereum with Zero-Knowledge (ZK) Technology. Launched in April 2023, it quickly gained a lot of value locked. Let’s have a look at how it and three compadre Layer 2s are doing. For this review, we leave out ZK Layer 2s that already have a token, such as Polygon’s ZkEVM. Why? Well, airdrops are on the horizon…

Layer 2s (L2s) allow developers to build apps on Ethereum with low gas fees and high/fast throughput, backed by the security of Ethereum.

What is special about Zero-Knowledge Layer 2s? With Zero-Knowledge technology, a batch of transactions can be processed together on the L2. A single proof representing the entire batch’s validity is then posted to the main chain – without giving insight into the transactions themselves (this is the zero-knowledge/privacy aspect). This process significantly reduces the amount of data processed and stored on Ethereum.

As the name suggests, enhanced privacy is a key benefit: zero-knowledge rollups allow one party to prove to another that a statement is true without revealing any information beyond the validity of the statement itself. Imagine that I can prove that I am the legitimate owner of a valid passport, without showing my passport to the clerk at customs, or to the car rental agency!

This adds a layer of privacy to transactions that is not necessarily present in traditional blockchain transactions (even though ZK-rollups are also hot again on Bitcoin).

ZK rollups are designed to be compatible with Ethereum’s ecosystem, including smart contracts and decentralized applications (dApps). Without this compatibility there is no use for a Layer 2: you want different services and protocols to seamlessly interact with each other, even if they’re on a different layer.

The Difference Between Zero-Knowledge Rollups and Optimistic Rollups

Popular Layer 2s such as Arbitrum and Optimism are so-called ‘optimistic rollups’. This type of scaling solution is currently more mature than ZK-rollups. (Arbitrum and Optimism have already released their tokens but the ZK Layer 2s under discussion haven’t yet. We smell… opportunity.)

In the case of optimistic rollups, transactions are ‘optimistically’ posted to Ethereum Layer 1. This means it is assumed they are valid until proven otherwise. Validators have a dispute period of a week. This means that withdrawal latency is longer for optimistic rollups compared to ZK-rollups.

On the flipside, ZK-rollups have faster finality and withdrawal times, and better privacy.

ZK-technology is more complex to build though.

The choice between Optimistic and ZK-Rollups depends on the specific requirements of the application, such as speed, cost, privacy, and EVM compatibility.

Ethereum founder Vitalik Buterin has predicted that ZK-Rollups will eventually outcompete Optimistic Rollups. But in terms of adoption, they have some ground to cover.

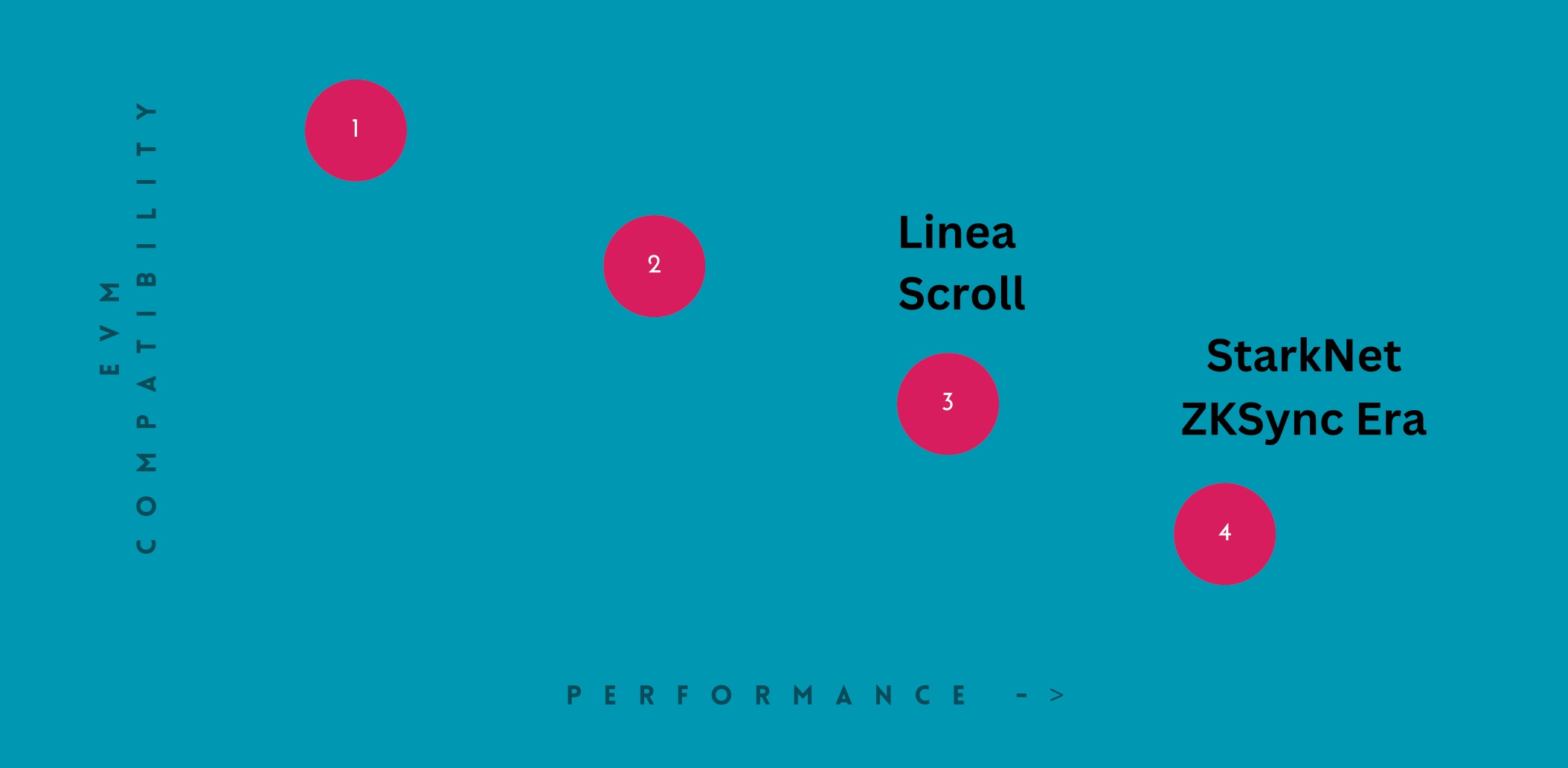

Types of ZK-rollups

Different ZK-rollups make different tradeoffs: some are more compatible with the Ethereum Virtual Machine (EVM) and thus existing tools. Compatibility is important if you want your ZK-Rollup chain to be able to do more than only for example token swaps.

Other ZK-rollups perform better (faster, more throughput). This is Vitalik’s classification of ZK-rollup types:

- Type 1, fully Ethereum-equivalent: perfect compatibility with Ethereum, but lower scalability.

- Type 2, fully EVM-equivalent: perfect equivalence at the VM level, improved scalability compared to type 1

- Type 3, almost EVM-equivalent: easier to build + better scalability, but not compatible with all dapps

- Type 4, high-level-language equivalent: easiest to build + highest scalability, but less compatible with existing tools

The Layer 2s discussed here lean towards the types 3 and 4 (see below). Meaning they focus on throughput and scalability. They all have work to do on compatibility.

Linea and Scroll currently fall in type 3 and lean more towards compatibility (nice for developers). They even have plans to make the move towards Type 2.

It’s conceivable that over time, the practical differences between zkEVMs will diminish. Every project will want to make it as developer-friendly as possible. Ethereum on its end will want to make updates that make it more ZK rollup-friendly.

StarkNet: the First

StarkNet launched in February 2022. It got $225 million in funding. It reached a valuation of $8 billion in its Series D funding round in May 2022.

StarkNet uses so-called zk-STARKs and is known for its scalability and security. However, StarkNet does not work with the Ethereum Virtual Machine directly. This means it requires specific adjustments and tools for development and usage.

In StarkNet, account abstraction is integrated at the protocol level. The classic accounts we all know (Externally Owned Accounts, where we have to store our seed phrase) and Smart Contract Accounts (SCAs) are merged. This simplifies the development process as developers can treat all accounts as if they have smart contract capabilities.

For users, account abstraction allows for a more seamless and efficient user experience, supporting features such as different authentication methods, gas payments in ERC-20s, and transaction scheduling.

Linea: Developer-Friendly

Linea went live in July 2023. It was developed by ConsenSys, a leading blockchain company.

Linea can execute unaltered code in line with the EVM. Linea’s goal is to reach a Type 2 ZK-EVM status, obtaining near-complete compatibility with Ethereum while maintaining scalability.

According to its website, Linea is ‘a developer-ready zkEVM rollup for scaling Ethereum dapps’. In other words, Linea brands itself as developer-first. It is trying to deliver zk-rollups in such a way that would support the environment for developers without any friction.

As a newer entrant, Linea might face challenges in wider adoption and integration with existing tools.

Scroll: Developer-friendly, aiming to be Fully EVM-Compatible

Scroll mainnet was launched in October 2023. It raised a total of $83 million, at a valuation of $1.8 billion.

Like Linea, Scroll is a zk-Rollup on Ethereum, also a Type 3 zkEVM wanting to proceed to Type 2. Its long-term goal is even to prioritize EVM compatibility & decentralization over fast ZKP generation, thus moving to a Type 1 zkEVM.

ZkSync Era: Focus on Speed

ZkSync Era launched in March 2023. It is currently a Type 4 zkEVM. It focuses on the high speed of ZK-proofs. The downside is it doesn’t have EVM compatibility. This will require app developers to make tweaks to the development process to build apps on zkSync. This L2 will probably add compatibility for EVM code over time, moving it towards type 3.

Like StarkNet, ZkSync Era has also integrated account abstraction at the protocol level.

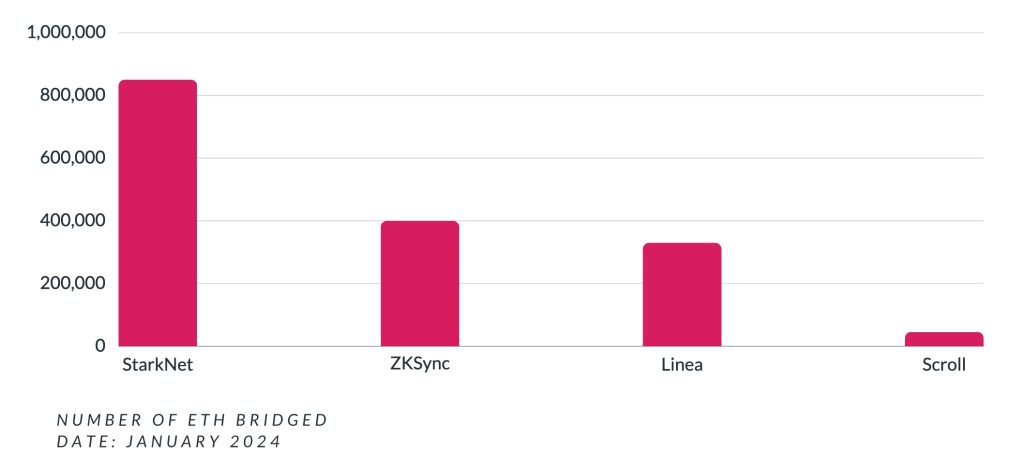

Total ETH Bridged

Now we compare the amount of ETH bridged to these L2s. It’s no big surprise that StarkNet, having launched more than a year earlier than its competition, has the biggest chunk of ETH deposited: more than 800.000.

Second and third are ZkSync and Linea, with 300.000+ ETH. Trailing is Scroll, with ‘not even’ 50k ETH bridged over.

Wen Tokens and Airdrops?

As mentioned, it’s not certain that all of these networks will airdrop a token. But it’s likely that a few of them will. We won’t give a detailed airdrop guide here per L2: that would require four separate articles.

In general, to qualify for airdrops you would need to bridge ETH to the L2, for example, Orbiter Finance. Next, interact with some dexes. The dex called SyncSwap, for example, interacts with Scroll, Linea, and ZKSync Era.

StarkNet

StarkNet is set to have its native token called STRK, which is expected to unlock in April 2024. The new unlock date has been pushed to mid-April 2024, from the previously scheduled date in November 2023. The total supply of STRK tokens is ten billion. Here on StarkWare’s website you can see the dApps that could potentially qualify you for an airdrop.

Linea

“At this early stage, we don’t have any plans to launch a token,” says Linea’s help center. Linea is EVM equivalent, and can use ETH as its native token. This doesn’t mean that Linea won’t launch a token in the future.

ZkSync Era

ZkSync has hinted at a token launch. We have written a detailed roadmap about a ZkSync Airdrop Strategy, as a liquidity provider for dex SyncSwap.

Scroll

The Scroll network has not officially announced it, but a Scroll airdrop is likely coming. Like all new chains, it wants to decentralize its ecosystem and reward early users.

Conclusion

Lagging the (token) launches of optimistic rollups such as Arbitrum, the tokenless ZK-Layer 2s have some ground to cover: the technical challenges are huge. But the benefits too. And for airdrop hunters, there is still some time to farm.