Earn High Yield on Polkadot (25%+ APR) with WETH & DIA

Earn High Yield on Polkadot

Before we get started, this is not a recommendation or endorsement to buy ASTR, LAY, or any tokens mentioned below.

Excited to highlight my first Polkadot-based yield farm! Polkadot is a network that allows blockchains to communicate and pool security while letting them run their own functions. Some of these blockchains operating on Polkadot will focus on DeFi applications, such as Astar Network (for a deep dive into Astar Network read this article). As with other DeFi communities, we’re just beginning to see major money legos launching on Polkadot-based blockchains like Astar, which allows for smart contract development to host DeFi and Web3 apps that we’d normally use on L1s like Ethereum and Terra.

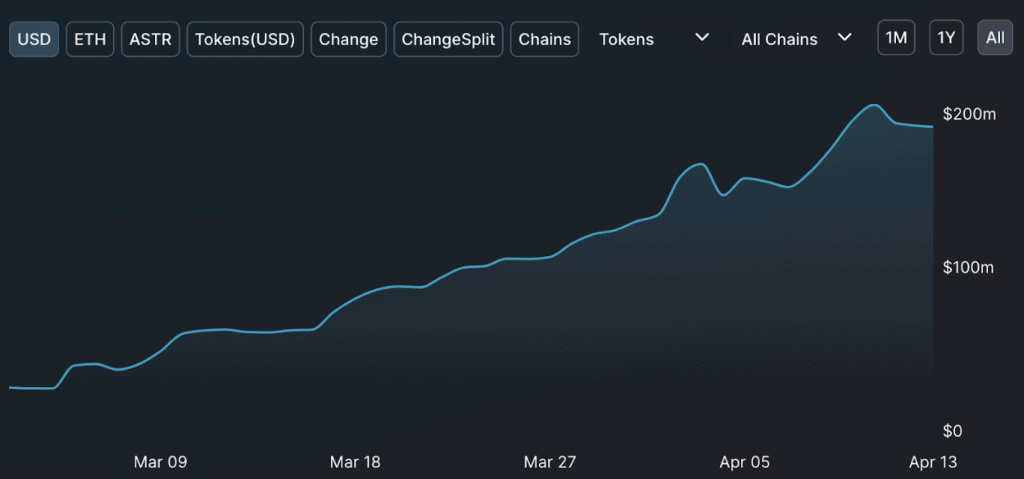

Over the last few months, Starlay Finance launched as one of the earliest DeFi protocols on Astar, designed for users to easily borrow and lend cryptoassets, similar to how Compound or Aave work. Depositors can provide liquidity to earn interest as a stable passive income, while borrowers can leverage their assets without selling. As of this writing, Starlay has grown to just over $186M TVL.

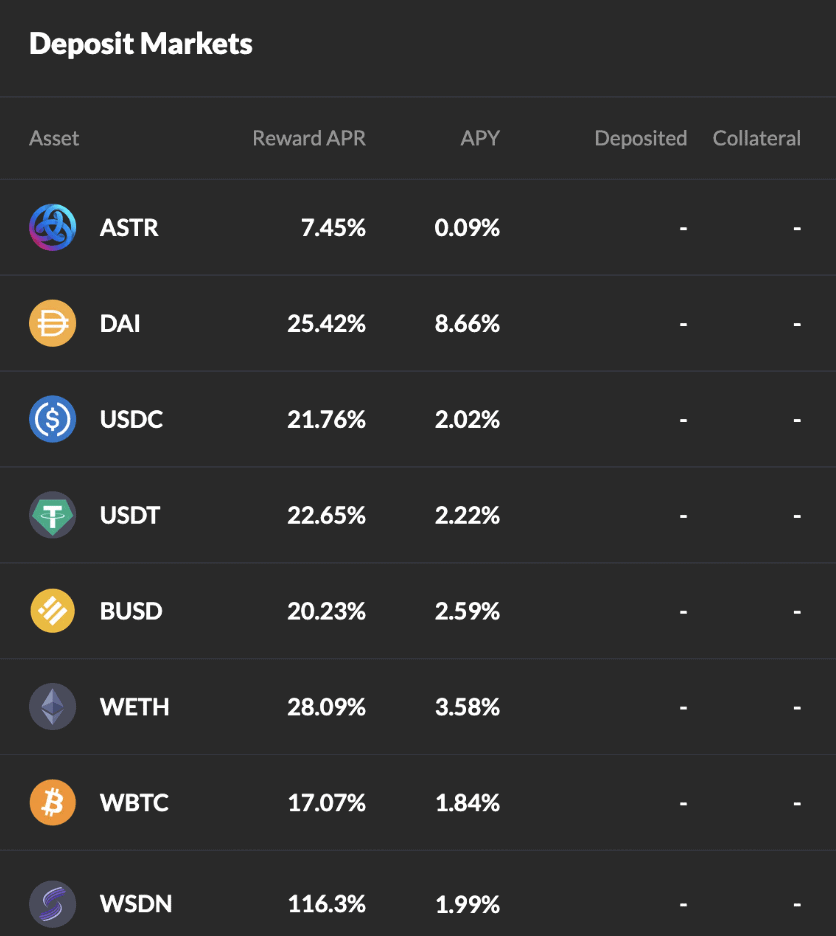

How to Earn Up to 28% APR on WETH and 25% APR on DAI on Polkadot

For anyone holding stablecoins, WETH, or WBTC on Astar Network, an EVM-compatible network, I’ll walk through how I might deposit stablecoins above to earn as high as 25% APR, as of this writing.

Before we get started, please be aware of a few major risks.

- Smart contract risk in Starlay