Ethereum vs Polkadot: Updated 2023 Comparison

TL;DR

- Polkadot was conceived and developed in anticipation of Ethereum’s scaling problems.

- While both are open source, decentralized, and proof-of-stake (POS), Ethereum is a layer 1 (L1), stand-alone blockchain, while Polkadot is a layer 0 (L0) blockchain ecosystem.

- Polkadot uses on-chain governance and a forkless upgrade mechanism while Ethereum’s governance is off-chain with a hard-fork upgrade mechanism. Each protocol uses slightly different POS consensus mechanisms.

- Fundamentally, Ethereum is striving for Polkadot’s technology while Polkadot is working for Ethereum’s third-party developer and user-base.

The cryptocurrency market is the freest, fastest, and fiercest on earth. It’s survival of the fittest. A Darwinian death for most with only a handful of projects to emerge as the foundational pillars for a burgeoning Web3 economy. Meanwhile, investors are doing their best to grasp the technology and attempt a prediction about which might be the victors.

Currently, Ethereum and Polkadot hold significant dominance and influence in the market. But these two were competing before both were even invented. That’s because the founders – Vitalik Buterin and Gavin Wood – disagreed over how to best build a platform to handle mass adoption.

This is Ethereum vs Polkadot. A fresh look at two of crypto’s most prominent protocols.

Development History

In The Beginning . . . Vitalik Buterin proposed the Ethereum whitepaper (2013). The innovative idea was decentralized applications (dApps) fueled by smart contracts. Soon after, Buterin assembled his team, which included a guy named Gavin Wood. Ethereum launched in 2015 as a proof-of-work protocol and due to the extreme usefulness of dApps, Ethereum became the second largest crypto by market cap . . . Buterin saw that it was good and rested.

At some point in the timeline above, Gavin Wood foresaw Ethereum’s scalability problems. So he departed for another solution. The Polkadot whitepaper was published in 2016. Wood then launched a foundation and a company, held an ICO, and developed Polkadot. It’s mainnet launch occurred in 2020.

Make no mistake, Polkadot was conceived and designed in response to anticipated scalability problems for Ethereum. And with that in mind, let’s delve into these protocols.

What is Ethereum?

Ethereum is an open source, decentralized, proof of stake (POS), layer one (L1), blockchain protocol. Ethereum’s core innovation is the ability to build and use dApps on the blockchain. And because of dApps, Ethereum’s ecosystem has flourished. Currently, the protocol has over 3,600 dApps, is the second-largest with a $200 billion market cap, and has 20% total market dominance. With these facts in mind, Ethereum can perhaps best be described as a global blockchain protocol that supports an open, evolving, and diverse digital marketplace.

However, don’t let the unicorns fool you, not everything has been sunshines and rainbows. Ethereum suffered serious congestion and exorbitant transaction fees during the 2020 and 2021 crypto bull-run. High user-demand plus limited block space (Ethereum could only handle about 10 to 20 transactions per second) equaled transaction fees, at times, into the hundreds of dollars.

In response, the free market found solutions. Third parties deployed layer-2 (L2) networks (e.g. Polygon, Arbitrum, Optimism, etc.) while Ethereum developers hammered away at Ethereum 2.0 (successful as of November 2022). And these solutions helped. Ethereum’s transactions per second (TPS) are increasing (especially when factoring in L2s) and while gas fees are falling.

And development isn’t over. Looking ahead, Ethereum’s next major upgrade is sharding, tentatively scheduled for late 2023 and 2024. Sharding will allow Ethereum to engage in parallel transaction processing, which is supposed to further boost TPS and lower transaction fees.

What is Polkadot?

Polkadot is an open source, decentralized, proof of stake (POS), layer zero (L0), multi-blockchain ecosystem. Polkadot’s core innovation is a platform that allows for the creation and deployment of interoperable, sovereign blockchains. Thus, Polkadot’s overarching goal is a multi-blockchain ecosystem that’s extremely scalable and efficient. And by extremely scalable, I mean 1 million TPS (Polkadot’s stated goal).

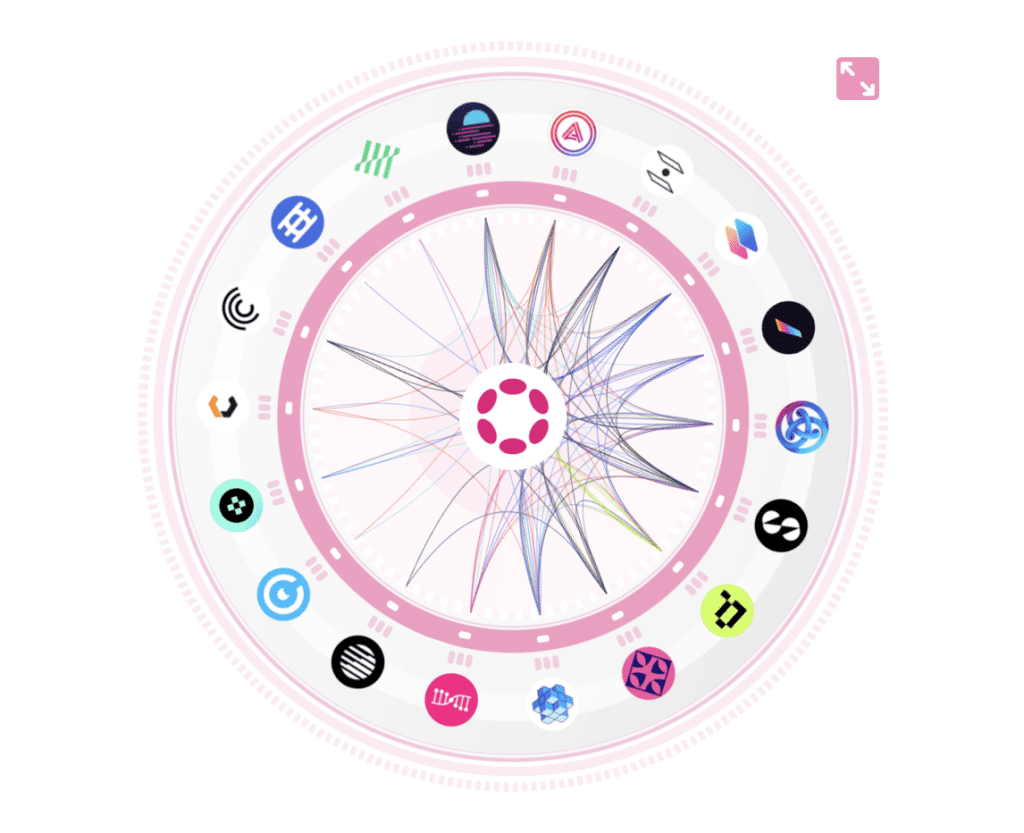

The core of Polkadot is its “relay” blockchain. The relay chain is the utility blockchain for the entire ecosystem. Its primary function is to provide security and interoperability for all the other chains. The other chains are known as “parachains”, which are sovereign, highly-customizable blockchains owned and operated by third-party developers. Parachains run in parallel to the relay chain and communicate with it and with each other. Polkadot supports up to 100 parachains, although there are currently 20 that are live and operating. The current heavyweights are Acala (ACA), Moonbeam (GLMR), Parallel Finance (PARA), and Astar (ASTR).

Here’s some other important concepts to understand:

- dApps are deployed on parachains and not the relay chain.

- Polkadot features multiple bridges that allow the ecosystem to connect to external blockchains like Bitcoin and Ethereum.

- Polkadot auctions parachain slot leases to third-party developers. Winning bidders deploy their blockchain as a parachain. You can stake DOT via a crowd-loan to projects that you want to become a parachain. If successful, you’ll receive payouts in the project’s currency for the duration of the lease in proportion to your amount staked.

While it appears Polkadot has constructed a solid foundation for blockchain scalability and interoperability, the network, at the time of this writing, is on the outside of the top ten cryptocurrencies with a $7 billion market cap. Some argue this is due to certain complexities with regards to parachain development, along with a bad user-experience of Polkadot’s native Polkdadot.js wallet.

Ethereum vs Polkadot: Differences

Both protocols are complex. Polkadot is extraordinarily complex. So note that the following is not a comprehensive list of differences. Instead, the following are some major differences with a focus on how any divergences might affect each protocols’ development.

| Technical Table | Ethereum | Polkadot |

| Architecture | Layer-1, Single Chain | Layer-0, Multi-Chain Ecosystem |

| Consensus Mechanism | Proof-of-Stake | Nominated Proof-of-Stake |

| Governance | Off-Chain | On-Chain Republic |

| Upgrade Mechanism | Hard-Fork | Forkless |

Architecture Affecting Performance

Ethereum operates as a single blockchain (i.e. the Beacon Chain) where all of its transactions and smart contract executions are sequentially validated. Ethereum is considered a layer 1 blockchain, meaning that dApps and L2 blockchains can be built on top it, but all the economic actively ultimately filters down to Beacon Chain validation. Polkadot operates as a multi-chain ecosystem. It’s an L0 protocol that allows for the creation of L1 parachains to operate under its umbrella. These L1 blockchains are highly customizable, with their own processing functions, consensus methods, tokenomics, dApps and L2 scaling.

Unsurprisingly, the stark difference in architectural designs has created different scalability (TPS) outcomes. Ethereum’s current TPS, when factoring in all of its layer 2s (excluding Polygon), is approximately 29. The general rule is that the entire Polkadot ecosystem processes roughly 8x – 10x the TPS of Ethereum.

Governance Relating to Protocol Upgrades

Ethereum and Polkadot have very different governance and protocol upgrade structures. And these differences have varying implications.

At the end of the day, Ethereum’s governance is off-chain. While there is an Ethereum Improvement Proposal (EIP) system in place, the vast majority of power resides with Ethereum’s core development team. The buck stops with them. Add to that the fact that Ethereum uses a hard fork procedure for every upgrade. This means that each upgrade needs consensus from validators and node operators. If consensus is not achieved, and the core development team jams an upgrade through anyways, guess what happens? The blockchain splits. And the dissenters continue running the older version of the protocol. Ethereum Classic anyone?

Compare that to Polkadot, which uses an on-chain, republic governance system. There’s DOT holders, the On-Chain Council, and the Technical Committee. DOT holders elect the On-Chain Council, and the latter elects the Technical Committee. There’s processes in place that allow all three groups to submit protocol upgrade proposals. Proposals that survive and receive enough votes are implemented by the Technical Committee. Interestingly, Polkadot upgrades are disbursed throughout the network via a Wasm meta-Protocol and don’t require a hard fork. While it appears that a hard forks are still possible, Polkadot’s governance and upgrade implementation design reduces the risk of there ever being a major dispute and relay chain split.

POS Consensus Mechanism

While there are some differences between Ethereum and Polkadot’s consensus mechanisms, understand that at a high level, both use POS models the provide security through slashing and the threat of slashing. Staking (getting money) + slashing (losing money) = network security via an economic carrot and stick.

Ethereum works by validators

- Staking a minimum of 32 ETH into a special smart contract on the Beacon chain, and

- Running a validation software package, in order to

- Validate and propose new blocks. A RANDAO algorithm randomly selects which validator gets to propose the next block. The selected validator creates the next block and sends it across the network. The other validators check the broadcast block and vote on whether to accept it or not, using a CasperFFG protocol.

Polkadot uses a Nominated Proof-of-Stake (NPOS) system. There are nominators and validators. Nominators must stake a minimum of 250 DOT to the validators (up to 16) that they support and trust. The 1,000 validators with the most nominations validate and propose blocks on Polkadot’s relay chain. A BABE algorithm randomly selects each validator to propose the next block. The block is proposed and broadcast throughout the network. The other validators vote on each proposed blocks using the GRANDPA protocol.

Final Thoughts

Fundamentally, it appears that Ethereum is striving for Polkadot’s technology, while Polkadot is working for Ethereum’s third-party developers and user-base.

Gavin Wood is a blockchain prophet. He was correct about the scalability issues that Ethereum eventually hit. But the free market and the Ethereum core development team were able to stick and move, as the litany of L2 solutions and Ethereum 2.0 appears to have alleviated high transaction fees. However, what’s particularly interesting is the concept of Ethereum sharding. At a high level, a successful implementation of sharding gives Ethereum a multi-chain structure like Polkadot. So what does it mean for the future of Polkadot if Ethereum sharding is wildly successful?

On the other hand, Polkadot does have some established hard-hitting parachains, and it’s very reasonable to think that the future is multi-chain, so it’s hard to think that Polkadot does not have a bright future. However, Polkadot will be much better positioned by increasing its user-base now, before any successful Ethereum sharding upgrade.

Responses