Instadapp Lite | How to Earn Up to 8.63% APR in ETH

Before we get started, this is not a recommendation or endorsement to buy any token(s) mentioned.

Instadapp is one of the oldest and most popular applications in DeFi. Instadapp started as a dashboard for managing leveraged positions on Ethereum in Compound and Maker. This premier dApp grew even more popular in the summer 2020 (DeFi Summer) for its signature flashloan recipes which allow the average DeFi user to wind up leveraged positions to maximize earning COMP rewards. Today, Instadapp has about $5.1B TVL in its smart contracts and has grown to support other chains such as Polygon, Avalanche, Fantom and Ethereum L2s such as Optimism and Arbitrum. Instadapp allows DeFi power users to do just about anything with leveraged positions in Compound, Maker, and Aave such as collateral swaps, debt swaps, loan migrations, and unwinding positions in a few clicks using flashloans.

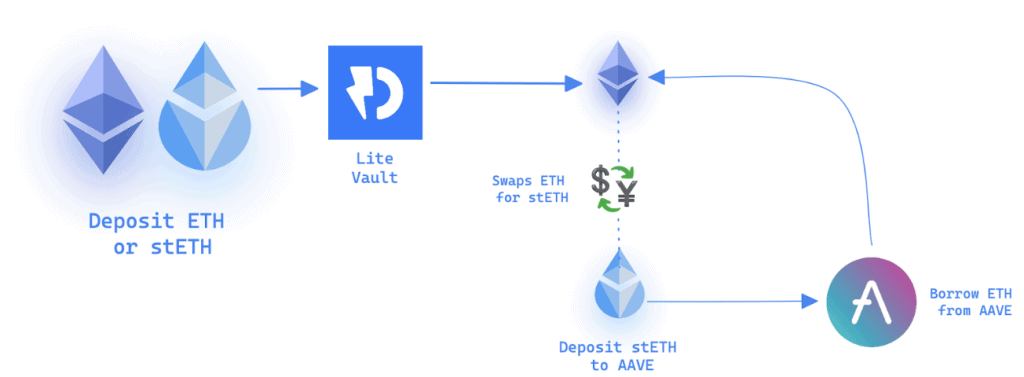

Recently, Instadapp Lite launched to help DeFi users more easily maximize gains by reducing the number of transactions, saving on gas, and automating fee collection, while actively monitoring their DeFi strategy. Instadapp Lite is similar to Yearn, whereby you get exposure to complex yield strategies in 1-2 clicks, but by using Instadapp's DeFi Smart Layer. Instadapp Lite is able to use staking rewards from Ethereum and trusted DeFi protocols to generate yields across popular assets like ETH, WBTC and stablecoins.

The most popular Instadapp Lite vault today uses a strategy where staked ETH from Lido (aka stETH) is deposited into Aave. stETH on its own is earning 3.8% APR in ETH validator rewards. By utilizing a leverage strategy where we borrow ETH against stETH collateral, swap ETH for more stETH, redeposit more stETH, and borrow more ETH, we