Monthly Crypto Alpha Report – June 2024

Many times, I have opened newsletters with the statement that the past month was the craziest, most consequential month in crypto.

But crypto proves it can be even wackier. Crypto has outdone itself... again.

The SEC's Gensler approving the Ethereum ETF…

Trump smelling blood and suddenly standing up for the right of self-custody of the American people…

The Democratic party scrambling to appease the US pro-crypto army…

Wow (still, Biden himself didn’t bend the knee and went against his Democratic Senators’ votes, vetoing a bill that would overturn a controversial bulletin that will prevent banks from custodying crypto).

This is bullish of course, as we're now moving deeper in an election year in which both parties want to appease the tens of millions of Americans who hold crypto. In the background, the money printer is being loaded up with fresh paper and ink.

The pro-crypto army has proven to be stronger than the anti-crypto army.

The older generation Dems were slow to realize that you better not kick a nest of cyber hornets. We crypto maniacs have the energy and money to fight, and maybe even more importantly... the memes!

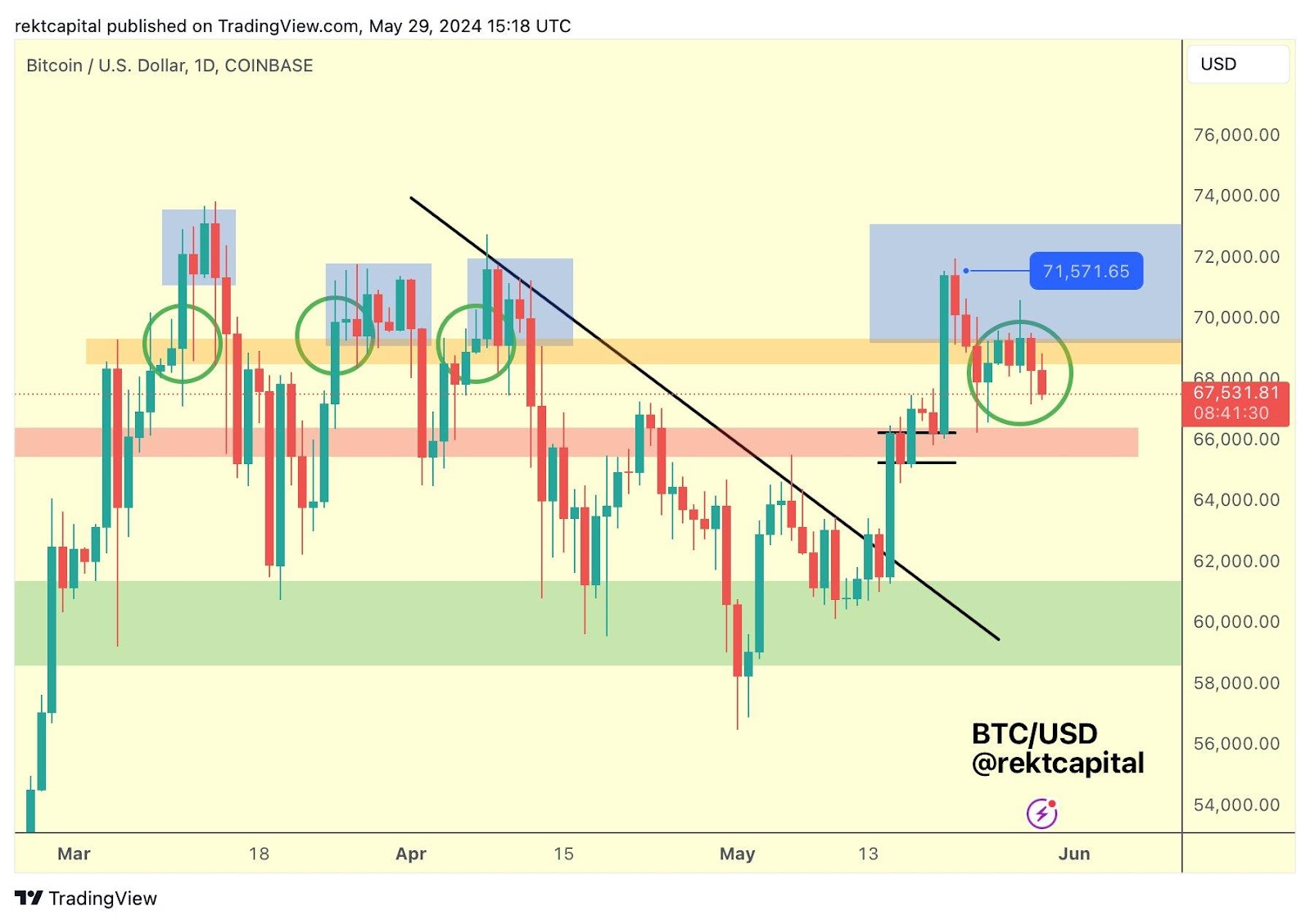

Considering all this crazy backdrop, the price of BTC has been relatively flat, just consolidating.

BTC continues to slide down after failing to reclaim the orange area as support. In fact, Bitcoin is showing signs that it has turned

HI, I would like to know, how to find entry and exist point of coins you are recommending investing.

Well first we are not recommending you what coins to buy. We share reports and I share my portfolio moves, but you need to make your own calls with what to do with your money.

Regarding entry, try to buy on massive pullbacks, crashes, and when no one is paying attention. Sell when markets are pumping and everyone is fomoing. Learn how to use support, resistance and tools to the fibbonacci to help determine good entry and exit points as well