Hong Kong ETFs Next Week!

GM friends.

If Reuters is on point, then we might be due for a very unexpected bitcoin pump this next week! Our hopes are based on your competence, traditional media!

So pour that coffee, and have a chair. Here comes your mid-week crypto update. ☕️📰

Here’s what’s in today’s issue:

- David shares his thoughts on the Hong Kong ETFs likely being approved next week, the BTC halving potentially being a sell the news event, USA ETH ETFs might be rejected, EigenLayer launching & Sui has a portable gaming device.

- Rekt Capital has the latest technical analysis for you on the market.

- Erik has an article on the top signals for a crypto bull market.

- In case you missed it by Rebecca.

Ready to take your crypto journey to new heights? Look no further – Bitget is your ticket to seamless and rewarding trading experiences!

- User Friendly

- Advanced Tools For Traders

- Huge range of top coins to trade

💰 Sign Up Now for Exclusive Bonuses Up To $30,000! 💰

Hong Kong ETFs “Likely” to be Approved Next Week

Hold onto your butts people.

On Wednesday, Reuters reported that the first Hong Kong spot Bitcoin ETFs will “likely” be approved this next week. The news outlet bases this claim on two unnamed sources “familiar with the matter.”

According to Reuters, the sources further claim that Hong Kong regulators have sped up the approval process, and that if the approvals do soon occur, then we could see the ETFs start trading in April.

Apparently, Hong Kong’s Securities and Futures Commission (SFC) is sitting on four active applications from the following firms: China Asset Management, Harvest Fund Management, Bosera Asset Management, and a joint application from VSFG and Value Partners.

The first three firms are mainland Chinese companies with branches located in Hong Kong, and VSFG and Value Partners were founded in the city.

We’ve been talking for a while now about the tsunami of money that could flow into these ETFs. Part of the reasoning here is that there’s pent-up demand for mainland Chinese money to find its way into crypto. And that’s because crypto trading in China is illegal. However, Chinese financial firms that have branches in Hong Kong – like the ones mentioned above – are permitted to trade crypto. So the idea here is these companies could serve as bridges that move mainland Chinese money into the Hong Kong ETFs.

China Asset Management, Harvest Fund Management, and Bosera have $271 billion, $230 billion, and $231 billion (USD) in assets under management, respectively.

Reuters’ sources said they were not authorized to speak on the matter, and they declined to be identified. And so far no one from the SFC or the companies have made any public statements in response to this news.

Will the Bitcoin Halving be a Short-Term Sell the News Event?

According to Arthur Hayes and analysts at Steno Research . . . probably.

On Monday, BitMEX co-founder Arthur Hayes dropped a new blog post where he argued that there’s a decent chance we see bitcoin and crypto prices drop in the short-term before and after the halving. Hayes had two reasons.

First, he thinks the halving will be a classic “sell the news” event given that “the narrative of the halving being positive for crypto prices is well entrenched.” So therefore, “the opposite usually happens [ . . . ] when most market participants agree on a certain outcome.”

Second, Hayes cited the U.S. tax season and some scheduled U.S. Treasury monetary tightening, both events due for late April, as other short-term factors that might suppress prices.

And Hayes is not alone in this opinion. Analysts from Steno Research just dropped a report arguing that the halving will also be a “buy the rumor, sell the news” event. The report further argues that bitcoin’s price will mimic that of the 2016 post halving, where prices were suppressed for about four months before exploding.

FYI, both Hayes and Steno Research are bullish in the medium to long terms. And for those living under a rock, we are T-10 days from the halving. LFG!!!

VanEck CEO Thinks ETH ETFs will be Rejected in May

The CEO of VanEck, Jan van Eck (yes, real name), thinks it’s unlikely that the SEC approves any of the spot ETH ETF applications in May.

And you got to respect the simplicity of this man’s reasoning. They don’t pay him the big bucks for nothing.

In an interview with CNBC on Tuesday, VanEck’s van Eck said that the SEC has been very unresponsive to all the filings. “We’ve filed our S1 and we haven’t heard anything. So that’s kind of a sign. It won’t happen without getting the disclosure documents in order.”

Compare this to the SEC’s uber-responsiveness in the run-up to the spot bitcoin ETF approvals.

And van Eck isn’t the only one saying this. CoinShares CEO Jean-Marie Mognetti thinks the ETH ETFs won’t be approved this year, and Bloomberg ETF analyst Eric Balchunas thinks the approvals are unlikely due to “radio silence” from the SEC.

EigenLayer Launches Mainnet; Google and Coinbase Join as Operators

On Tuesday, EigenLayer went live on Mainnet.

EigenLayer is a highly anticipated Etheruem restaking protocol. This means that users can stake their ETH to Ethereum, and then restake their staked ETH “receipts” (i.e. stETH, liquid staking derivatives, etc.) to EigenLayer for further rewards.

Economically speaking, staked ETH receipts have value because they’re yield generating instruments (i.e. ETH staking rewards), and because they represent something else that has real economic value (i.e. ETH).

Users delegate their receipts to EigenLayer operators, and these operators process dApps built on top of EigenLayer. The protocol also has a data availability solution that competes with Celestia.

And speaking of operators, both Coinbase and Google Cloud have both joined. The announcements came shortly after mainnet went live.

EigenLayer now has the second highest TVL for all Ethereum protocols, at $13.5 billion.

Sui-Based Portable Gaming Device Coming in 2025

On Wednesday at the Sui Basecamp conference in Paris, two development teams announced a portable gaming device that’s meant to compete directly with the Steam Deck, by allowing gamers to play both PC and blockchain-based video games.

Here’s what we know so far.

It’s called the SuiPlay0x1. Its competitive advantage is that it gives users more gaming options via the integration of blockchain-based games across multiple networks. The device will run on a Linux-based operating system, and it will be deeply integrated with the Sui blockchain. Users will also be able to play games from Steam and Epic Game Store. The expected launch is 2025.

The development teams behind the project are Playtron and Mysten Labs. They say there will be some token incentives for purchasers, but they haven’t released any more details than that.

In today’s edition of the Wealth Mastery Newsletter, the following cryptocurrencies will be analysed & discussed:

- Ethereum (ETH)

- Dogecoin (DOGE)

- UniSwap (UNI)

- Polkadot (DOT)

- VeChain (VET)

- Crypto Com (CRO)

- Kyber Network (KNC)

- Thorchain (RUNE)

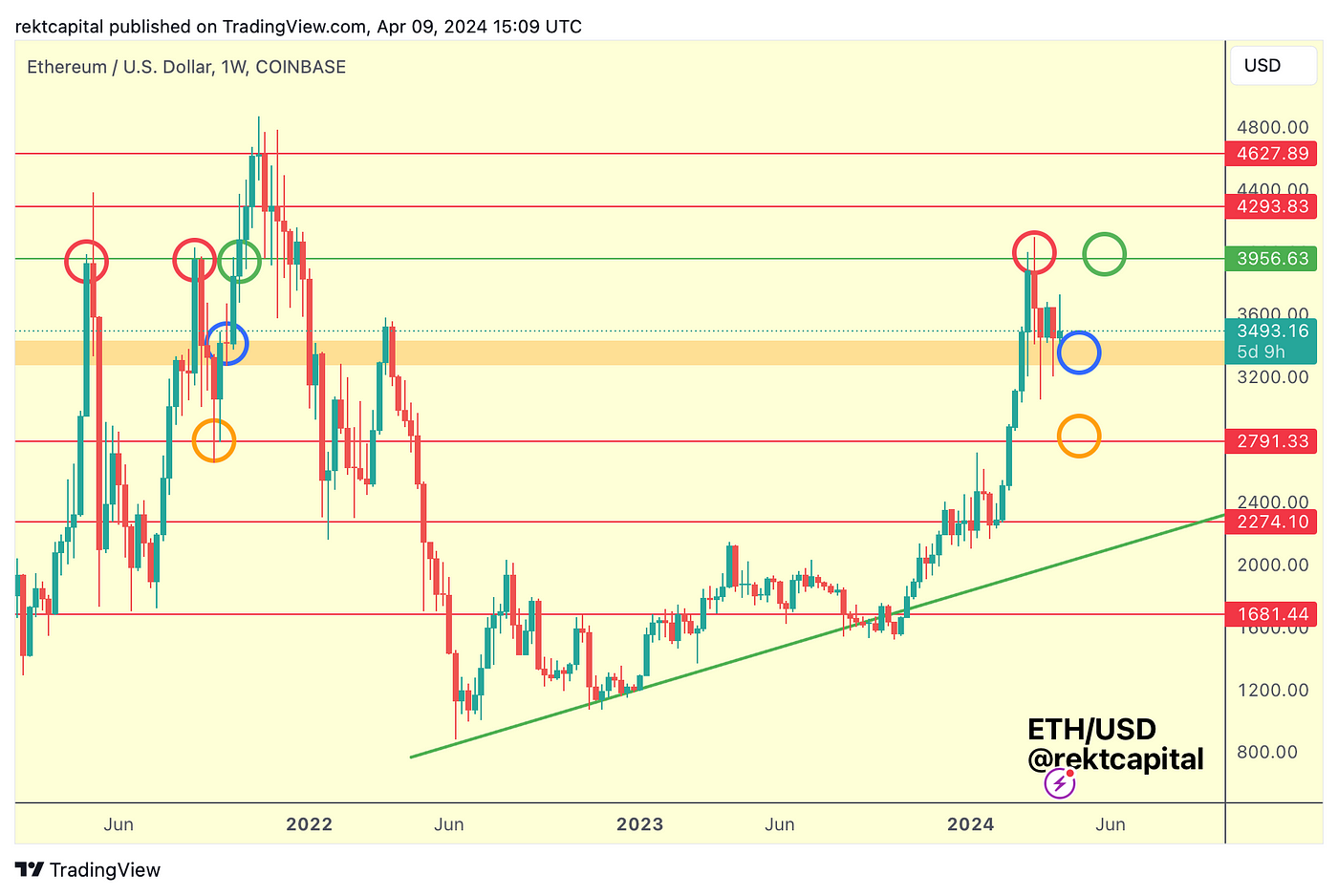

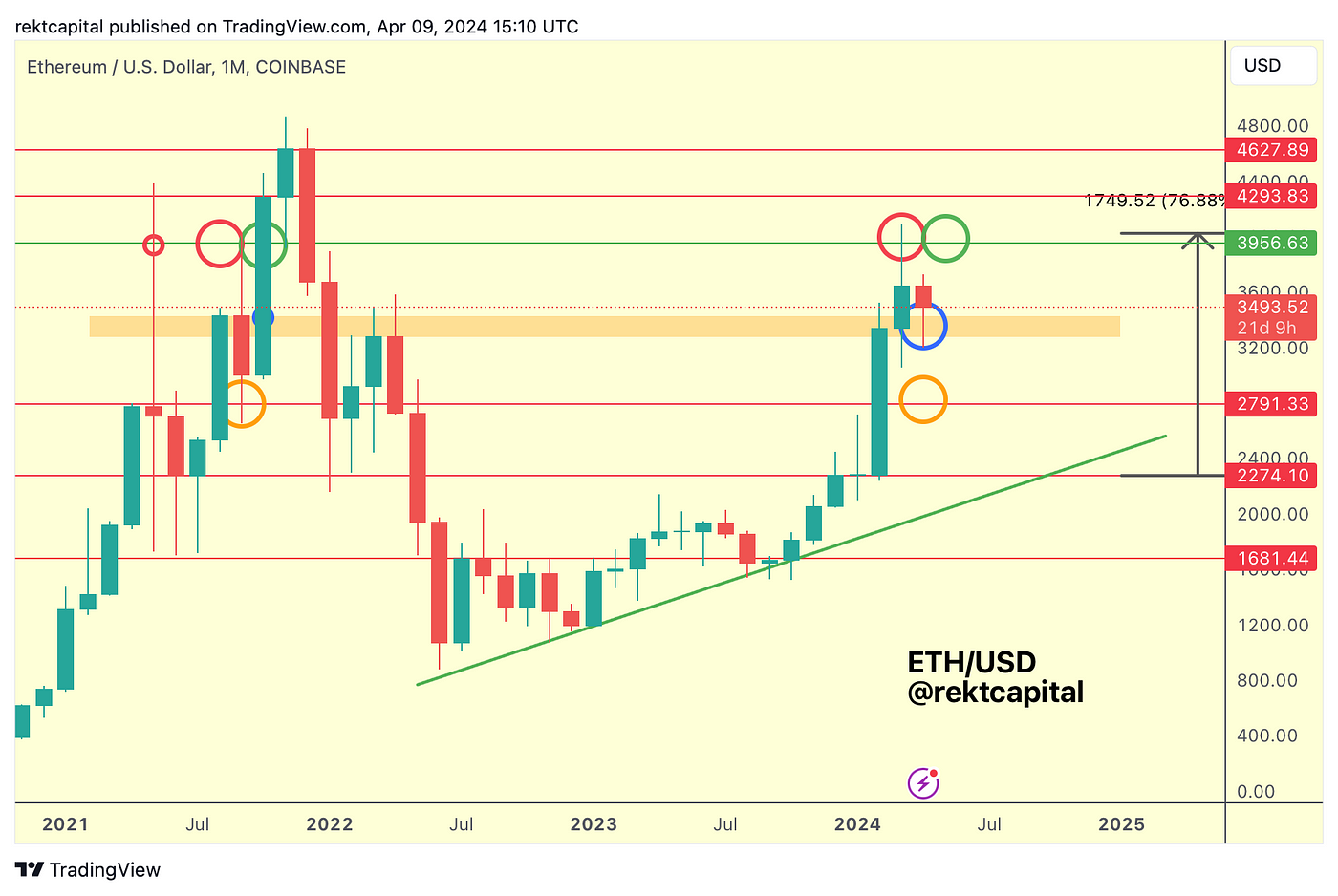

Ethereum — ETH/USD

Ethereum is consolidating just above the orange are of support.

For a few weeks now, ETH has been holding here, downside wicking in the process however still forming Higher Lows on those wicks nonetheless.

ETH needs to simply hold this orange area as support as it has done thus far if it is to remain positioned for potential upside (blue circle).

The blue circle showcases how successful retests here have preceded upside to the green ~$4000 resistance.

Can ETH continue to hold here?

Again, the downside wicks forming a Higher Low are an encouraging sign, so is the multi-week price stability here — but at some point ETH needs to produce trend continuation from here.

The orange circled region represents a bargain-buying scenario that may not come if ETH continues to exhibit this price-strength confirmation at the orange boxed support.

And the Monthly timeframe depicts this well:

According to the Monthly timeframe, this orange area used to act as resistance in mid-2021 and mid-2022 and even as recently as earlier this year.

Now, ETH is in the process of retesting this area as new support for the first time, arguably ever, because in mid-2021 ETH simply broke beyond this orange area which acted as resistance back then.

So for the first time ever, ETH is in the process of retesting this historical area of resistance as new support.

Retest is in progress and the current and previous Monthly candles are forming downside wicks at a Higher Low.

Continued stability here should see ETH a revisit of the green ~4000 resistance.

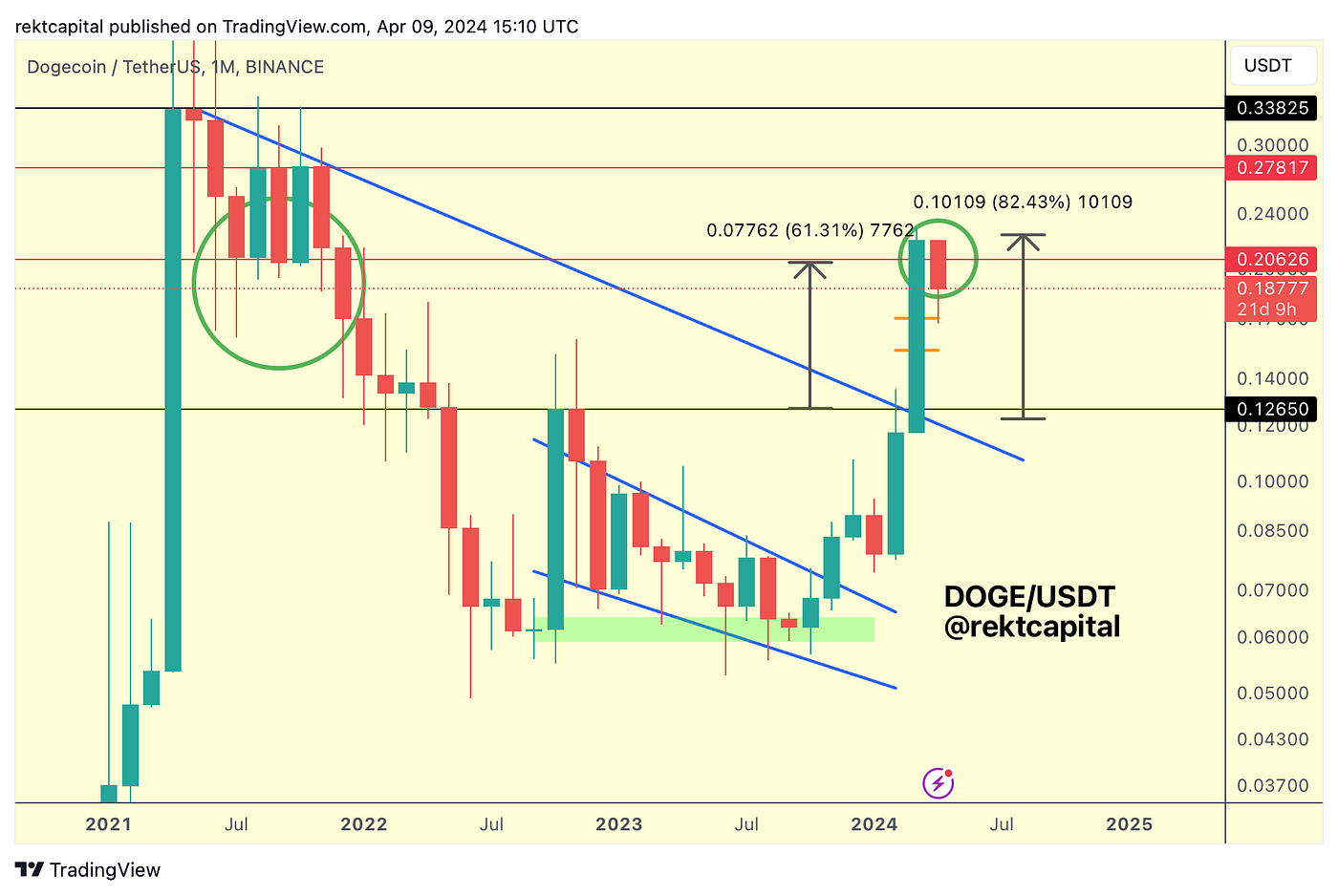

Dogecoin — DOGE/USDT

Dogecoin is technically in the process of a volatile Monthly retest, following its successful March Monthly Close above the red ~$0.20 resistance.

History suggests such volatile retesting is not out of the ordinary, especially if we look to mid-2021 (green circle).

Generally, DOGE is trying to break back into the red-red macro range (~$0.20-$0.27) and this retest is a key step in that process.

The Weekly Bull Flag retest may play an important role is facilitating the aforementioned Monthly retest:

The orange Bull Flag that DOGE broke out from a few weeks ago has been successfully retested last week.

This retesting behaviour needs to continue for DOGE to have a chance at successfully retesting that ~$0.20 level as support on the Monthly.

For the time being, the Bull Flag top retest was successful but this week the $0.20 level is acting as resistance on the Weekly timeframe; it’s too early in the week to say this is conclusive.

Effectively, DOGE is now bouncing about between the Bull Flag Top support and the $0.20 resistance and as long as that Bull Flag Top retest continues to be successful, the $0.20 resistance should be reclaimed just in time for the new Monthly Close above it.

CLICK HERE to go Premium and read the rest of this week’s Market Analysis – Premium subs can read Rekt capital’s full report.

Top Signals For a Crypto Bull Market

TL;DR We’re in a bull market but we won’t be forever.

If you consider selling all or some of your stash, you want to be tuned into top signals and act on them.

I’ll discuss different types of top signals: technical indicators on the charts, on-chain behavior, valuation, and finally, sentiment.

TO READ THE REST OF THIS ARTICLE, CLICK HERE – “Top Signals For a Crypto Bull Market”

Crypto Market News

- Ripple’s CEO has said the crypto market will likely double in market cap by the end of 2024. Source

- Chinese funds are using Hong Kong subsidiaries as a way to enter the Bitcoin ETF market. Source

- The average crypto portfolio is up $2,804 so far in 2024 according to data from tax software platform CoinLedger. Source

- Q1 has seen a record number of memecoin traders and has become the most profitable crypto narrative of the year so far. Source

- The US authorities have moved $2 billion in Bitcoin seized from Silk Road to a new wallet. Source

- Crypto staking rewards are now on average 450% higher than the average S&P 500 dividend. Source

- Van Eck’s heir is launching a USD-based stablecoin after closing a $12M funding round. Source

- Ark 21 Shares spot Bitcoin ETF has seen record outflows of $87.5M on April 2. Source

- Morgan Stanley wants to become the first Bitcoin ETF bank and hopes to beat UBS to it. Source

- Franklin Templeton has said Bitcoin Ordinals drives “positive momentum” in innovation. Source

- VanEck says Ethereum Layer-2 networks will hit a market cap of $1 trillion by 2030. Source

- Galaxy Digital is reportedly raising $100M for early-stage crypto startups. Source

- The Paraguayan economy stands to lose more than $200M a year if the country’s planned crypto mining ban goes ahead. Source

- Crypto-friendly bank Revolut has been freezing customer accounts in the UK. Source

Coins and Projects

- Bitcoin needs to stay above $80,000 for miners to be profitable after the halving, according to data from CryptoQuant. Source

- Bitcoin miner Gryphon Digital has been confirmed as using 100% renewable energy. Source

- Bhutan is planning to boost its mining capacity by 500% before the halving. Source

- BlackRock has added Goldman Sachs, Citigroup and UBS as authorized participants in its spot ETF. Source

- A spot Bitcoin ETF in Australia is expected to launch in the next few months according to Monochrome CEO. Source

- Coinbase has chosen David Marcus’ LightSpark for its Bitcoin Lightning integration. Source

- Bitcoin miner Bitfarms will invest almost $240M to upgrade its mining equipment. Source

- Hut 8’s CEO has said Bitcoin miner bankruptcies will be less common during this market cycle. Source

- EigenLayer’s data availability solution EigenDA has launched on Ethereum’s mainnet. Source

- Aave has launched a proposal to adjust the risk parameters of MakerDAO’s Dai stablecoin. Source

- Uniswap has reached $2 trillion in all-time trading volume which is larger than Australia’s GDP. Source

- Starknet suffered an outage which stopped blocks from being produced for 4 hours on April 5. Source

- PayPal’s PYUSD stablecoin will be able to be used by US customers for international payments. Source

- Circle has launched its USDC stablecoin on Ethereum’s zkSync. Source

- Binance will end support for Bitcoin Ordinals by ceasing trade and deposits from April 18. Source

- The FTX estate sold over half of its Solana tokens at a 63% discount on April 5. Source

- $24M in staked Solana tokens were unintentionally locked on Lido due to a faulty smart contract. Source

- Solana’s community has voted to introduce the Timely Vote Credits mechanism to improve the network’s transaction processing speed. Source

- Fantom’s founder Andre Cronje is concerned that Ethena Labs’ USDe could lead to a Terra-style crash. Source

- Andre Cronje has shown support for the Solana network after its recent network congestion. Source

- Ripple is planning on launching a USD-backed stablecoin to compete with USDC and USDT. Source

- Ethena has added Bitcoin as backing to its USDe yield-bearing stablecoin. Source

- dYdX suffered an outage which saw block production halted due to a scheduled upgrade. Source

- 1inch has launched a crypto debit card in partnership with Mastercard and Baanx. Source

Macro News

- The Bank for International Settlements (BIS) and 7 central banks are exploring asset tokenization through its Project Agora. Source

Thank you so much for your support, and I truly hope that today’s issue will give you insights needed to help you master your wealth.

If you are reading this it means you are on the free version of the Wealth Mastery Investor Report, which is great for news and tips on the crypto markets.

If you really want to take advantage of fastest growing asset class EVER, I highly recommend that you check out my new altcoin course: Mastering Altcoin Investing

In this course we’ll teach you all about how to spot, choose and acquire the winning altcoins of the next bull market.

Learn how to build your portfolio so that growth is ensured and risk is mitigated. Let me help you build a strategy that’ll change your life forever in the upcoming bull run.

See you next time!

Lark and the Wealth Mastery Team

💰 BINANCE: BEST EXCHANGE FOR BUYING CRYPTO IN THE WORLD 👉 10% OFF FEES & $600 BONUS

🚀 BYBIT: #1 EXCHANGE FOR TRADING 👉 GET EXCLUSIVE FEE DISCOUNTS & BONUSES

🔒 BEST CRYPTO WALLET TO KEEP YOUR ASSETS SAFE 👉 BUY LEDGER WALLET HERE

📈 TRADING VIEW: BEST CHARTING SOFTWARE ON THE INTERNET 👉 JOIN NOW

1️⃣ COINLEDGER: #1 CRYPTO TAX SOFTWARE 👉 IF YOU OWN OR TRADE CRYPTO YOU NEED THIS

Wealth Mastery (Lark Davis, and the Wealth Mastery writing team) are not providing you individually tailored investment advice. Nor is Wealth Mastery registered to provide investment advice, is not a financial adviser, and is not a broker-dealer. The material provided is for educational purposes only. Wealth Mastery is not responsible for any gains or losses that result from your cryptocurrency investments. Investing in cryptocurrency involves a high degree of risk and should be considered only by persons who can afford to sustain a loss of their entire investment. Investors should consult their financial adviser before investing in cryptocurrency.

You can find a full disclosure of all my crypto & venture investments here.