Geo-Political Panic: How Safe Is Your Crypto?

GM friends!

We hope you’re relaxed and well after a turbulent weekend.

Just when crypto was looking all set for a smooth approach into the halving, world events have stormed the stage, plunging the market into a state of volatility.

But, before jumping into today’s issue, quick reminder that the 33% Bitcoin Halving offer is expiring in 2 days.

If you are wondering what’s in store for Bitcoin after the halving and where I intend to invest during these months, join Wealth Mastery Premium and ride this cycle with me and my team!

👉 Picking the 6 month plan will grant you FREE access to the “Mastering Bitcoin Investing” Course!

Time is ticking! If you want to make the most of the upcoming cycle, you’ll want to have the Premium Wealth Mastery Report by your side.

Now, here’s what’s in today’s issue:

- Sam shares his thoughts on why crypto crashed over the weekend, Wall Street buying BTC, Solana’s congestion being fixed, Berachain raising another $100 million & a blank jpeg is selling for 900k.

- Week 9 update on the 10x portfolio.

- This week on chain.

- This week’s trending coins by Rebecca.

Thanks to our sponsor CoinStats!

One of the best things about crypto is how diverse and deep the space is.

You have Bitcoin, Altcoins, NFTs, DeFi, and more.

The problem?

Keeping track of everything is literally impossible.😕

That’s where CoinStats comes in.

CoinStats gives you the ability to manage your funds across 300+ wallets & exchanges, 100 blockchains, 1,000 DeFi Protocols & 20,000+ coins.

With CoinStats, you can:

- Get in-depth profit & loss analysis with portfolio analytics 🤑

- Get customized and personalized price alerts 💬

- Set up your crypto Exit Strategy with AI ✨

CoinStats has teamed up with Wealth Mastery to offer readers 50% off on their annual plan.

Crypto Crashes on Fears of War

Bitcoin and alts plummeted at the weekend on news that Iran was launching drone and missile strikes towards Israel, with BTC dropping by around $6K in about thirty minutes, and crypto markets losing around $200 million in market cap.

Prior to that, alts had already dropped, while BTC and ETH had registered small dips, just on the anticipation of conflict escalation, but the larger crash came when the attack was initiated.

Events have now moved on and trading has calmed, but what can we expect from the markets from here?

A couple of points come to mind.

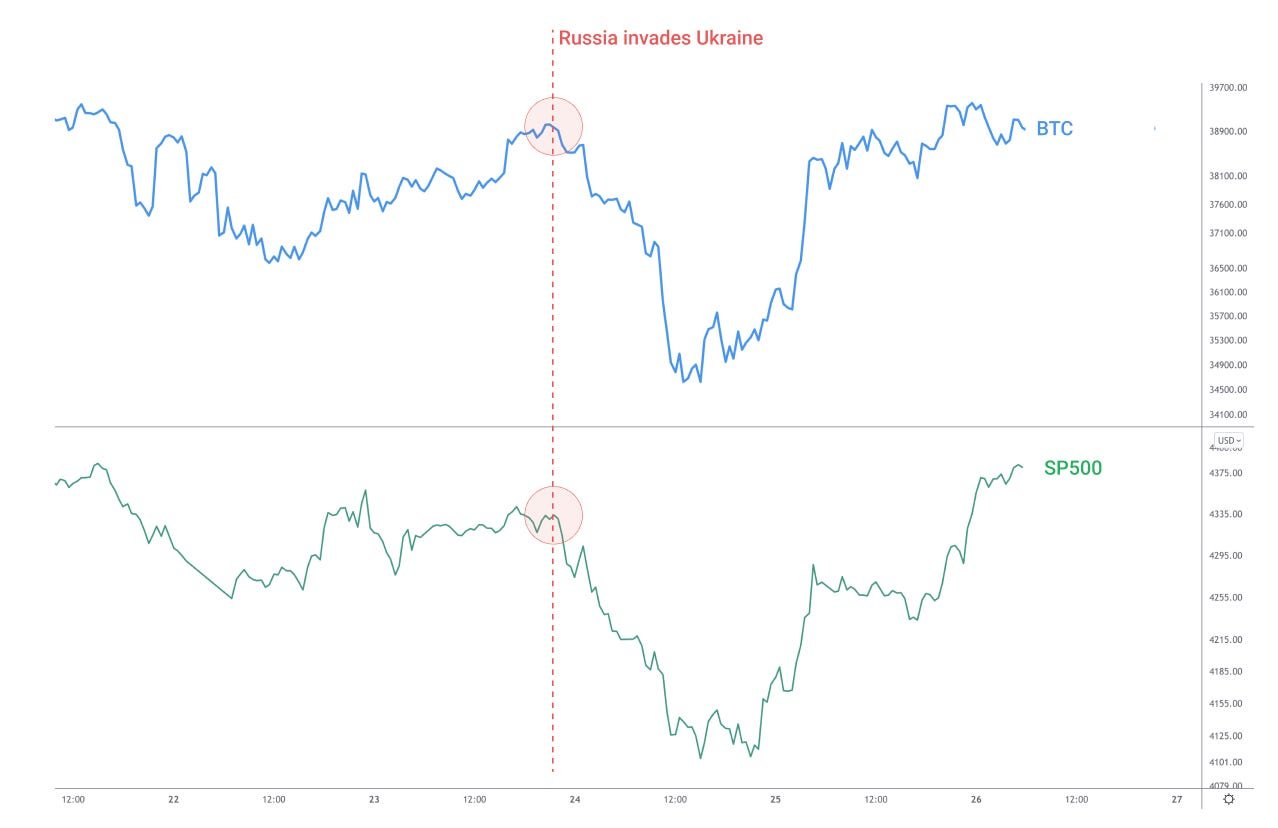

First, the most obvious comparison is with the dip when Russia invaded Ukraine, which was short-lived and doesn’t stand out in the charts now.

And before that, there was the covid crash of 2020, which was caused by a true black swan event: impossible to foresee, very rare, and–regarding the global restrictions that followed–totally unprecedented.

By those measures, this weekend’s events don’t fall into the same category, and crypto’s price movements haven’t been close to the severity of that total collapse. And besides which, don’t forget that the 2020 covid crash was soon followed by a raging bull run.

Secondly though, by hitting all-time highs before the halving, Bitcoin this year appeared to be getting ahead of itself.

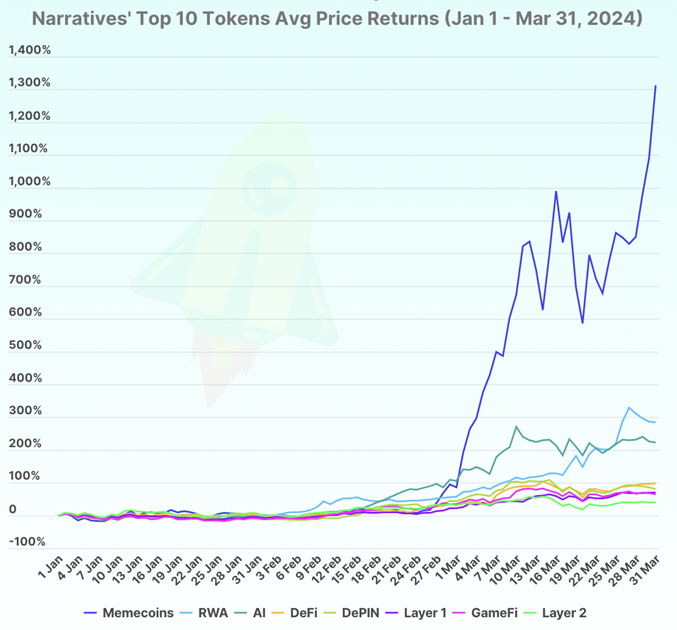

The cycle looked accelerated, possibly left-translated, and already a little frothy in places (the meme coin places, specifically), but this weekend’s dip returned prices a little nearer to where we might expect them to be pre-halving, and potentially laid the ground for a bull market more similar to those of past cycles.

But what are you expecting for crypto now? Is it an extended grind back up as we head into the halving, a rapid recovery, or could there be further downward shocks in store? Reply to this email and let us know what you think.

SEC Filings Reveal Wall Street Buying BTC

You may have seen reference to 13-F filings floating around Crypto Twitter recently, and a quick check in the Big TradFi Encyclopedia reveals that these are SEC forms filed quarterly by large institutional investors (those managing $100 million + in assets), in order to show their equity holdings.

This transparency is useful for regular investors as the forms provide insights into where institutional flows are going, and the latest filings are especially interesting if you’re into crypto, because they reveal that some major players have started to gain Bitcoin exposure through the newly launched spot BTC ETFs.

The latest 13-F filings show that ETF buyers now include American National Bank, which appears to have tested the waters by picking up 100 shares of the Ark ETF, while management firms including Park Avenue Securities (which has $9.9 billion in AUM) and Inscription Capital (with $1.1 billion in AUM), have bought GBTC shares.

While the window for 13-F filings opened in April, the deadline is May 15th, so expect further ETF-buying names to become public in the coming few weeks.

Solana Congestion Fix Released on Devnet

Phantom users who’d grown used to opening the wallet and reading a message stating that “Solana is experiencing network congestion” were greeted with a new notice over the weekend, now informing them that “Solana network is unusually slow”.

Is unusually slow an improvement on network congestion? It looks that way, and fixes are definitely in the works with congestion remedies now deployed to Devnet and recommended for testnet use in the v1.18.11 testnet release.

This much-needed maintenance is the work of devshop Anza, which is focused on Solana development, and which–regarding the congestion fixes–has asked testnet validators to “upgrade ASAP to help us start analyzing the effects of the proposed congestion fixes.”

Prior to this, Phantom wallet had already posted that it had been successfully “working around the clock” on solutions to current problems, explaining that,

“For the past 24 hours, our metrics show that transactions have been landing nearly 90% of the time, almost a 5x improvement from a week ago.”

The work being done by Phantom to improve the situation has been in collaboration with Helius Labs, Jito Labs, and Triton One, and Phantom added bullishly that,

“With core network improvements rolling out soon, it’s clear that we will overcome this temporary setback.”

Berachain Raises Another $100 Million

Incoming new Layer-1 Berachain is scheduled to launch in Q2 this year, or in other words, anytime around now (although delays are always possible), and it has just secured a further $100 million in a Series B funding round led by Framework Ventures and Brevan Howard Digital.

This comes after the in-development blockchain last year raised $42 million in a Polychain Capital-led private token round, while participants in the Series B round include (among several others) well known names such as Samsung Next, Nomura’s Laser Digital, Yat Siu of Animoca Brands, Sandeep Nailwal of Polygon, and also, Polychain Capital features again.

Berachain is an EVM-compatible network built on the Cosmos stack, and if you’re interested in its progress, keeping in mind the possibility of a future token airdrop, then its testnet is live and usable.

Would You Buy a Blank JPEG For $900K?

At the top of a bull run, there are–not surprisingly–top signals, but where it gets confusing is that there are sprinklings of what look like top signals all the way through the middle of bull runs too, such as, for example, completely blank JPEGs changing hands for figures approaching a million dollars.

0 by XCOPY. The artwork is right there on the left above the Description.

That’s what happened last week anyway, when an item originally minted back in 2019 by top tier digital artist XCOPY, traded for 255 ETH, which was equal at the time to almost $900K.

The minimalist-to-the-extreme work in question (which is far removed from the artist’s usual colorful style) is titled 0, and its sales history shows its price rising from an initial 0.15 ETH, to 0.35 ETH, to what seemed like an insurmountable 15 ETH in 2020, before achieving the latest huge transfer.

There’s been a lot of speculation about the future of ETH NFTs lately, with attention shifting this year to Bitcoin Ordinals and meme coins, but it looks like Ethereum might still be the place to go for deep-pocketed art-collector flexing.

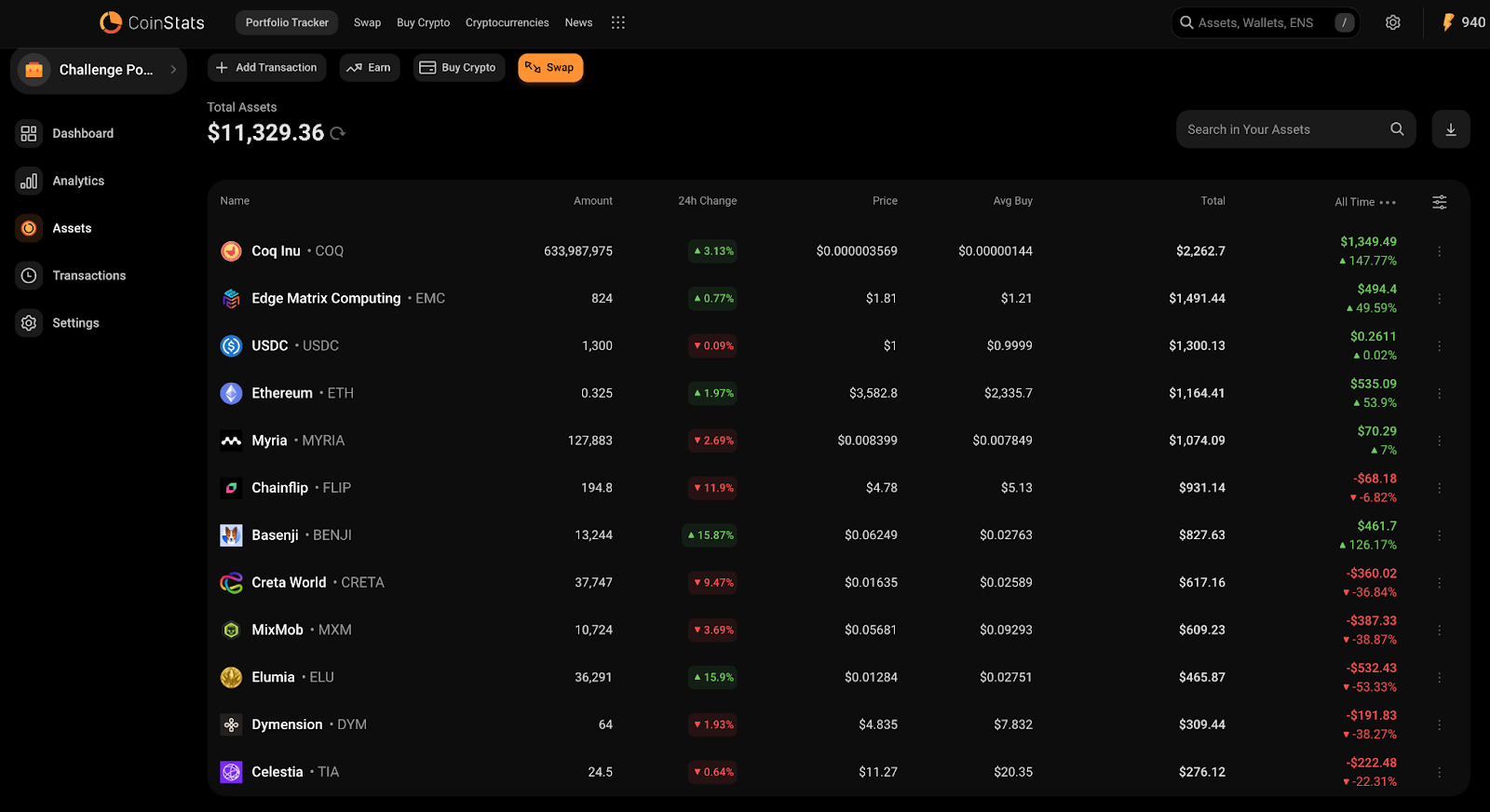

Week 9 Crypto Portfolio Updates

Well, memes continue to be holding up the portfolio. Coq Inu and the newly added Benji are both doing very well.

Games, still slaughtered, down between 30 and 50% on 3 of my gaming coins.

I am still thinking about selling my Myria, just to reduce the reliance on gaming in this portfolio. Haven’t decided yet on what to flip it for though. But it will be something on BASE, possibly more memecoins, maybe some defi… going to need to think about it. Might even add more to EMC as it is starting to pick up steam with centralized exchange listings.

Claimed Trader Joe meme rush rewards – it was like $11, so not much, but free money is free, and $11 is more that I would have made by not staking it in Trader Joe.

It appears that Marginfi is possibly backing out of doing a token, but also there was some drama about them apparently not distributing some token rewards. CEO resigned. So there might not be an airdrop to farm. I am getting the money out. Damn. Just put in more last week too.

I took my cash out of Parcl too with the season 3 airdrop points season now finished there was not much reason to keep cash there. Now I have a bunch of extra cash from both Parcl and Marginfi, so next week I will figure out where to put it. Might try to find a farm on BASE or put some money into Meteora on Solana, or just more into Elixir.

Still have Parcl, Elixir and Zerolend as potentially decent airdrops, but these are also heavily flooded by whales, so who knows…

Also, I have been thinking that once I get the Milkyway airdrop for staking my TIA, that I will probably sell the TIA after that.

So, on to the next farm. And this one is called deBridge, which allows for bridging between various chains. Moving between Ethereum layer twos is cheap, and so I am pushing a bunch of transactions between Base and Polygon which seems to be one of the highest point reward routes.

I am pushing through $10 USDC at a time, fees are only a few pennies, and that gets me about 360 points per transaction. For now the $512 I had in Marginfi will be in cash. Next week I will try to find a new coin to put it in.

Did the latest social tasks for PARAM. Pretty damn diluted, but let’s see what happens.

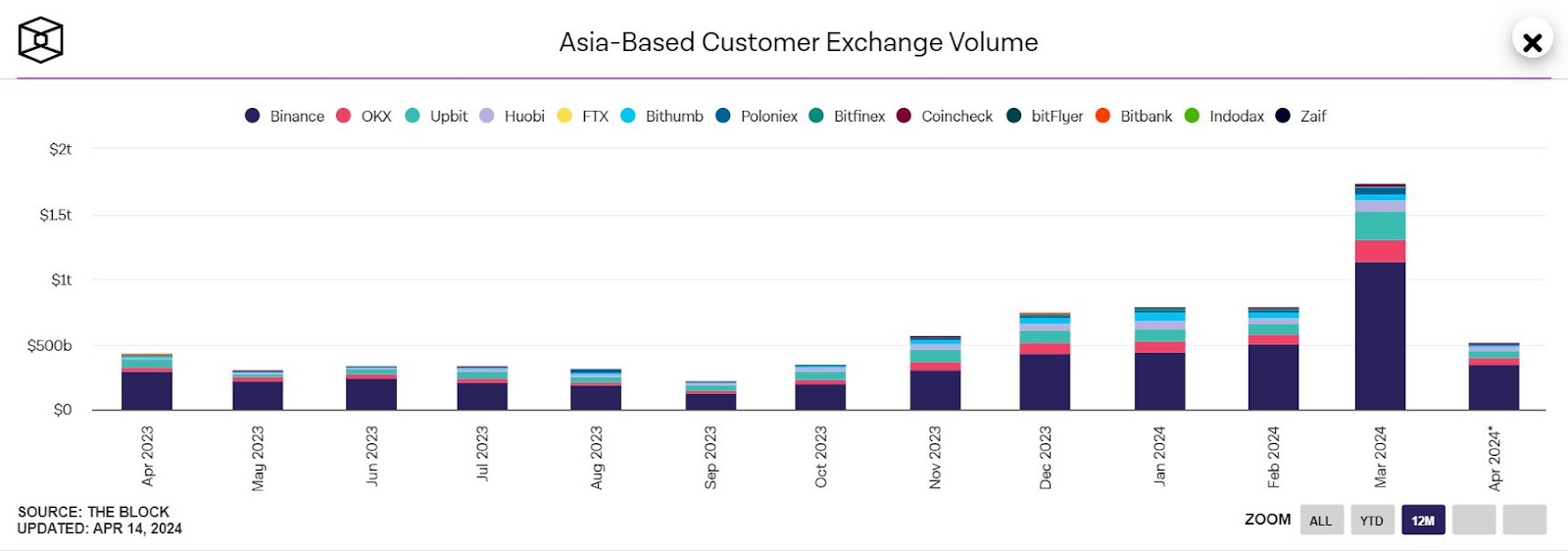

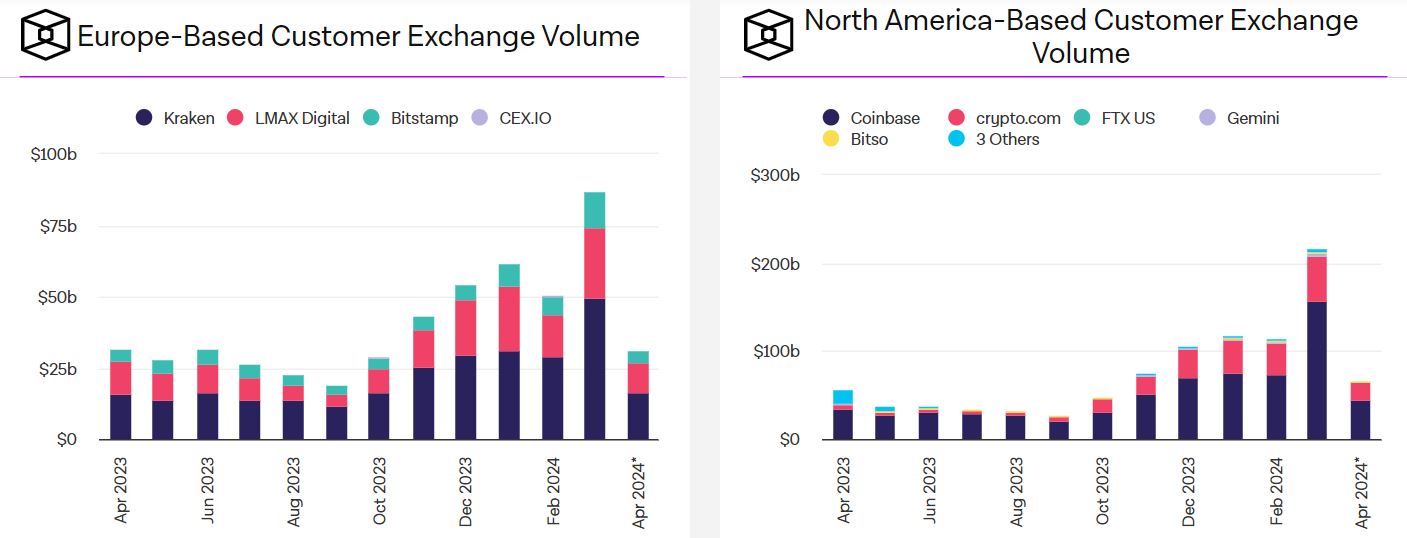

With Hong Kong-based spot BTC and ETH ETFs on the way, there are questions around how significant they will be compared to the US spot BTC ETFs that launched in January. The effect of Hong Kong’s funds remains to be seen, but there’s a possible indicator if we compare Asia-based customer volumes on crypto exchanges with equivalent numbers for North America and Europe.

In that case, Asian volumes are much larger than those elsewhere, with the highest monthly figures (for March 2024) hitting 1.74 trillion, while in North America that figure is 216.2 billion, and in Europe it’s 86.95 billion.

However, a counter to this is that the Hong Kong Stock Exchange doesn’t come close to the NYSE or the Nasdaq in terms of trade volume, while investors buying crypto ETF shares are not the same crowd as those buying actual crypto.

Either way, it will be interesting to see how the Hong Kong ETFs play out, and whether they pick up a significant portion of that existing Asian crypto volume.

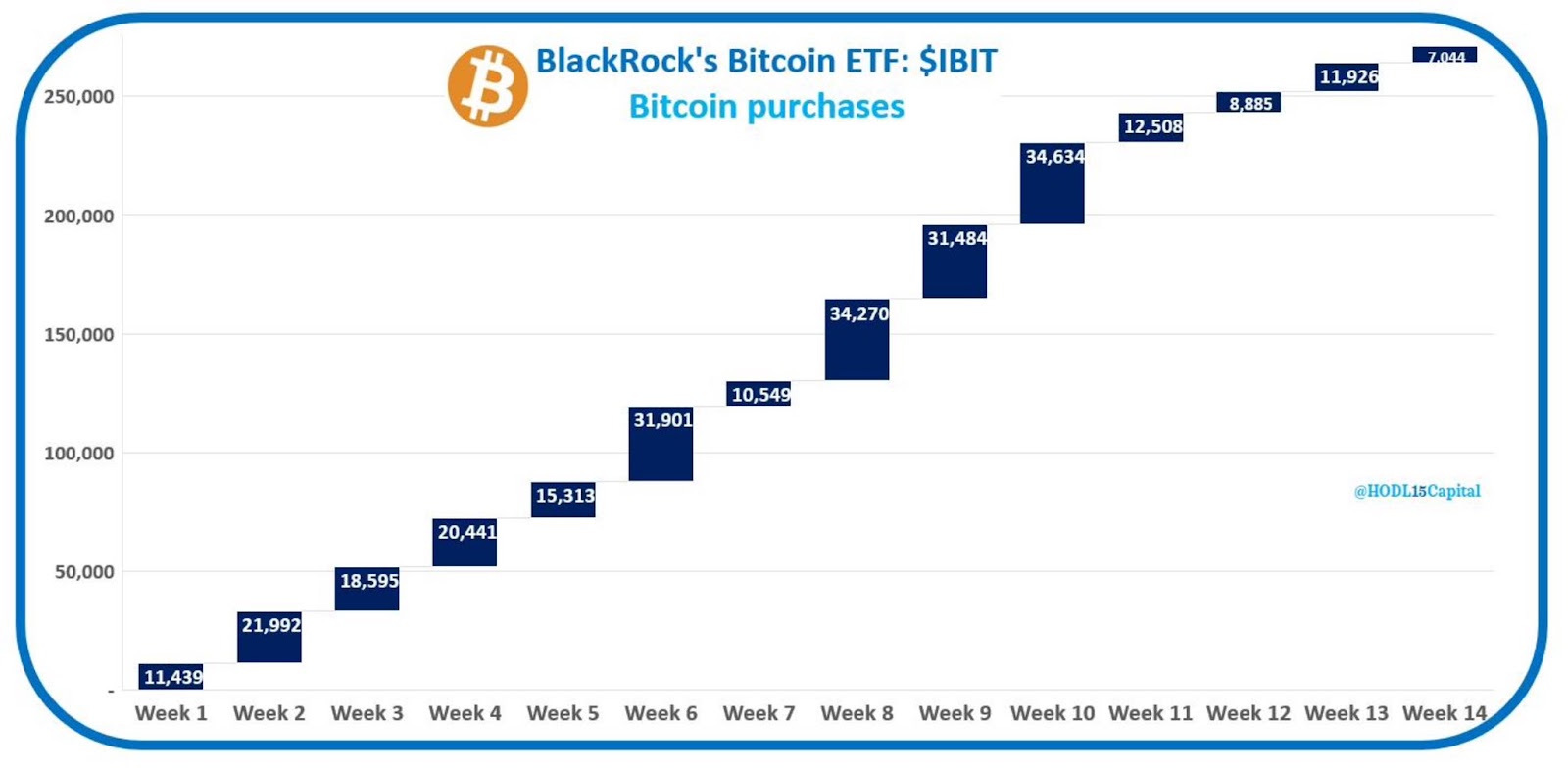

And as for the US spot BTC ETFs, BlackRock’s buying has been relentless since launch, as every week it has eaten up more BTC than is newly mined in the same time period. That means BlackRock is now sitting on a stack of 271,000 BTC, which is over 1.4% of future total supply, and it’s rapidly catching up with Grayscale, which currently holds just under 316,000 BTC.

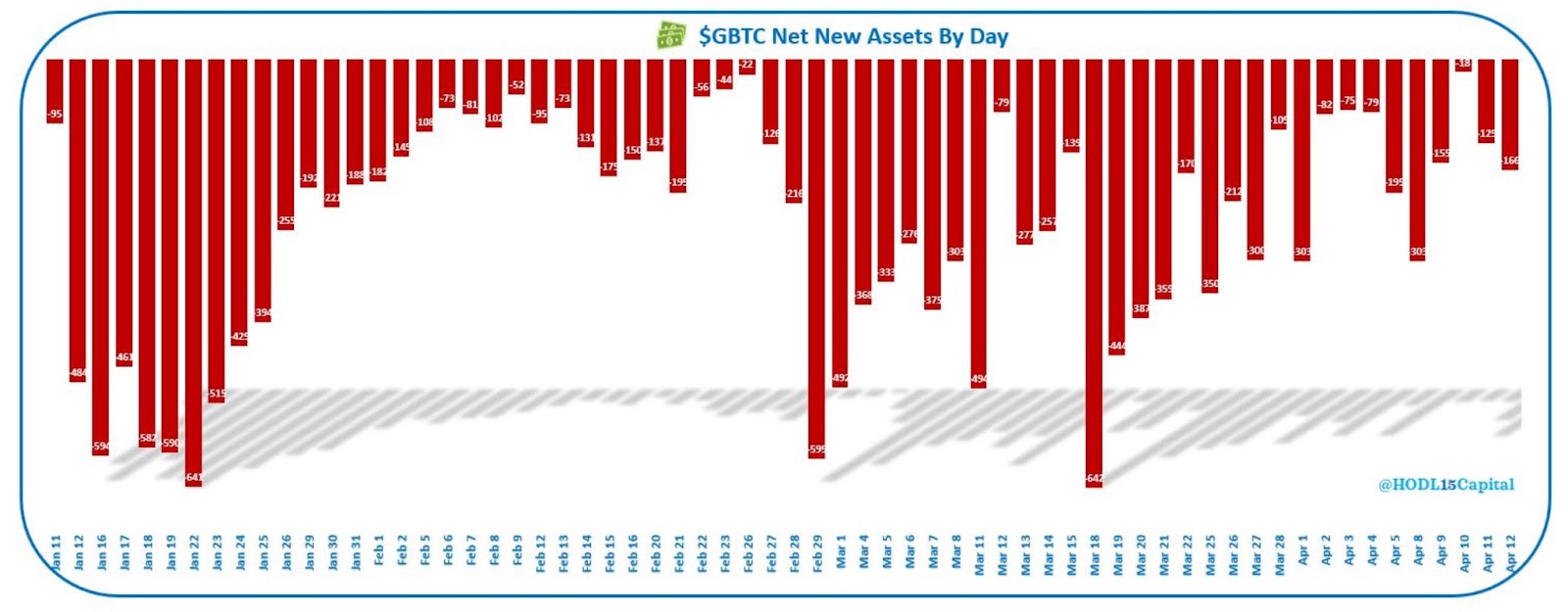

And speaking of Grayscale, GBTC selling remains a constant, although the red bars charting last week’s outflows don’t look as precipitous as they have in some previous periods, as across the week Grayscale sold a total of $767 million worth of BTC.

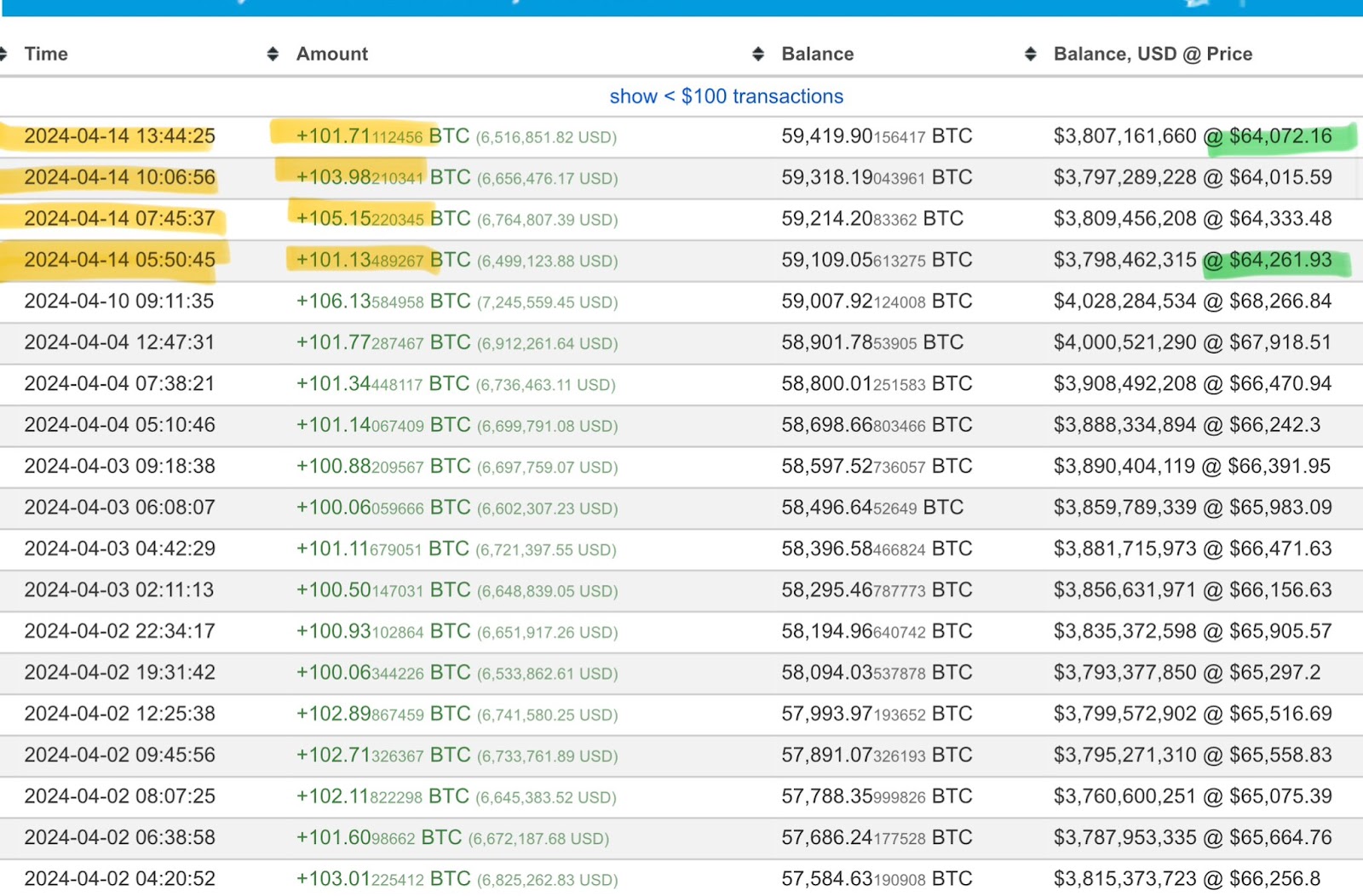

You might recall that among the hardest-stacking BTC wallets is a mysterious entity known as Mr 100, who has been consistently buying up clips of roughly 100 BTC, no matter the market conditions. It’s not known whether Mr 100 is a corporation, a nation state, or a very wealthy individual, but he continued his purchasing through the weekend’s volatility, picking up four of his customary packages.

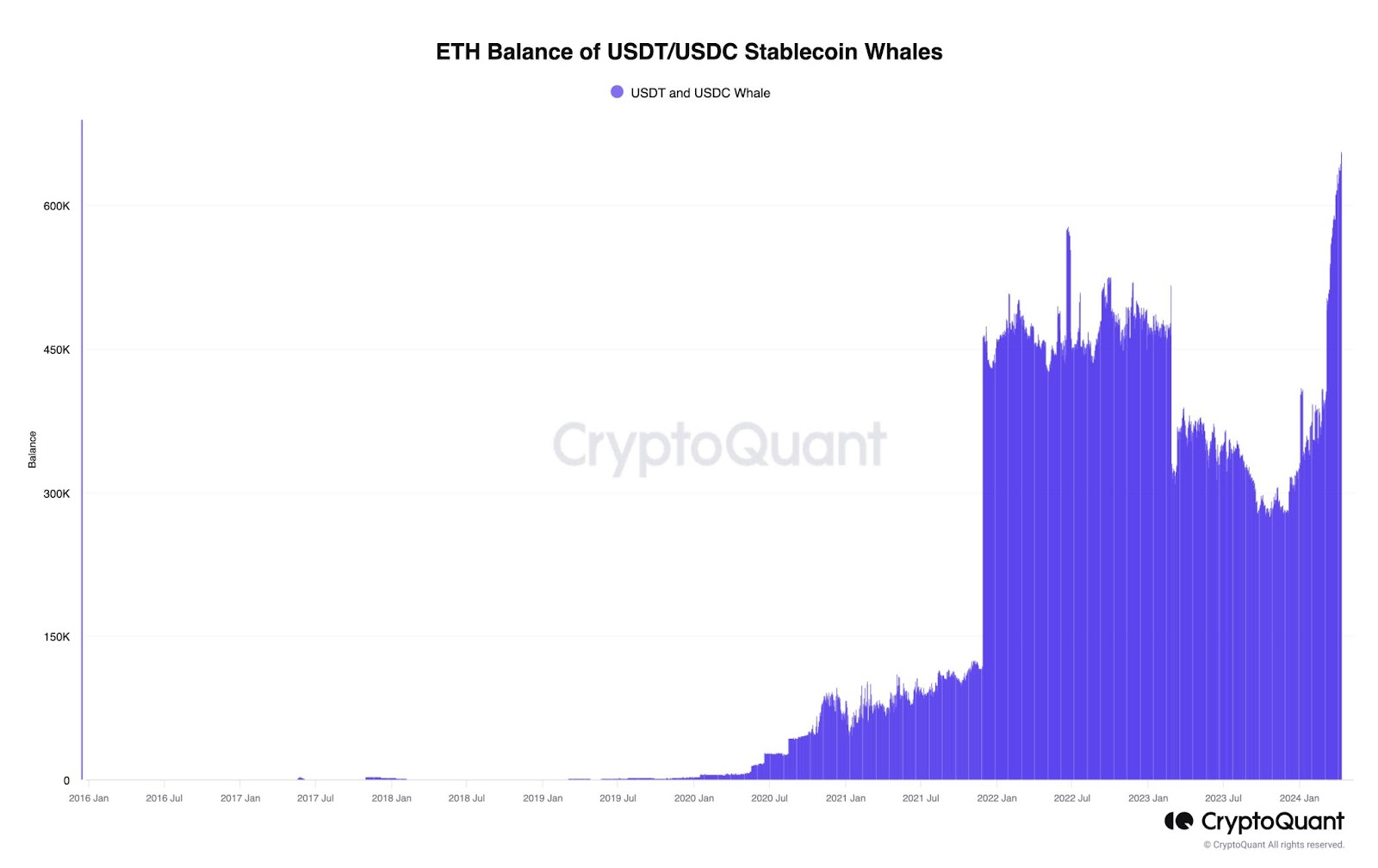

And bitcoin is apparently not the only crypto asset attracting the attention of big spenders, as data shows that stablecoin whales have this year been aggressively accumulating ETH, and haven’t eased up when it comes to expanding their stacks. There’s currently a lot of uncertainty around the prospects for spot ETH ETFs in the US, but this doesn’t appear to have phased these buyers.

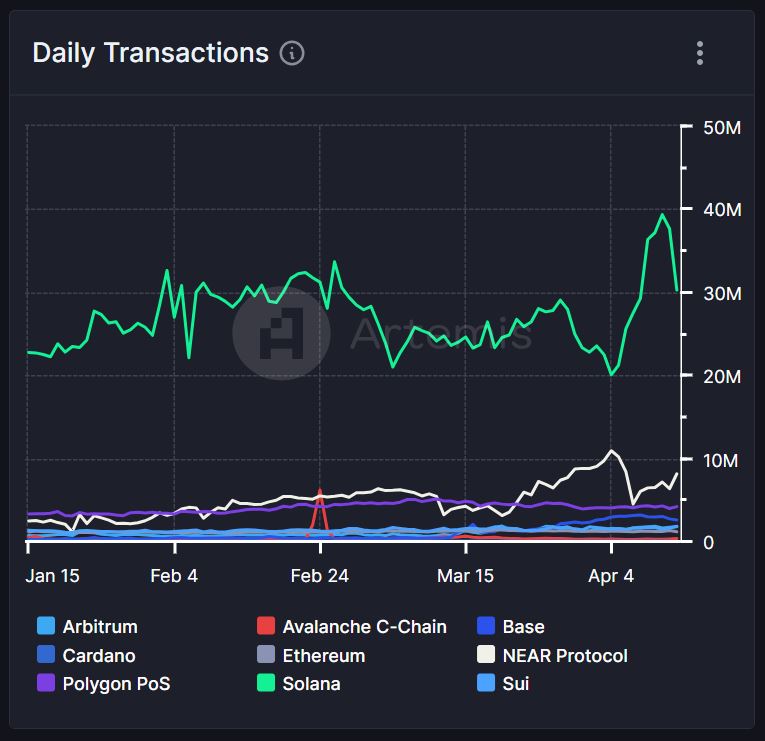

Although fixes are reportedly on the way, Solana has experienced bouts of network congestion recently, and this might not come as a surprise considering the amount of activity around Solana meme coins. A comparison on-chain reveals that the number of daily Solana transactions climbed to around the 40 million mark, and is now around 30 million, indicating that the chain is outperforming competitors, and that any congestion problems Solana is encountering are due to its success in bringing new users on board.

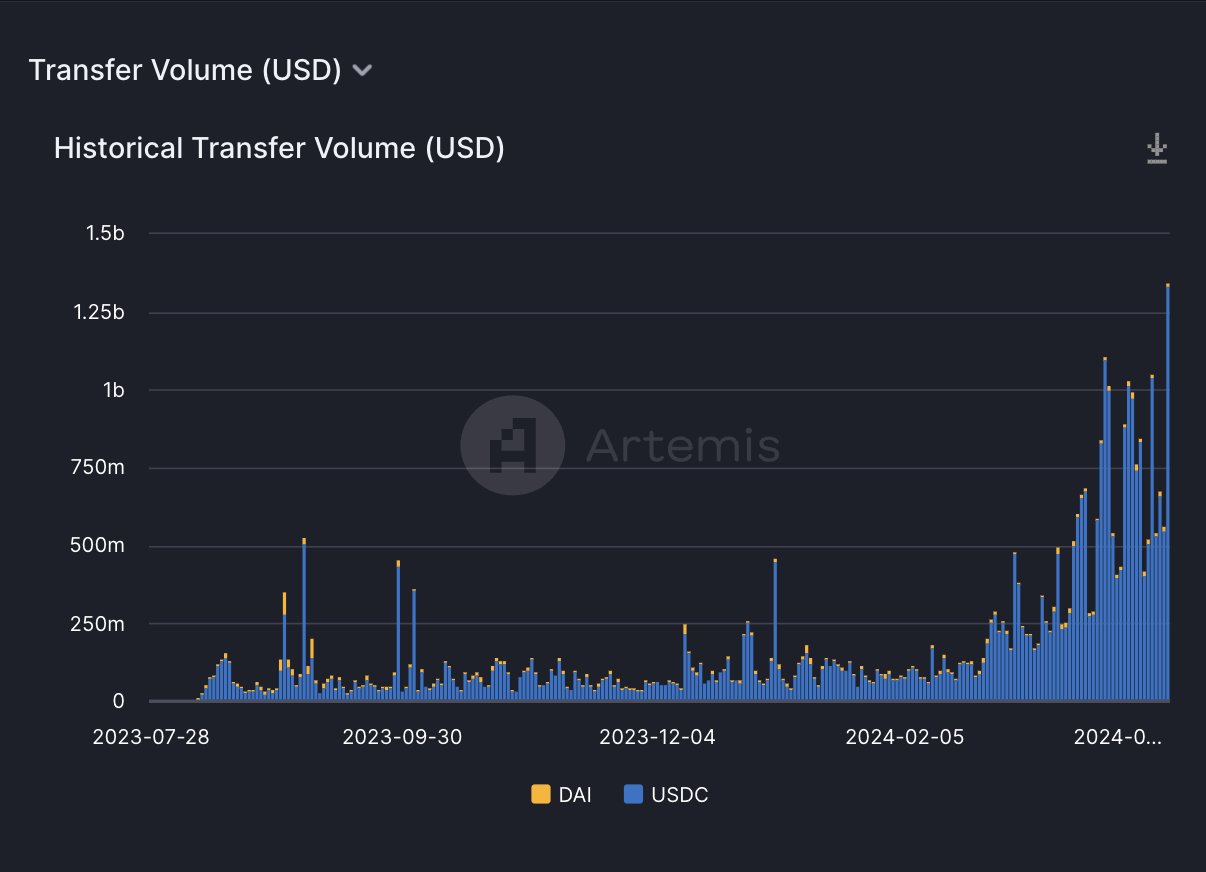

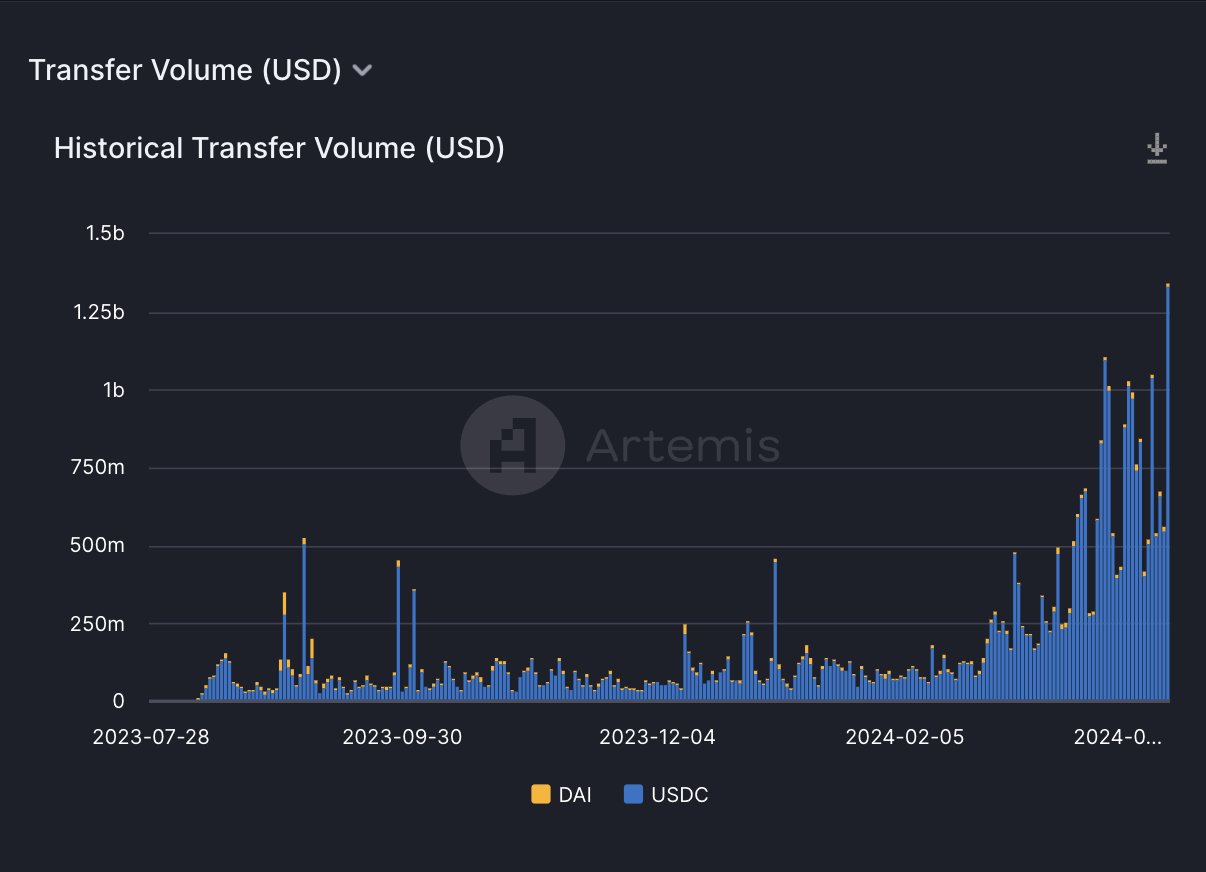

Meanwhile, layer-2 Base may not yet have Solana’s transaction numbers, but it looks well positioned to grow, and if we look at stablecoin transfer volumes, we can find that the numbers have been soaring lately, and hit $1.33 billion last Friday.

And as for just how explosive the ascent of meme coins has been, if we look at Q1 2024 average price returns broken down by narrative sector, then meme coins are clearly dominant, registering 1,300% returns, while the next closest sector is RWA, at around 300%.

Here are my key takeaways from the trends this week and despite the geopolitical tensions there has been a ton of launches and developments in the market.

- Gala is a play-to-earn (P2E) gaming and music ecosystem that’s debuted its sci-fi thriller movie RZR on Gala Films. Gala has also launched its new artist upload feature on Gala Music.

- Non-Playable Coin is a memecoin on Ethereum and Base that’s seen crypto trader, CryptoWizardd, post on X that the “NPC upside potential is insane.”

- Orbs is a Layer 3 blockchain that’s integrated with PancakeSwap to enable limit orders.

- Tenset is an Ethereum blockchain-based project that’s teasing the launch of its first memecoin Catamoto on April 19.

- Ondo is a Real-World Assets (RWA) platform that’s tested the near-instant conversion of shares in BlackRock’s BUIDL tokenized fund into USDC.

- Celestia is a modular data availability network that’s launched its data availability solution called Blobstream on Arbitrum Orbit. Celestia has also teamed up with NodeKit to enable rollups on the composability layer.

- Wormhole is a token bridge that’s seen Injective’s Ionic upgrade expand its integration by connecting with Wormhole Gateway.

- Pepe is a memecoin that’s seen its price jump on the news that Coinbase International will launch perpetual futures for PEPE on April 18.

- Solana is a Layer-1 blockchain that’s deployed a fix on the devnet to overcome its network congestion issues. Solana’s HackerHouse in Dubai kicks off on April 15.

- Ethena is a DeFi platform that’s seen backer Arthur Hayes introduce a risk tracker by intotheblock.com that monitors the token’s peg to the US dollar.

- Ethereum developers are already teasing its next upgrade called Pectra. EigenLayer’s EigenDA has also launched on Ethereum’s mainnet.

- Injective is an L1 blockchain and DEX protocol that’s burned over 9,000 INJ tokens, one of its biggest token burns to date. Injective is also teasing on X that the ultimate upgrade to its tokenomics is coming.

- Bitcoin’s price dropped over 7% after Iran launched attacks on Israel which triggered $1.6 billion in liquidations. Hong Kong is also fast-tracking Bitcoin ETFs which could launch on April 15.

- Toncoin is a Web3 ecosystem within Telegram messenger that’s airdropped $2.2 million in tokens to memecoin traders. Toncoin has also reached a new all-time high.

- Render is an image and video rendering protocol that’s been featured on the Bankless podcast with an appearance by EMostaque announcing he’s become an advisor to the project.

Thank you so much for your support, and I truly hope that today’s issue will give you insights needed to help you master your wealth.

If you are reading this it means you are on the free version of the Wealth Mastery Investor Report, which is great for news and tips on the crypto markets.

If you really want to take advantage of fastest growing asset class EVER, I highly recommend that you check out my Altcoin course: Mastering Altcoin Investing

In this course we’ll teach you all about how to spot, choose and acquire the winning altcoins of the upcoming bull market.

Learn how to build your portfolio so that growth is ensured and risk is mitigated. Let me help you build a strategy that’ll change your life forever in the upcoming bull run.

See you next time!

Lark and the Wealth Mastery Team

💰 BINANCE: BEST EXCHANGE FOR BUYING CRYPTO IN THE WORLD 👉 10% OFF FEES & $600 BONUS

🚀 BYBIT: #1 EXCHANGE FOR TRADING 👉 GET EXCLUSIVE FEE DISCOUNTS & BONUSES

🔒 BEST CRYPTO WALLET TO KEEP YOUR ASSETS SAFE 👉 BUY LEDGER WALLET HERE

📈 TRADING VIEW: BEST CHARTING SOFTWARE ON THE INTERNET 👉 JOIN NOW

1️⃣ COINLEDGER: #1 CRYPTO TAX SOFTWARE 👉 IF YOU OWN OR TRADE CRYPTO YOU NEED THIS

Wealth Mastery (Lark Davis, and the Wealth Mastery writing team) are not providing you individually tailored investment advice. Nor is Wealth Mastery registered to provide investment advice, is not a financial adviser, and is not a broker-dealer. The material provided is for educational purposes only. Wealth Mastery is not responsible for any gains or losses that result from your cryptocurrency investments. Investing in cryptocurrency involves a high degree of risk and should be considered only by persons who can afford to sustain a loss of their entire investment. Investors should consult their financial adviser before investing in cryptocurrency.

You can find a full disclosure of all my crypto & venture investments here.