Monthly Crypto Alpha Report – March 2023

Market Roundup

The markets have been crazy on all fronts. Bank runs, USDC temporarily depegging, lawsuits against crypto firms, bitcoin pumping... quite possibly the craziest month I've seen in the six years that I cover this space!

Mid-March, bitcoin experienced one of the best-performing weeks of price action in history, closing 35% up on the week. This has only happened a handful of times in bitcoin's history. The Orange Coin managed to finally break above the important 200-week moving average, which it failed to cross in February. The bump turned into a nice pump but the 28.3k level has proven tough resistance.

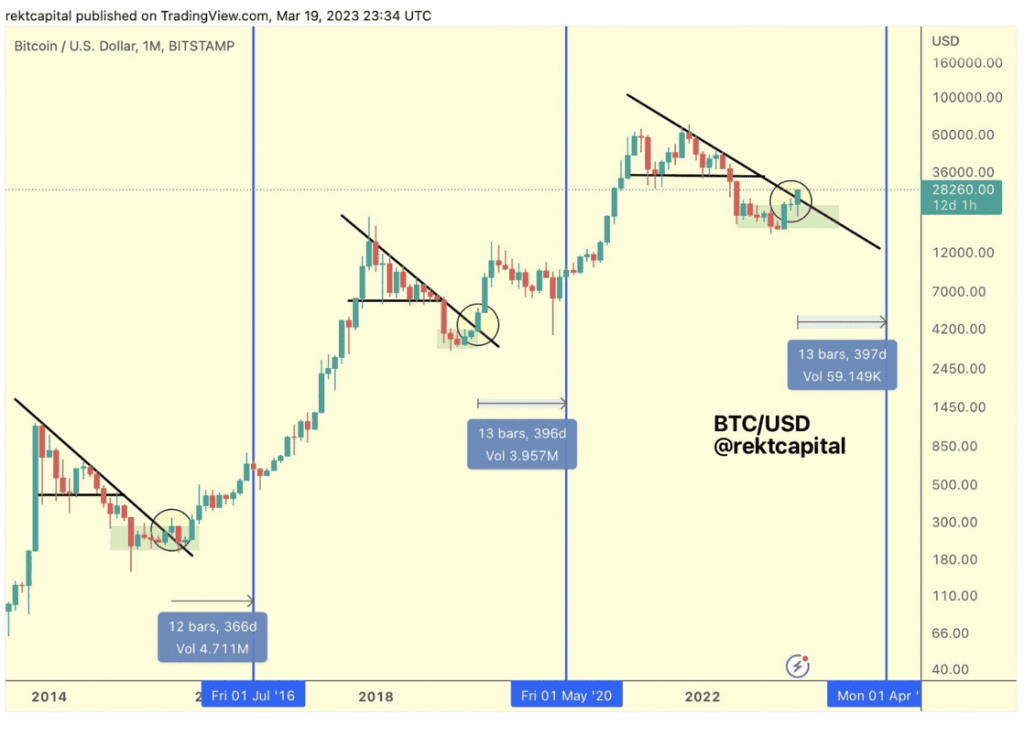

In February's roundup report, I pulled up Rekt Capital's chart that suggested March could become the breakout month. It has proven to be just that: see the chart below.

Steady lads

As bitcoin believers, we can't help but smile that this pump is happening against the backdrop of an unfolding banking crisis. In March's Fed meeting, Jerome Powell assured us that the bank failures were incidents and contained. From every higher-up, we hear that the banking system is 'sound and resilient', 'safe and sound', 'resilient, with strong capital and liquidity positions' (Lagarde of the ECB). It's central bankers' speak for 'steady lads'. It's when depositors start shifting in their seats a bit.

To be sure, there are currently no bank runs. But according to The Economist, depositors have drained 500 billion dollars from commercial banks over the past 12 months. People realize they can get better rates at money market funds. And withdrawals can in this age of

Responses