Top Avalanche Subnets

TL;DR

Avalanche has a strange list of recent bedfellows. What other blockchain ecosystem can claim it welcomes partners ranging from investment banks to first-person shooter games? The technology that makes this possible is called subnets. Let’s review a few bustling Avalanche subnets.

A prelude. Avalanche has in recent weeks even outperformed Solana. Avax’s price is up more than 100% in 30 days. Transactions have spiked like crazy.

This spike in transactions appears to be unrelated to the topic of this article: subnets. But it’s worth touching on. A new token standard has hit Avalanche. These ASC-20 tokens use inscription to post information onto the Avalanche C-chain, in the metadata of each transaction. This new token standard is comparable to Bitcoin’s BRC-20 tokens.

These types of transactions have surged and are responsible for more than 95% of Avalanche’s daily on-chain transactions. This is just to show that a lot is going on on Avalanche. Now back to subnets.

What are Subnets?

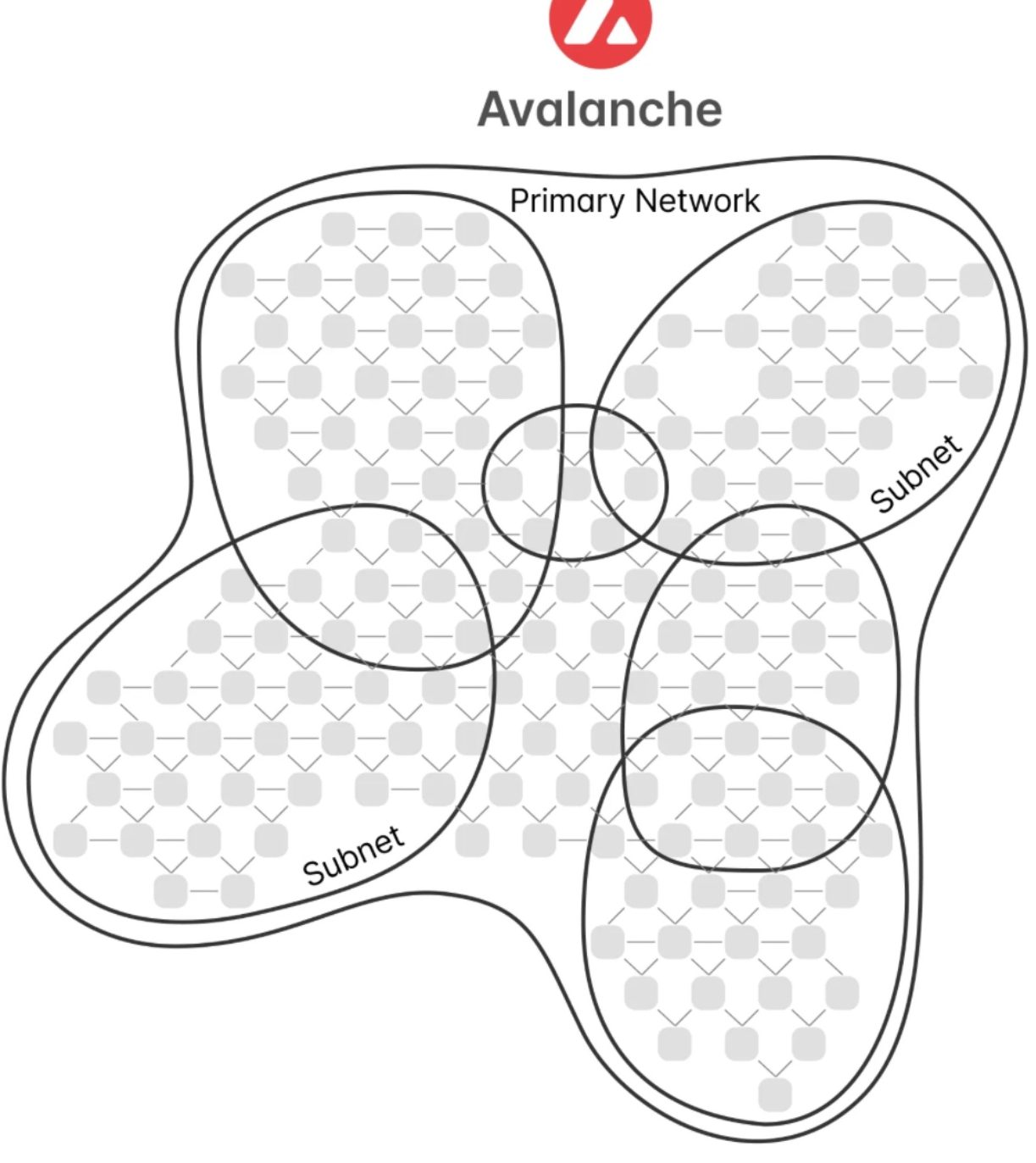

What are Avalanche subnets? They are like private lanes off the highway called Avalanche. Each private lane (subnet) can have its own rules and operate independently while still being part of the larger Avalanche ecosystem.

Avalanche has three main chains, by the way:

- The Exchange (X) Chain

- The Contract (C) Chain

- The Platform (P) Chain. This coordinates Avalanche’s validators and allows for the creation and management of Subnets.

Avalanche subnets allow for the creation and customization of unique tokens and tokenomics that operate within each respective network.

- Each subnet must host at least one blockchain, but can host more.

- Each blockchain is only validated by the one subnet that it’s nested within.

- Validators can be members of multiple subnets (see image below).

- Validators must stake AVAX onto the main chain. Needless to say, this is good for the Avax price.

Who would want to deploy subnets? Well, the technology enables third-party developers to create and operate customized blockchains. Subnets can be tailored for specific purposes, like gaming, finance, or other specialized digital transactions.

Types of Avalanche Subnets

There are currently 20+ Avax subnets. See here the overview of subnets. Let’s discuss a few types, and for each type, a leading example.

Evergreen Subnets: Catering to Financial Institutions

In the spring of 2023, Avalanche launched Evergreen Subnets, a suite of blockchain tools designed for financial institutions. These institutions sometimes shy away from public and permissionless chains, which they obviously have no control over, and instead want something custom-made.

Still, they don’t want to build an entire blockchain ecosystem from the ground up. They do want to benefit from the security of established chains. That’s where Avalanche comes in, making the option of subnets available to these players. This means that the custom-built subnets for these tradfi institutions can be permissionedchains – unlike the permissionless chains we have come to love. With permissioned chains, the institutions gate the access. They need to, as they have Know-Your-Customer requirements to comply with.

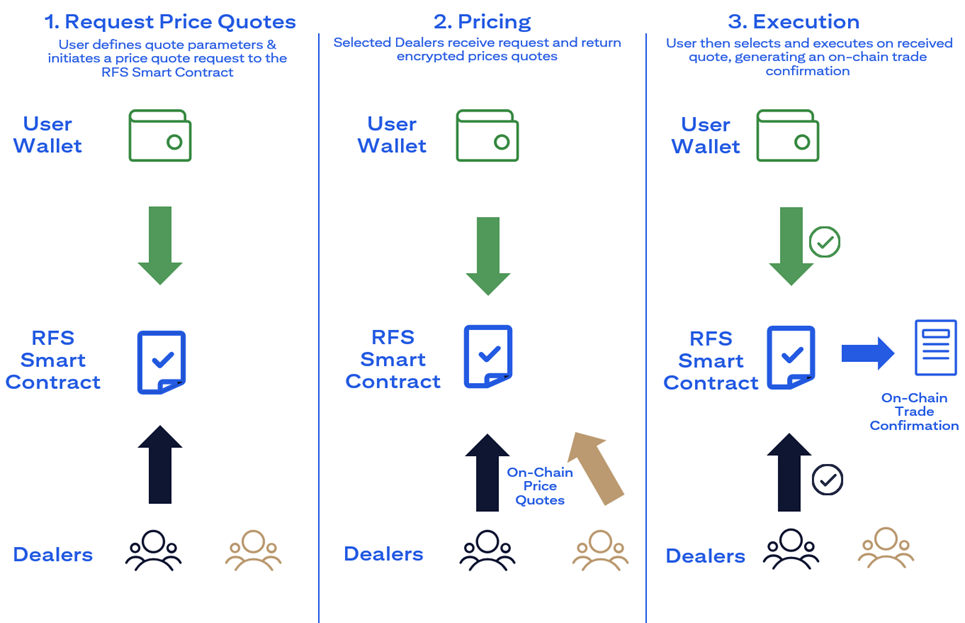

Investment bank Citi recently delivered a proof-of-concept for an RFS (request for streaming) solution for foreign exchange (FX) trades (in this test version they implemented the US dollar – Singapore dollar pair). Let’s briefly look at this use case.

In a traditional Request-for-Quote (RFQ) process, clients send an RFQ to one or more dealers. Dealers respond to a client with a price quote. The trade will be executed once the client agrees to the price quote.

In Citi’s prototype on-chain app, all price quotes and trade confirmations will be recorded on-chain. Clients can use their wallets for identification, receive streaming prices, and confirm their trades on-chain, cryptographically secure.

Who wouldn’t want that? Well, Citi does! And it has done so by building an Avalanche subnet on Avalanche’s Evergreen suite.

Another similar development is Avalanche’s partnership with JP-Morgan to build their new ONYX blockchain.

Subnets for Tokenization of Real-World Assets

Currently, a mortgage can be financed by someone else’s pension fund investment. These are linked through a complex process called securitization. The issuance, secondary market trading, and fund administration are currently fragmented, not transparent, and come with high fees. Needless to say, there are benefits to moving this stuff on-chain!

A notable recent development is the plan by Republic Crypto to launch a revenue-sharing tokenized security on the Avalanche blockchain: R/Note. The security in this case is the real-world asset (it may be confusing, but also ‘paper’ assets are called real-world assets).

Again, as was the case with Citi’s permissioned Avalanche subnet, Republic Crypto wanted a side chain that they could optimize for, among other things, the regulatory rules associated with being a digital security.

Avalanche Gaming Subnets

And then the completely different bedfellow. A big category of Avalanche Subnets is related to blockchain gaming. There is a frenzy going on in this space. Every developer team wants to be the first that launches a breakthrough crypto game. Such a breakthrough would no doubt be a massive catalyst for a gaming coin bullrun.

Unlike first-generation crypto games like Axie (built on Ethereum sidechain Ronin) the upcoming generation of games will be high quality. Axie was underwhelming and people played it mostly for financial gains. The new generation of crypto games are not Play-to-Earn like Axie, but let’s call them Play-and-Earn. A first-person shooter such as Shrapnel (to be launched) is said to be as highly engaging as your non-crypto game.

Beam

The prime example of a subnet built for gaming is Beam. It was created by the Merit Circle DAO (Merit Circle has its own coin). Merit Circle has said that Avalanche’s subnets were the key reason for choosing Avalanche to power this gaming network, citing low fees and quick settlements as beneficial for Web3 gaming.

Beam is actively attracting game developers and promises easy deployment of on-chain games. Some gaming-friendly features Beam touts are gas-optimized transactions, asset management, and oracles for web2 games and marketplaces.

Furthermore, Beam provides facilities for players to swap tokens linked to Beam dApps and a marketplace named Sphere for trading in-game NFT assets.

Conclusion

Picking a winning crypto game token is almost a lottery (even though, granted, many could pump simultaneously once/if the gaming bull run kicks off). And however successful Citi’s or JPMorgan’s permissioned Avalanche subnet will become, you can’t buy their coins. What you can do is follow these developments and consider a bet on the underlying infrastructure: Avalanche.

Go figure: buying the companies that sold the picks and shovels was a profitable strategy during the gold rush of the nineteenth century. Buying AVAX is a similar bet. Not financial advice 😉