Real-World Assets On-Chain: One of Crypto’s Biggest Potential Growth Markets

TL;DR

It’s said to be potentially one of the catalysts of the next bull run: real-world assets on-chain. Indeed, a transparent, easily accessible ledger of stuff we currently trade in the traditional financial system would be nice to have. Which protocols are promising? And which pitfalls come with tokenizing stuff?

The Global Financial Crisis of 2008 was not just a result of toxic mortgage-related products. It also escalated because of the lack of transparency of the ‘global financial ledger’. Against the backdrop of crashing bank stocks and troubled collateralized debt obligations, the question that started looming large was: Who owes what to whom? The ‘database entries’ were just not clear and this caused the banking system to freeze up, forcing the US government to flashflood the system with freshly printed dollars.

What if all those troubled assets would have been on-chain? It wouldn’t have prevented the markets from crashing of course, but at least there would have been clarity about every player’s financial position.

What are Real-World Assets?

A Real-world Asset protocol is an app that allows users to tokenize and trade real-world assets (RWA). They are also called asset tokenization protocols.

Real-world assets is a broad term. First of all, it’s important to realize that it is used for more than just physical items in the real world. Sure, land or real estate are examples of real-world assets. But the term is also used for financial assets from the TradFi system such as stocks and bonds. Utility tokens for businesses are yet another subcategory. These are a new way in which companies can hand out value to their customers. It’s like owning a piece of the product (a real-world asset). That piece is tradable on secondary markets AND redeemable for (a part of) the product. (read more in Future use cases for DeFi)

To sum up. Basically, anything that can be tokenized and traded but is not crypto-native is a real-world asset on-chain. (Crypto-native assets would be native tokens such as BTC and ETH. These things live exclusively on-chain.)

The Advantages of On-Chain

As mentioned, there are advantages to capturing ownership of real-world assets on the blockchain.

- Ownership is provable.

In the current system, you place an order with a bank and then the purchase order and the number of units of the relevant financial asset in your portfolio show up on your screen. You can only assume that you are indeed the owner. There is no public record of your ownership. We would like to see the proof on-chain. - The issuance process can be more efficient.

The buying and selling of for example bonds currently takes many intermediaries, who all take their time and pocket their cut. Viewed like this, blockchain tech is just another efficiency step that could price the current settlement system out of the market. Plus, with these efficiency gains, tokenization of things of small value could also become feasible. - The accessibility becomes better.

Imagine living in an African country and having no bank account but a mobile phone. With tokenized real-world assets, investing becomes an option: you buy a tokenized and/or fractionalized Tesla stock.

The State of Adoption of RWA in Crypto

Let’s look at a few examples of within-crypto adoption first.

An important example of a protocol that includes RWA’s – but isn’t focused exclusively on them – is MakerDAO, the DAO behind stablecoin DAI. It has approved the conversion of centralized stablecoins like USDC to U.S. Treasury bonds. So tokenized government and corporate bonds can be used as collateral for minting DAI.

Another big category of RWA protocols is uncollateralized lending projects in defi. The term uncollateralized is important here. Most of the lending in defi happens with collateral. The above-mentioned DAI stablecoin is an example. To receive a stablecoin, you have to put up collateral. But this ‘pawn-shop model of lending’ is not how the majority of lending in the real world happens. Lending often happens without collateral: a bank gives you a loan based on your credit rating, which isn’t tangible collateral.

Of the uncollateralized lending protocols, Maple Finance is a prominent example. It is an on-chain capital marketplace for institutions. Lending opportunities to institutions are provided by teams of credit professionals who operate lending pools. These credit professionals are the ones who assess the creditworthiness of the borrower. This resembles traditional lending, but make no mistake: the institution connects its crypto wallet! And Maple is built on Ethereum.

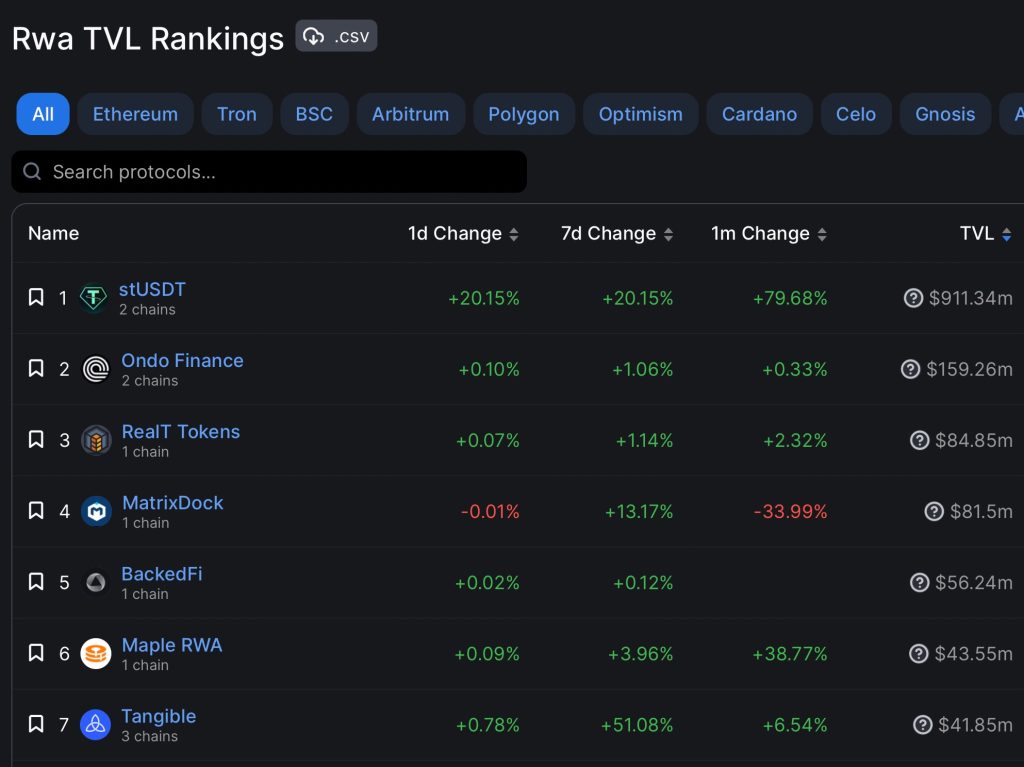

Top RWA Protocols

Here’s a list of Real-World Asset protocols, ranked in order of their total value locked.

A top 3 protocol is Ondo Finance. It lets stablecoin holders directly invest in ETFs of for example BlackRock. United States bonds of more than $100 million have been issued via Ondo, per rwa.xyz data.

The Institutions are Coming!

In the past few years, there have been quite a few banks and institutions issuing bonds on-chain. Banco Santander was one of three private banks that helped the European Investment Bank issue its first digital bond using blockchain technology. The €100 million bond was launched in April 2021 on Ethereum. German company Siemens has issued $64M of digital bonds on a public blockchain. However, other institutions have used private blockchains. For example, the Israeli Ministry of Finance has been rigging their own chain to issue its bonds on (even though it is compatible with the Ethereum Virtual Machine).

Reasons for Caution

Okay, let’s take a step back from the potential bullishness. While blockchain offers promising solutions for many applications, there are inherent risks and complications to the introduction of real-world assets like houses and government bonds onto the blockchain.

Owning a token of let’s say a government bond isn’t the same as owning the bond. As Byron Gilliam pointed out to crypto natives, it’s like the difference between owning wrapped BTC on Ethereum vs. owning BTC in cold storage. A token can be more cost-efficient and more easily tradeable, but it’s still a representation of a thing, not the thing itself.

This ties into the question of control of the ledger. To what extent does ‘not your keys, not your coins’ hold up here? Put differently, if you can show your keys, do you indeed own your ‘coins’?

Here’s a quote from Limpwar by Micah Warren (also discussed in my article about the likelihood of nation states engaging in hash wars).

It’s not obvious that putting control of property (other than bitcoin or blockchain native things like NFTs) on a blockchain would be a good idea. You have to ask: who will accept that I own this property if it’s on the blockchain, that would not have accepted my ownership without it? If you’re traveling to Kenya from Japan and need some means to transfer money, obviously Bitcoin is a solution. The ledger is respected in both places. Bitcoin is also a fungible token used by many people. But your house? If you live in a place of law and order, your records at the county registrar suffice. If you live in a place without law and order, there’s little the blockchain can do for you.

Indeed, if real estate deeds are on a public blockchain, malicious actors might manipulate the chain. This could create the potential and absurd situation where rightful property ownership is overwritten. An extreme hypothetical example: a malicious conglomerate of Chinese miners might 51% attack the Bitcoin blockchain and try to double-spend your… house? That makes no sense, as your local authorities, even if they would have agreed to on-chain homeownership, can still deny a claim of ownership from a Chinese miner. In other words, ‘layer 0’ or the ‘social layer’ is in the end what determines ownership.

Conclusion

RWAs on-chain is a sector of fast-growing financial instruments that merges traditional finance with the blockchain. But to be fair, the total value locked of these protocols is still very low. It also remains to be seen to what extent institutions will depend on public blockchains like Ethereum or build their own chain. Still, it is a development to keep a close eye on in the coming bull market.