Avalanche Subnets vs. Polygon Supernets

But does it scale?

That’s a central question and challenge for the blockchain industry. As global adoption grows, powerhouse blockchain networks suffer from increased congestion. As a result, users pay higher fees and must wait through slower transaction processing periods. Not good.

Fortunately, blockchain developers are tackling this issue head-on. Two recent, promising solutions that have recently emerged are known as Avalanche Subnets and Polygon Supernets. At a high level, both enable third-party developers to create and operate customized, unique blockchain networks that function inside their larger, respective ecosystems.

And these sub-networks do help their larger ecosystems scale. If the Avalanche and Ethereum blockchains are major highways running through very crowded cities, then Subnets and Supernets represent new, adjacent, connected highways and roads. They help clear up traffic on the main highway, and therefore the cities become increasingly efficient and economically vibrant.

Multiple indicators are telling us that Subnets and Supernets are in demand. In March, the Avalanche Foundation committed $290M for the development of Subnets. Then in April, Polygon core developers promised 100M for the support of Supernets. Even an internet rumble broke out between Avalanche and Polygon developers over the merits of each platform. Clearly, the market needs these scaling solutions, and there’s money to be made.

The following will provide:

- A brief overview of Avalanche, Polygon, Subnets, and Supernets,

- A comparison showing some concrete similarities and differences, and

- Broader level conclusions about the two projects. OK, let’s do this!

Avalanche: An Overview

Avalanche is a decentralized, proof-of-stake, layer one blockchain protocol. Avalanche has a base layer blockchain network that’s referred to as the primary network. The primary network consists of a unique consensus model, a native token (AVAX), and three main blockchains.

Avalanche’s three main chains are known as the Exchange (X) Chain, the Contract (C) Chain, and the Platform (P) Chain. The X Chain allows users to create and swap assets. The C Chain facilitates the creation and execution of smart contract-enabled NFTs, DeFi, and other decentralized applications. And the P Chain coordinates Avalanche’s validators and allows for the creation and management of Subnets.

Avalanche Subnets: An Introduction

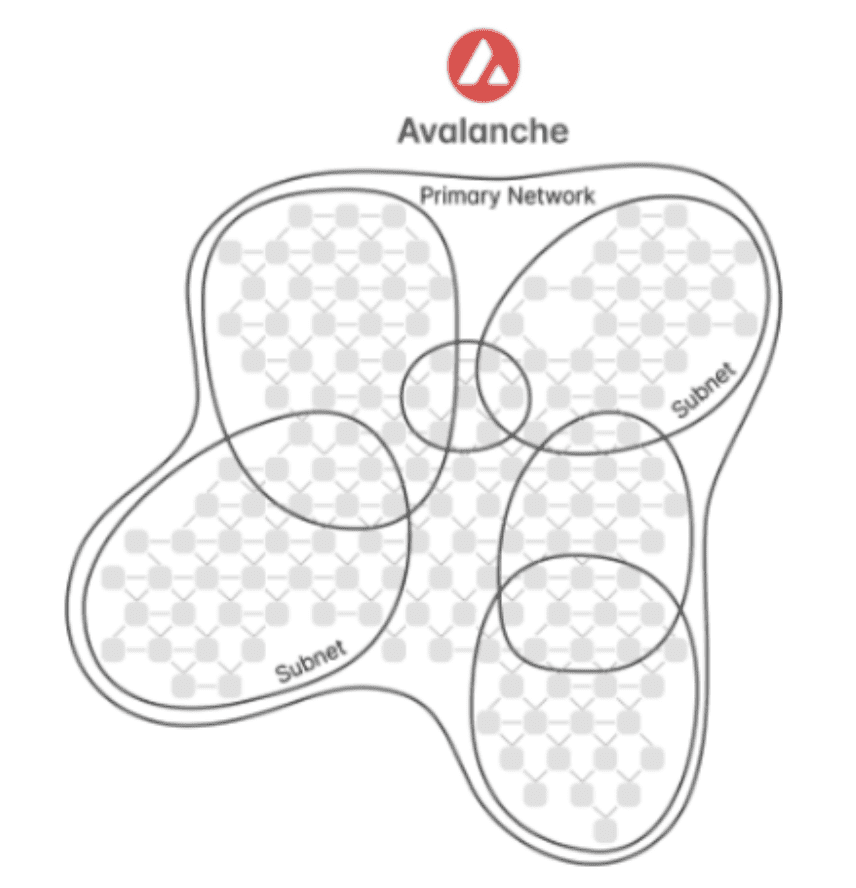

Avalanche’s P Chain architecture includes infrastructure that enables third-party developers to implement and launch their own independent Subnets. These Subnets are composed of one or more third-party created blockchains that can operate with a very high degree of autonomy and independent customization with concerns to tokens and rules.

Avalanche’s Developer Evangelist, Gabriel Cardona, says that Subnets allow developers to “spin up a tailor-made network with custom virtual machines and complex validator rule sets.” With Subnets, developers have extensive autonomy when choosing their validators, validator incentives, gas prices, and virtual machines. Importantly, a greater degree of autonomy comes with a greater need for developmental and operative competence.

A few more details with regards to the macro perspective of the Subnet ecosystem:

- Each subnet must host at minimum one (but can host multiple) blockchain;

- Each blockchain is only validated by the one subnet that it’s nested within; and,

- Validators can be members of multiple subnets.

- So, you can visualize the entire Avalanche and Avalanche Subnet ecosystem like this:

All of this adds up to the idea that Avalanche is a network with ever-expanding networks. Conceptually, Subnets allow Avalanche to horizontally scale, a necessary component if blockchain technology is to witness global adoption.

Polygon: An Overview

Polygon is a decentralized, proof-of-stake, layer two blockchain protocol that runs alongside the Ethereum network. Polygon’s core purpose is to bolster Ethereum by reducing the latter’s gas fees and increasing its transaction output. Polygon is an existing and successful scaling solution for Ethereum. Polygon achieves both lower gas fees and increased transaction output for Ethereum by quickly processing transactions on the Polygon chain, and then batching over in bulk the synthesized transaction data onto the Ethereum chain. Polygon’s native token is MATIC. Polygon can process about 65,000 transactions per second.

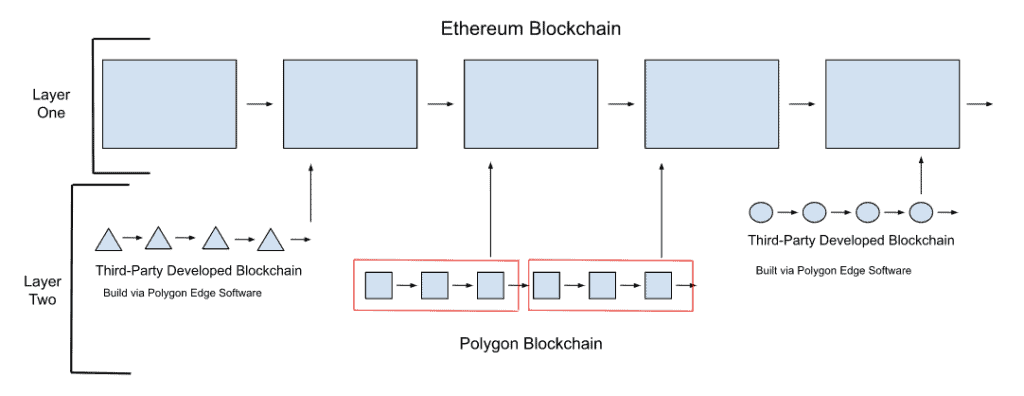

Additionally, Polygon also has a developer kit called Polygon Edge. Polygon Edge is a blockchain tooling kit that allows third-party developers to build and run their own customizable, Ethereum-compatible blockchains. Essentially, Polygon Edge allows other groups to develop new layer two blockchains that can also run alongside Ethereum, as well as communicate with Polygon. As we will notice later, an important point concerning third-party developed blockchains with Polygon Edge is that validation is self-organized. (like Avalanche Subnets!!). Meaning, third-party developers are responsible for pulling together validators to secure their own blockchain.

So, you can picture Ethereum, Polygon, and new chains created via Polygon Edge like this:

Even though Polygon Edge allows for horizontal scaling within the Ethereum ecosystem, developers have indicated that it’s difficult to coordinate the new chain’s independent validators with the Ethereum blockchain. This coordination issue between the new chains and Ethereum congests the networks and compromises security. And it’s for this reason that the Polygon team developed Polygon Supernets.

Polygon Supernets: An Introduction

Polygon Supernets represent a software toolkit (software powered by Polygon Edge) that allows third-party developers to build custom, Ethereum-compatible blockchain networks. So how exactly are Supernets any different from blockchains developed via Edge?

With Polygon Supernets, third-party developers outsource – or offload – their validator needs to the already existing class of 100 professional validators who are already servicing the Polygon ecosystem. Thus, third-party developers are no longer forced to self-organize their validation needs. In order to validate for Polygon, nodes must first stake a minimum of 20K MATIC onto the Ethereum blockchain. Polygon Supernets tap into these validators. So when a new Supernet comes online, it’s absorbed into the existing validator network, and certain validators are automatically selected to service it.

The workflow design that Supernets represent seems to present a few benefits for third-party developers. First, the major headache of gathering and coordinating validators for a new blockchain on Polygon is removed. Third-party developers instead build out their Supernet, and then conveniently tap into Polygon’s 100 validators for the heavy lifting. Second, the Polygon team states that third-party developers have access to a broader set of tool-kit support with this process.

Avalanche Subnets vs. Polygon Supernets

By now, it’s clear that Avalanche Subnets and Polygon Supernets are the same at a conceptual level. Fundamentally, both platforms serve as horizontal scaling solutions for their larger respective blockchains. Both offer third-party developers software platforms for the creation of independent blockchain networks to be nested inside the larger applicable ecosystem. Having said that, an analysis of the two projects reveals that the development teams have somewhat opposed philosophical perspectives in at least two major ways, and there is at least one key question that seems apparent.

Opposing Philosophical Perspectives between Avalanche and Polygon

These philosophical perspectives will be expanded upon below, but for now, keep the following in mind:

- The Avalanche Subnet model seems to prioritize decentralization and free market competition while the Polygon Supernet model takes a more centrally planned, collective approach.

- The Avalanche Subnet model seems to sacrifice convenience for greater developmental customization and security. The Polygon network does the opposite. It sacrifices developmental customization and security for plug-in-play convenience and greater developer support tools.

Key Question

At a high level, is it possible that Polygon has already learned a hard lesson from Edge that Avalanche has not yet learned with Subnets?

Polygon Supernets were created because developers, when using Polygon Edge, were running into challenges when self-organizing their own validators. But Avalanche Subnets are responsible for self-organizing their own validators! So will Avalanche developers run into similar issues as did those with Polygon Edge? This answer is unclear, in part because Avalanche and Ethereum do differ technologically in many ways.

4 Specific Similarities between Subnets (Avalanche) and Supernets (Polygon)

1. Tokenomics

Both allow for the creation and customization of unique tokens and tokenomics that operate within each respective network.

2. Validators Must Stake to and Validate Main Chain

Both require validators to stake predetermined amounts of AVAX or MATIC onto their main chains. Validators in both systems must help validate the main chains if they are to validate for the smaller chains.

3. Number of Third-Party Projects

Both ecosystems have roughly the same number of projects launched. Avalanche currently has 23 while Polygon has 35.

4. Transaction Finality

Both systems achieve transaction finality in approximately 2 seconds.

9 Specific Differences between Subnets (Avalanche) and Supernets (Polygon)

1. Consensus Protocol Designs

Avalanche Subnets use a proof-of-stake consensus variant called the Snowman Consensus Protocol. At a basic level, the Snowman Consensus Protocol uses an algorithm to randomly and repeatedly subsample nodes until consensus is achieved. Consensus is achieved once a quorum is reached and the nodes are within a high confidence range of agreement. The Avalanche team states that this protocol design allows for near infinite scalability due to the protocol using probabilistic math and confidence ranges.

Polygon Supernets use the Istanbul Byzantine Fault Tolerance (IBFT) proof-of-stake consensus protocol. Under this model, 100 nodes that have each staked at least 20K MATIC onto the Ethereum blockchain share validation responsibilities for every Supernet. This means that Supernets have a shared security system with each other.

2. Decentralization & Free Market Competition vs. Central Planning & Collectivism

Avalanche Subnets seem to be more decentralized due to the ecosystem currently hosting approximately 1300 validators. Once Avalanche validators have staked 2000 AVAX to the main chain (currently $43K), they are free to choose which Subnets to validate. This therefore means that Subnets must engage in a market competition to incentivize validators to join their Subnet (however, Avalanche validators can join multiple Subnets, so it’s not clear just how cut-throat this competition might be).

Polygon Supernets seem to be less decentralized because 100 validators share transaction processing responsibilities for every Supernet within the Polygon ecosystem. Once a Supernet comes online, the system automatically assigns validators to it out of the 100 validator pool. So in that sense, Polygon is more centrally planned, communal, and cooperative. Currently, Polygon validators must stake 20K MATIC (currently $16K).

3. Developmental Customization & Security vs. Convenience

Avalanche Subnets seem to prioritize developmental customization and security over convenience. In Avalanche, third-party developers can tap into a large, diverse set of validators. They also have complete control over the validation requirements and parameters. This makes development on Avalanche customizable and secure, but it decreases convenience.

Polygon Supernets seem to prioritize convenience over developmental customization and security. Third-party developers automatically inherit Polygon’s 100 validator class upon launch. This is an excellent plug-in-play convenience feature. But developers don’t have control over any validation parameters (reduced customization) and share the same validator set as all other Supernets (reduced security).

4. Cross-Chain Bridges & Communication:

Currently, Subnets connect and communicate with the Avalanche main chains, but intra-Subnet cross-chain transactions and communication channels are not yet online. Avalanche states this capability should come online at some point in 2022.

Polygon currently has cross-chain bridges and communication capabilities established between Supernets.

5. Permission Differences between Subnets (Avalanche) and Supernets (Polygon)

Avalanche Subnets can either be permissioned or permissionless. When a new subnet is created, third-party developers can choose whether the network is to be public or private. If public, anyone can choose to opt-in and validate for the Subnet (permissionless). If private, the third-party developer retains control of who and how many validators can work the Subnet (permissioned).

Polygon Supernets are currently only permissioned networks. This is because Polygon validators do not choose which Supernt to validate.

6. Slashing

Avalanche does not allow for slashing. The idea is that slashing is unfair to delegators because these delegators have no control over if a validator intentionally or negligently misbehaves. Why punish someone for another’s actions of whom the former doesn’t control?

Polygon is willing to sacrifice the innocent delegator for broader network security. Slashing + validators must stake MATIC to the Ethereum blockchain = Validators are economically disincentivized to misbehave. This also makes sense!

7. Validator Fees

For Avalanche’s Ethereum VM, Subnet transaction fees are paid in the native token for that Subnet. Therefore, Avalanche validators receive both the applicable Subnet’s native token (for choosing to validate for that Subnet) and AVAX (from staking AVAX to the mainnet). It’s up to Subnets to determine their fee payment amounts and schedule.

For Polygon, Supernets do not pay validators with their native currency. Instead, validators are incentivized by only the larger MATIC rewards gained through validating Polygon.

8. Virtual Machines

Avalanche offers third-party developers a menu of customizable VMs and allows developers to implement their own. Currently, developers can utilize the Ethereum VM, Avalanche VM, Spaces VM, Blob VM, and Timestamp VM.

Polygon utilizes the Ethereum VM for every Supernet in the ecosystem.

9. Transactions Per Second

Avalanche claims that Subnets process approximately 4,500 transactions per second.

Polygon claims that Supernets process approximately 1,500 transactions per second.

Final Thoughts

Comparing Subnets and Supernets in terms of which is “better” is likely the wrong frame of analysis. Developers will analyze each in the context of which platform best fits their unique technological needs and addressable consumer base. Developers will also consider the trade-offs with regards to decentralization, competition, customization, security, and convenience. They might also consider the key question posed earlier in this article.

Finally, it pays for AVAX, ETH, and MATIC investors to understand these networks, and gain a sense of which might achieve scalable mass adoption over the next several years. Those able to correctly predict the platform(s) that will garner disruption level mass adoption stand to make a lot of money.

Recommended read: How to stake Polygon | Matic staking

Responses