Bitcoin Hits All Time High

GM friends.

We did it folks. Bitcoin hit an ATH on Tuesday.

But then the party crashed as the asset immediately dumped 12%.

But then the party returned as the asset climbed back up to $67,000+

Welcome to the big show, Class of 2024!

So brew up a fresh pot and take a chair. Here is your mid-week crypto update. ☕️📰

Here’s what’s in today’s issue:

- David shares his thoughts on Bitcoin hitting its ATH, BRICS creating a blockchain payment system, Grayscale introducing a crypto staking fund, MicroStrategy raising $600M for more BTC & Arizona Senate pushing for BTC ETF in retirement fund.

- Rekt Capital has the latest technical analysis for you on the market.

- Erik has an article on meme coins and why you shouldn’t fade them.

- In case you missed it by Rebecca.

Ready to take your crypto journey to new heights? Look no further – Bitget is your ticket to seamless and rewarding trading experiences!

- User Friendly

- Advanced Tools For Traders

- Huge range of top coins to trade

💰 Sign Up Now for Exclusive Bonuses Up To $30,000! 💰

Bitcoin Hits All Time High

Shortly after US markets opened on Tuesday morning, bitcoin hit a record all time high at $69,325. This new ATH just barely eclipsed bitcoin’s previous one at $69,000, which was hit in November 2021.

But unfortunately, if you blinked on Tuesday, then you would have missed it. That’s because price abruptly cratered once bitcoin hit this new ATH. And by cratered, I mean price crashed 12% to $60,000 within five hours after the ATH.

What Caused the Pump and Dump?

If you can’t guess the reason for the pump, then you haven’t been reading this newsletter. Two words: bitcoin ETFs.

Monday and Tuesday’s ETF net inflows were $562M and $648M, respectively. And Tuesday’s inflows were enough to push bitcoin into ATH territory.

Now what about the dump? Analysts say that about 1K bitcoin that have been dormant in a particular wallet for the last 10 years were moved to Coinbase and sold as bitcoin hit its ATH. It’s thought that this wallet is owned by an old miner.

Given the spot order books are extremely thin, large transactions have an outsized impact on price. And once price began to fall on Tuesday, leveraged longs started to get liquidated, which further fueled more downwards price action.

By the time the dust settled, $1 billion worth of leveraged long contracts were wiped out.

Where Does Bitcoin Go from Here?

This is hard to predict. What’s interesting however is – at least the time of this writing – bitcoin has recovered from $60K, and is back to the upper $60Ks.

This is a hot take but my sense is that if ETF inflows remain strong for the remainder of this week, we will get a sustained price break above $70K.

Conversely, we could see other dormant wallets become activated in the high $60Ks and push price back down. Moreover, multiple analysts are arguing that the market looks overheated, and a correction into the $50Ks or even $40Ks is conceivable.

If you’re holding spot bitcoin, just take a deep breath, relax, and enjoy the show. None of this short term volatility matters in the long run.

But if you’re playing the leverage game, make sure you’re setting stop losses and using low leverage, because we’ll likely see a lot more volatility in the near future.

BRICS to Create Blockchain Payment System

It appears some seismic shifts are happening with the global monetary order.

On Tuesday, the Kremlin announced that the BRICS nations (i.e. Brazil, Russia, India, China, and South Africa) “will work to create an independent payment system based on digital currencies and blockchain.”

Now, we have no idea what specific digital currencies the BRICS leaders have in mind. It’s very conceivable that one or multiple CBDCs could be used on this proposed payment rail.

But what we can confidently say is that BRICS is continuing to de-dollarize their economies. Therefore, this move puts downward pressure on the US dollar, and adds further uncertainty to and fractionalizes the current monetary order.

I believe one of the unintended consequences of all of this is digital assets like bitcoin become even stronger.

In a world with a fractionalized monetary order, I think more and more people will gravitate to bitcoin, because it makes more sense than remaining under the arbitrary thumbs of politicians, central bankers, and dictators.

Grayscale Introduces Crypto Staking Fund

Grayscale, the operator of the world’s largest spot bitcoin ETF, is bringing a new investment vehicle to market.

Announced Tuesday, the Grayscale Dynamic Income Fund will be made up of a basket of cryptocurrencies that receive staking rewards. Investors will be able to buy shares of the investment, and in return will receive U.S. dollars on a quarterly basis based on the cumulative staking rewards.

Here’s the cryptos to be included in the investment so far: Aptos (APT), Celestia (TIA), Coinbase Staked Ethereum (CBETH), Cosmos (ATOM), NEAR, Osmosis (OSMO), Polkadot (DOT), SEI, and Solana (SOL).

Saylor’s MicroStrategy Raising $600M for More Corn

Yes, I talk about this guy every week. And no, I won’t apologize for it.

On Tuesday evening, MicroStrategy announced that it will be raising $600 million through a convertible debt offering aimed at private investors for the purchase of buying more bitcoin.

Someone call the psychologist. Saylor has lost his mind.

Convertible debt offerings are corporate bonds with a twist. Investors loan money to corporations for a promise of principal repayment plus interest over a period of time. However, investors also have the option to convert their bonds into a predetermined number of stock shares at a predetermined price.

This is not the first time MicroStrategy has issued bonds in order to buy bitcoin, and it won’t be the last.

MicroStrategy holds 193,000 bitcoin, which is currently valued at $13 billion.

Arizona Senate Pushing for Bitcoin ETFs in State Retirement Funds

News broke this week that the Arizona Senate has passed a resolution for bitcoin ETFs to be considered in the State’s public retirement funds.

Specifically, the resolution asks investment managers of the Arizona State Retirement System and the Public Safety Personnel Retirement System to examine the opportunities and risks associated with adding the spot bitcoin ETFs into the retirement portfolios.

State retirement funds are pooled investments for the purpose of facilitating retirement benefits for public employees. The entire U.S. state retirement fund market is worth approximately $5.5 trillion.

The resolution is now headed to the Arizona House for further debate.

This is not the first sign of interest from state retirement funds in the U.S. In 2021, a firefighter pension fund in Houston allocated $25 million into bitcoin and Ethereum. And in 2019, a police officer retirement fund in Virginia allocated $50 million into a basket of cryptocurrencies.

In today’s edition of the Newsletter, the following cryptocurrencies will be analysed & discussed:

- UniSwap (UNI)

- Theta Token (THETA)

- Coti (COTI)

- Chiliz (CHZ)

- Ethereum (ETH)

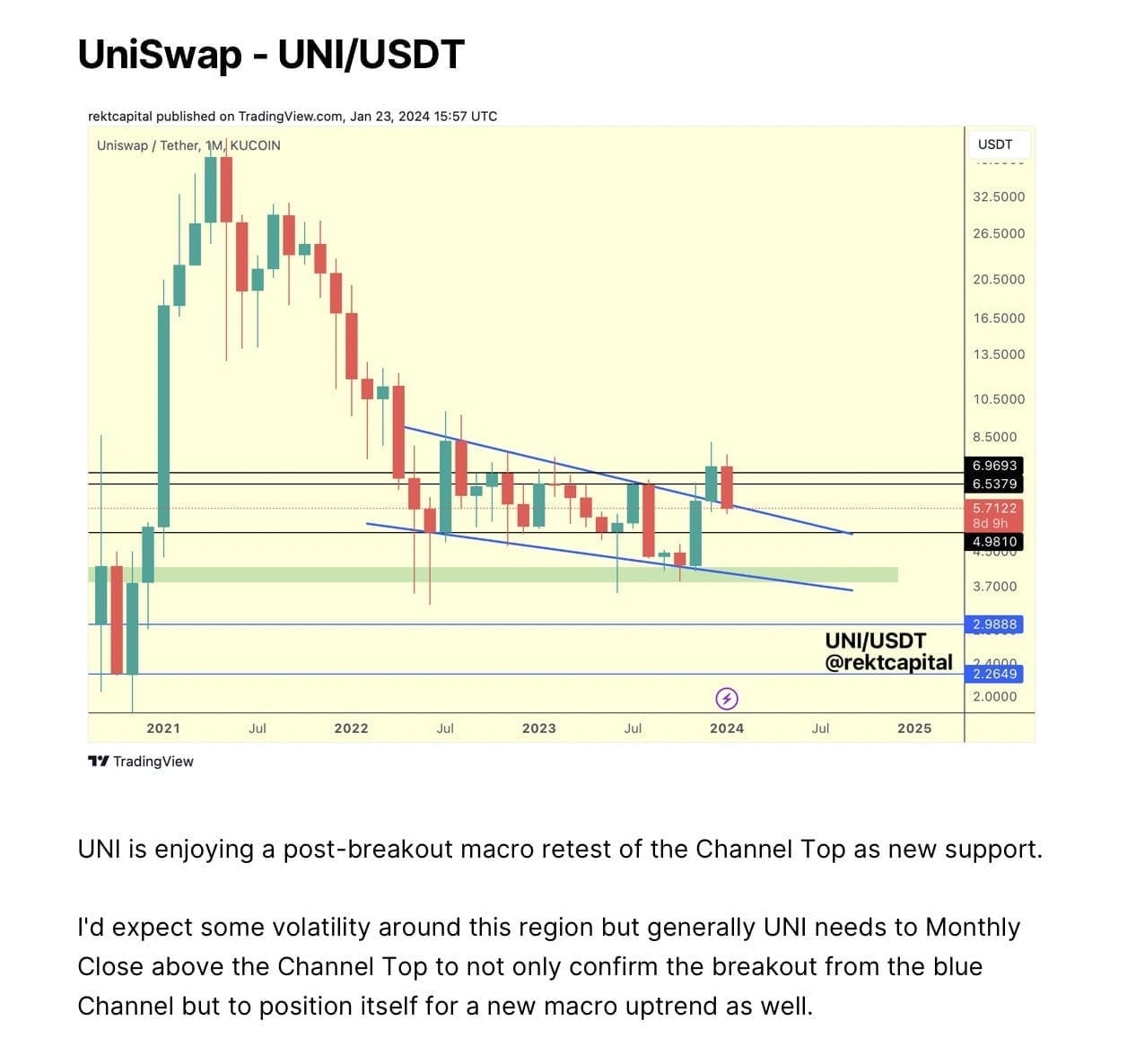

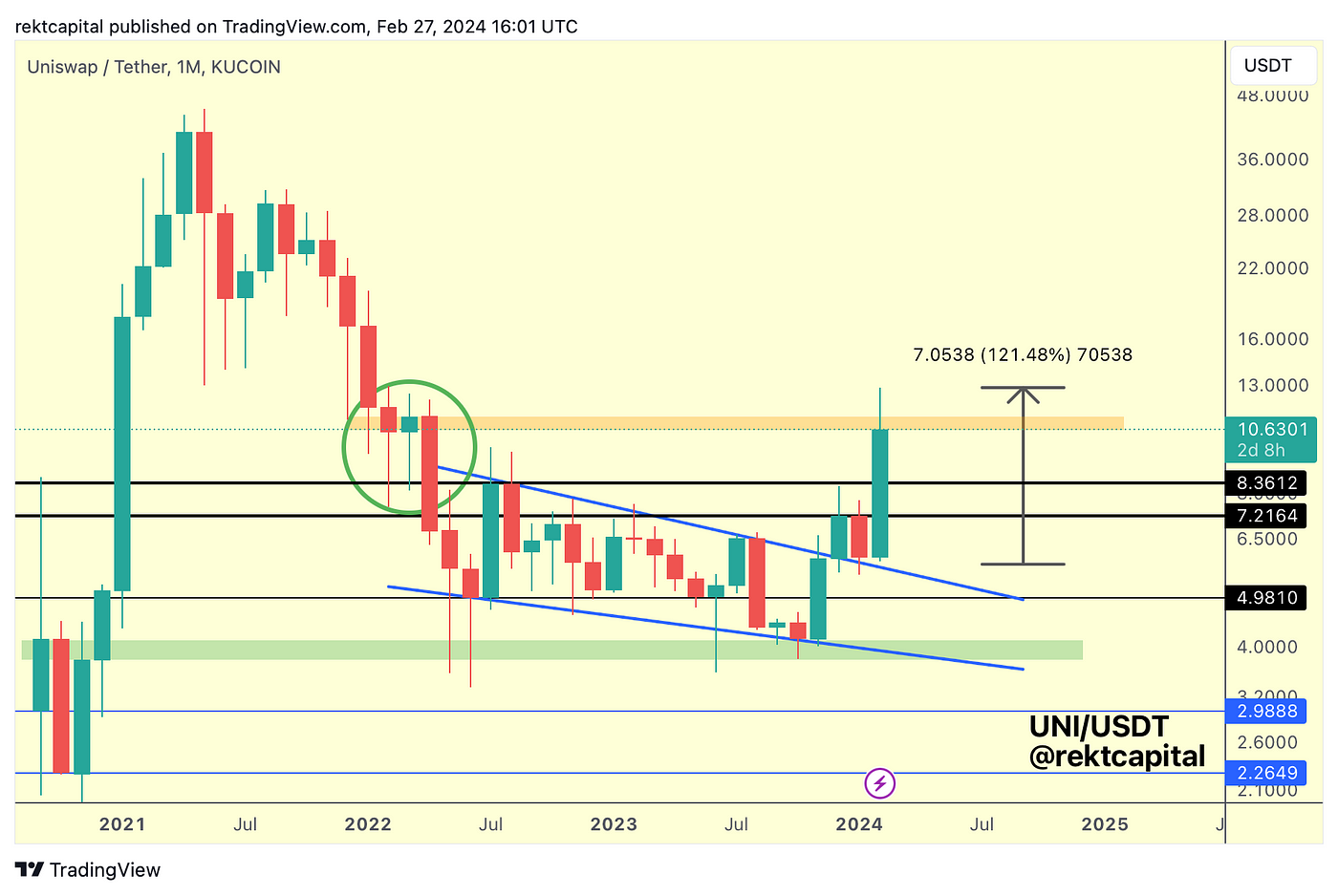

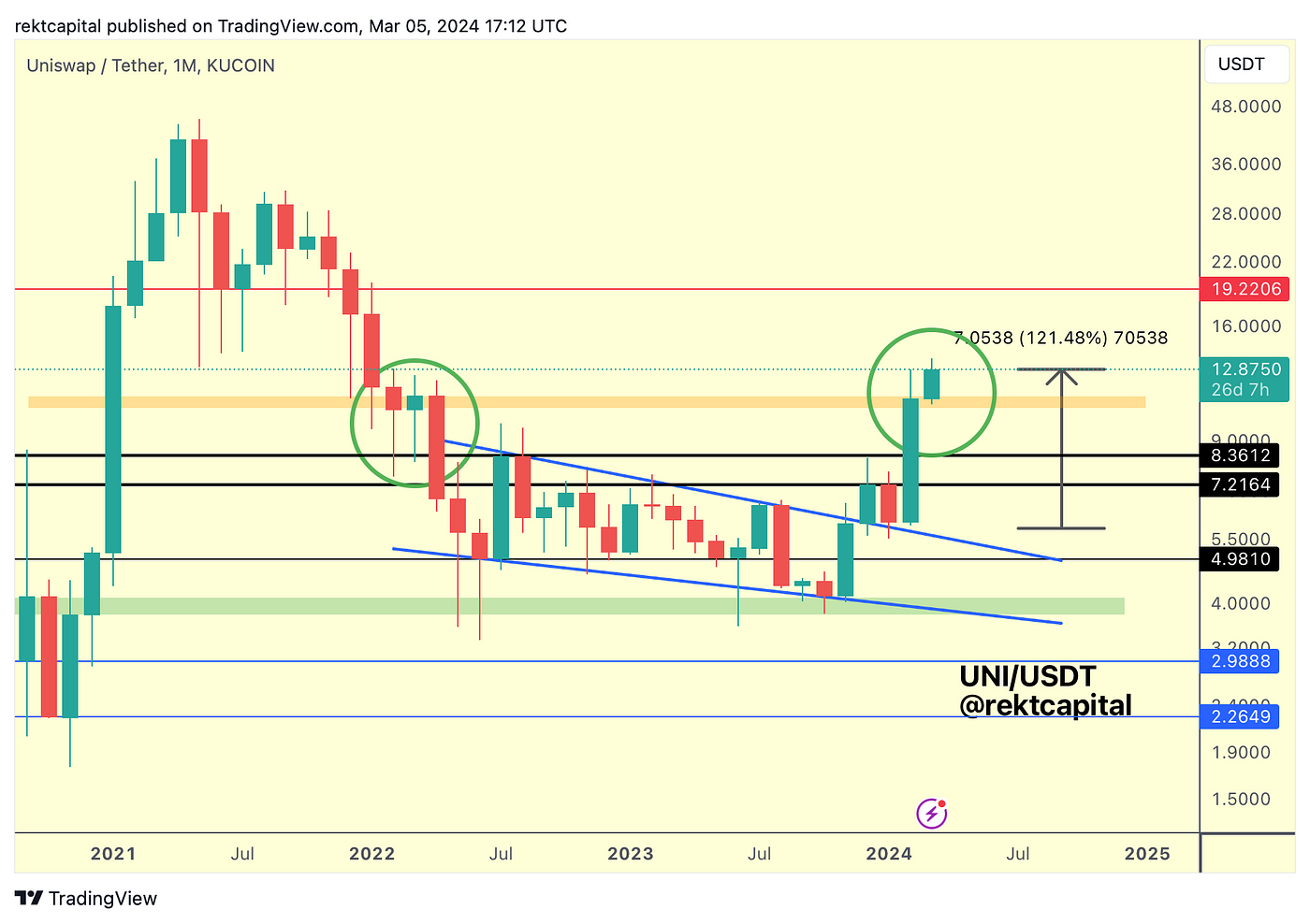

UniSwap — UNI/USDT

UniSwap has come a long way since retesting its macro market structure:

Here is last week’s chart:

And here is today’s chart on UNI:

UNI is technically really well positioned for upside, given its price stability at the orange region of history resistance, which is now figuring as new support.

As long as UNI holds here as it has been doing this month, there is scope for further upside over time for UNI to revisit the red resistance over time; the red resistance being the next available major resistance ahead.

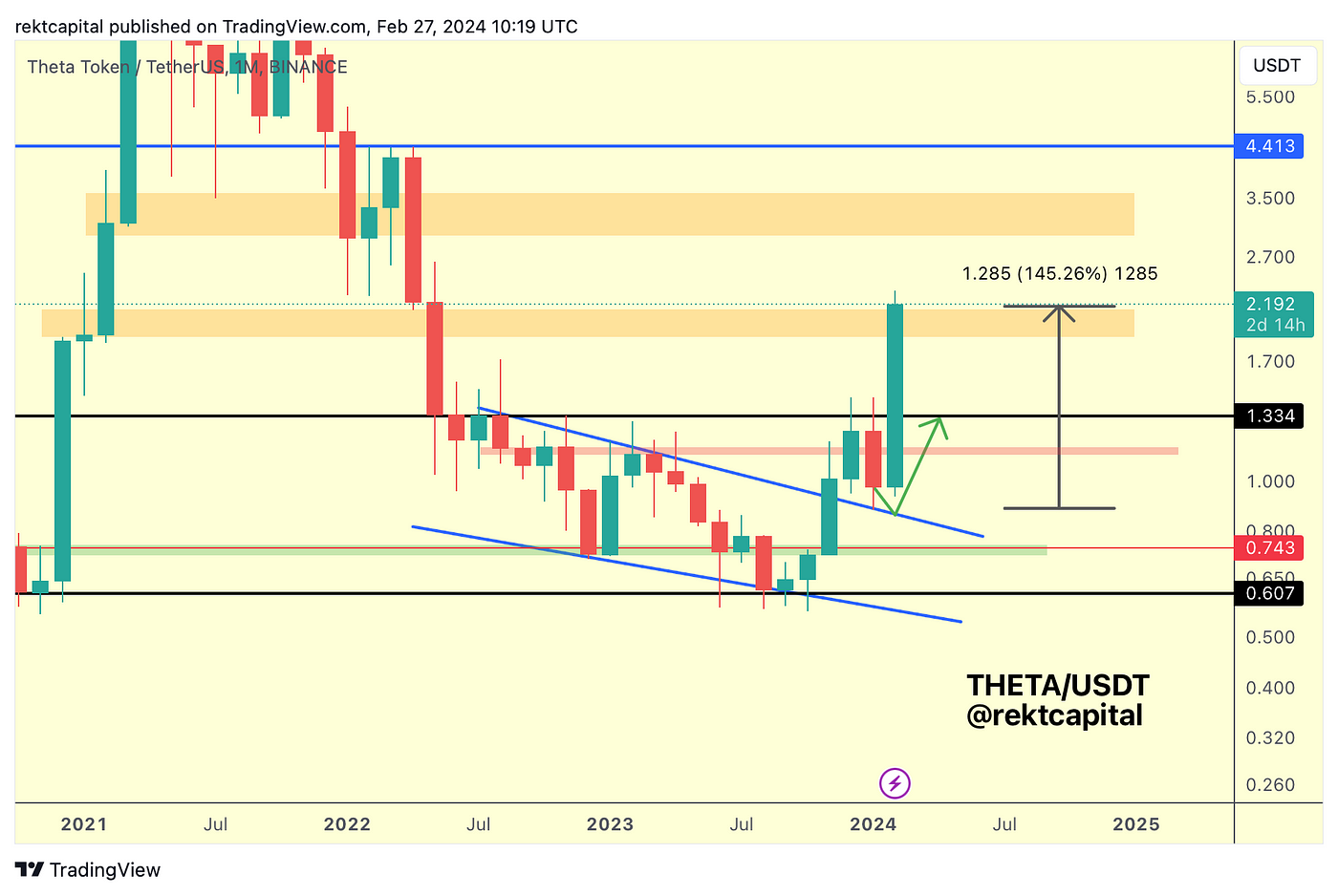

Theta Token — THETA/USDT

Last week, we discussed THETA’s price positioning and how it could dip before spring-boarding higher.

Here is the chart from last week:

And here is the analysis from last week:

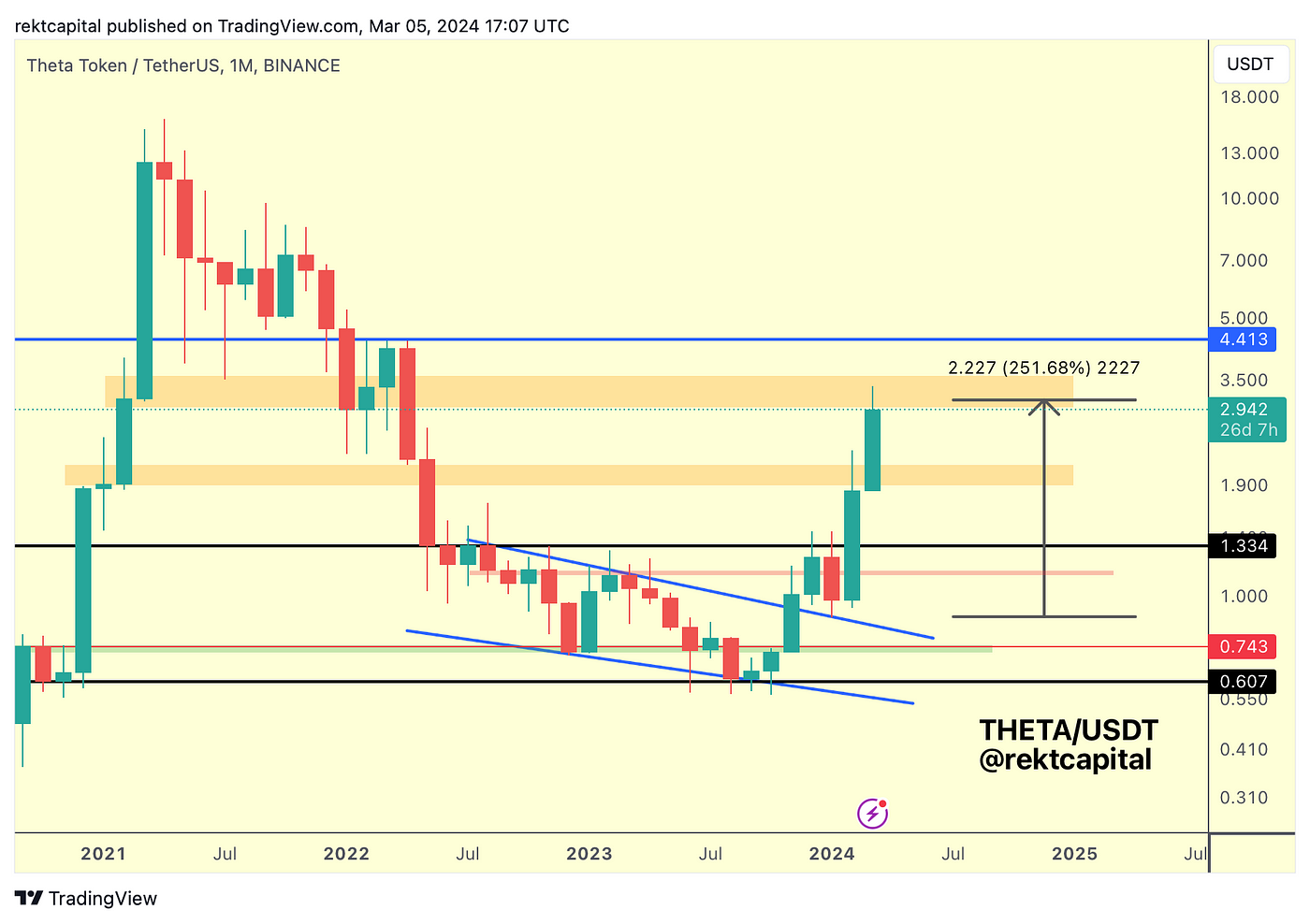

Here’s today’s update:

THETA has enjoyed phenomenal upside since last week, rallying +250% since the breakout point we’d extensively been covering in recent months.

THETA has broken into its orange-orange macro range, revisiting the Range High resistance in the process.

Reclaiming the bottom of the orange Range High resistance box would be bullish, enabling price to rally to the blue resistance at $4.41.

However, because THETA is inside this orange-orange range, until it breaks out from it — technically, there is room for a re-accumulation range to be built right here.

Of course, if given that sort of pullback opportunity into the orange Range Low, I’d certainly be interested in adding to the position.

In the meantime however, it’s better to watch for THETA’s next technical step, whether it becomes ready to breakout from the range, or ready to consolidate within it.

CLICK HERE to go Premium and read the rest of this week’s Market Analysis – Premium subs can read Rekt capital’s full report.

Meme Coins: Why You Shouldn’t Fade Them

Meme coins have pumped tremendously in the past two weeks or so.

They dominate the top gainers dashboard on a weekly and monthly timeframe. In recent years, meme coins have proven that they’re more than a joke and in fact are an investible asset class within crypto.

You have to know when to enter though: around the time the masses arrive. And you have to be aware of the role of meme coin ecosystems.

TO READ THE REST OF THIS ARTICLE, CLICK HERE – “Title Here”

Crypto Market News

- Bitcoin has hit a new all-time high of over $69,000 for the first time since November 2021. Source

- MicroStrategy plans to raise $600M to buy more Bitcoin by offering a private sale of convertible senior notes. Source

- BlackRock has filed with the US Securities and Exchange Commission (SEC) to add Bitcoin ETFs to its strategic portfolio. Source

- Stanford University’s Blyth Fund has allocated 7% of its portfolio to Bitcoin. Source

- Kraken has launched an institutional division to capitalize on the spot Bitcoin ETFs. Source

- Coinbase has expanded its asset recovery tool to Polygon and BNB Chain. Source

- VanEck has launched a self-custodial NFT marketplace and is set to offer split ownership token-backed watches and wine. Source

- Strike app has rolled out its full suite of services to African countries initially including Gabon, Ivory Coast, Malawi, Nigeria, South Africa, Uganda and Zambia. Source

- Coca-Cola HBC has partnered with Solana-based platform ALL.ART to revamp its internal verification system for staff qualifications. Source

- Missing Bitcoin’s top 10 days means you could miss all annual gains according to Fundstrat. Source

- Marathon Digital has announced a Bitcoin Layer 2 network called Anduro. Source

- Marathon Digital’s new Slipstream service has mined the largest Bitcoin block on record. Source

- Bitcoin miner Argo Blockchain has sold its Quebec facility for $6.1M to repay debt owed to Galaxy Digital. Source

- CryptoPunk #3100 has become the second most expensive in the collection after selling for 4,500 ETH which is around $16M. Source

Coins and Projects

- Bitcoin’s market cap has hit a new all-time high of $1.303 trillion after more than 2 years. Source

- BlackRock’s IBIT Bitcoin ETF has crossed $10 billion in assets in just over 7 weeks compared to the first US gold ETF taking over 2 years to hit the same milestone. Source

- Over 97% of Bitcoin wallet addresses are in profit now according to data from IntoTheBlock. Source

- Bitcoin futures on centralized exchanges hit an all-time high of over $26 billion on Friday, March 1 which is higher than Q4 2021. Source

- Tether’s USDT stablecoin has hit a new all-time high in market cap of $1 billion. Source

- Tether has launched a recovery tool allowing users to move their USDT between blockchains if any become unresponsive. Source

- Uniswap has launched a web extension for its wallet. Source

- Arbitrum has partnered with Robinhood to offer swaps to users. Source

- Telegram has launched ad revenue sharing in almost 100 countries with a 50/50 split and rewards paid out in Toncoin. Source

- Ethereum Layer 2 Blast has launched unlocking $2.3 billion in staked crypto. Source

- SynFutures has launched its V3 on Blast and has introduced a points rewards program. Source

- StarkWare has announced a new open-source zero knowledge prover called Stwo. Source

- Worldcoin developer Tools for Humanity has acquired a Solana-based wallet called Ottr. Source

- Chainlink has integrated with Ark Invest for proof of spot Bitcoin ETF reserves. Source

- Fetch.ai has invested $100M in AI-related blockchain technology and introduced rewards for token holders. Source

Macro News

- The US national debt is increasing by $1 trillion every 100 days. Source

- The UK government will be able to freeze crypto assets used in crime without requiring a conviction from April 26. Source

- Turkey’s annual inflation rate has jumped from 65.7% to 67% in February. Source

- OPEC+ has extended its voluntary cuts on oil supply until June. Source

- BRICS has announced plans to create a blockchain-based currency to rival the US dollar. Source

Thank you so much for your support, and I truly hope that today’s issue will give you insights needed to help you master your wealth.

If you are reading this it means you are on the free version of the Wealth Mastery Investor Report, which is great for news and tips on the crypto markets.

If you really want to take advantage of fastest growing asset class EVER, I highly recommend that you check out my new altcoin course: Mastering Altcoin Investing

In this course we’ll teach you all about how to spot, choose and acquire the winning altcoins of the next bull market.

Learn how to build your portfolio so that growth is ensured and risk is mitigated. Let me help you build a strategy that’ll change your life forever in the upcoming bull run.

See you next time!

Lark and the Wealth Mastery Team

💰 BINANCE: BEST EXCHANGE FOR BUYING CRYPTO IN THE WORLD 👉 10% OFF FEES & $600 BONUS

🚀 BYBIT: #1 EXCHANGE FOR TRADING 👉 GET EXCLUSIVE FEE DISCOUNTS & BONUSES

🔒 BEST CRYPTO WALLET TO KEEP YOUR ASSETS SAFE 👉 BUY LEDGER WALLET HERE

📈 TRADING VIEW: BEST CHARTING SOFTWARE ON THE INTERNET 👉 JOIN NOW

1️⃣ COINLEDGER: #1 CRYPTO TAX SOFTWARE 👉 IF YOU OWN OR TRADE CRYPTO YOU NEED THIS

Wealth Mastery (Lark Davis, and the Wealth Mastery writing team) are not providing you individually tailored investment advice. Nor is Wealth Mastery registered to provide investment advice, is not a financial adviser, and is not a broker-dealer. The material provided is for educational purposes only. Wealth Mastery is not responsible for any gains or losses that result from your cryptocurrency investments. Investing in cryptocurrency involves a high degree of risk and should be considered only by persons who can afford to sustain a loss of their entire investment. Investors should consult their financial adviser before investing in cryptocurrency.

You can find a full disclosure of all my crypto & venture investments here.