Next Week Could Be Huge for Bitcoin

The US spot ETFs changed the game—there’s no doubt about it.

Now, more players are lining up to join the game.

Only this time, it’s the banks that will be joining in too.

Keep reading to find out more…here is your weekend crypto update:

Here’s what’s in today’s issue:

- Rebecca shares her thoughts on the battle of the Bitcoin ETF banks, Franklin Templeton liking Bitcoin Ordinals, VC funding making a comeback in crypto, Ethereum L2s possibly exploding to $1 Trillion & an XRP stable coin coming soon.

- Altcoin alpha by David.

- This week’s airdrop by Jesse.

- Sam has an NFT report on What Is AnimeChain?

Thanks to our sponsor CoinStats!

One of the best things about crypto is how diverse and deep the space is.

You have Bitcoin, Altcoins, NFTs, DeFi, and more.

The problem?

Keeping track of everything is literally impossible.😕

That’s where CoinStats comes in.

CoinStats gives you the ability to manage your funds across 300+ wallets & exchanges, 100 blockchains, 1,000 DeFi Protocols & 20,000+ coins.

With CoinStats, you can:

- Get in-depth profit & loss analysis with portfolio analytics 🤑

- Get customized and personalized price alerts 💬

- Set up your crypto Exit Strategy with AI ✨

CoinStats has teamed up with Wealth Mastery to offer readers 50% off on their annual plan.

The Battle Of The Bitcoin ETF Banks

Morgan Stanley and UBS are reportedly going head-to-head to become the first Bitcoin ETF bank.

Whilst there has been no official announcement from either bank, the whispers are coming from crypto insider Andrew AP Abacus.

If this is true, this would be humongous for Bitcoin on top of the already massive announcement of US spot ETFs, plus rumblings of Hong Kong and the UK also launching Bitcoin ETFs later this year.

UBS and Morgan Stanley have ~$4 trillion and $1.5 trillion in global assets respectively. With these banks offering Bitcoin ETFs to their customers, it will only be a matter of time before all banks are doing it too.

So let’s try and unpack what’s really going on here…

- April 2: Andrew says UBS will add Bitcoin ETFs to its platform next week between April 8-12

- April 3: Andrew says Morgan Stanley execs want to be the first to launch and may announce “a few days before UBS”

- April 3: Bloomberg analyst Eric Balchunas says neither of them are yet to add Bitcoin ETFs and are still in a “holding pattern”

This is a watch-this-space kinda story.

Franklin Templeton Likes Bitcoin Ordinals

Bitcoin Ordinals is quite a controversial concept in the Bitcoin community.

It’s yet to be decided whether taking up valuable blockchain space on Bitcoin for memecoins and NFTs is worth it. But one Ordinals fan is Bitcoin ETF issuer Franklin Templeton.

Needless to say, the Bitcoin community was stunned to see Templeton publish a report called “The Rise of Bitcoin Ordinals.” Inside the report, Templeton refers to Ordinals as a “renaissance” that has seen “positive momentum in innovation.”

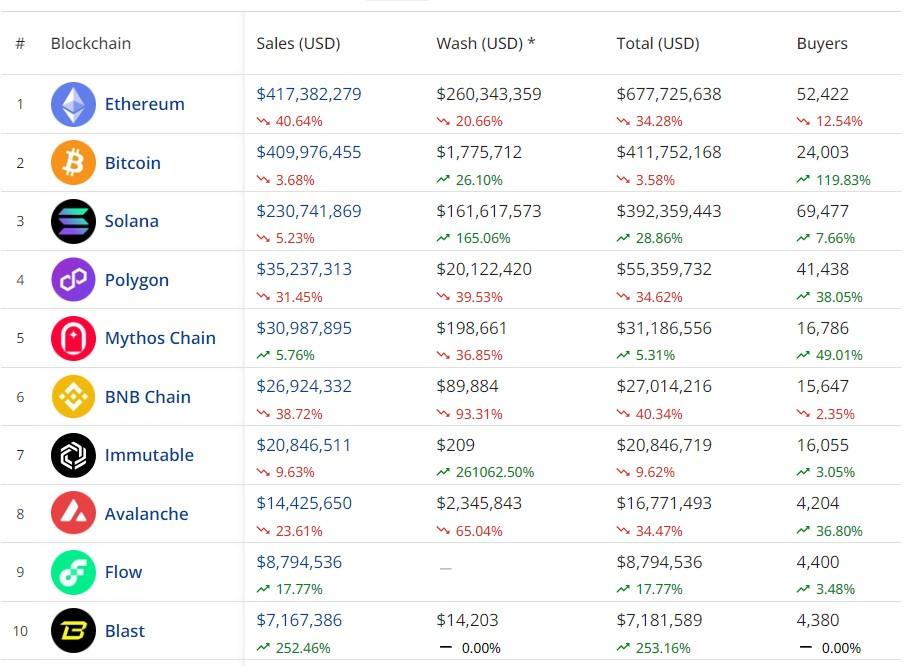

Not only that, but they acknowledge that Bitcoin NFTs are gaining popularity and taking market share away from other blockchains.

This follows on from Templeton’s earlier note to investors on March 14 titled “The Value Between Meme Coins and Their Native Networks.” Inside the bulletin, they acknowledged that memecoins succeed due to the strong community that’s tied to a memecoin’s native blockchain. For example, Solana with BONK.

Ordinals and BRC-20 tokens are now following this same trend, given the strong community surrounding Bitcoin.

What’s funny yet also slightly worrying about this report is how Templeton admits that memecoins require little technical knowledge and have the potential for quick profits.

It’s official…institutions like Bitcoin and memecoins! Wall St. is full of surprises.

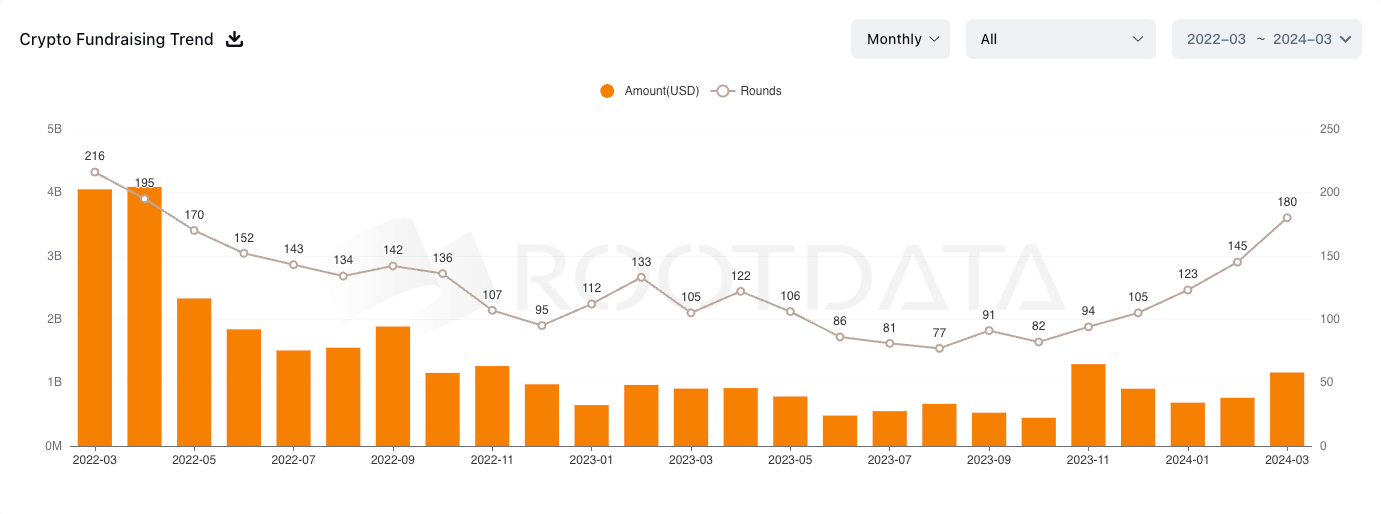

VC Funding Is Making A Crypto Comeback

It’s no surprise to see VCs piling into the crypto space once again. They’re a fickle bunch! As soon as there’s money to be made again, they will be backing as many horses as they can.

And they already are! Crypto VC funding jumped 38% in Q1 compared to Q4 last year with almost $2 billion invested into crypto projects.

$1.1 billion of that came in March, with VC funding up 53% month-on-month.

This was mostly allocated into infrastructure and DeFi projects.

Optimism took the title for the most popular blockchain with $89 million in funding in March alone.

April is already starting off strong with the following VC deals…

- A16z: $30 million in funding for Web3 gaming

- Galaxy Digital: $100M in funding for early-stage crypto startups

VC funding in crypto peaked at $14 billion in Q1 2021 during the previous bull market. So to even get close to those funding levels once again, we have a long way to go!

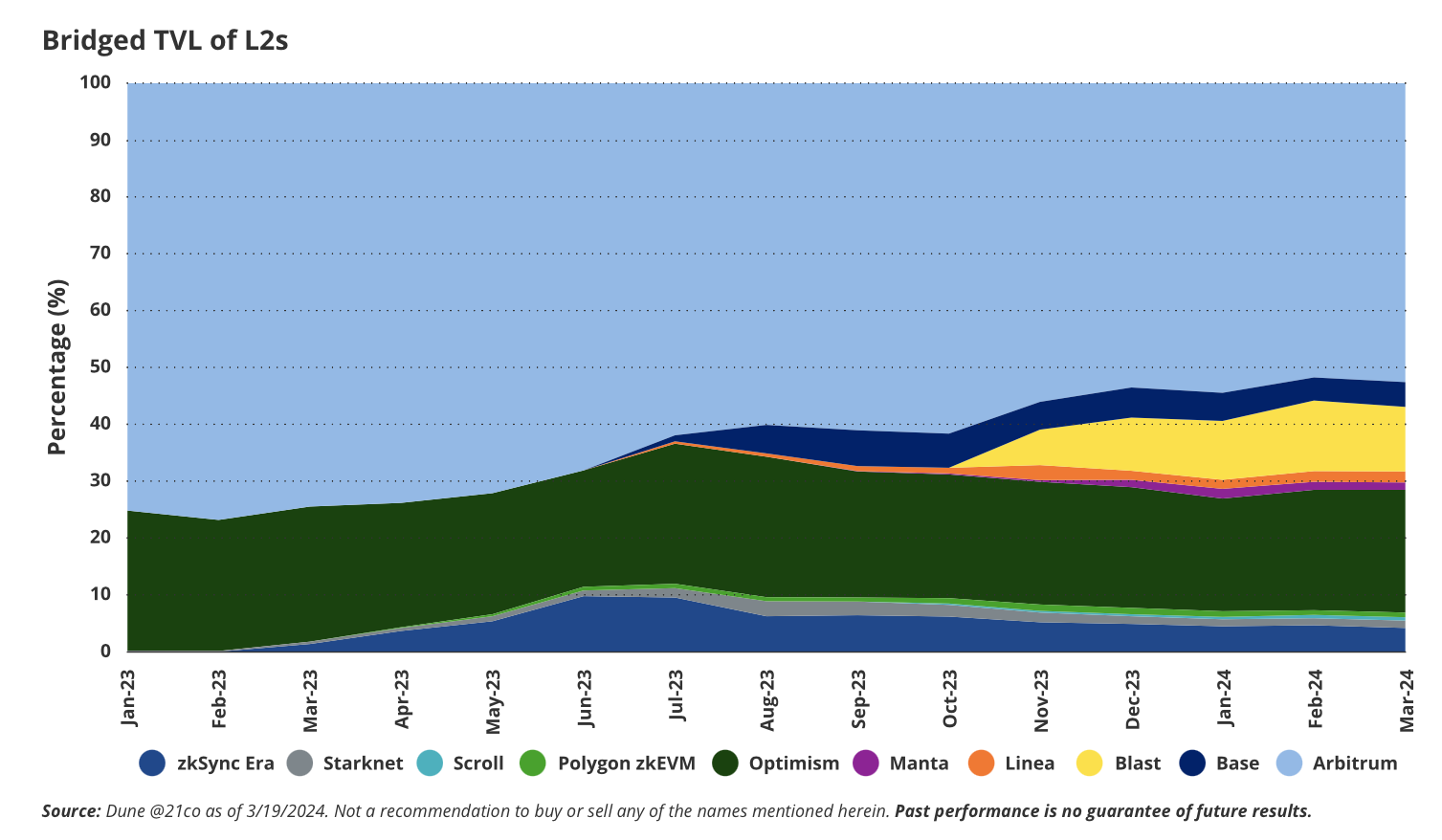

Ethereum Layer-2s Could Explode To $1 Trillion

Analysts at Van Eck have made the bold claim that Ethereum Layer-2s could reach a market cap of $1 trillion by 2030.

They say it’s because Layer-2s will take full advantage of Ethereum’s primary challenge—scalability. Ethereum will struggle with its limited capacity to process and store data. That’s where the Layer-2s will flood the market to plug the gap.

The prediction assumes that Ethereum will take 60% of all public blockchain market share. With ETH Layer-2s currently occupying $39 billion in total value locked (TVL), that’s how they’ve been able to get to the $1 trillion valuation.

But before you go FOMO’ing into Layer-2 tokens, VanEck has issued a warning.

They believe that whilst the Layer-2 market will explode in value, there will be thousands of players and only a few winners.

The blockchain space is cut-throat and the competition will be tough, so you better choose wisely.

An XRP Stablecoin Is Coming Soon

Tether’s USDT and Circle’s USDC stablecoins are getting fresh competition from none other than Ripple and XRP.

Ripple is planning to launch a US dollar stablecoin backed entirely by US dollar deposits, government bonds and cash equivalents.

The stablecoin will be launched on XRP Ledger and Ethereum later in the year as Ripple is eyeing up a piece of the stablecoin market share.

According to Ripple, the stablecoin sector could grow to $2.8 trillion by 2028. So they see this stablecoin demand as a way to create more use cases and liquidity for its XRP Ledger.

The competition isn’t mad about it either. The CEO of Circle welcomes Ripple’s stablecoin as it encourages “a compliance-first approach to building on-chain dollars.”

Does this signal the death of Ripple’s XRP token? Reply to this email and let us know what you think.

Existing Projects / Tokens

- Celestia [TIA] is now available for developers using Arbritrum Orbit. This means developers building L2s or L3s with Orbit can now tap Celestia for data availability services. More demand for Celestia = more demand for TIA = higher TIA prices.

- Clearpool [CPOOL] is expanding to Avalanche. Clearpool is a decentralized credit marketplace that has originated over $480M in loans.

- Frax Finance’s [FXS] fee switch proposal has been activated. This past week, FXS stakers earned approximately $400K in protocol fees.

- LYRA is now available on Base, Etheruem’s 3rd largest L2. Lyra is a spot, perpetuals, and options exchange, powered by Optimism and Celestia.

- Optimism [OP] recently announced a fresh allocation of 850M OP ($3.3B) to incentivize and fund ecosystem developers and builders. This creates price compression in the short term, but is bullish long term.

- Synthetix [SNX] will soon be made available on both Solana and Sui blockchains.

Upcoming Projects / Tokens

- Mina Protocol [MINA] developers are running final tests before Mina’s Berkeley upgrade, which will launch Mina’s mainnet. Mina is a ZK proof protocol.

Level Up Your Altcoin Investing Game

Explore the new Mastering Altcoin Investing Course. In this value-packed course, we’ll teach you all about how to spot, choose and acquire the winning altcoins of the next bull market.

ChoiseAI wants to combine significant crypto expertise and strong market vision to build the most powerful MetaFi ecosystem accessible within a single App. Providing seamless crypto purchasing and swapping, interest accounts, passive income on your holdings, access to liquidity pools, and many other earning tools. Choise has something to offer every crypto user.

However, Choice is not a new project. It was originally launched as Crypterium back in 2017. After the recent rebrand to Choise, the project has decided to launch a Choise TaskOn Campaign to bring new users to the project. This Campaign includes a prize pool of $1,000 USDT and 40,000 CHO Tokens.

Participating in this event is super easy. Just head over to the campaign page and follow the 10 simple steps. At the end of the follow and join journey, you’ll be able to upload your confirmation email to be entered into the ChoiseAI raffle.

What Is AnimeChain?

AnimeChain is a new project that’s building an anime-focused specialist chain on Arbitrum, and aims to become a hub for Web3 anime activity, while onboarding users from Web2.

Chiru Labs, the Weeb3 Foundation, and the Arbitrum Foundation are working together to build AnimeChain, but there is competition from Capsule House, which launched a token called ANIME, and from Anime Foundation, a project being built with the involvement of San FranTokyo and Animoca Brands.

TO READ THE REST OF THIS ARTICLE, CLICK HERE – “What Is AnimeChain?”

Go Premium To See This Weeks Top 3 NFT Mints

Subscribe to the Wealth Mastery Premium Investor Report to get this weeks top 3 NFT mints AND gain full access to the premium archives.

Thank you so much for your support, and I truly hope that today’s issue will give you insights needed to help you master your wealth.

If you are reading this it means you are on the free version of the Wealth Mastery Investor Report, which is great for news and tips on the crypto markets.

If you really want to take advantage of fastest growing asset class EVER, then the Premium subscription is for you.

Premium Members get access to:

- My updated portfolio

- Technical Analysis from Rekt Capital

- Deep dives on altcoins

- DeFi tutorials

- Airdrop reports

- NFT drop reports

The time to build your portfolio is now. Don’t get left behind.

See you next time!

Lark and the Wealth Mastery Team

💰 BINANCE: BEST EXCHANGE FOR BUYING CRYPTO IN THE WORLD 👉 10% OFF FEES & $600 BONUS

🚀 BYBIT: #1 EXCHANGE FOR TRADING 👉 GET EXCLUSIVE FEE DISCOUNTS & BONUSES

🔒 BEST CRYPTO WALLET TO KEEP YOUR ASSETS SAFE 👉 BUY LEDGER WALLET HERE

📈 TRADING VIEW: BEST CHARTING SOFTWARE ON THE INTERNET 👉 JOIN NOW

1️⃣ COINLEDGER: #1 CRYPTO TAX SOFTWARE 👉 IF YOU OWN OR TRADE CRYPTO YOU NEED THIS

Wealth Mastery (Lark Davis, and the Wealth Mastery writing team) are not providing you individually tailored investment advice. Nor is Wealth Mastery registered to provide investment advice, is not a financial adviser, and is not a broker-dealer. The material provided is for educational purposes only. Wealth Mastery is not responsible for any gains or losses that result from your cryptocurrency investments. Investing in cryptocurrency involves a high degree of risk and should be considered only by persons who can afford to sustain a loss of their entire investment. Investors should consult their financial adviser before investing in cryptocurrency.

You can find a full disclosure of all my crypto & venture investments here.