Bullish for Bitcoin? Genesis GBTC Offloaded

GM friends.

Here we are now in the halving month, and after a period of chop and consolidation, there are plenty of crypto positives lining up.

So, let’s start with a look at Genesis, what’s happened to its GBTC share selling, and how the funds raised might be kept within the crypto ecosystem.

Here’s what’s in today’s issue:

- Sam shares his thoughts on Genesis being done selling GBTC, a BlackRock ETF update, Aave possibly turning on the fee switch, Solana’s network congestion & Korean politicians backing BTC ETFs.

- Week 8 update on the 10x portfolio.

- This week on chain.

- This week’s trending coins by Rebecca.

Thanks to our sponsor CoinStats!

One of the best things about crypto is how diverse and deep the space is.

You have Bitcoin, Altcoins, NFTs, DeFi, and more.

The problem?

Keeping track of everything is literally impossible.😕

That’s where CoinStats comes in.

CoinStats gives you the ability to manage your funds across 300+ wallets & exchanges, 100 blockchains, 1,000 DeFi Protocols & 20,000+ coins.

With CoinStats, you can:

- Get in-depth profit & loss analysis with portfolio analytics 🤑

- Get customized and personalized price alerts 💬

- Set up your crypto Exit Strategy with AI ✨

CoinStats has teamed up with Wealth Mastery to offer readers 50% off on their annual plan.

Genesis GBTC Selling Finished

According to a court filing, as of April 2nd, Bankrupt crypto lender Genesis finished selling GBTC, having offloaded almost 36 million of the Grayscale shares over the last three weeks.

This was all part of a plan for Genesis to reimburse its creditors, as having sold off the GBTC shares, the money raised was then used to purchase 32,041 BTC, also on April 2nd. And with those bitcoin currently valued at close to $2.2 billion, this stack will be used to pay back Genesis’ out-of-pocket customers.

This appears to have been an effective strategy, as the price of GBTC shares rose by about 50% in the period between Genesis being given permission to sell by the bankruptcy court at the start of February, and actually selling the assets this month, while the price of BTC at the time of the Genesis purchase (below $66K) was lower than it is right now (above $72K at the time of writing.)

What’s more, converting the shares to their underlying BTC in this way increases the likelihood that funds will remain in the crypto ecosystem, an outcome that’s especially probable during a bull market.

How do you feel about this development, is it bullish for bitcoin, and how do you see the situation with GBTC outflows–have they affected the BTC price, and what happens when they stop? Reply to this email and let us know what you think.

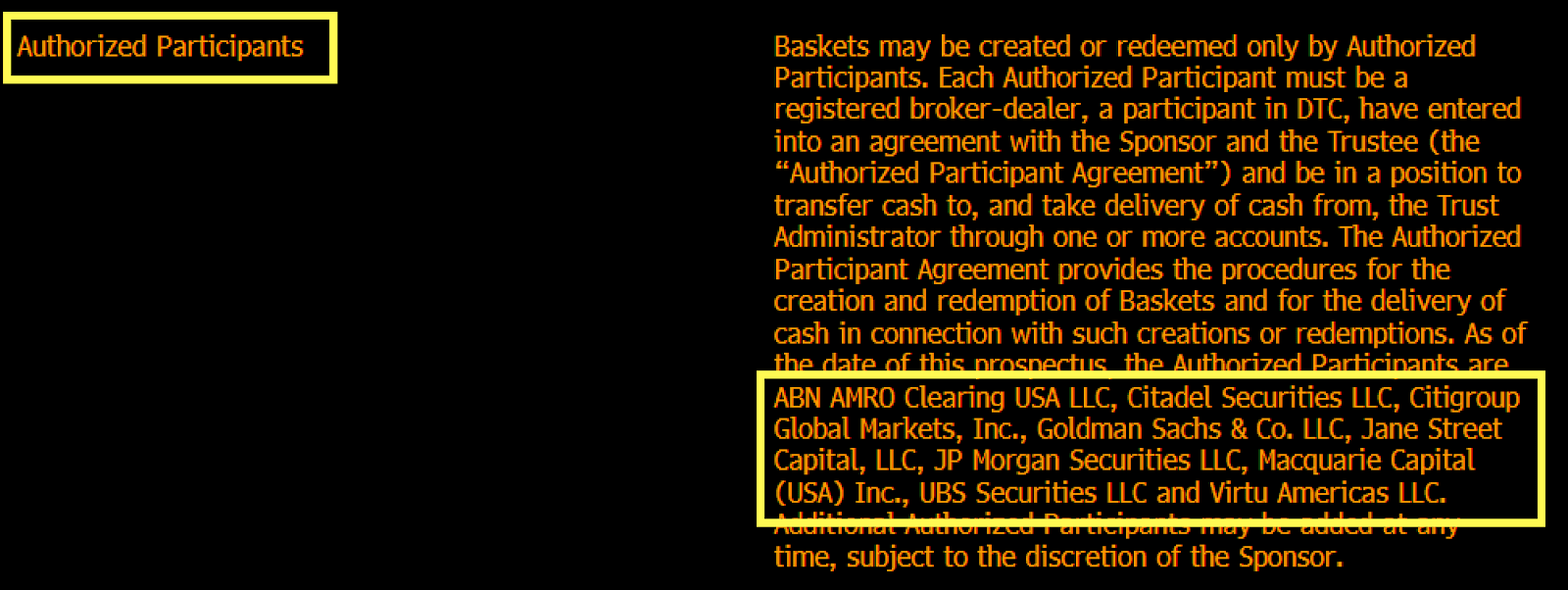

BlackRock ETF Update Names Major Firms as APs

Remember way back… let me see… way back last week, when the Chief Investment Officer of Goldman Sachs’ Wealth Management Unit declared, “we’re not believers in crypto”, and stated that bitcoin “creates absolutely no value in any shape or form.”

Sounds bad, you might have thought, but then, it turns out there’s a contradiction between Goldman Sachs’ statements and Goldman Sachs’ actions, as updates to BlackRock’s BTC ETF prospectus have revealed an extended list of Authorized Participants, and among the names is–you guessed it–none other than Goldman Sachs!

Authorized Participants take care of share creation and redemption, and are integral to the provision of liquidity, and besides Goldman Sachs, BlackRock has also added TradFi giants Citigroup, ABN Amro, UBS, and Citadel Securities as named APs.

It’s not clear whether these entities have recently jumped on board, or are simply now relaxed about their Bitcoin connections becoming public knowledge, but it seems that with the ETF launches exceeding even the most bullish of expectations, and with BTC looking increasingly legit outside of crypto circles, it’s good PR to be part of the movement.

Is an Aave Fee Switch Incoming?

With the Aave treasury containing around $50 million in ETH, stable coins, and other tokens, the Aave DAO pulling in around $60 million a year in profits, and a substantial runway in place, Aave, which is a decentralized lending platform, is now contemplating a fee switch.

This means there would be a change in the protocol that could allow for governance to put in place a revenue sharing system, distributing fees among Aave holders.

That possibility is according to a Twitter post from Marc Zeller, the founder of Aave Chan–which itself is the primary delegate of the Aave DAO–who has announced that there will be a temperature check this week, allowing participants to register agreement or otherwise.

The AAVE one month chart

The price of the AAVE token–which has a market cap around $1.8 billion–has risen since that announcement, although it has recently been going through a choppy period anyway, and remains within its prior range.

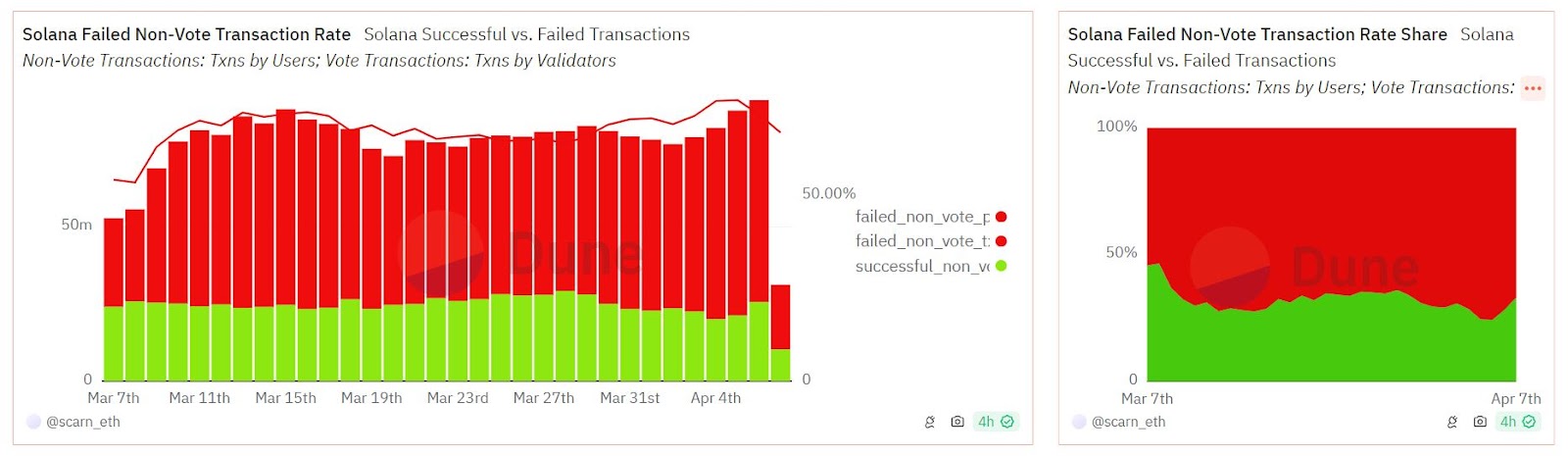

Solana Surge Brings Network Congestion

If you’ve been using the leading Solana wallet Phantom recently, then you may have come across this warning when you opened it up from your browser bar: Solana is experiencing network congestion.

So what’s going on, wasn’t Solana supposed to be taking over from Ethereum as the future of betting on pictures of animals the future of finance?

Well, yes, maybe not entirely taking over from Ethereum (yet), but providing solid competition, and in fact, that may be exactly why the network is feeling a little jammed up at the moment, as the huge surge in on-chain activity is testing Solana’s operational capacity.

At its worst point, late last week, the transaction failure rate was hitting 75%, and Helius CEO Mert (among others), has pointed out that Solana is currently not well equipped to deal with bot spam on the network, although he also offered reassurance that networking patches are on the way, and he questions the usefulness of charts like the one above (showing failed transactions), as they mostly represent “just bots failing arbitrage attempts.”

On top of spam activity, the impact of the newly launched token mining protocol Ore has also been highlighted, as its users have reportedly been creating over one million transactions per hour.

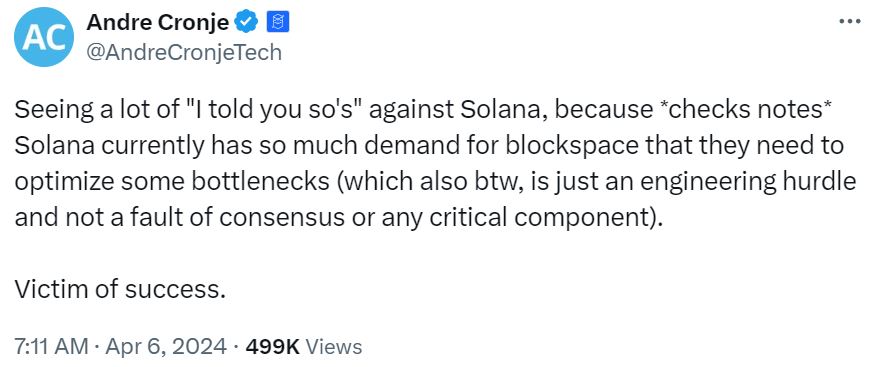

However, hitting back at Solana FUD, the Director of Fantom (as in the blockchain, with an F, not the Solana wallet, with a PH), Andre Cronje, tweeted that Solana is a “victim of success”, and that current problems stemming from demand for blockspace are “just an engineering hurdle and not a fault of consensus or any critical component.”

Also, just for context, don’t forget that CryptoKitties broke Ethereum back in 2017, but that didn’t turn out too badly for Ethereum in the end, as it seems that improvement through battle-testing is part of the crypto process.

Korean Politicians Back BTC ETFs

Finally, let’s circle back to those BTC ETFs, but from an East Asian perspective. Over in Korea, national elections are scheduled for April 10th, and in statements that will make bitcoin bulls happy, a policy specialist speaking on behalf of the Democratic Party, which is an opposition party, explained, “we’re going to allow the ETFs, whether domestic or overseas.”

However, Korea is also set to implement stricter crypto rules covering new token listings on centralized exchanges, with the incoming guidelines due to take effect later in April or early in May, so there’s currently a mixed picture emerging.

That all said though, with spot BTC ETFs likely to be approved in Hong Kong later this year, and the possibility of Korea giving the go-ahead to ETFs too, it looks like Asia may be about to provide Bitcoin with another major boost.

But what do you think, will Runes tokens on Bitcoin take off, and are you positioning yourself now to take advantage of the opportunity? Reply to this email and let us know what you think about Runes.

Week 8 Crypto Portfolio Updates

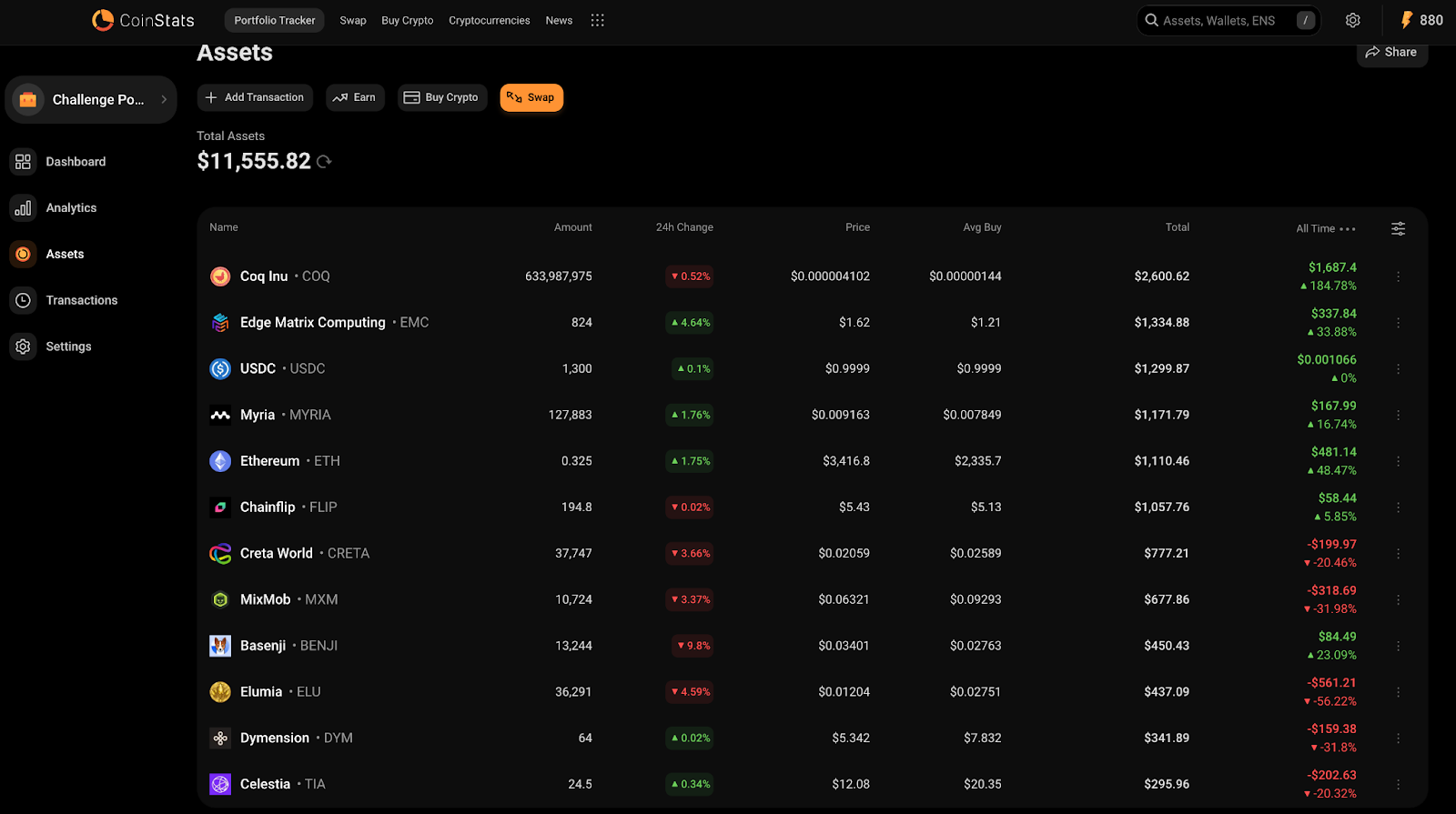

Overall an uneventful week for the portfolio. The portfolio is largely following the general sentiment in the market right now. Still in profits, but not by much. Coq Inu still holding up the portfolio.

Our recent meme coin purchase of Benji had a nice initial pump, but has since mellowed out, still in profit though and still has decent potential for a meme coin. Holding for now.

Gaming coins are rekt, but I don’t think they will stay that way.

Unrealized losses on Elumia right now are brutal. Needs to pump 100% just to get back to break even.

Some of this gaming stuff feels almost irrationally oversold. Although this portfolio might be overexposed to gaming.

Perhaps I will cut one of these and put it into another memecoin, or maybe some kind of DeFi play. For example, I might cut Myria and put the money into something on BASE like AERO or Baseswap.

Part of me thinks I should be doing some more short term plays in this portfolio to make it a little more exciting, and maybe I will add in some more stuff like that going forward.

But, also, this portfolio just underlines what a lot of investing is, waiting and boring consistency of showing up and putting in the work.

Got Kamino airdrop, or well more accurately I can see how many coins I will get. It was super lame. Getting my funds out of Kamino. Let’s move on to find the next one.

This is a big reality with airdrop farming you won’t win them all. I did make $6 in interest. The airdrop itself will be worth about $25-30… Not great, but also a 10% return in 8 weeks, so not terrible in perspective.

When I do finally get the coins I will sell them for USDC.

For now I am moving the funds into Marginfi as it is also on Solana and has not done their snapshot for their airdrop yet. When I get that one, I might move the funds off of Solana and into something like Elixir. That remains to be seen though, as I may simply move to another Solana farm when the time comes.

This is the last week of social and gaming missions for NYAN HEROES. Reminder if you want to get involved in this free airdrop to follow the link, Enter Code “TheCryptoLark”.

I did this week’s tasks for the PARAM airdrop, all just sharing stuff. Not hard, but also might not be huge because it is so easy.

Got the TORO airdrop for my TIA staked in Milkyway, claimed the airdrop anyway, the coins will be sent to my wallet in about two weeks when the claim period ends.

I don’t expect much from this to be clear, but hey, possible free money.

Still waiting on the Milkyway snapshot to be taken to see if it is worth anything. I feel like a lot of people are expecting a JITO like airdrop that makes thousands, but my feeling is it will probably not be a crazy one.

Missed Nibiru KYC, damn, I am upset with myself for that one. It was such an easy thing to do too, but I missed the deadline for doing the KYC. I know KYC for airdrops is kind of BS, but I had no problem doing it. I just dropped the ball.

Still a lot of good airdrops coming up. Will try to find a new one to share next week.

And, yes, as usual still pushing transactions across the layer twos and testnets.

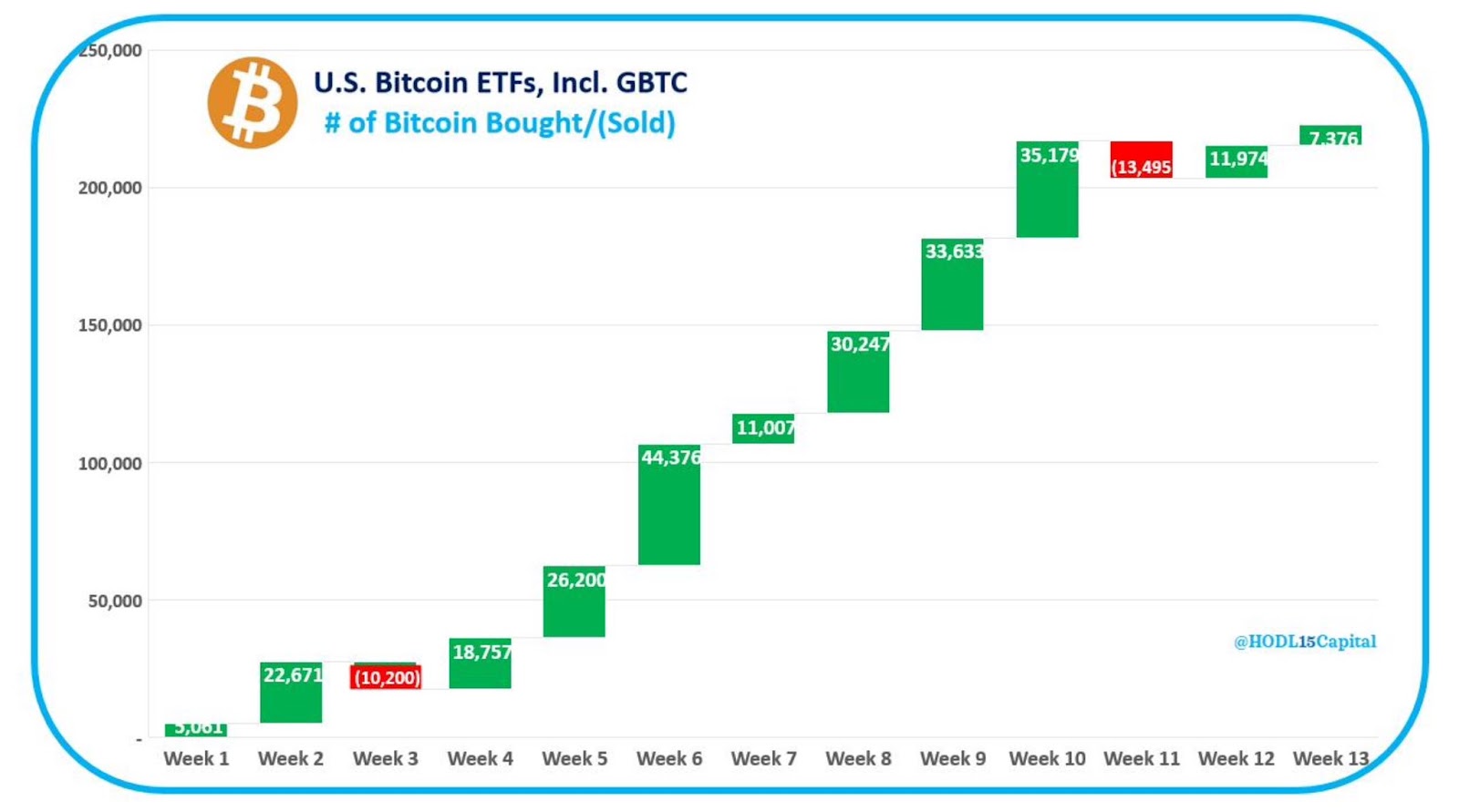

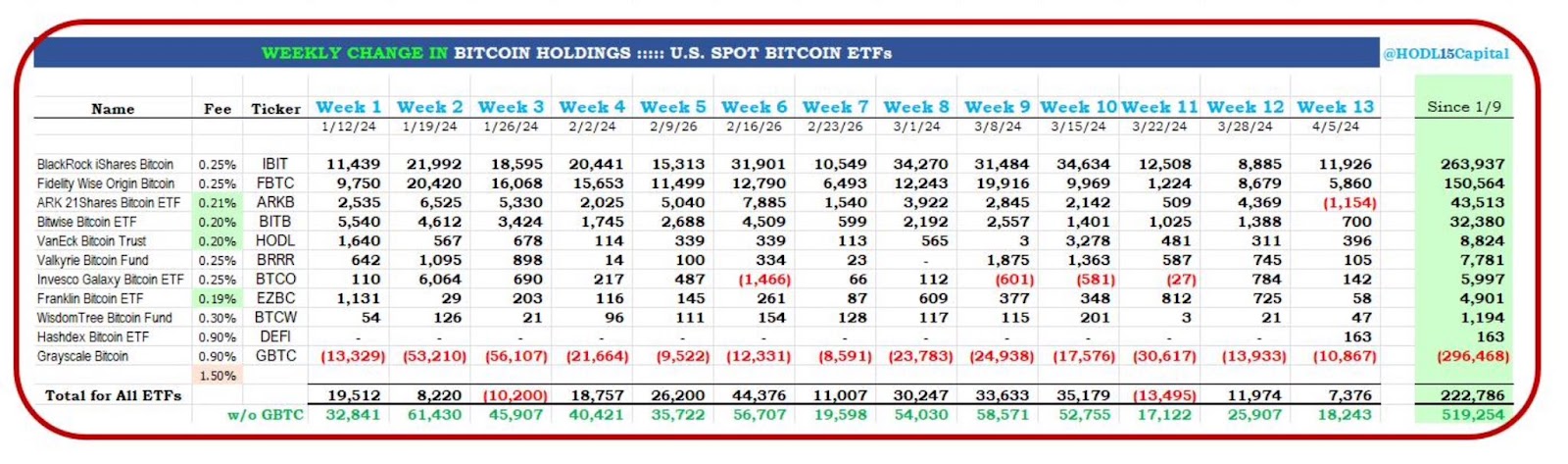

Starting with a look at the BTC ETFs, we can see that last week was another green week, with a net 7,376 BTC added across all funds, despite Grayscale selling another 10,867 BTC, and with the ARK 21Shares ETF seeing its first negative week since launch.

It’s also notable that after Fidelity almost catching up with BlackRock’s inflows the week prior, BlackRock came back to display renewed dominance.

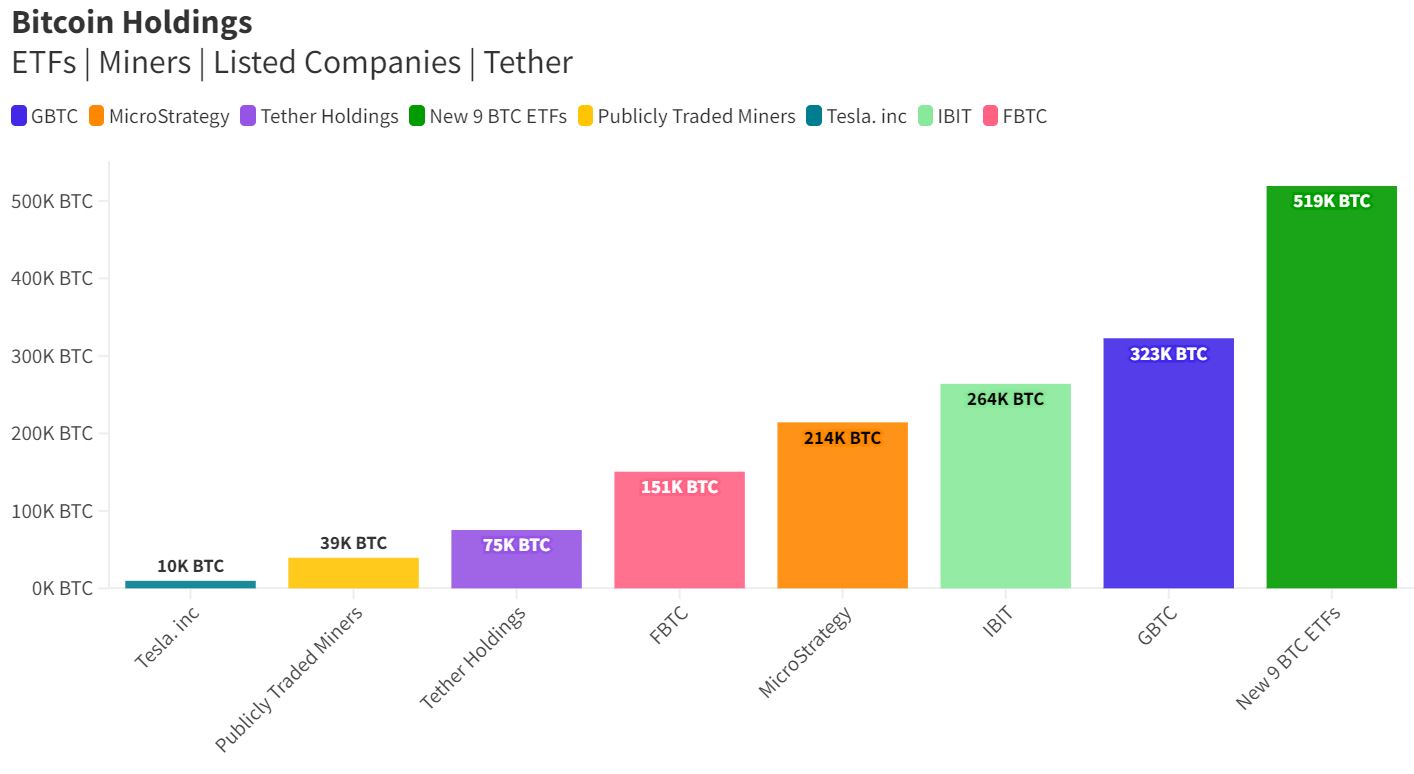

We can also see that the ETFs are changing the overall Bitcoin landscape as they absorb increasing amounts of the available supply of coins, as is apparent when we compare BTC holdings, with the nine new ETFs now in possession of 519,000 BTC, while GBTC holds 323,000 BTC, while by comparison, MicroStrategy holds 214,000 BTC and Tether holds 75,000 BTC.

This stacking of supply by the ETFs is particularly relevant if we consider how the market has been comfortably absorbing BTC selling when it occurs.

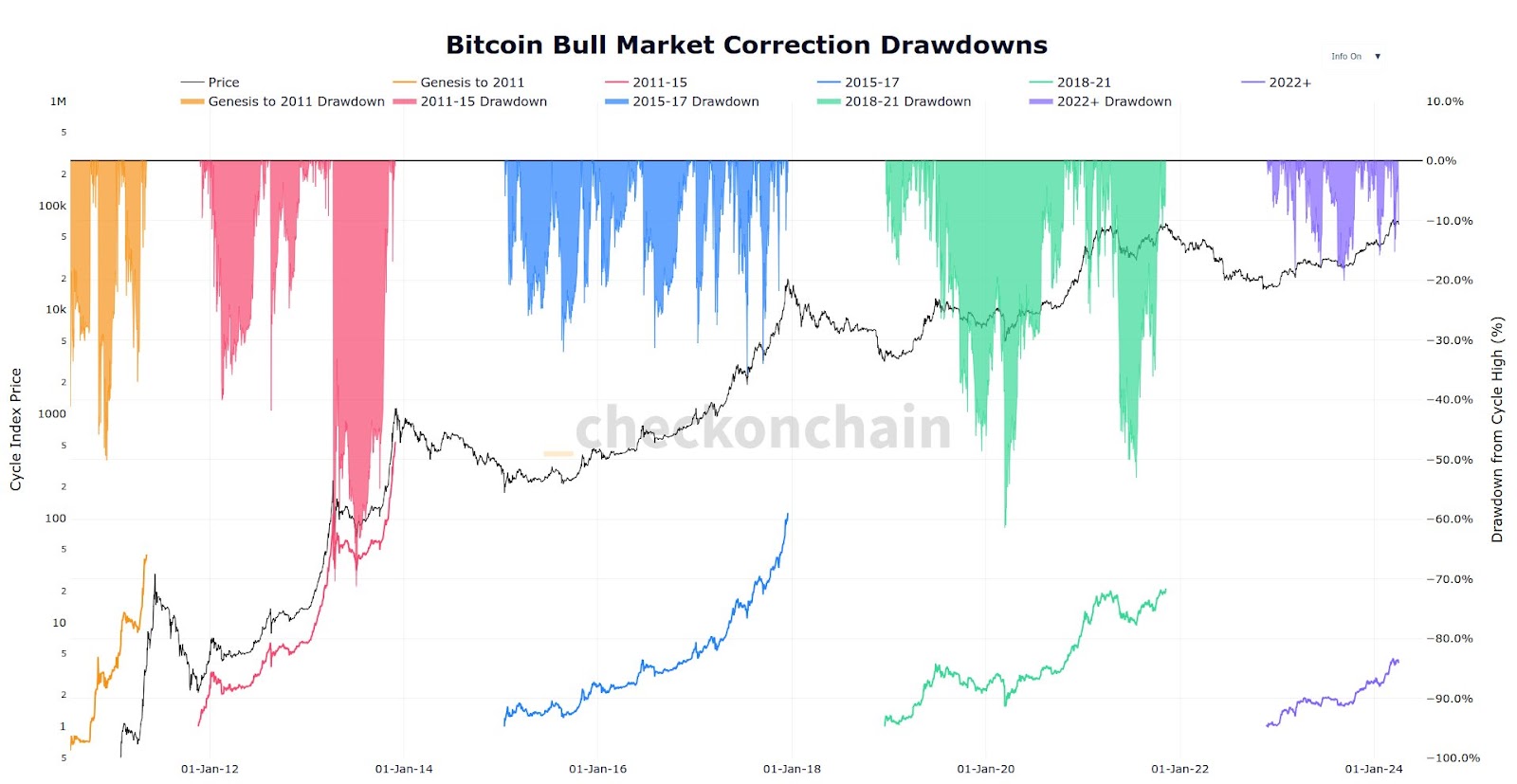

We can pick up on this if we look at how shallow recent drawdowns have been compared to those in previous cycles, with none hitting the 20% mark so far (although a bigger drop is always possible), even though some very deep pullbacks were common in previous bitcoin bull markets.

Away from Bitcoin, while Solana has been receiving all the attention, Avalanche provides another interesting ecosystem, and we can see that liquidity there has been rising, with the Avalanche stable coin market cap climbing this year to approach $1.8 billion, although its 2022 peak was around $4.5 billion, so there’s still some way to go to reclaim that.

And another network positioning itself as a solid ecosystem in which to find early plays, with some of its meme coins picking up holders lately, is the Layer-2 Base.

If we compare its performance to that of the Ethereum Layer-1, then Base its outstripping Ethereum with 36 tps, compared to 14 tps, indicating that it has the capacity to scale as new users come onboard.

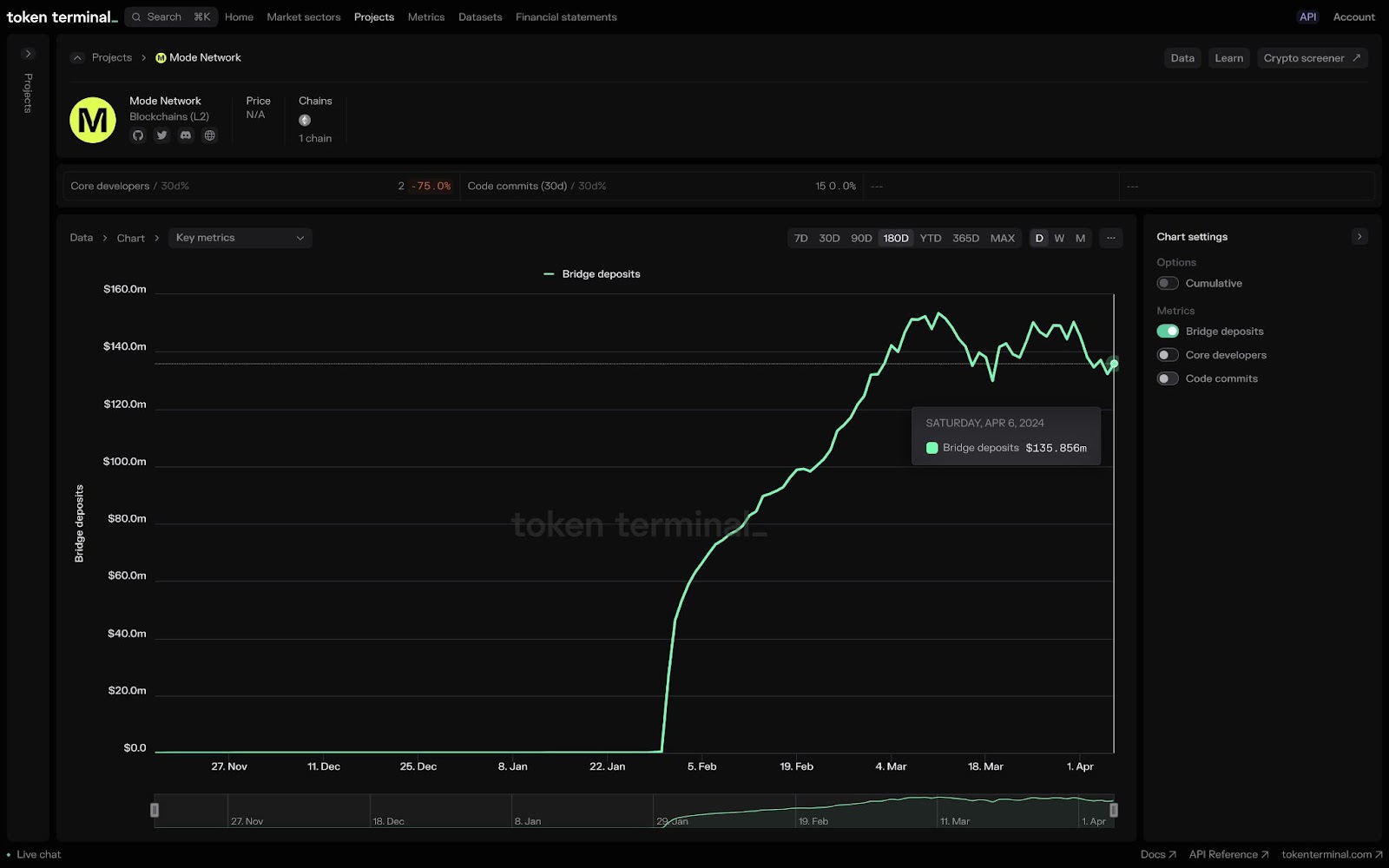

That said though, Ethereum now is all about its many Layer 2s, and another among them is Mode Network, which describes itself as “the Modular DeFi L2”. And it looks like Mode is picking up and keeping users, as bridged deposits have reached up to around the $140 million mark.

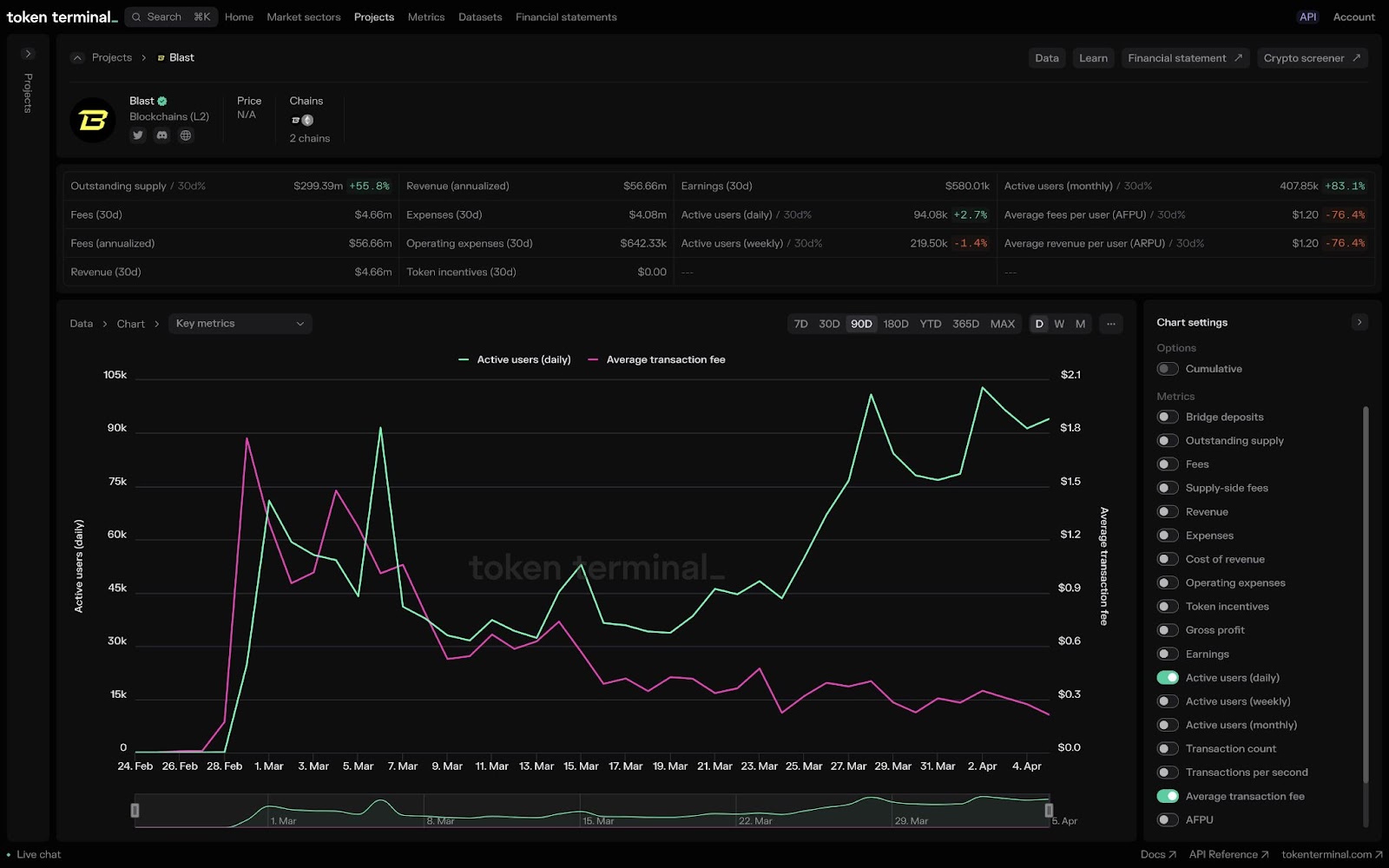

Continuing on the subject of Layer-2s, one of the most hyped launches this year was Blast.

It’s still early days for the new network, and crypto attention is being fragmented across a wide range of competing projects and tokens, but Blast has been experiencing solid growth over the past several weeks, with the number of daily active users now approaching the 100,000 mark.

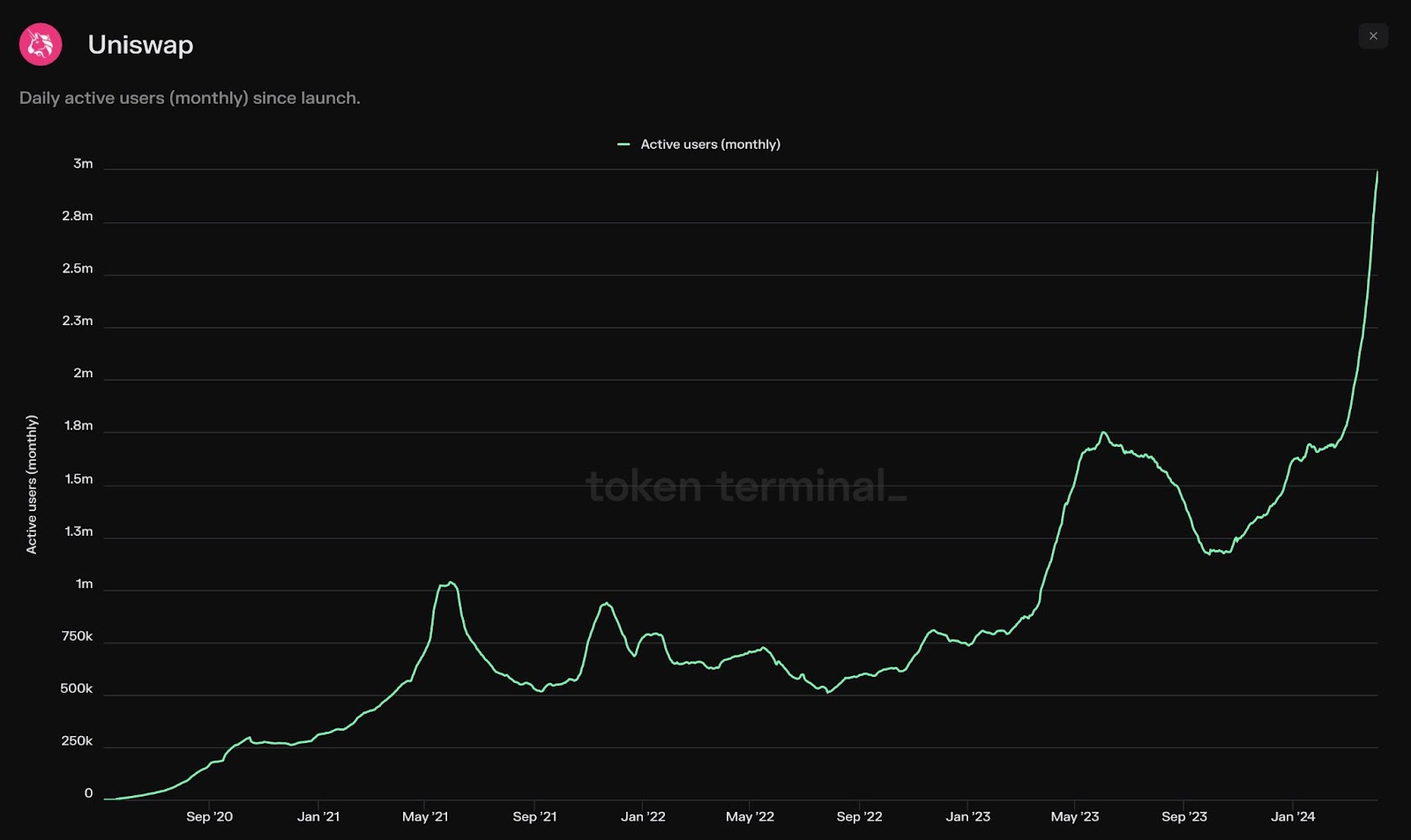

Strong user growth is also apparent on Uniswap, which has seen its monthly active user numbers soar to around three million this year, having been below 1.8 million at the start of 2024.

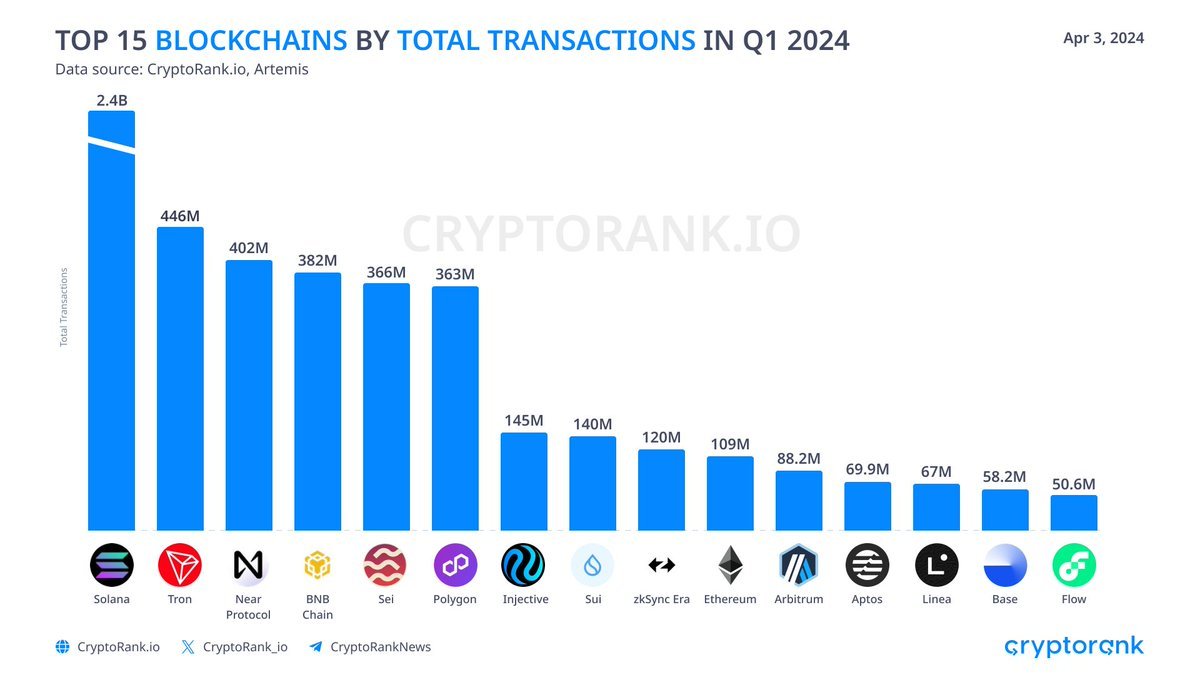

However, as mentioned, Solana has been at the forefront of this current cycle, and to get an idea of its ascent, we can compare the total number of transactions across different networks, and see that Solana is way out in the lead this year, with 2.4 billion transactions in Q1 2024.

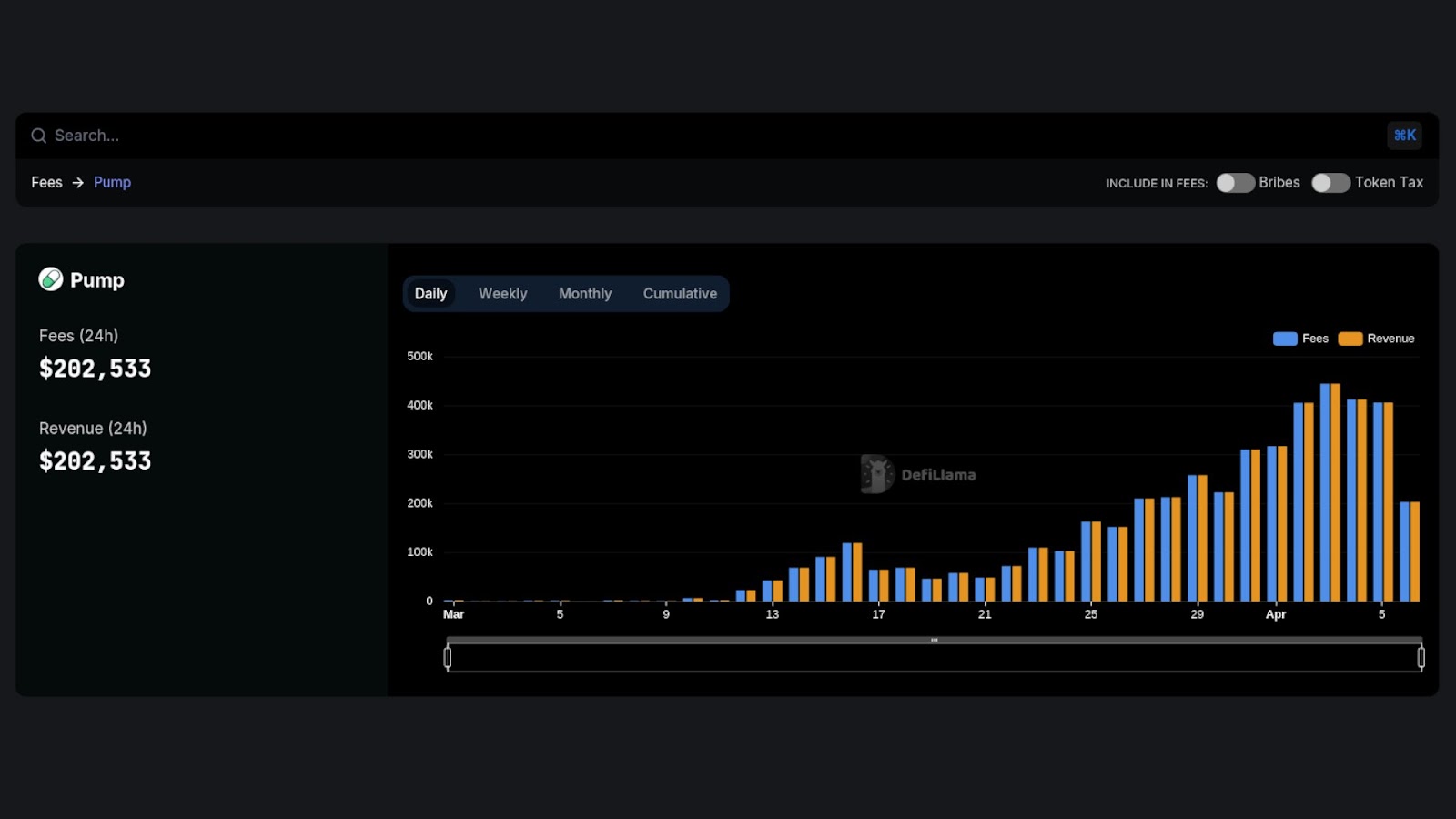

Much of Solana’s activity has been meme-related, and as meme coins look set to be a prominent category this cycle, it’s worth keeping tabs on Pump.

This is a new platform that lets users launch meme tokens very cheaply and without having to seed liquidity, and it’s been growing steadily in terms of fees and revenue, with momentum continuing into April.

Here are my key takeaways from the trends this week and amongst the token listings, partnerships and airdrops there has of course been bugs and exploits too!

- Gala is a play-to-earn (P2E) gaming and music ecosystem that’s partnered with a blockchain-based travel platform called Staynex. The trailer has also been launched for a film on the Gala blockchain.

- Cat in a dogs world is a Solana-based memecoin that’s seen BitMEX co-founder Arthur Hayes tweet about the MEX token.

- CatCoin is a memecoin on BNB Chain, Ethereum and Solana that’s been listed on MEXC for trading. Catcoin has also been included in the BNB Chain’s Meme Innovation Battle where up to $1M is up for grabs.

- Moon Tropica is a roleplaying game that’s been featured in a YouTube video from crypto influencer Alex Becker.

- Artrade is an NFT marketplace on Solana for Real-World Assets (RWA) that’s been listed on Gate.io, Coinstore and AscendEx for trading.

- Aerodrome Finance is a liquidity marketplace on Base that’s teasing the upcoming launch of Slipstream.

- Wormhole is a token bridge that’s suffered a $223M exploit after hackers meddled in the airdrop for its W token. The airdrop launched on April 3 which saw 617M tokens distributed to users.

- Ethena is a DeFi platform that’s added Bitcoin as backing for its USDe yield-bearing stablecoin to make it safer. Fantom’s Andre Cronje is concerned USDe could be the next Terra Luna. Ethena also airdropped 750M ENA tokens to USDe holders on April 2.

- Degen is a newly launched Layer-3 blockchain on top of Base that’s been listed on Phemex for trading.

- Ondo is a Real-World Assets (RWA) platform that’s been featured in a Chainalysis article about asset tokenization.

- Brett is a memecoin on Base that’s become the largest memecoin on the network after increasing 89% in a week.

- Affyn is a metaverse and Web3 gaming ecosystem that’s launched its Play-2 airdrop event that’s happening from April 4 to May 2.

- NodeAI is a GPU network that’s announced it will be launching a Layer-1 blockchain. NodeAI has also announced an enterprise partnership with Zignaly who will be providing GPU nodes to power their investment algorithms.

- Solana is a Layer-1 blockchain that’s suffered network congestion due to the memecoin mania causing 75% of transactions to fail. Solana founder Anatoly Yakovenko has said the bug that caused the congestion has been fixed.

- Bitcoin has gotten more backing from Wall St. as Goldman Sachs, Citigroup, and UBS have been added as authorized participants in BlackRock’s spot ETF.

Thank you so much for your support, and I truly hope that today’s issue will give you insights needed to help you master your wealth.

If you are reading this it means you are on the free version of the Wealth Mastery Investor Report, which is great for news and tips on the crypto markets.

If you really want to take advantage of fastest growing asset class EVER, I highly recommend that you check out my Altcoin course: Mastering Altcoin Investing

In this course we’ll teach you all about how to spot, choose and acquire the winning altcoins of the upcoming bull market.

Learn how to build your portfolio so that growth is ensured and risk is mitigated. Let me help you build a strategy that’ll change your life forever in the upcoming bull run.

See you next time!

Lark and the Wealth Mastery Team

💰 BINANCE: BEST EXCHANGE FOR BUYING CRYPTO IN THE WORLD 👉 10% OFF FEES & $600 BONUS

🚀 BYBIT: #1 EXCHANGE FOR TRADING 👉 GET EXCLUSIVE FEE DISCOUNTS & BONUSES

🔒 BEST CRYPTO WALLET TO KEEP YOUR ASSETS SAFE 👉 BUY LEDGER WALLET HERE

📈 TRADING VIEW: BEST CHARTING SOFTWARE ON THE INTERNET 👉 JOIN NOW

1️⃣ COINLEDGER: #1 CRYPTO TAX SOFTWARE 👉 IF YOU OWN OR TRADE CRYPTO YOU NEED THIS

Wealth Mastery (Lark Davis, and the Wealth Mastery writing team) are not providing you individually tailored investment advice. Nor is Wealth Mastery registered to provide investment advice, is not a financial adviser, and is not a broker-dealer. The material provided is for educational purposes only. Wealth Mastery is not responsible for any gains or losses that result from your cryptocurrency investments. Investing in cryptocurrency involves a high degree of risk and should be considered only by persons who can afford to sustain a loss of their entire investment. Investors should consult their financial adviser before investing in cryptocurrency.

You can find a full disclosure of all my crypto & venture investments here.