Bitcoin, Why You Sleeping RN?

GM friends.

Are you scratching your head about bitcoin’s boring price performance? Well today, we’re going full macroeconomics to figure out what’s the deal.

Pour that coffee, and buckle in. Here comes your mid-week crypto update. ☕️📰

Here’s what’s in today’s issue:

- David shares his thoughts on Macro factors influencing Bitcoin, the US government looking to sell more Silk Road Bitcoin, Argentina passing mandatory registration for crypto platforms, Goldman Sachs hating on crypto bros & Celestia going to Arbitrum Orbit.

- Rekt Capital has the latest technical analysis for you on the market.

- Erik has an article deciphering how far into this bull market we are right now.

- In case you missed it by Rebecca.

Thanks to our sponsor CoinStats!

One of the best things about crypto is how diverse and deep the space is.

You have Bitcoin, Altcoins, NFTs, DeFi, and more.

The problem?

Keeping track of everything is literally impossible.😕

That’s where CoinStats comes in.

CoinStats gives you the ability to manage your funds across 300+ wallets & exchanges, 100 blockchains, 1,000 DeFi Protocols & 20,000+ coins.

With CoinStats, you can:

- Get in-depth profit & loss analysis with portfolio analytics 🤑

- Get customized and personalized price alerts 💬

- Set up your crypto Exit Strategy with AI ✨

CoinStats has teamed up with Wealth Mastery to offer readers 50% off on their annual plan.

Macro Factors Pushing Bitcoin into the Mid-$60Ks

Well, bitcoin is back in the mid-$60Ks this week, and everyone wants to know why we’re stuck here, and not hitting more of those sweet, sweet all time highs.

It appears the answer is due to larger macroeconomic factors happening outside the crypto markets.

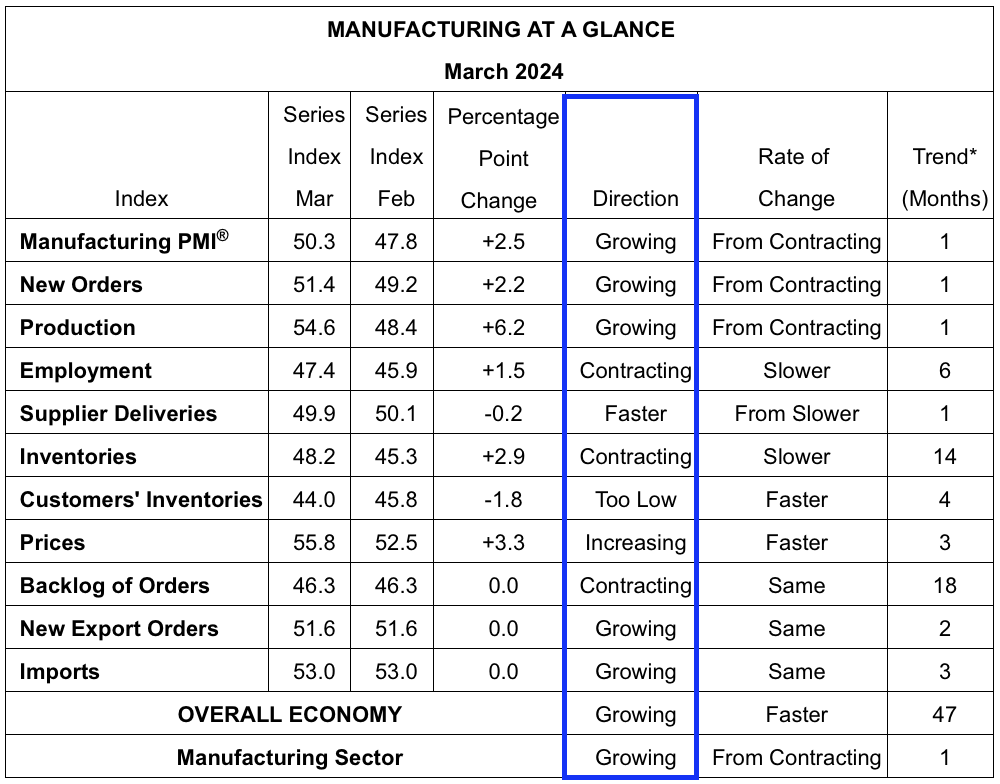

The driving factor is likely new economic data released Monday, which shows that U.S. manufacturing picked up in the month of March.

It’s called the “Manufacturing PMI.” It measures factory activity in the U.S. So we are talking about things like new manufacturing orders, production metrics and backlogs, and employment. Essentially, the Manufacturing PMI gives us a good idea if the overall U.S. economy is expanding or contracting.

Well, the PMI hit 50.3% in March. And according to analysts, percentage indicators this high indicate that the U.S. economy is expanding. So what does any of this have to do with the short-term price of bitcoin?

Here’s the logic: if the U.S. economy is expanding (i.e. the economy is “healthy”), then that tends to both strengthen the U.S. dollar and reduce the likelihood that the Fed will cut interest rates. And both of these factors in turn work to suppress bitcoin’s price.

The U.S. Dollar Index (i.e. index that measures the dollar’s strength against other currencies) hit 105 this week, which is the highest reading in the past four months. A strengthening dollar inherently makes “risk” assets – like bitcoin – more expensive. This naturally lowers bitcoin’s demand and creates additional selling pressures.

And then there’s the Fed interest rate issue. When the U.S. economy is strengthening, the Federal Reserve is less likely to cut interest rates because . . . what’s the point in stimulating the economy when it’s already strong?

So, analysts now think that the expected Fed rate cut in May will no longer happen, and they believe there’s only a 50% chance of one occurring in June. Therefore, the realization that the money supply won’t expand as previously thought means more downward pressure on bitcoin.

So that’s where we’re currently at.

What’s hilarious about all this is people are bummed that bitcoin has “fallen to the mid-$60Ks.” If you’ve been around crypto for a while, just sit back and think about that.

U.S. Government Gearing to Sell More Silk Road Bitcoin

OK, these guys totally suck.

On-chain data shows that on Tuesday morning, a wallet believed to be controlled by the U.S. government moved 30,175 bitcoin. 2,000 corns went to Coinbase, and the other 28K went to a second government-identified wallet.

Obviously, the 2,000 BTC sent to Coinbase are already – or will soon be – toast.

But to anyone in the U.S. government reading the beloved Wealth Mastery: if you care about the fiscal solvency of the employer that feeds you, then you WILL HODL THESE 28K BITCOIN!

The bitcoins at issue are likely part of the 50,000 BTC batch that U.S. authorities seized from the Silk Road website in 2022. The last time the U.S. government sold off some of these was in March 2023.

Currently, it’s thought that the U.S. holds just over 200,000 BTC, or close to 1% of bitcoin’s max supply.

Argentina Passes Mandatory Registration for Crypto Platforms

A lot of bitcoin maxis and like-minded libertarians got a bit of whip-lash last week.

That’s because the Argentine government signed into law the Registry of Virtual Asset Service Providers, or VASP. The law now requires all users on crypto platforms within the country to adhere to a government-mandated registration process.

Essentially, the government wants accurate reporting data for all individuals and entities who buy, sell, trade, or move crypto on sanctioned centralized platforms.

What’s interesting is that this legislation was in the works under Argentina’s former government, but newly-elected President Milei signed it into law anyways. Milei is a self-described libertarian and anarch-capitalist. So, many people were shocked by this turn of events.

Max Kaiser on X said that this was Milei’s “first major mistake”. And bitcoin payments company Strike has in response closed off some of the app’s functioning for Argentine users.

I’m taking the glass-half-full perspective and thinking all this is Melei’s preliminary setup before he designates bitcoin as legal tender. Heyoooo.

Goldman Sachs: “We Don’t Like You Crypto Bros”

I guess Goldman Sachs (along with Vanguard) is just NGMI.

This week, Goldman’s chief investment officer of the Wealth Management unit, Sharmin Mossavar-Rahmani, told the Wall Street Journal that the bank doesn’t “think [crypto] is an investment asset class [and that they’re] not believers in crypto.”

And the CIO went one step further stating that the company’s clientele aren’t banging down their doors for crypto offerings.

This is all very interesting.

Why are BlackRock and Fidelity clients apparently demanding crypto investment exposure, but Vanguard and Goldman clients are not? That seems odd, but perhaps it’s just a fundamental difference in client profiles.

Celestia Goes to Arbitrum Orbit

Celestia is now available to blockchain developers who are using Arbitrum Orbit.

Arbitrum Orbit is a blockchain development kit that allows developers to build independent, customizable blockchains that settle on either Ethereum or Arbitrum.

And now these developers have Celestia as part of their toolkit.

We’ve discussed Celestia before. The protocol is a data availability provider. Basically, blockchains can offload some of their data and processing requirements to Celestia, which in turn makes it easier for these blockchains to grow. And it also helps provide for less fee-intensive environments.

Blockchains must pay Celestia’s validators in TIA (i.e. Celestia’s native token) for these data services. Therefore, increased demand for Celestia creates upwards price pressure on TIA.

In today’s edition of the Wealth Mastery Newsletter, the following cryptocurrencies will be analysed & discussed:

- Dogecoin (DOGE)

- Ethereum (ETH)

- Litecoin (LTC)

- Crypto Com (CRO)

- Kyber Network (KNC)

- Thorchain (RUNE)

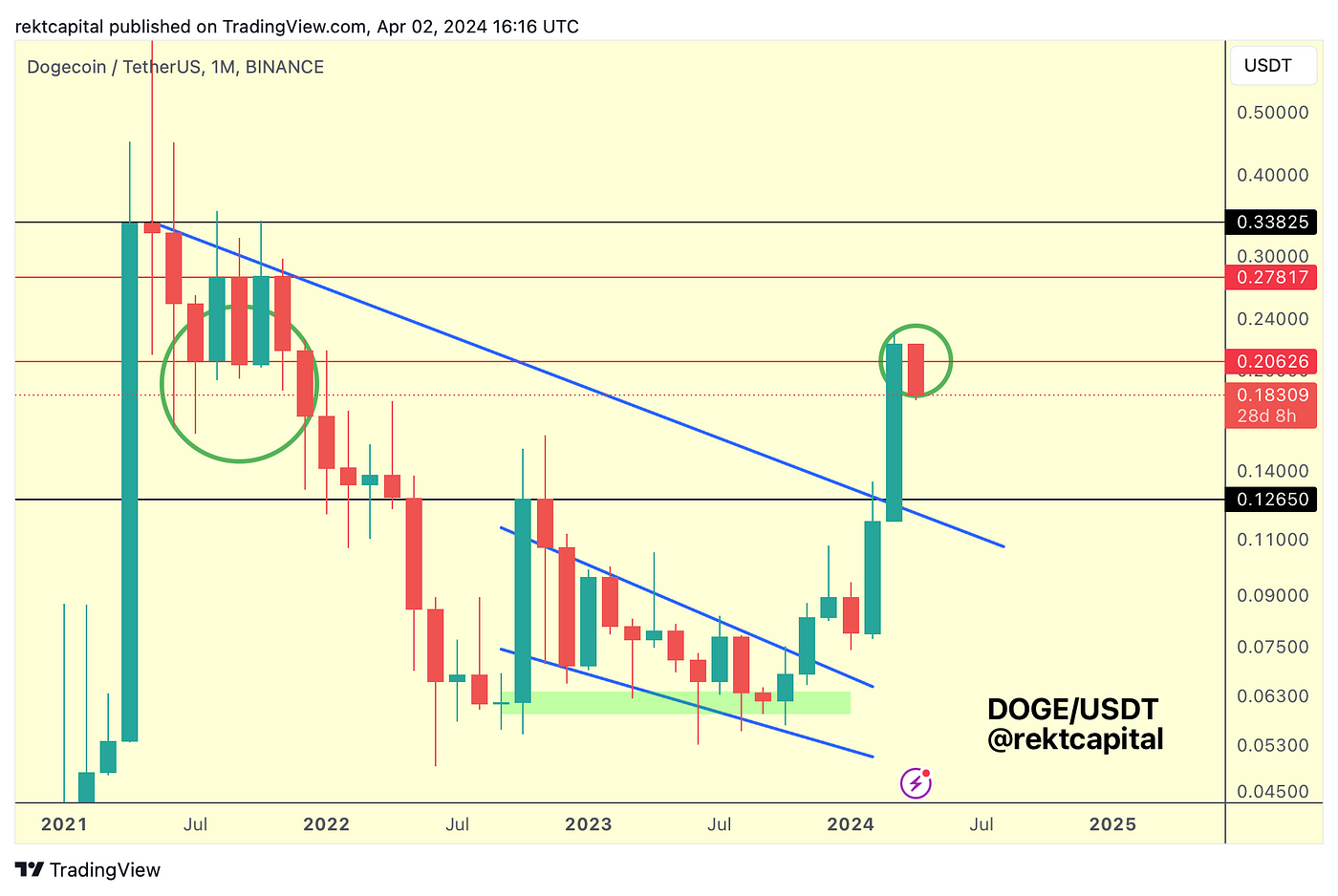

Dogecoin — DOGE/USDT

Dogecoin has broken its Macro Downtrend late last month.

The multi-year downtrend is now over and DOGE is ready for a new Macro Uptrend.

With its most recent Monthly Close, DOGE has began its break into the red-red Range ($0.20-$0.27).

However, with break-ins into a new range, it occurs in two steps:

- Monthly Close above key level (this indeed occurred as DOGE Monthly Closed above the red $0.20 level)

- Followed by a successful retest of said level (DOGE is arguably in the process of this retest, however it is a volatile one).

Moreover, historically, DOGE tends to perform very volatile retests of its $0.20 level, as the 2021 green circle shows.

So with the Month still young, lots could still change and DOGE could still Monthly Close in April above the $0.20 red level to confirm a successful Monthly retest.

However until then…

DOGE could still dip even deeper.

In fact, DOGE broke out from a Weekly Bull Flag (orange) last week to actually enable this bullish Monthly Close above the red $0.20 level.

As is the case with breakout moves however, price sometimes needs to dip into that post-breakout structure for a retest.

DOGE could thus still dip into the Bull Flag top for a retest; a successful one would see price try to then recover back above the red $0.20 level.

However, the way I view DOGE’s price is that any dips even into as low as the blue Macro Downtrend would still technically be fine; after all, the Macro Downtrend could be retested as support as well.

This Macro Downtrend retest of course happened on the Weekly timeframe a few weeks ago, but what if DOGE wants to retest it on the Monthly timeframe as well?

Many Altcoins have broken such Macro Downtrends but didn’t have to retest them as new support to rally higher.

So while this is a possibility, it is the best bargain-buying opportunity DOGE could ever offer at this point in the cycle but it does feel too good to be true given DOGE’s 2024 overall bullish momentum.

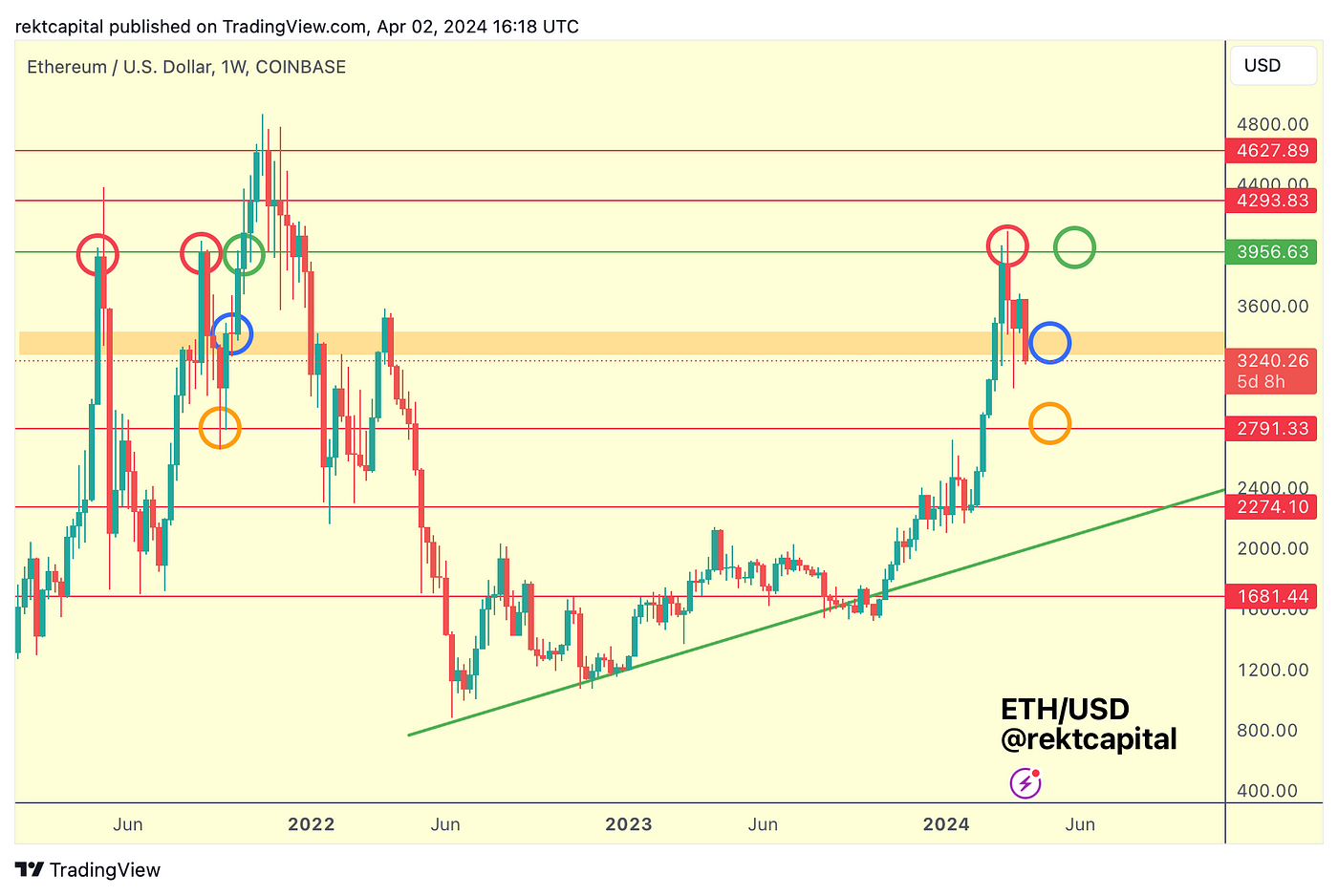

Ethereum — ETH/USD

Ethereum rejected from the red resistance (red circle) at $3956.

And if it loses the orange area as support, ETH could drop into the orange circled level of $2791.

Thus far, ETH has been holding the orange area but with little reaction so if this continues, then this area may arguably be weakening as support.

At some point in the future, ETH will need to reclaim this orange area to be able to revisit the blue circled area ($3956), but this may occur after a drop into the orange circled level given the lack of reaction from this orange boxed area thus far.

ETH needs to continue holding the orange area as support for a chance at revisiting the blue circle above; turning the orange area into resistance would send price into the orange circle.

CLICK HERE to go Premium and read the rest of this week’s Market Analysis – Premium subs can read Rekt capital’s full report.

How Far Are We in this Bull Market?

TL;DR How far in the bull market are we?

Drawing from a range of both macroeconomic and on-chain indicators, we can conclude that we are smack in the middle of the crypto bull market. Top signals haven’t flashed yet: there seems to be fuel left in the tank.

TO READ THE REST OF THIS ARTICLE, CLICK HERE – “How Far Are We in this Bull Market?”

Crypto Market News

- Spot Bitcoin ETFs saw net outflows on Monday April 1 as Grayscale’s GBTC lost another $302.6M. Source

- KuCoin withdrawals have risen to $1 billion after facing charges from US authorities. Source

- KuCoin is planning a $10 million airdrop of Bitcoin and its native KCS token according to a CEO letter. Source

- Ark 21Shares Bitcoin ETF has hit the milestone of $200M in daily inflows for the first time since it launched in January. Source

- The US SEC is moving forward with its lawsuit against Coinbase after a judge ruled that it has a plausible case. Source

- Sam Bankman-Fried has been sentenced to 25 years in prison for the FTX fraud. Source

- The FTX estate has sold $7.65 billion SOL tokens at a 68% discount to its current market price. Source

- FTX has set a goal to start repaying customers by the end of 2024. Source

- A16z plans to invest $30M in multiple gaming tech startups. Source

Coins and Projects

- Bitcoin has become more volatile than Ethereum as the halving approaches. Source

- Spot Bitcoin ETF monthly trading volume reached $111 billion which is almost triple the amount from February. Source

- Tether added 8,889 Bitcoins to its holdings in Q1 bringing its total to 75,354 Bitcoins worth around $5.2 billion. Source

- US Bitcoin miner Giga Energy has expanded into Argentina to utilize wasted energy from natural gas flaring. Source

- Hashdex’s spot Bitcoin ETF has finally started trading on the US stock market. Source

- Fidelity has filed an application with the US SEC for an Ethereum ETF with a staking feature. Source

- Crypto market maker GSR has reduced its probability of a spot Ethereum ETF approval in May to 20%. Source

- Ethereum has reached the milestone of 1 million validators, but community members think this is too much and could become problematic. Source

- Ethereum has proposed a new way to incentivize better decentralization of the network. Source

- Vitalik Buterin has shared the next steps in the network’s key stage called the Purge. Source

- Ethereum’s BlobScriptions have pushed Layer-2 fees up by over 10,000%. Source

- Coinbase will move its customer and corporate USDC balances to the Base network. Source

- Base has seen a 1,900% surge in phishing scam thefts on the network. Source

- Polygon’s CEO has said Layer-3 networks are taking value away from Ethereum. Source

- Solana DEX trading volume hit a monthly ATH of $60 billion in March. Source

- A $7.5 billion AI token merger between SingularityNet, Fetch.ai, and Ocean Protocol will be put to a community vote on April 2. Source

- Ondo Finance will move $95M to BlackRock’s new tokenized fund to allow instant settlement for its Treasury bill token. Source

- BlackRock’s new tokenized fund has seen $245M in inflows during its first week. Source

- BNB Chain has launched a $1M reward for developers deploying memecoins on the network. Source

- Mantle has launched its Rewards Station allowing users to connect their wallets and lock their MNT tokens for rewards. Source

- Near has launched multichain transactions from a single account. Source

- Ethena Labs has launched its airdrop with a total of $450M worth of tokens up for grabs. Source

- Telegram has enabled Toncoin payments for in-platform ad purchases. Source

- Telegram’s trading bot called Solareum is permanently shutting down after a $520K exploit. Source

- Conflux has been used to launch a public blockchain infrastructure platform for the Chinese government. Source

Macro News

- Cleveland’s Fed President Loretta Mester has said that US interest rates are still expected to be cut in 2024, but not in May. Source

- Argentina has announced mandatory requirements for crypto companies to register with its regulatory body or cease operating entirely. Source

- Oil prices have risen to a 5-month high on escalating tensions in the Middle East. Source

Thank you so much for your support, and I truly hope that today’s issue will give you insights needed to help you master your wealth.

If you are reading this it means you are on the free version of the Wealth Mastery Investor Report, which is great for news and tips on the crypto markets.

If you really want to take advantage of fastest growing asset class EVER, I highly recommend that you check out my new altcoin course: Mastering Altcoin Investing

In this course we’ll teach you all about how to spot, choose and acquire the winning altcoins of the next bull market.

Learn how to build your portfolio so that growth is ensured and risk is mitigated. Let me help you build a strategy that’ll change your life forever in the upcoming bull run.

See you next time!

Lark and the Wealth Mastery Team

💰 BINANCE: BEST EXCHANGE FOR BUYING CRYPTO IN THE WORLD 👉 10% OFF FEES & $600 BONUS

🚀 BYBIT: #1 EXCHANGE FOR TRADING 👉 GET EXCLUSIVE FEE DISCOUNTS & BONUSES

🔒 BEST CRYPTO WALLET TO KEEP YOUR ASSETS SAFE 👉 BUY LEDGER WALLET HERE

📈 TRADING VIEW: BEST CHARTING SOFTWARE ON THE INTERNET 👉 JOIN NOW

1️⃣ COINLEDGER: #1 CRYPTO TAX SOFTWARE 👉 IF YOU OWN OR TRADE CRYPTO YOU NEED THIS

Wealth Mastery (Lark Davis, and the Wealth Mastery writing team) are not providing you individually tailored investment advice. Nor is Wealth Mastery registered to provide investment advice, is not a financial adviser, and is not a broker-dealer. The material provided is for educational purposes only. Wealth Mastery is not responsible for any gains or losses that result from your cryptocurrency investments. Investing in cryptocurrency involves a high degree of risk and should be considered only by persons who can afford to sustain a loss of their entire investment. Investors should consult their financial adviser before investing in cryptocurrency.

You can find a full disclosure of all my crypto & venture investments here.