EU Crypto Crackdown: Cause for Concern or Fake News?

The crypto markets have been choppy as we speed towards the halving next month, but the overall outlook is bullish.

However, uncertainty was stirred by recent reports of self-custody crypto wallets being banned in Europe, but is the EU really taking this drastic step, or is it fake news?

Let’s take a look and find out.

Here’s what’s in today’s issue:

- Sam shares his thoughts on the EU banning crypto self-custody, BTC ETF’s week of negative flows, Mr 100 buying more BTC, bearish news regarding the ETH ETF and Gensler asking for $2.6 Billion to fight crypto.

- This week on chain.

- This week’s trending coins by Rebecca.

Step 1: Sign up using this link

Step 2: Fund your account with $100 or more

Step 3: Claim your bonus and free trade

Has the EU Banned Crypto Self-Custody?

There was outrage on Crypto Twitter over the weekend in response to an article in Finbold reporting that new EU Anti-Money Laundering Regulation (AMLR) is, in effect, going to ban self-custody crypto wallets.

The ability to take care of your own assets, in a decentralized way and without third parties, is core to what crypto is all about, so the concern is understandable, as were comments pointing out that bans are not practically feasible. After all, how do you ban people from memorizing a seed phrase?

On closer inspection though, claims that the EU is targeting self-custody appear to be inaccurate.

In reality, AMLR isn’t aimed specifically at crypto, but it does include what the EU calls CASPs, meaning crypto-asset service providers, such as centralized crypto exchanges.

However, CASPs were already regulated in the EU through existing directives, along with MiCA, which is a comprehensive framework of crypto regulation that was adopted by the European Parliament last year, and AMLR doesn’t make any major changes.

Providers of non-custodial wallets (such as MetaMask, for example) are outside the scope of MiCA and AMLR, as are transactions from one self-custody wallet to another, but there are requirements on CASPs–so, exchanges and brokers–not to allow anonymity. But then, that’s nothing new: what you’re looking at, basically, is KYC.

Overall, AMLR doesn’t look like the attack on crypto it was initially framed as, and you could even argue that the EU’s MiCA regulation is a crypto-friendly step. Unlike the SEC in the US, the EU is not stubbornly battling crypto with existing laws that don’t fit, it’s creating new rules designed to try and align crypto with traditional finance. Or in other words, accepting that crypto is part of the financial landscape.

On the other hand though, it’s true that AMLR bans cash payments above 10,000 EUR for goods and services, which is not the action of a government (or whatever the EU actually is) concerned with personal freedoms, but that’s not a crypto issue.

What do you think though, is Europe going full 1984, or are these all just standard regulatory developments? And might the EU be open to fully embracing crypto? Reply to this email and let us know what you think.

One Week of ETF Negative Flows

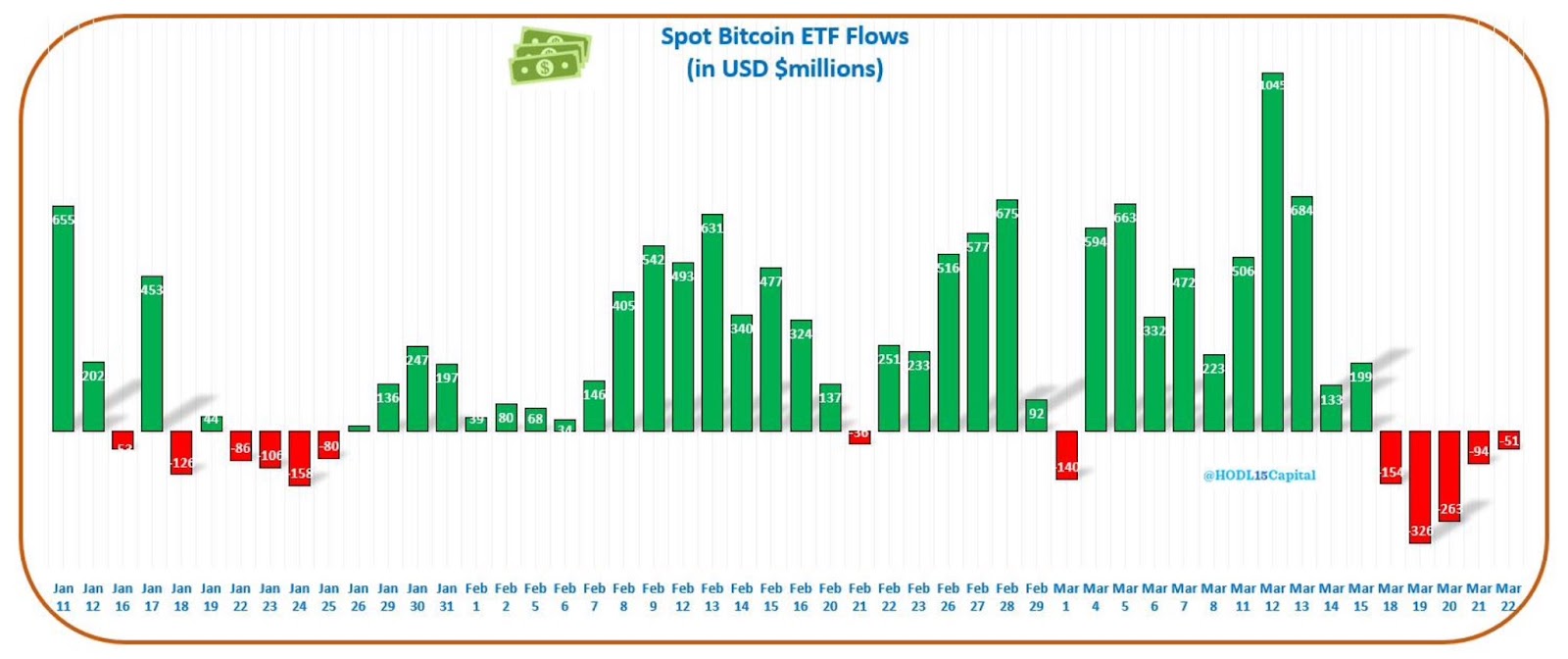

After an absolutely spectacular first couple of months, the new spot BTC ETFs last week went through a relatively bearish period, experiencing, for the first time, a full five days of negative net flows.

Put in the context of their overwhelmingly positive start though, and considering that these funds are here for the long term, this data shouldn’t be too worrying.

Also, it comes as BTC is going through a not-at-all unusual pre-halving dip, and the negative flows peaked last Tuesday at $326 million, but by Friday had come down to $51 million.

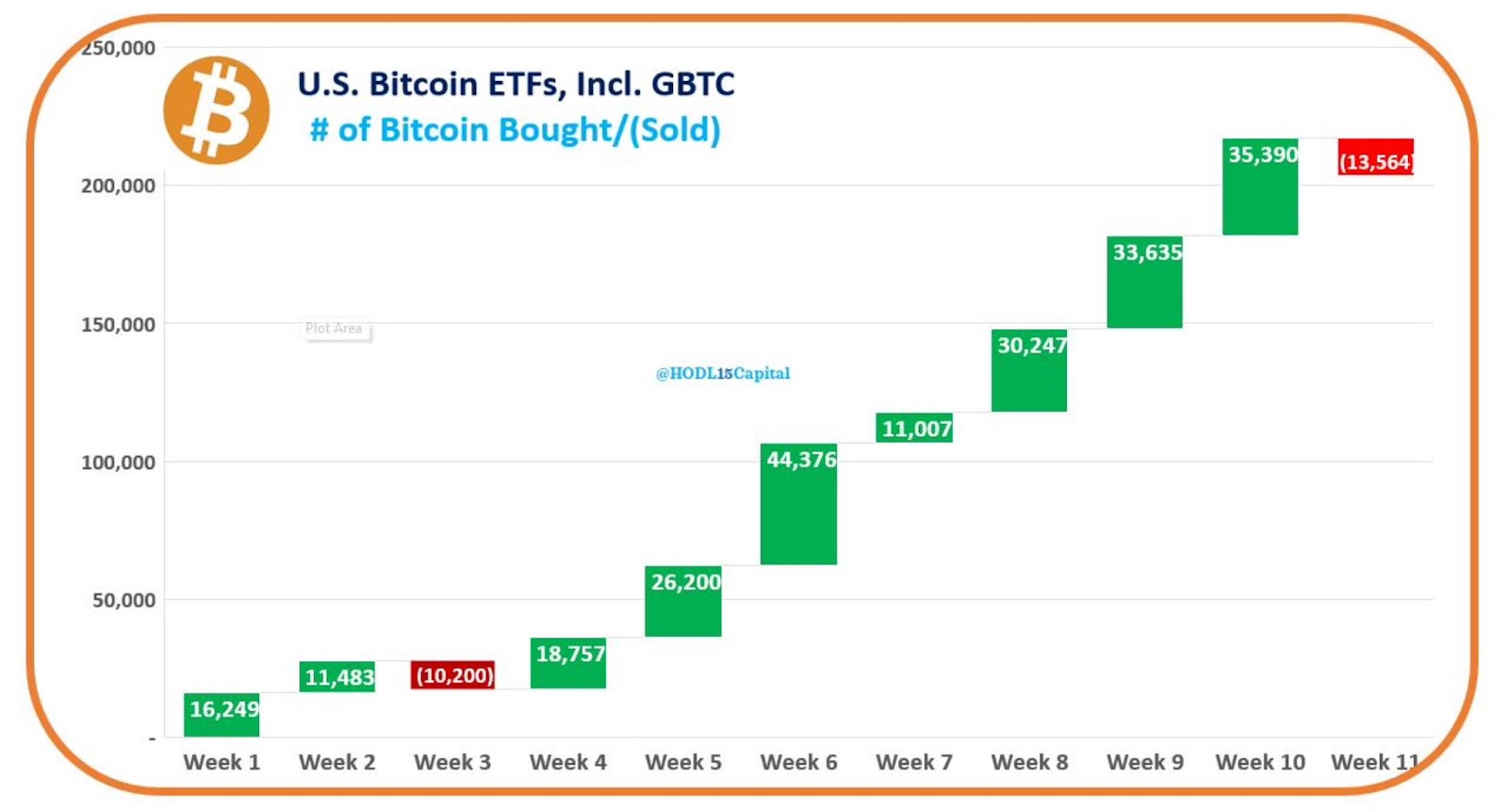

Furthermore, looking at the overall picture, the ETFs have bought a truckload of bitcoin since launch (203,400 BTC so far), and have up to now only had two red weeks out of eleven.

Mr 100 Keeps Buying BTC

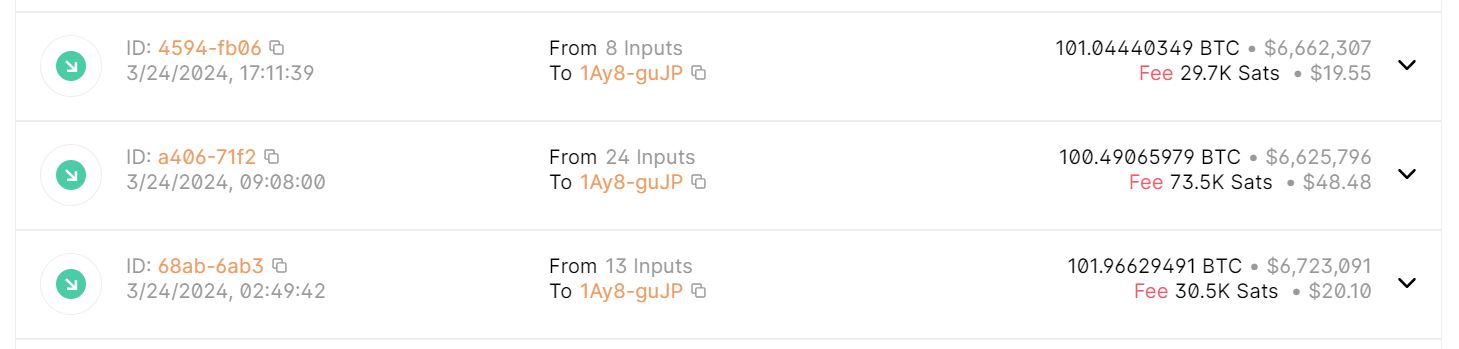

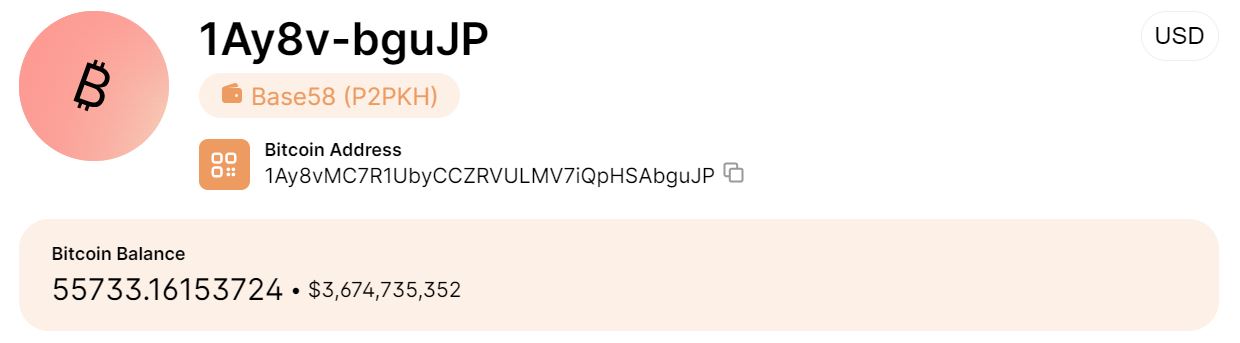

Everyone likes a mystery, and an intriguing question being asked in crypto right now, is who is Mr 100?

Just to get you up to scratch, Mr 100 is the name given to an unknown buyer who has been regularly scooping up BTC in clips of about 100 since February this year, having first started receiving BTC in 2022, and he’s currently showing no signs of slowing down.

In fact, in the space of just one 24-hour period last week, Mr 100 put in eighteen such 100-coin orders, and this enigmatic whale alone is sometimes absorbing more than the entire daily mined BTC issuance.

Mr 100 is now the thirteenth largest holder of BTC, with a stack of 55,733 coins, but will he ever reveal his identity?

We’ll have to wait and see, but the buying has been in such bulk that some people are speculating that Mr 100 may be a financial institution or a sovereign wealth fund. However, this is just guesswork, and for now the mystery remains as accumulation goes on.

Galaxy and BlackRock Sound Bearish on ETH ETF

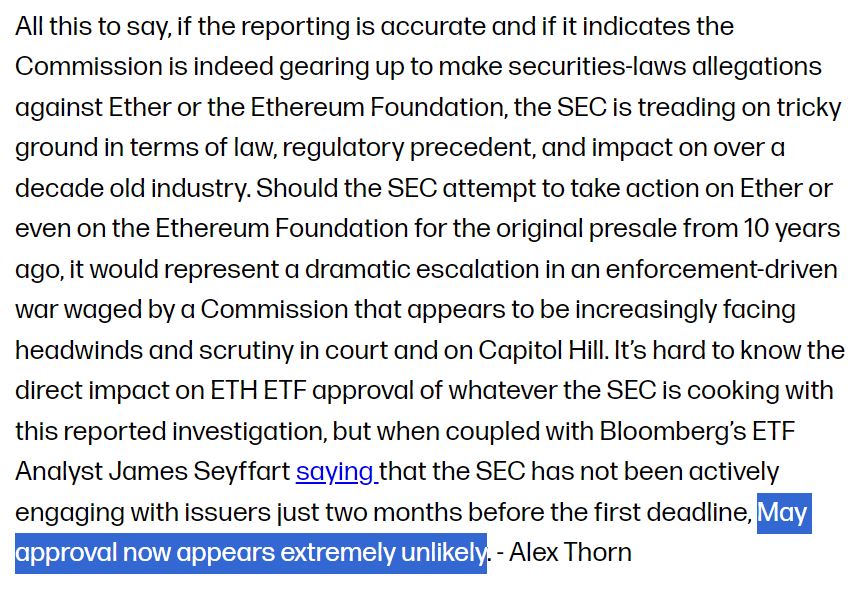

The first deadline for approval from the SEC is May 23rd, so is a spot ETH ETF incoming? Not according to Alex Thorn, the Head of Research at Galaxy Digital.

In a post published last week, Thorn discusses the SEC investigating the Ethereum Foundation, mentions speculative theories that the regulatory commission “intends to perform some kind of crackdown on the world’s second most valuable blockchain network”, notes that the SEC is not engaging with issuers as the first deadline approaches, and concludes that, “May approval now appears extremely unlikely.”

Relatedly, BlackRock, which has applied for approval to launch an ETH ETF, has sounded an underwhelming note on Ethereum, with Head of Digital Assets Robert Mitchum–speaking at a conference in New York– stating that, “for our client base, bitcoin is overwhelmingly the number one focus, and a little bit Ethereum.”

Gensler Wants $2.6 Billion for the SEC

Finally, crypto arch-nemesis Gary Gensler, the blockchain-averse chairman of the SEC, has requested around a hefty $2.6 billion of funding for the agency, part of which will be used to continue his obsessive battle against the cryptocurrency industry.

This request comes in the SEC’s Annual Performance Plan for 2025, which includes as the second of its three “strategic goals”, an ambition to “develop and implement a robust regulatory framework that keeps pace with evolving markets, business models, and technologies”. The plan then mentions a part of the SEC known as Finhub, which, according to the document,

“Helps coordinate the agency’s oversight and response regarding emerging technologies in financial, regulatory, and supervisory systems, including in the areas of distributed ledger technology (including crypto asset markets), automated investment advice, digital marketplace financing, and artificial intelligence/machine learning.”

As mentioned earlier, the SEC looks like it’s gearing up, potentially, for a court battle with the Ethereum Foundation, and it appears that it will have a deep warchest of financial resources as it does so, although whether or not its legal arguments are up to scratch is another matter.

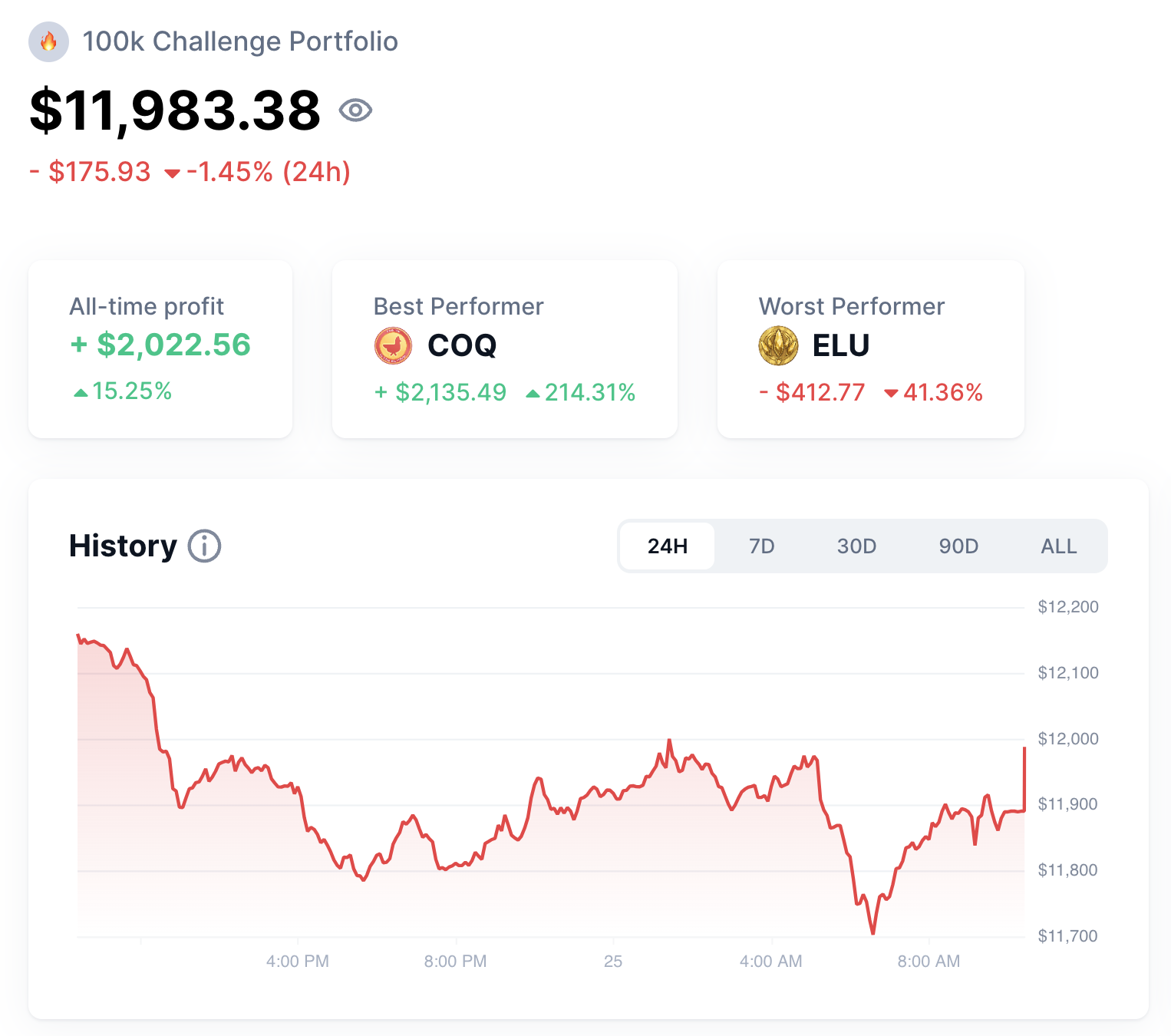

Week 6 Crypto Portfolio Updates

The portfolio is still in profit despite the big sell off last week.

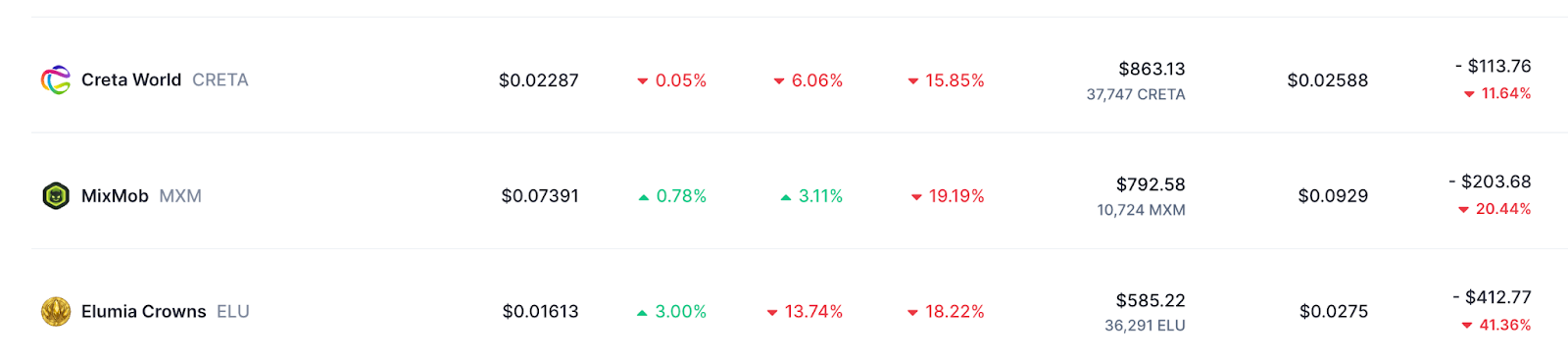

Memecoin COQ INU still holding up the portfolio. I might consider adding another meme in the coming weeks, or maybe $100 in 3 of them. Will update you on this.

Our gaming coins are getting hit the hardest. Currently sitting on $700 in unrealized losses on our low cap high risk gaming coins.

Sometimes it can be hard to hold positions when they are in loss, but with crypto in general we must expect volatility. Gaming season will come again, the only question is when.

Looks like we have a confirmed airdrop for staking the Dymension tokens. We will be getting 70 NIM. I will sell them when I get them. Hope they are worth a bit. Claimed, but not received at the time of writing.

I did the Plena Finance tasks on Galxe. A bunch of free social tasks mostly. Not that heavily diluted compared to most Galxe airdrop farms.

I did all the new Nyan Hero tasks. These free airdrop missions may or may not be good, but previous gaming airdrops have been decent. If you want to try to get this airdrop too then follow this link and enter the code “TheCryptoLark”.

Likewise I did all of the new tasks for Param Labs. You can sign up here

There are new staking tasks for Burnt Finance (XION), it is a free testnet, so I did the tasks.

I am always surprised by how few people actually do these tasks, relative anyway to the number of people in crypto. I know they are a pain in the butt, but free money…

And, I do feel the need to mention again, I did the usual run of transactions across the Ethereum layer two networks. Consistency is key.

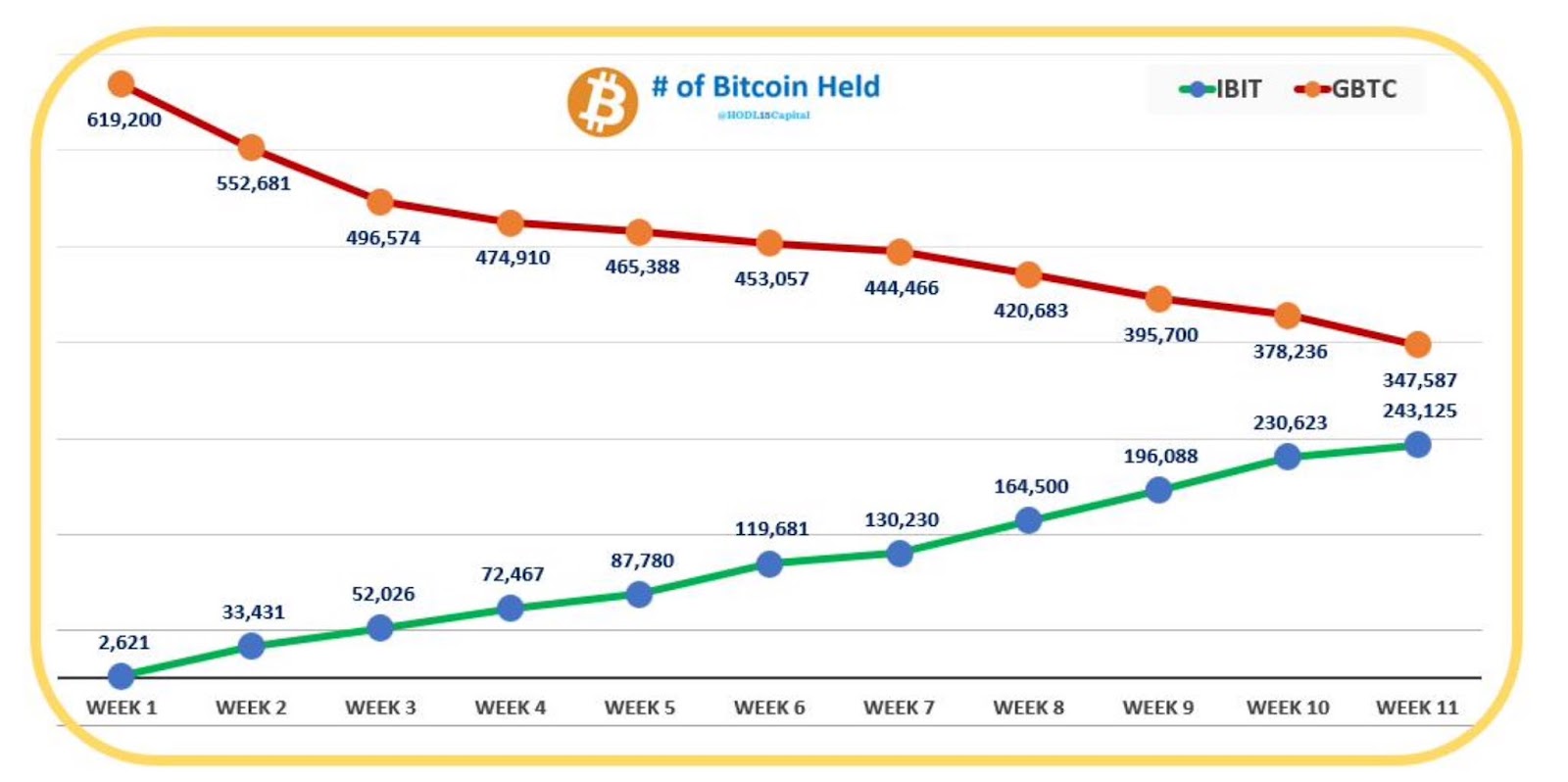

It wasn’t a great week for the BTC ETFs last week, with five days of net negative flows, but that comes after an incredibly strong first two months, and it’s interesting to compare Grayscale GBTC outflows with BlackRock IBIT inflows over this initial period.

Here we can see that for all the funds flowing out of GBTC, there have been about equal funds flowing into IBIT, creating a balanced pattern.

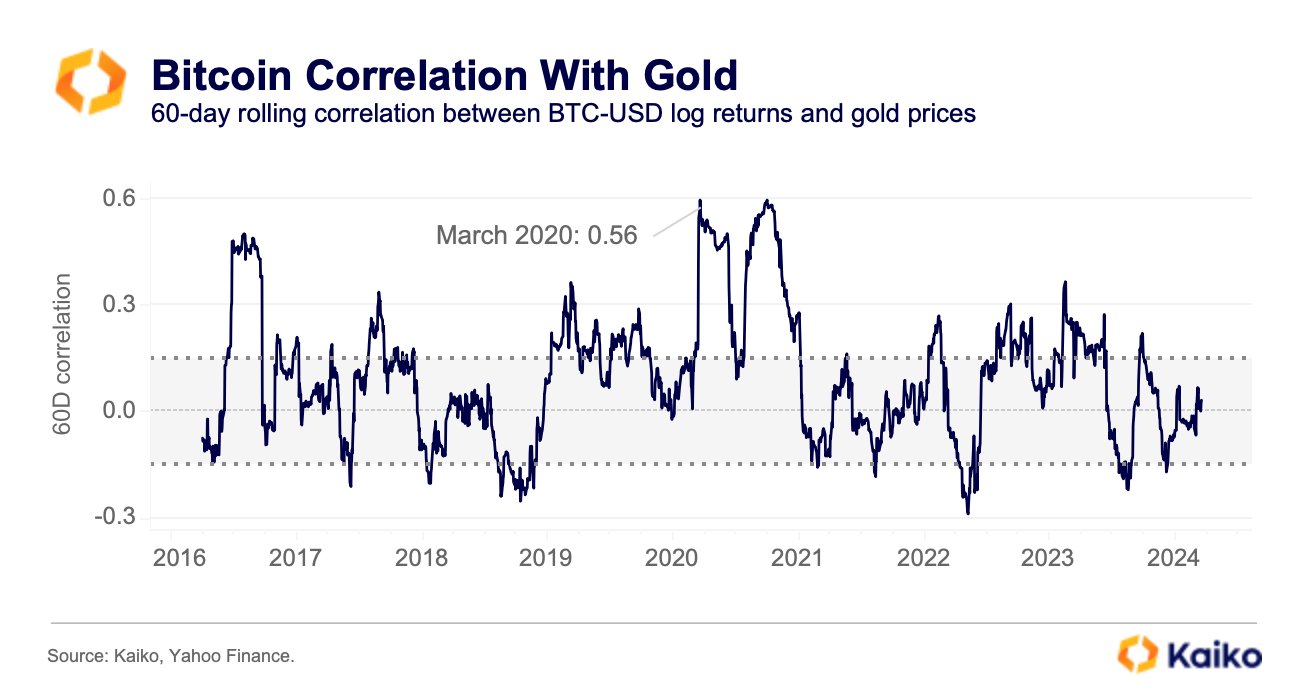

As for whether or not BTC is gold 2.0, if you look at the long-term correlation between BTC and gold over the past eight years, it has remained low, suggesting that while BTC can perform the same store-of-value role as gold, the two assets are, perhaps, being acquired by different kinds of buyers.

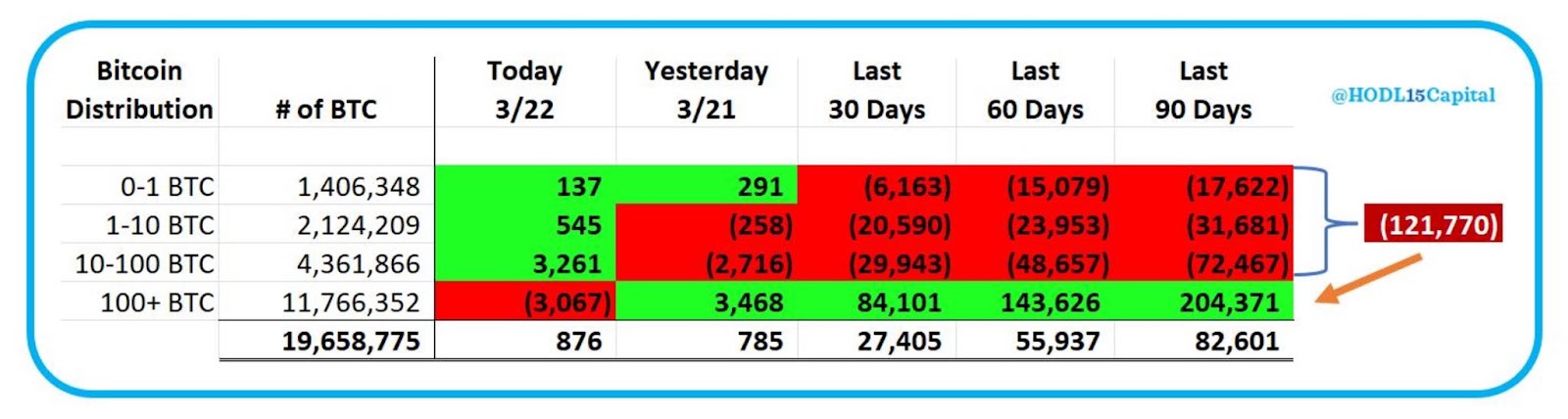

And sticking with bitcoin, the end of last week saw changes in the types of wallet that are buying, with wallets holding fewer coins (which would mean retail buyers), leading the buying, while whale wallets were selling, which is the opposite of the dynamic in play over the rest of the week prior to that.

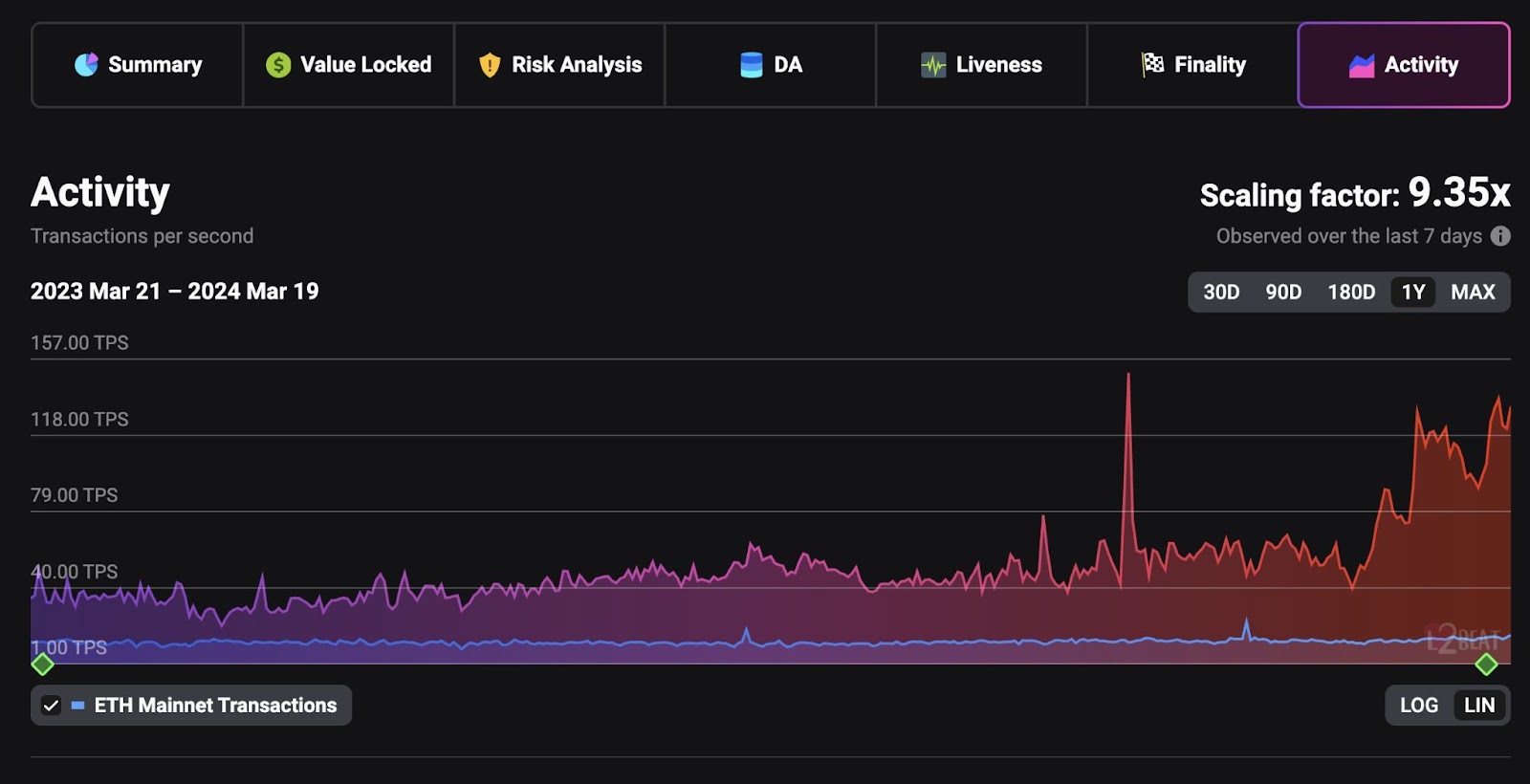

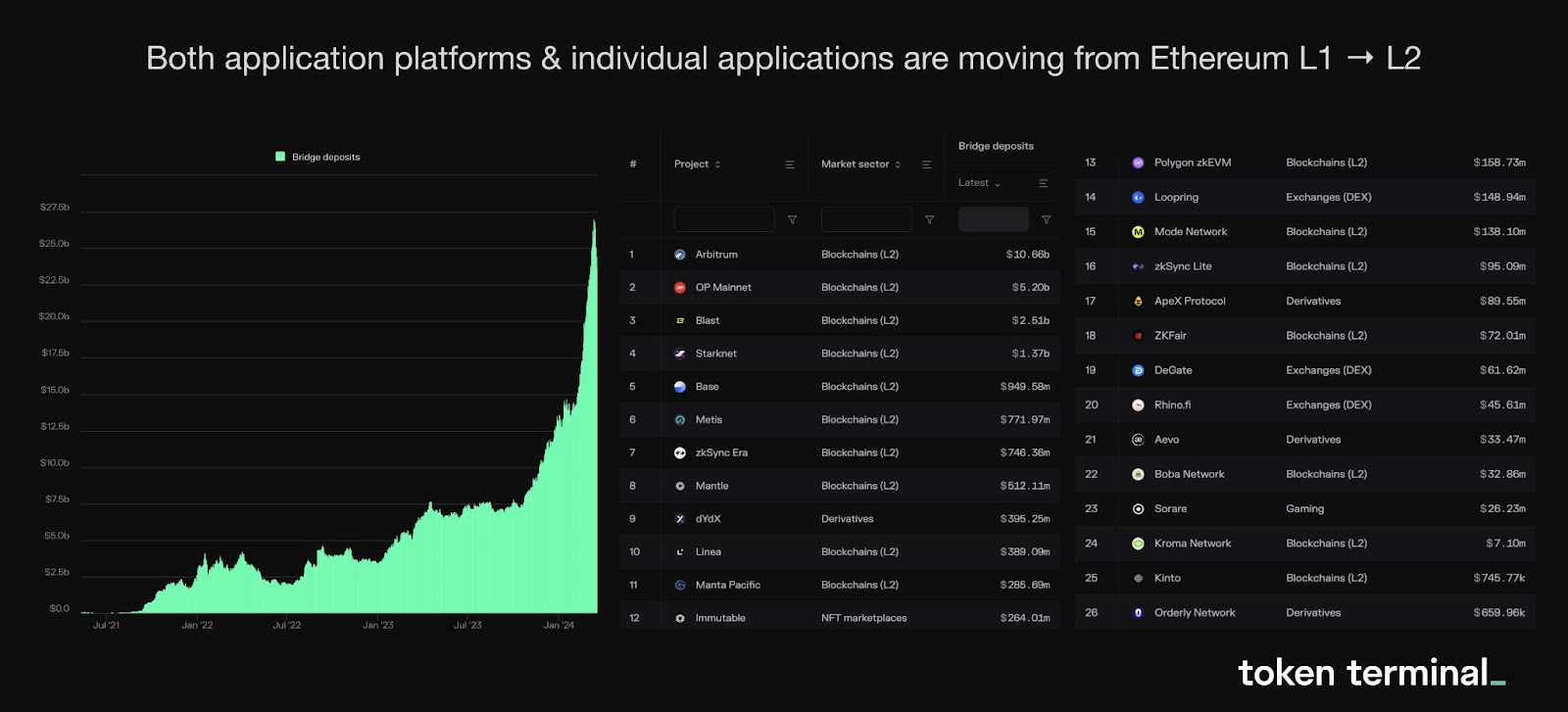

Switching our attention to Ethereum, Layer-2 activity is picking up a lot. This comes after the Dencun upgrade, which significantly lowered Layer-2 transaction costs, and while gas fees on the mainchain have been excessively high.

In line with this, we’re also seeing assets moving from Layer-1s to various Layer-2s, with a total of approaching $27.5 billion of assets being bridged across. Of the many and various Layer-2s being used, Arbitrum is the clear top choice, with $10.66 billion of deposits, while OP Mainnet comes in second with $5.2 billion, and hyped-up newcomer Blast is in third position, with assets worth $2.51 billion moved across.

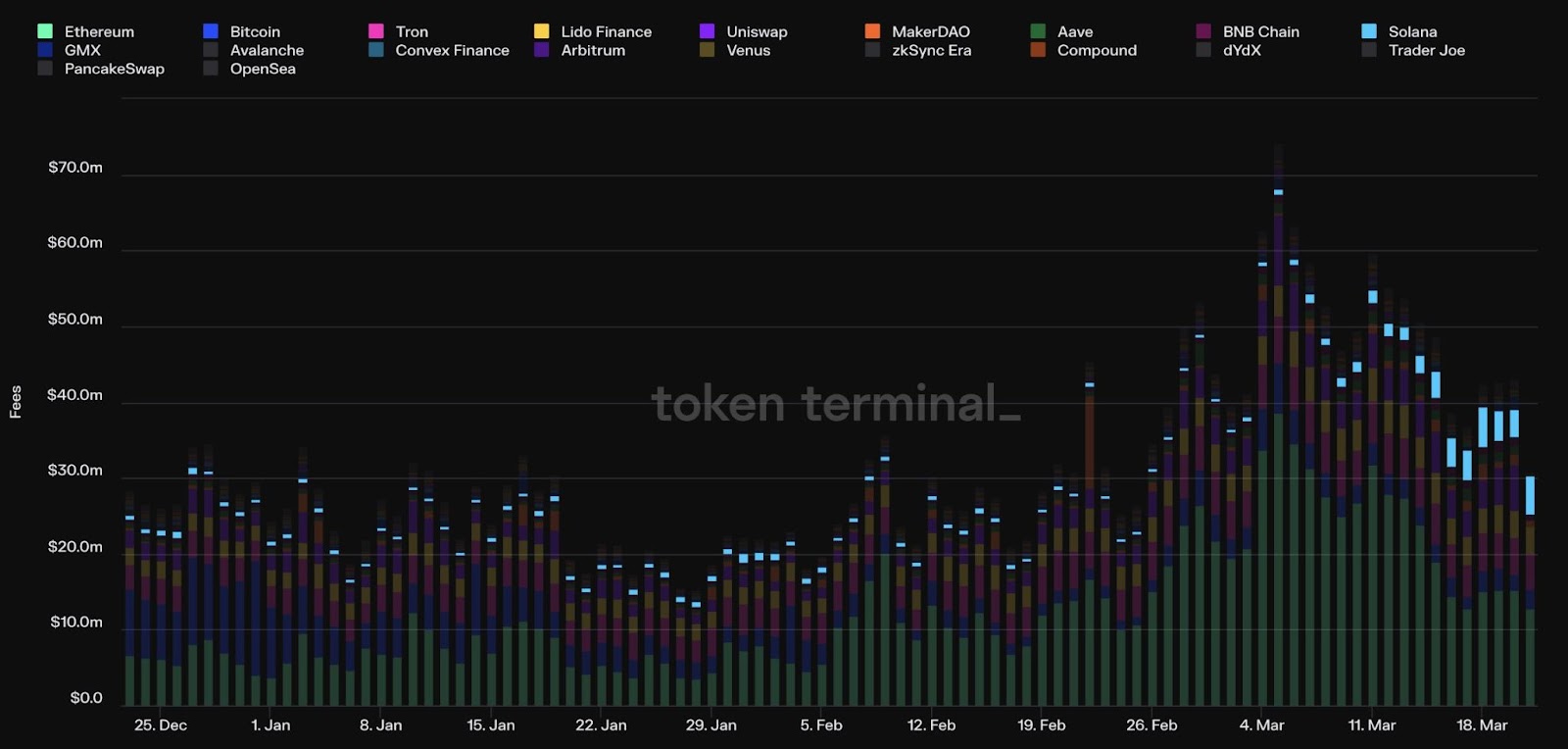

On Solana, some impressive stats continue to roll in, with the speedy Layer-1 making gains against its competitors in terms of network fees captured. As an example, on Thursday last week there were around $31 million of fees across all networks, of which Ethereum captured $12.9 million, while Solana was second with $4.95 million, giving it around a 16% share, and representing huge recent growth.

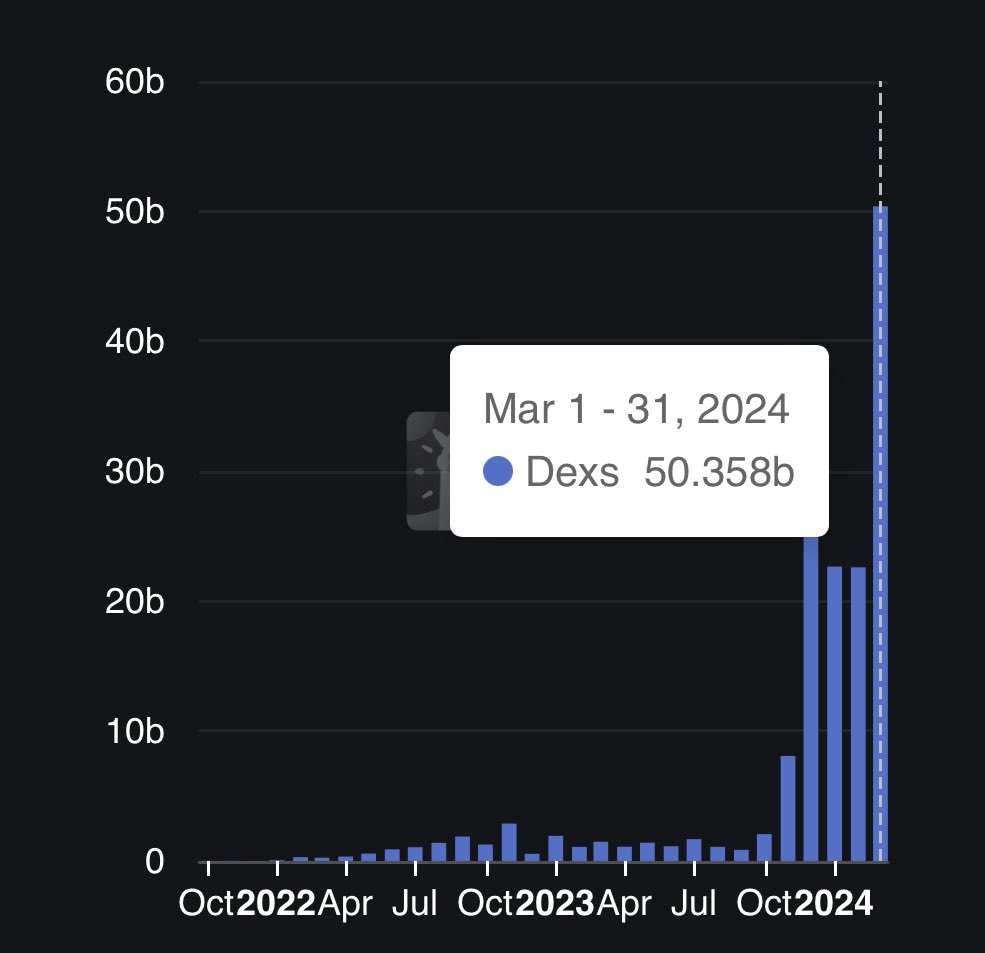

Solana is also seeing record high monthly DEX volumes, surpassing the $50 billion mark, and monthly revenue that has surged above $20 million in March, from around $7 million in February, and around just $625K if you go back a whole year to March 2023, not forgetting also that the current month has not yet finished.

Solana functions as a direct competitor to Ethereum, and if we look at the price ratio between the two, we can see that Solana has been performing very strongly against its rival since around Q4 2023, and continues to do so even after Ethereum’s Dencun upgrade.

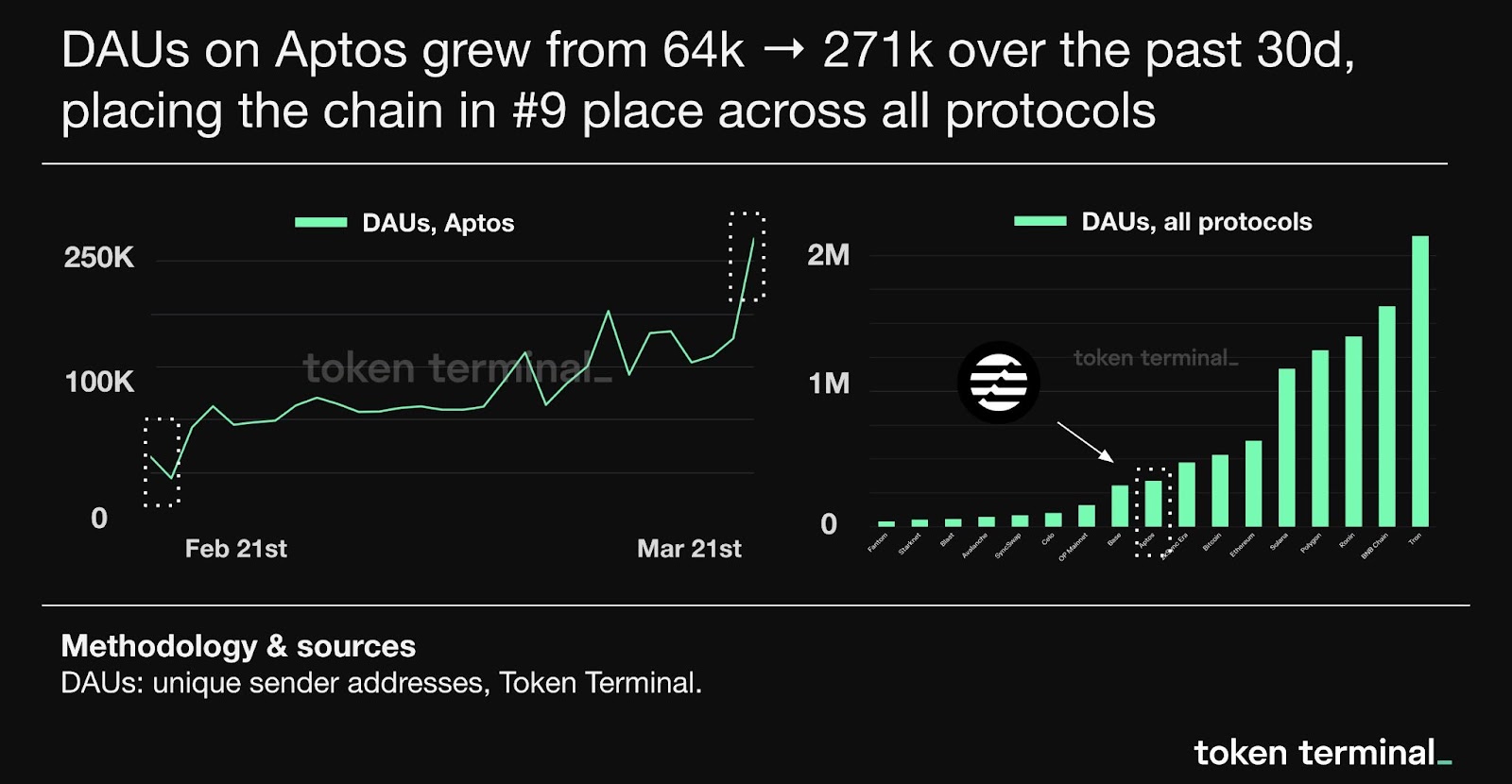

Another Layer-1 vying for position is Aptos, which launched in October 2022 and is showing considerable recent growth, with a big increase in Daily Active Users from February 21st to March 21st, a period in which the user numbers climbed from 64K to 271K, which, by this metric, places Aptos between Base and zkSync Era.

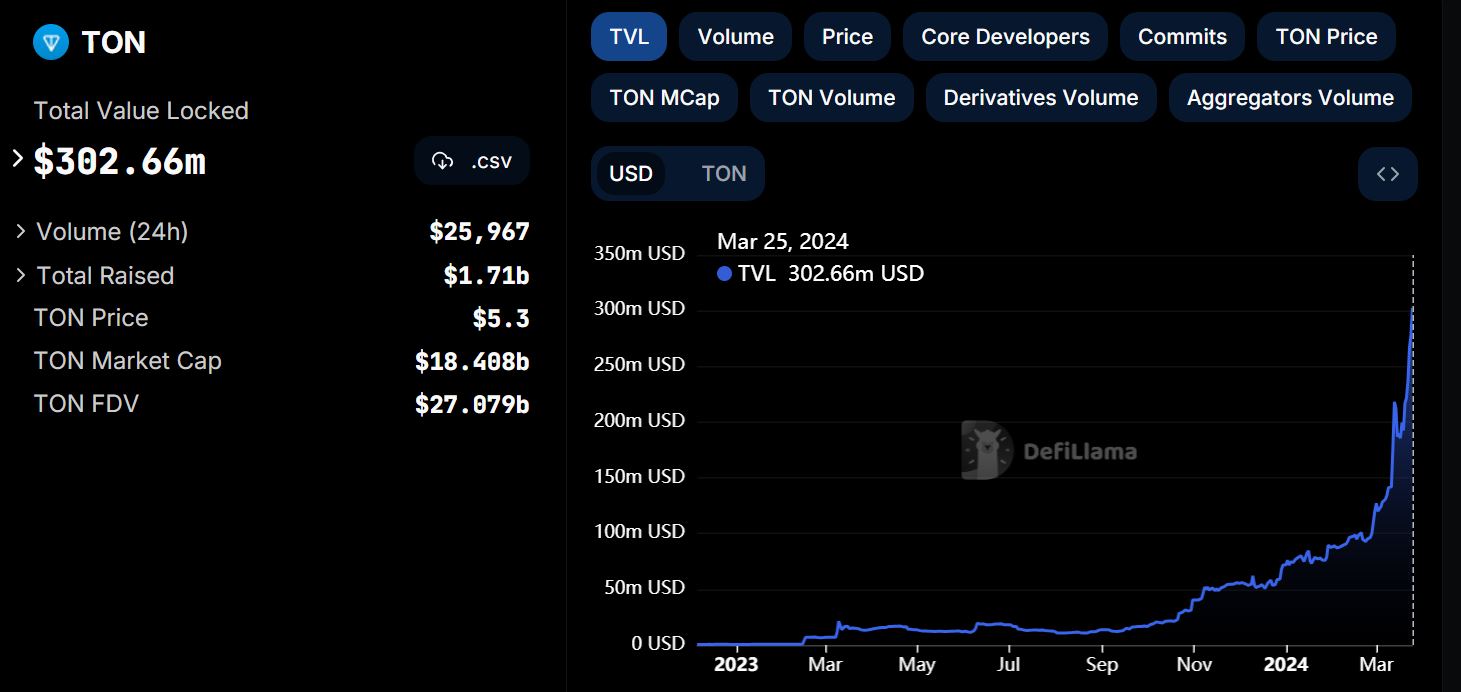

TON, a Layer-1 originally built by Telegram (which subsequently stepped away from the project), is a sometimes overlooked blockchain, but it’s been outperforming recently, and its TVL has soared this month to over $300 million.

And finally, if we compare developer activity–as determined by Github activity–over the last thirty days across chains, we can find that ChainLink is out on top, while Cardano has been bumped into second place.

Here are my key takeaways from the trends this week and as Bitcoin has been consolidating the altcoins have come out to play.

- r/CryptoCurrency Moons is a Reddit Community Points token that’s now live on Celer Bridge and has spiked in price due to Reddit’s stock market IPO.

- WiFi app is a decentralized internet app on Polygon that’s been featured in Binance Research’s Navigating Crypto Map for March 2024 within the DePIN sector.

- Open Campus is a community-led education protocol that’s surpassed 100,000 Open Campus IDs claimed by users.

- Gala is a play-to-earn (P2E) gaming and music ecosystem that’s just completed its San Francisco hackathon.

- Decubate is a Web3 software company that’s added support for the Arbitrum network.

- Grape is a gaming and metaverse blockchain that’s allowing users to sign up for its GRP airdrop.

- Tenset is an Ethereum blockchain-based project that’s burned 70,000 10SET tokens and has made new launchpad tiers available.

- Degen (Base) is a newly launched ERC-20 token that’s launched a meme contest on Farcaster and has partnered with Drakula app to make DEGEN its primary transaction token.

- Ondo is a financial platform focusing on Real World Assets (RWA) that’s hit a new ATH of $0.81 due to whale activity.

- Solana is a Layer-1 blockchain that’s become the most popular blockchain ecosystem of 2024 capturing over 50% of crypto investor interest.

- Mog Coin is a meme token on Ethereum that’s skyrocketed over 400% in the last month and 20% in 24 hours on speculation that an Ethereum ETF will be approved.

- Aerodrome Finance is a liquidity marketplace on Base that’s reached a new record high of over $355M in total-value locked (TVL). Slipstream is also coming to Aerodrome in a few weeks, enabling concentrated liquidity on Base.

- Toncoin is the native token for the TON blockchain inherited from Telegram that’s launched a community rewards initiative called The Open League valued at over $115M.

- Ethereum is under investigation by a state authority and the US Securities and Exchange Commission (SEC) has delayed its decision on more Ethereum ETFs.

- Book of Meme is a newly launched Solana-based memecoin that’s jumped 50% in 24 hours as the highly anticipated Dogecoin20 (DOGE20) ICO is nearing.

Thank you so much for your support, and I truly hope that today’s issue will give you insights needed to help you master your wealth.

If you are reading this it means you are on the free version of the Wealth Mastery Investor Report, which is great for news and tips on the crypto markets.

If you really want to take advantage of fastest growing asset class EVER, I highly recommend that you check out my Altcoin course: Mastering Altcoin Investing

In this course we’ll teach you all about how to spot, choose and acquire the winning altcoins of the upcoming bull market.

Learn how to build your portfolio so that growth is ensured and risk is mitigated. Let me help you build a strategy that’ll change your life forever in the upcoming bull run.

See you next time!

Lark and the Wealth Mastery Team

💰 BINANCE: BEST EXCHANGE FOR BUYING CRYPTO IN THE WORLD 👉 10% OFF FEES & $600 BONUS

🚀 BYBIT: #1 EXCHANGE FOR TRADING 👉 GET EXCLUSIVE FEE DISCOUNTS & BONUSES

🔒 BEST CRYPTO WALLET TO KEEP YOUR ASSETS SAFE 👉 BUY LEDGER WALLET HERE

📈 TRADING VIEW: BEST CHARTING SOFTWARE ON THE INTERNET 👉 JOIN NOW

1️⃣ COINLEDGER: #1 CRYPTO TAX SOFTWARE 👉 IF YOU OWN OR TRADE CRYPTO YOU NEED THIS

Wealth Mastery (Lark Davis, and the Wealth Mastery writing team) are not providing you individually tailored investment advice. Nor is Wealth Mastery registered to provide investment advice, is not a financial adviser, and is not a broker-dealer. The material provided is for educational purposes only. Wealth Mastery is not responsible for any gains or losses that result from your cryptocurrency investments. Investing in cryptocurrency involves a high degree of risk and should be considered only by persons who can afford to sustain a loss of their entire investment. Investors should consult their financial adviser before investing in cryptocurrency.

You can find a full disclosure of all my crypto & venture investments here.