The Team from GensoKishi & How To Get The Best Return On Your Stablecoins

In This Issue

- The team from GensoKishi talks about their incarnation of the award winning Nintendo Switch/PS4 game “Elemental Knights”.

- Matt has a report for you on how to get the best returns on your stablecoins.

Premium members also get the following:

- My latest portfolio updates

- Rekt Capital has the latest technical analysis for you on the market.

- Rebecca has all of the latest news for you.

- Upcoming NFT drops

- Defi Dad has a tutorial for you on how to earn up to 33% APR with stablecoins on Fantom’s Beethoven-X.

- Jesse has a ton of hot new airdrops for you.

- Hot new token sales.

- Rebecca breaks down this week’s trending coins.

- Jesse has a deep dive for you on Astar Network.

And much more!

GensoKishi Inverview

For anyone not familiar what is GensoKishi?

GensoKishi Online Metaworld is a GameFi and metaverse incarnation of the award winning Nintendo Switch/PS4 game “Elemental Knights” which has a 14 year history and has accumulated a total of 8 million downloads worldwide. So yes, we already have a 3DMMORPG game with active users, with a fully-functioning 3D metaverse, that simultaneously connects users from around the world, be it smartphones, PCs, or video game consoles!

What does the MV token do?

The MV token is our governance token. By owning MV tokens, players receive various rights and privileges inside and outside the game. For example, to bid in our LAND auctions and Cosplay NFT auctions you need $MV. The UGC feature is an important feature of the game, and to unlock this feature you need to stake a certain amount of $MV (UGC allows users to earn by designing/creating original maps, NPCs, and Cosplay NFTs). Also, by staking $MV, players receive $ROND, our in-game token. Last but not least, as Genso aims to become a DAO in the future, $MVs will be voting power to decide the direction of the game.

You have a second token, ROND, what is its function?

$ROND is our in-game token. GensoKishi is a “Play to Earn” game, so when users play, they earn $ROND.

There are many ways to earn $ROND in the game. Players can earn by selling items obtained from adventures and defeating monsters in the game. Creators can earn by designing maps and charging players $ROND for entry or by designing Cosplay NFTs and selling them to other players. The currency aims to also be listed on CEXs in the future.

You recently made a big announcement regarding an artist from the Final Fantasy series, can you tell us more about this?

Yessss! As gamers, we are BIG BIG fans of Final Fantasy, and their top designer Yoshitaka Amano is a gaming god, a legend in game art and design. We had been in talks with him since January.

Through this collab, we will have an entire collection of these Amano-designed NFT Cosplays ready. There will definitely be “genesis” collections but please follow us for more! Of course we will let Lark know once the details are here!

Who are your biggest partners and how will they help you succeed?

We have several. As you can see on our homepage we have partnered with Consensys. Polygon Studios has assisted us from day one. GSR is our Market maker, and we have a brilliant team of advisors helping us throughout this journey.

On the game side, we have been in this industry for 20+ years. We know this industry in and out. That is why our previous “Elemental Knights” series had super big IP collaborations. I’m sure we will have those big names come on board GensoKishi as well.

Can you tell us a little bit about your team?

Maxi, our CEO, has been working in Japan (Tokyo) for 10 years and ran a consulting business for startups for 5 years. He entered the blockchain industry in 2017, as a senior consultant for Blockchain Media. He ran several businesses such as KOL marketing and has always been in the digital area. A gamer himself, he has many connections with Japanese game developers, and that’s why he is working on the GensoKishi Project now.

Our advisors: Taiwan’s GameFi ambassador Ricky Chen, Blockcast (Blockchain Media) CEO Kevin Hoo, the most famous blockchain lawyer in Taiwan Kunchou Tsai, Uwabo Tokuhiko a game creator from SEGA, Kato Masaki exCEO of NHN Japan the biggest mobile game maker in Japan/Korea, and Akira Morikawa exCEO of LINE, the WhatsApp of Japan.

When can we expect to see a playable game?

May is our alpha, June is our beta launch. August is the official launch. DEVELOPMENT IS ON SCHEDULE!

What comes next for Genso Kishi?

Amano’s NFT sales and the alpha launch, both in May.

Stablecoins – Getting The Best Return by Matt

If you’re sitting on a bunch of stablecoins in your portfolio, you might want to consider earning some yield on these idle assets. I mean let’s face it, in the fiat world, banks are offering deposit rates of less than 1%. That’s hardly very enticing and it’s well below the rate of inflation which has skyrocketed since Covid-19 shocked the world and governments set their money printers to full blown brrrrrrr……mode.

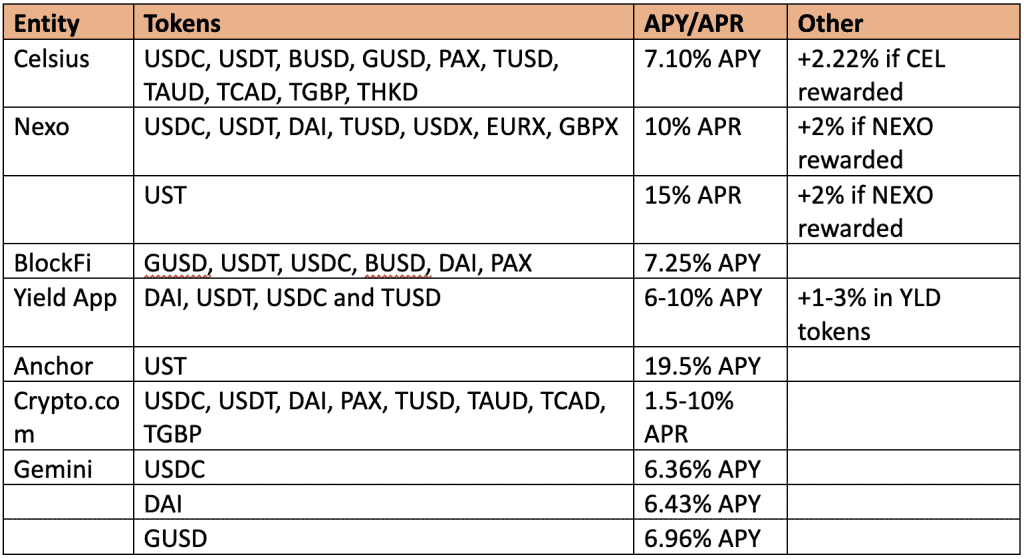

When it comes to stablecoins, there are plenty of options available to earn yield. So, let’s explore some of them.

Celsius

With over 1.6 million users and $21 billion in assets under management, Celsius have become a major player in the yield generation space.

They are currently offering 7.10 % APY (Annual Percentage Yield) on USDC, USDT, BUSD, GUSD, TUSD and PAX. They also offer yield on other currencies via the True stablecoin family which includes TGBP, THKD, TCAD and TAUD, all available with the same APY.

Celsius gives their users the option to earn a bump in their interest rate of 2.22% (so total 9.32%) if they accept their native $CEL token as rewards, rather than in-kind rewards. Interest is paid on a weekly basis and they also offer yield on other popular cryptocurrencies as well.

Nexo

Nexo has over 4 million users and $12 billion in assets under management.

The platform offers yield on a range of stablecoins and are currently offering 10% APR (Annual Percentage Rate) on USDC, USDT, TUSD, USDX, EURX and GBPX. They are also offering 15% APR on UST.

Similar to Celsius, Nexo gives users the option to earn additional interest (+2%) if users accept their native $NEXO token as rewards, rather than in-kind rewards. Interest is paid on a daily basis and they have a $375 million insurance fund in the event of hacks or theft.

BlockFi

BlockFi is a major competitor to Celsius and Nexo. They offer bank-like services to their users including interest on crypto assets deposited, a token swap service and a credit card so that users can spend their earnings.

BlockFi is currently offering 7.25% APY on GUSD, USDT, USDC, BUSD, DAI and PAX. Interest accrues daily and is paid to users on a monthly basis.

Note that BlockFi does not have its own native token.

Yield App

Yield App is a global fintech company managed by an experienced team in capital markets. Users can buy, swap, and earn yield on a range of crypto assets, including stablecoins.

Yield App offers incentives to holders of their native token, $YLD. By owning and staking the $YLD token, users can enjoy interest rate boosts. There are 4 different tier levels available, from Bronze to Diamond membership.

The platform currently offers between 6 to 10% APY on DAI, USDT, USDC and TUSD. With added bonuses to token holders of between 1 to 3% depending on their tier level. These additional rewards are paid to users in the $YLD token. By way of example, Diamond tier holders earn in-kind rewards of 10% plus 3% in $YLD token rewards (total 13%).

Anchor Protocol

Anchor Protocol is a decentralized money market savings and lending platform built on the Terra blockchain. The platform offers users approximately 19.5% APY on deposits of $UST which is the TerraUSD stablecoin.

Leading stablecoins such as USDC and USDT, are pegged to the price of the USD by a mixture of cash and debt. Unlike this, UST is an algorithmic stablecoin which maintains its peg to the USD through a network of arbitrageurs who buy and sell Terra’s volatile cryptocurrency called $LUNA. The elasticity of supply is designed to keep the peg in place.

Crypto.com

Crypto.com offers trading and yield generation services to its users. They are well known for their popular Visa Debit Card.

The yields that the platform offers are based on two key factors. Namely, the term that a deposit is locked and also how much $CRO, the native token of the crypto.com ecosystem, that a user owns. For example, a user that deposits any supported stablecoin for 3 months and also has 4,000 $CRO tokens staked would earn 8% APR. The platform pays interest on a weekly basis.

Stablecoins supported include USDC, USDT, DAI, PAX, TrueUSD, TrueAUD, TrueCAD, and TrueGBP.

Gemini

Gemini is an exchange where users can buy and sell crypto assets. They also offer yield services on popular assets, including stablecoins.

Gemini prides itself on security and has insurance on the user deposits that it holds.

The platform currently offers 6.43% APY on DAI, 6.36% APY on USDC and 6.9% APY on their very own GUSD.

Stablecoin Yield Summary

Investors should be mindful that there are risks to consider whenever they relinquish control of their crypto assets to any yield generating platform. As the saying goes, ‘not your keys, not your crypto’. Users need to weigh up the risks compared to the expected rate of return.

Hacks and outright theft are unfortunately commonplace in the DeFi/CeFi sector. Unlike traditional banks which are often backstopped with Government guarantees, crypto platforms do not offer the same peace of mind. If an event occurs which impacts the underlying principle, there is a possibility that user funds may be lost.

Be mindful of token locks and withdrawal limits. Most platforms have quite flexible arrangements when depositing and withdrawing assets however some require users to lock up their crypto for a period of time and may also have daily withdrawal limits. So, check the terms and conditions before depositing your funds.

A final note. Investors should be aware of the difference between quoted APR and APY. These terms may sound very similar but they are actually quite different. APR represents the annual % rate earned while APY also takes into account the compounding of interest earned.

Users should take the time to do their own due diligence and consider the reputation of each platform, the security of the assets that they manage and any insurance which may be in place to protect them. Consideration should be given to splitting assets across multiple platforms to reduce risk exposure to any single entity.

Follow Matt

Twitter @buyzeedips

Youtube https://youtube.com/c/CryptoBadgers

Final Notes

Thank you so much for your support, and I truly hope that today’s issue will give you insights needed to help you master your wealth.

If you are reading this it means you are on the free version of the Wealth Mastery Investor Report, which is great for news and tips on the crypto markets.

If you really want to take advantage of fastest growing asset class EVER, I highly recommend you join us in the Premium Investor Report.

You’ll immediately get access to:

- Deep dive Altcoin report & The Trending Coin Report

- Technical Analysis on the crypto large caps and overall market

- Token sales, Airdrops and DeFi Tutorials

- Updates on the NFT Ecosystem and new mints

- My Investment Portfolio Updates

See you next time!

Lark and the Wealth Mastery Team

Legal Disclaimer

TCL Publishing ltd (director Lark Davis, owner of Wealth Mastery) is not providing you individually tailored investment advice. Nor is TCL Publishing registered to provide investment advice, is not a financial adviser, and is not a broker-dealer. The material provided is for educational purposes only. TCL Publishing is not responsible for any gains or losses that result from your cryptocurrency investments. Investing in cryptocurrency involves a high degree of risk and should be considered only by persons who can afford to sustain a loss of their entire investment. Investors should consult their financial adviser before investing in cryptocurrency.