The Bitcoin Halving: Meme Value, Price Effect, and Death Spiral Myth

TLDR: The Bitcoin halving is a monumental event that reminds us each time of the immutability of the Bitcoin protocol. Despite its memetic significance to Bitcoin’s essence, it usually doesn’t cause any significant price action – at least in the short term. Doomsday scenarios like a miner death spiral have always been refuted.

The author of this piece, yours truly, will witness his first BTC halving soon after this article goes live. A class of 2020 guy, I took my first rabbit hole dive in June 2020, too late to witness the previous halving, which took place in May 2020. I can’t wait for this one, I’ll be glued to the halving clock.

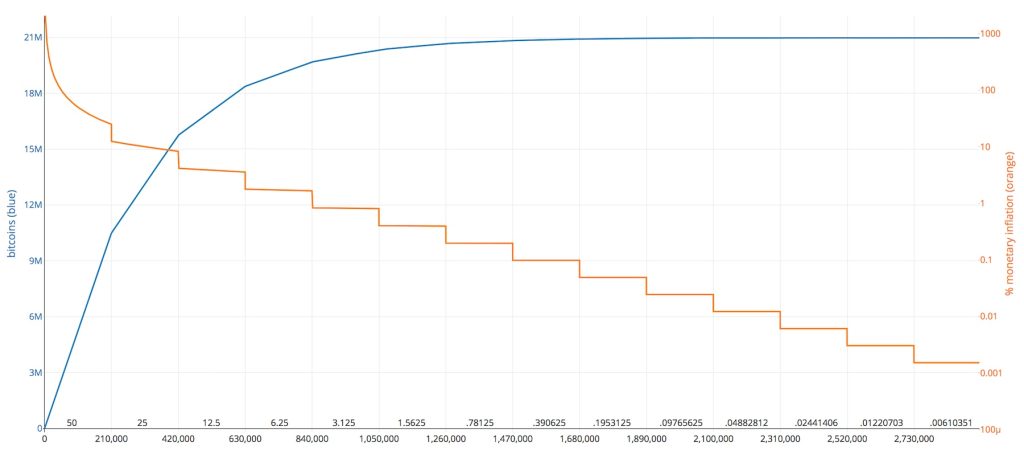

Bitcoin’s Tokenomics: the Halving

The Bitcoin Halving, also called the halvening, must be the most talked about event for a number on a screen changing one digit (in binary terms it’s one digit). Every 210.000 blocks, or roughly every four years, the number of BTC that the Bitcoin protocol spits out to lucky miners is cut in half. For the first four years of Bitcoin’s existence, the amount of new bitcoins issued every 10 minutes was 50.

- First Bitcoin halving, November 28, 2012 — Block reward down from 50 BTC to 25 BTC

- Second Bitcoin halving, July 9, 2016 — Block reward down from 25 BTC to 12.5 BTC

- Third Bitcoin halving, May 11, 2020 — Block reward down from 12.5 BTC to 6.25 BTC

- Fourth Bitcoin halving date — April 20 (?), 2024 — Block reward down from 6.25 BTC to 3.125 BTC

Strictly speaking, the unit of account in the protocol is a satoshi. What will be issued per block after the 2024 halving is 312.500.000 satoshis.

This makes the so-called tokenomics of Bitcoin exceptionally easy to grasp. The inflation rate is cut in half for each fixed number of blocks. There’s no burning mechanism, no ‘unlock schedule’ of when VC investors can sell their coins.

The latter point is important to keep in mind. Unlike most crypto projects that came after Bitcoin, BTC is handed out based on work, not based on capital investment. Secondly, Bitcoin’s issuance schedule is hard-coded in the protocol and not subject to community governance (yes, theoretically the protocol could still be changed, but because a large part of the community would not accept this, it would lead to a hard fork).

The Max 21 Million Meme

The pre-programmed series of halvings and their subsequent BTC-per-block issuance will lead to a total issuance of 21 million BTC. No more BTC can ever come into existence.

This number is arbitrary – Satoshi could also have chosen 17 million, or 21 billion, or 1 billion or whatever. The point is that it’s a finite number that is predictable. It’s set in stone.

This immutability gives Bitcoin a quality of being set in stone. And things that are set in stone last. Compare this to the issuance schedule with Ethereum. At first, Ethereum’s consensus mechanism was proof-of-work, then it changed to proof-of-stake. The amount of ETH issued per block changed dramatically after this transition, and on top of that ETH started to get burned at a variable rate. Very clever, very adaptable, but to the layman onlooker: a mess. Not set in stone. Bitcoin has this set-in-stone quality of having a fixed and limited supply, contrasting it with the monetary debasement of fiat currencies such as the dollar.

Price Action After Previous Halvings

Despite its significance and rarity, the halving has historically not had a lot of effect on the price around the date of the halving. Looking at the daily chart around the halving, you couldn’t have pointed it out without knowing it.

If you look at the graph of around the 9th of July 2016 halving date, you would see something similar: it was an ordinary trading day.

Same for the day of the 2020 halving.

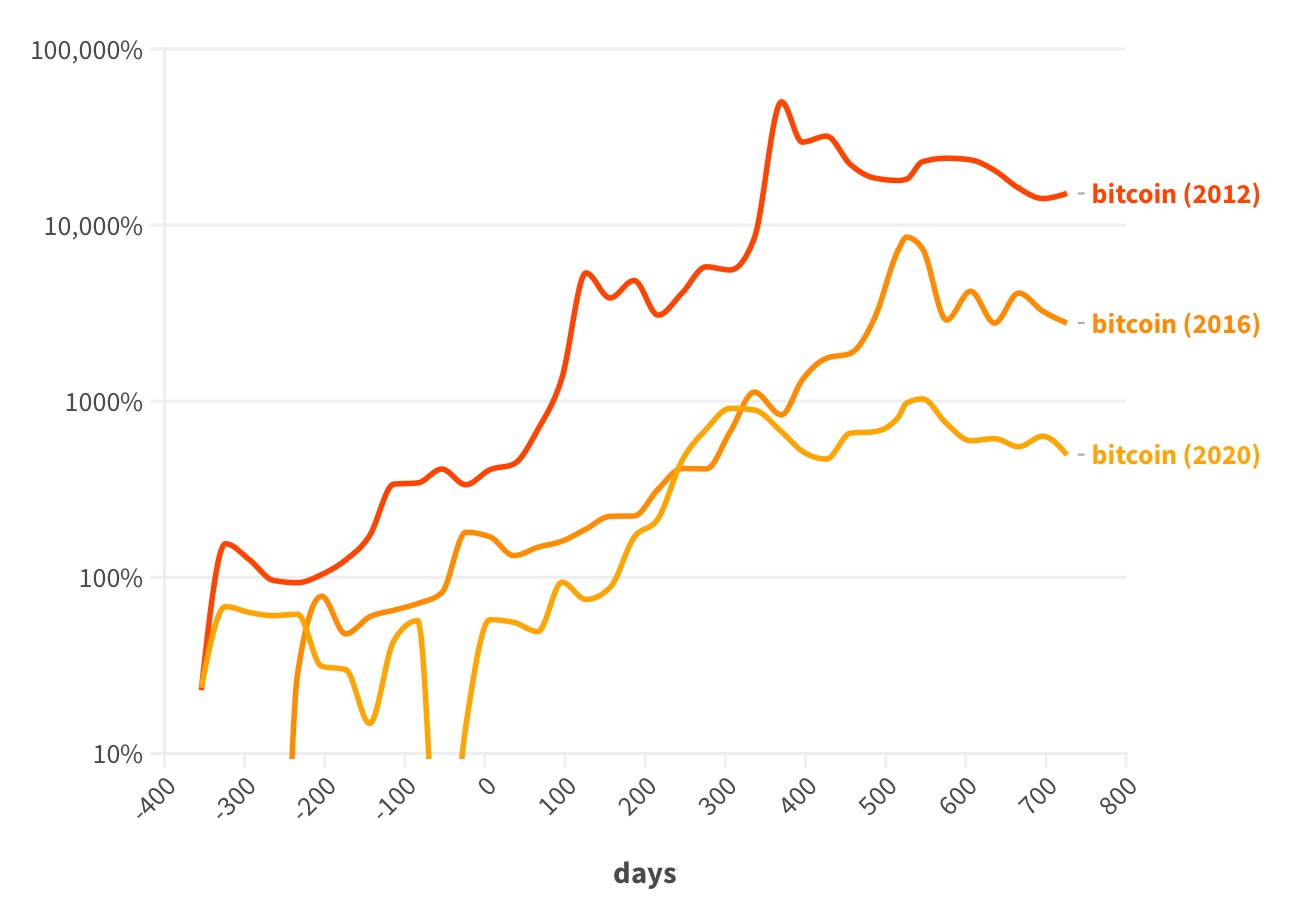

In this sense, the halving is priced in. It comes as no surprise to anyone and there is no reason for the price to dip or spike. But there’s more to the story. Historically, the BTC price after the halving has spiked, albeit with a six-months or so delay.

Price Effect

Here’s a log chart taken from Blockworks, where the diminishing returns post-halving are clearly visible. That’s to be expected because of two reasons. First of all, the

In each case, the chart post day 0 (the halving) stays flat for a while, as we’ve seen above.

But roughly five months after the halving, BTC has started grinding up exponentially. In each subsequent cycle, the returns diminish. Still, after the most recent halving BTC rallied from roughly 9k to 69k at the peak of 2021, more than a 7x. So, considering we’re around 65k in April 2024, what will this mean for the coming bull market? Will we see a large multiple of 65k?

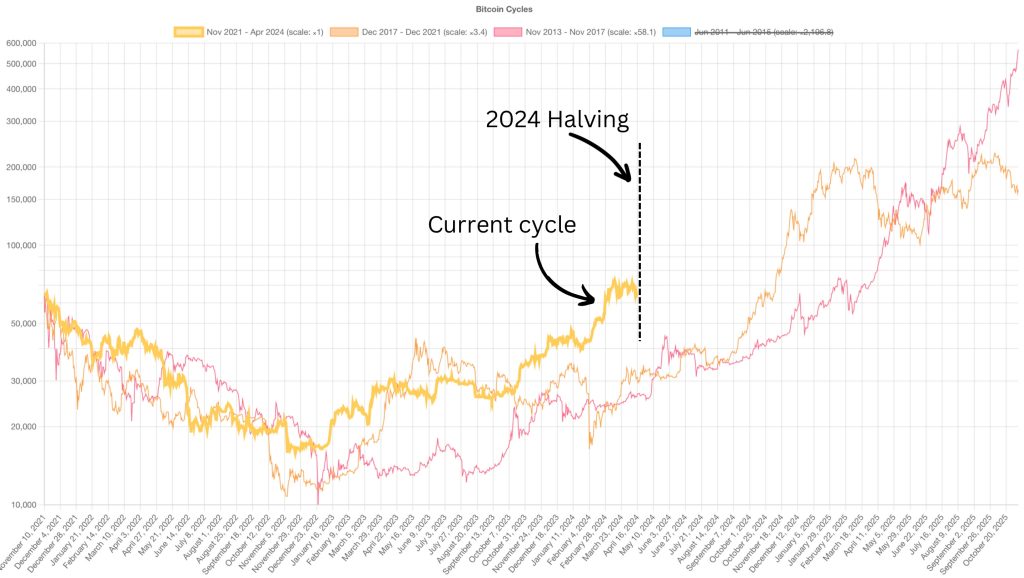

Is This Time Different?

There’s something of the current cycle that is different. In both previous cycles, the price at the halving was 60% below previous all-time highs. That would correspond to a 26k BTC price now! So clearly, we are ahead of schedule.

This leads people to speculate that we are in an accelerated cycle, or left-translated cycle, which will peak already in 2024. Maybe, but then again, we might cool off a bit from here and get on track compared to previous cycles.

It’s all to play for, let’s wait and see.

Myth: Bitcoin Death Spiral Post-Halving

Have you heard about the Bitcoin Death Spiral? It’s a bit of a myth, even though it has some potential truth to it. It predicts a catastrophic failure in the Bitcoin network following a halving event. How does the story go?

- After a halving, many miners will become unprofitable due to the decreased rewards and unchanged mining difficulty.

- As a result, these miners will shut down their operations, leading to a sharp decrease in the network’s hashing power.

- This decrease in miners would make it even harder to even mine the next block, further discouraging remaining miners

- This could lead to a feedback loop where more and more miners drop out.

- Block times would become slower and slower, and the entire Bitcoin network would stall before reaching the 2,016 blocks needed to adjust the difficulty level, thereby causing a complete operational halt.

Why has this death spiral not happened yet (and likely won’t)? Well, miners are not a uniform group; they use a wide variety of mining equipment with differing efficiencies, and they pay for electricity at varying rates. Some have access to free electricity. That’s why not all miners will become unprofitable simultaneously following a halving event.

Sure, the block time would become longer, but after the next difficulty adjustment, the remaining miners would become much more profitable. They are incentivized to sit the slower block times out and wait for the difficulty adjustment: after that, they will have less competition!

Conclusion

Around midnight of 19/20 April 2024 (UTC time), I suggest putting on orange goggles, grabbing a drink, and open a block explorer. Refresh every few minutes until block 840.000 pops up. Open it and witness how the number it states after ‘minted’ has become 3.125 BTC. Say cheers to yourself or to your bear market buddy who’s joining you on this joyous occasion. Then continue with your life as if nothing has happened.