Tough Markets, Anchor, Skale, Open Sea Phishing & New NFT Projects

Important Announcement:

Yesterday, we were supposed to close our 20% discount for the 6 month subscription, but we received quite a few emails from subscribers saying that the link did not work.

For that reason, we are keeping the cart open for one more day. So, if you missed your chance to claim the discount, you have 24 more hours to do so

It’s that easy!😊

Sign Up and Save 20%What’s On My Mind by Lark

Market Getting Hammered

Yeah… more fun times happening in the market. The sentiment right now is some of the worst I have seen in a long time. Stocks, particularly tech stocks have been hammered hard with many tech stocks down 50 to 80%. And they say crypto is too volatile! Speaking of which, most crypto coins have been smashed hard. In case you didn’t notice. Trading volume is down massively, 75% from the highs of November. Fed fears and war fears seem to be the primary fears spooking the market. With a healthy dose of inflation fear, rising oil price fear, and even recession fear. Fear is the name of the game now. Let us hope all of this de-escalates quickly. And as mentioned many times before, interest rate hikes will likely be bullish for the markets. The markets are messy right now. No doubt about that. It is much harder to make money in these conditions. But the markets will recover. They always do. The uncomfortable truth is that now is the time to be adding to positions. Within reason of course. Dollar cost averaging what you can afford is how winning will be done now. But remember that you must focus on survival in your portfolio. Maintaining adequate cash reserves to ride out market irrationality is key. Cash is trash, but it might just be king during a time of such uncertainty. Does that mean I have sold all of my crypto for cash? No. I am holding and accumulating, just not going all in.

Anchor Lives To Fight Another Day

Anchor has proven to be a very popular app for earning yield on stablecoins with their 19.5% rate. However the rewards fund nearly ran out recently. Which caused a lot of concern as people worried about a bank run on UST, the stablecoin used to earn interest. Thankfully Terra founder Do Kwon stepped in with a cool half billion to top up the rewards for Anchor. Which basically kicks the can down the road a few months. Will Anchor be able to find new ways to keep the rate high without massive cash injections? Time will tell. But perhaps simply lowering the rate would be the most sensible thing? Yet, that was not the chosen path. I will keep you updated as the situation develops, but Anchor is the premiere app on Terra right now. It must succeed and continue to keep users engaged. Anchor’s success is very important for Terra’s success right now. In other Terra news it was announced that Terra sold a billion worth of LUNA tokens which will be used to buy Bitcoin to back the UST token. Which should help concerns around holding the peg.

Skale 100 Million

Skale is an Ethereum layer two scaling solution working with massive partners and which is focused on running Ethereum applications faster and cheaper. They are launching a one hundred million dollar ecosystem fund in March. They join a long line of high profile funds. However Skale is valued at a much lower market cap compared to many of the other chains which have launched big funds. We are still so early in the scaling game that no clear winners have truly taken shape yet. So perhaps Skale is worth paying attention, if even just for farming opportunities in the near future.

Crypto Chicks NFTs

A collection of female based profile pictures called Crypto Chicks has been hit with plagiarism accusations as it appears that the entire collection was styled off of a 2018 collection by another non crypto artist.

On the left is the 2018 art, on the right is the Crypto Chick. See the similarity? And no, it is not just this one exact piece. A closer look reveals that this art was the base for much of the collection.

The floor prices have fallen fast and hard for Crypto Chicks after this revelation.

Sadly we just keep seeing this happen in the NFT space. Cash grabs are the norm, not the exception. Plagiarism is commonplace. Scamming is rife. There is zero barrier to make NFTs. Just blast out some art, and start selling it. Yes, there are great NFTs. BUT most are garbage. And I say this as someone that likes NFTs.

Open Sea Phishing

Open Sea has been hit by a new phishing attack that has so far netted around 2 million in profits for the scammers. Initial reports were basically completely wrong with some saying that 200 million had been stolen and calling this the NFT Mt Gox. This was false. Many also said that Open Sea V2 is at fault and that the contracts are flawed. Also false. It appears that a phishing link was likely shared in some NFT groups, perhaps on Discord. While these things usually take place via email, in this case it appears not to be what happened.

But this story serves as a good time to make a reminder. NEVER FOLLOW AN EMAIL LINK!!! NEVER DOWNLOAD A FILE OR OPEN A LINK FROM A STRANGER ON SOCIAL MEDIA OR IN CHAT GROUPS!!!! If you receive an email or someone tells you that you need to go to the website now to do an update, then go to the website via the link you have bookmarked and check to see if there are any notifications.

Now as for how the phishing attack was able to steal people’s funds. The affected users gave permission to a malicious smart contract. This has been a common attack vector in recent months. Once you give the permission to the malicious contract your funds will be drained. It is worthwhile to ensure that you have not enabled any unlimited spends or have connected to and approved any untrusted apps. You can check on either of these sites what permissions you have enabled.

You must be extremely careful! Just being involved in crypto makes you a target.

NFT Projects by Sam

NFT projects are getting more complicated, and to stand out it’s often necessary to create something more than just a nice-looking PFP. The lines between NFTs, DeFi, GameFi and the metaverse are getting more blurred, but that’s all part of the fun.

Something you might want if you’re buying into a project is not just the possibility of a quick flip, but a long-term hold with well-planned future benefits. Membership of a community is good, and tokens, staking and yield farming are going to keep people on board by offering, potentially, some attractive returns.

With its very low transaction fees and high speeds, Solana is home to a lot of projects that are promising this kind of action, so let’s take a look at some interesting ones, but be warned, there is a strong preference for pixelated animals in the Solana NFT space.

<h3 id="turtles“>TurtlesA collection of 3,333 turtles that has seen various airdrops and has minted the $TRTLS token. You can pick up the NFTs on secondary markets starting at a little over 8 SOL, and the token on Solana DEXes such as Jupiter and Raydium.

The $TRTLS token can be used to play at Solcasino, and coming soon, according to the roadmap, is an NFT staking mechanism by which to earn $TRTLS.

<h3 id="ubik“>UbikBeing upfront and honest is a good sign when assessing a project (always be on the lookout for rug pulls and cash grabs), so when a team posts thoughtfully about tokenomics, as Ubik has here, that’s a big positive.

Ubik are creating a “lofi metaverse” and an “electric sheep world”, and come on, who wouldn’t want to be part of those in these uncertain times?

There are native tokens, $POT and $NET, staking and airdrops, DAO plans, and some far-out ideas you can dive into in the Sheepaper called things like fission and mutant.

<h3 id="space-apes-empire“>Space Apes EmpireThis is a collection of 1,111 space-themed apes, linked to SolPlinko, a very simple gambling game. You don’t need to own one of the ape NFTs to play the plinko game, but ape holders can earn a share of the profits from SolPlinko.

Additionally, there are plans to integrate with Portals and Desolates, both metaverse projects being built on Solana. The NFTs are currently selling from around 4 SOL.

<h3 id="honey-finance“>Honey FinanceThis is a protocol aiming to link up DeFi and NFTs. The problem identified is that NFTs are illiquid, and Honey Finance aims to solve the opportunity cost of holding NFTs by opening up liquidity on your NFT assets.

Options the platform will provide include borrowing and lending, and NFT farming through which you can earn the $HONEY token. According to the whitepaper, you’ll be able to stake NFTs from various collections, but the primary method of farming will be through staking the native Honey Genesis Bee NFT.

<h3 id="lion-cats“>Lion CatsAt just 799 NFTs, this is a very low supply collection, and so it costs around 30 SOL to buy in at floor price. If you do so, you’ll be the owner of a cute pixelated feline, which you can then utilize to earn $IMBA tokens.

Earn enough $IMBA and you’ll be able to breed your cat, after which there is the promise of further utility and developments. It’s not cheap to join and the endgame is unclear, but for the moment at least, Lion Cats has been picking up momentum.

<h3 id="and-also…“>And also…There are many other projects offering these kinds of models, although the floor prices on some of the bigger projects are currently high so it’s a more substantial initial buy-in. To find out more, you might want to check out some of these well-established projects: Mindfolk, Taiyo Robotics, Boryoku Dragonz, SOL Flowers, Shadowy Super Coder.

There’s also MonkeDAO, which is an independent spin-off from Solana Monkey Business, one of the bluest-chip Solana projects, but there’s some drama unfolding around the two groups.

There’s ongoing disagreement over royalties, with the possibility that MonkeDAO could do something akin to a hard fork of the original project, wrapping SMB NFTs and enabling sellers to redirect royalties towards MonkeDAO rather than SMB.

One more project to highlight is MonkeRejects (I know, more monkeys). It has nice visuals and promises a token and staking, along with real-life physical products. This one is picking up attention and the floor is below 4 SOL, making it worth considering as a decent future prospect.

Solanalysis to Hyperspace

Staying in the Solana ecosystem, you might be familiar with Solanalysis, a very handy NFT data tool. In recent developments, the site has now been rebranded as Hyperspace, after raising $4.5 million in a seed round.

Solanalysis is still live as migration to the new site continues, but Hyperspace will also act as an aggregator across the various Solana NFT marketplaces, and you’ll be able to buy and sell NFTs through the new site.

GO PREMIUM TO SEE THIS WEEK’S TOP 3 NFT MINTS

Final Notes

Thank you so much for your support, and I truly hope that today’s issue will give you insights needed to help you master your wealth.

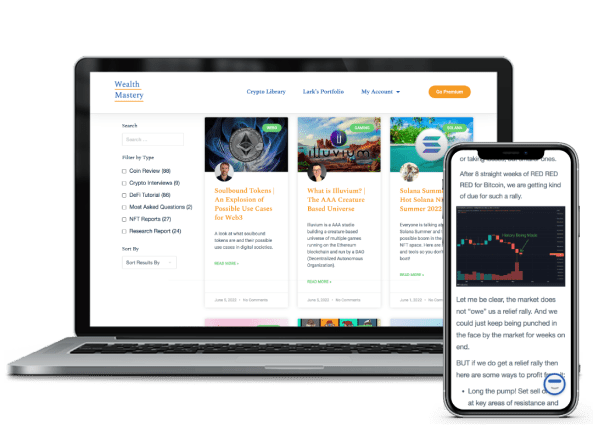

If you are reading this it means you are on the free version of the Wealth Mastery Investor Report, which is great for news and tips on the crypto markets.

If you really want to take advantage of fastest growing asset class EVER, I highly recommend you join us in the Premium Investor Report.

You’ll immediately get access to:

- Deep dive Altcoin report & The Trending Coin Report

- Technical Analysis on the crypto large caps and overall market

- Token sales, Airdrops and DeFi Tutorials

- Updates on the NFT Ecosystem and new mints

- My Investment Portfolio Updates

See you next time!

Lark and the Wealth Mastery Team

Legal Disclaimer

TCL Publishing ltd (director Lark Davis, owner of Wealth Mastery) is not providing you individually tailored investment advice. Nor is TCL Publishing registered to provide investment advice, is not a financial adviser, and is not a broker-dealer. The material provided is for educational purposes only. TCL Publishing is not responsible for any gains or losses that result from your cryptocurrency investments. Investing in cryptocurrency involves a high degree of risk and should be considered only by persons who can afford to sustain a loss of their entire investment. Investors should consult their financial adviser before investing in cryptocurrency.