[New Features Inside!] | Russia’s Crypto Payment Law, Cardano VASIL Hard Fork & Onmichain NFTs

![[New Features Inside!] | Russia's Crypto Payment Law, Cardano VASIL Hard Fork & Onmichain NFTs - - 2024 the team from elrond](https://thewealthmastery.io/wp-content/uploads/2022/04/Lark-Free-NL-TN-1024x536.jpg)

Before diving into this week’s content…I have an important announcement.

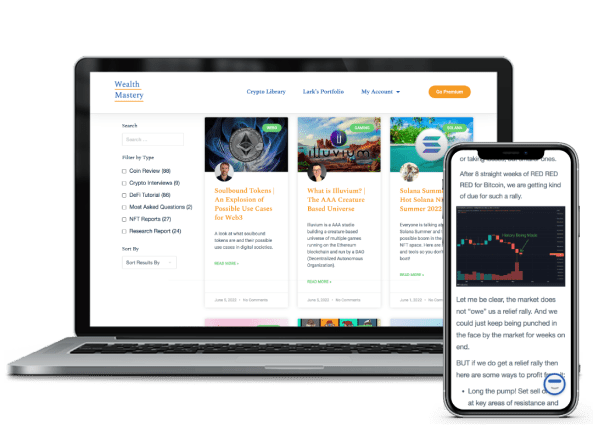

The Wealth Mastery team has been working hard to create new features to help YOU achieve your wealth goals.

Let me ask you something…

Would you like a dedicated page where you can track my exact investment portfolio?

What about a crypto library that breaks down specific coin reviews, DeFi tutorials and NFT projects?

Well…Not only can you access all of this right now. You can do so for FREE.

That’s right, we’re so excited about these new features at Wealth Mastery that we have decided to share a 7 day free trial to the Premium Newsletter and all of the incredible features that come with it.

All you need to do is click here to sign up and get access to Larks Portfolio and The Crypto Library Now!

This trial is only available for the next 7 days though, so act fast!

Enjoy and thank you for being a loyal subscriber to Wealth Mastery!

OK… Back to our regularly scheduled programming..

In This Issue

- I share my thoughts on the state of the market, Russia’s crypto payment law, token wars, AVAX subnets & the Cardano VASIL hard fork

- Sam has a report for you on omnichain NFTs

What’s On My Mind by Lark

<h3 id="the-state-of-the-market“>The State of the MarketAfter the big rejection from $48,000 down to $39,000 Bitcoin has slowly been grinding sideways. The market is still unable to define a strong trend either up or down. These “boring” times in the markets tend to be good times to average into positions. That being said there is still money to be made in this market. STEPN has reached a new high this week, now up like 300X from the ICO on Binance. Nuts. Not all token sales do anywhere close to that good, but there are still good returns on token sales across the board right now. And of course farming remains highly lucrative with new platforms launching all the time and with existing services continuing to offer good yields.

<h3 id="russia-crypto-payments-law “>Russia Crypto Payments LawRussia is said to be in the final stages of releasing a bill to legalize crypto as a form of payment inside the country. This has MASSIVE implications if the final bill goes as far as I hope. Crypto could end up being a lifeline for the Russian economy. Over the last few months Russia has been hit hard with sanctions over the government’s invasion of Ukraine. But as so often happens with sanctions, the regular people are hit the hardest. Let me give you an example of my friend Olga who works in a wine import company in Russia. Once sanctions hit and Russia was taken out of SWIFT (the international bank messaging service), their clients suddenly started canceling orders, because they no longer thought her company could pay their bills. They now demand up front payment for the wine. But her company cannot send money to them, because her company’s bank cannot talk to the foreign sellers bank. This is but one anecdotal example which will be replaying itself many times over across Russia. However, if her company was legally allowed to accept crypto then it would be a game changer!!! It would completely allow regular businesses to sidestep the SWIFT network and legacy banking system. The economic implications of this story are potentially massive.

<h3 id="token-wars “>Token WarsThe so-called protocol wars are when we see new protocols trying to acquire large portions of a different protocol’s tokens either to affect governance or to get big boosts to APR rewards. This has usually created a bullish narrative for the target token and often for the token of the protocol doing the acquisition. Curve and Convex on Ethereum are what started this trend. Furthermore the advent of vote locked tokens into crypto have created a very interesting form of token velocity for the protocols implementing it. The idea here is that as long as you keep the token locked up you will receive extra rewards, and as soon as you unstake your tokens you lose ALL of your boost power. So basically tokens must be locked for a long time. With protocols gobbling up millions of JOE tokens for this exact purpose it becomes a very interesting coin to keep an eye on. We also see this playing out for other protocols like Platypus Finance. Then when we layer on other factors like vote bribes then potential for investors starts to become very very interesting. This is an area that I think we will see a lot of growth in for the right platforms.

<h3 id="avax-subnets “>AVAX SubnetsI continue to be interested in the Avalanche ecosystem and so today I wanted to talk a bit about Avalanche Subnets. What is a subnet? Well, put simply it is a custom blockchain living alongside the main Avalanche chain. Essentially it is like a sidechain for Avalanche, and will help provide native scaling solutions for the blockchain. Basically layer two scaling for Avalanche. There is a $290 million fund which was announced to get subnets off the ground. This will allow for defi, nfts, and gaming to flourish on the Avalanche network. Subnets while piggybacking off of Avalanche, will be able to use their own tokens as gas fees instead of AVAX which would be useful in many scenarios like with a game. Subnets are not live yet, but they are getting the AVAX community excited about their potential! Popular Avalanche game Crabada has even launched a subnet on the testnet. The next era of Avalanche is coming soon!

<h3 id="cardano-vasil-hard-fork “>Cardano VASIL Hard ForkIn June Cardano will be undergoing a major hard fork called Vasil. The recent uptick in usage of the blockchain with the launch of defi applications and the growing NFT scene has meant that Cardano needs to scale! The team already has increased the block size by 25%, but this can only be done so much while maintaining security. Enter the Vasil hard fork. This hard fork will see a big increase to scalability of the blockchain. This will be done via pipelining (faster block propagation), UTXO on-disk storage, and bringing out Hydra. The upgrade will also bring in bridges to allow for interoperability. One thing I have had trouble finding is exactly how much better Cardano will be after this, but a lot better is what we can expect.

Omnichain NFTs by Sam

There are some huge launches taking place in the NFT space, with the Yuga Labs metaverse land sale still to come, VeeFriends Series 2 this month, and last weekend’s Moonbirds release.

These projects are surrounded by hype and high expectations, and BAYC’s land sale in particular will bring increased attention to the NFT space, which is definitely a good thing.

On the other hand, a sequence of expensive, big name releases can suck up liquidity. Keep this in mind if you’re considering jumping into any new, smaller projects, since it could be harder for them to make gains around this time.

Moonbirds did huge volume on secondary, with a floor price currently around 20 ETH after a 2.5 ETH mint price, so a more optimistic take is that sidelined money came into the market, and sellers now have that ETH to spend.

Prices on many other projects had dipped prior to the Moonbirds launch, as did the price of ApeCoin, so how it all plays out from here remains to be seen.

<h3 id="a-predictable-cycle“>A predictable cycleThere’s a common cycle developing around new NFT launches, which goes like this:

- A project that has gained a reasonable amount of hype and sold out its mint then pumps on OpenSea while still pre-reveal.

- After that, post-reveal, prices either crash or slowly drain out over a few days.

- Finally, sellers move on to the next project and the process repeats.

Some collections never really come back after dumping, but others carry on with their plans and recover, meaning the period after a post-reveal crash can–in some cases–be a good opportunity to buy, if a project looks solid.

The point is that this cycle exists at the moment, so be careful to buy, sell and hold accordingly. Overall though, it’s not a sustainable way for the NFT space to operate, and there’ll have to be a change (hopefully for the better) at some point.

<h3 id="omnichain-nfts“>Omnichain NFTsAn interesting new format is starting to be utilized to launch NFTs, called omnichain. What this means is that an NFT collection can be launched simultaneously across several different blockchains, and post-release, NFTs can be transferred between the compatible chains.

Omnichain NFTs can be created so that they have different characteristics depending on which chain they’re based on, and can alter when transferred across to a different chain. This kind of interoperability could lead to a situation where distinctions between different blockchains become less important, and we simply deal in NFTs as a whole, rather than having separate ecosystems.

LayerZero Labs

Omnichain NFTs are making use of the LayerZero protocol, developed by LayerZero Labs. The protocol enables interoperability between blockchains compatible with the EVM (Ethereum Virtual Machine), with plans to incorporate non-EVM blockchains in the future.

Currently, LayerZero works with Ethereum, Polygon, Binance Smart Chain, Avalanche, Fantom, Arbitrum and Optimism.

LayerZero Labs, which is based in Canada, recently raised $135 million in a funding round, with the company valued at $1 billion, which gives an indication of how significant interoperability might become within decentralized app development, and in web3 in general.

Gh0stly Gh0sts and Tiny Dinos

The first omnichain collection was Gh0stly Gh0sts, which stealth minted on April 3rd using LayerZero. The launch was across several blockchains, and it was free to mint. From there it took off on secondary, and is now holding a floor price on OpenSea of around 0.5 ETH.

There are 7,710 ghosts, with varying numbers on the different chains, but the majority are on Ethereum (a higher number minted on Ethereum to start with, and more have since been moved over to Ethereum). One feature of the design is that the background color indicates the minting chain, while the border changes color depending on which blockchain the NFT is currently located on.

There’s a possibility that Gh0stly Gh0sts could come to be seen as a historically significant collection.

Soon after Gh0stly Gh0sts, came Tiny Dinos. Also minting for free using LayerZero, this 10,000 piece omnichain collection had no roadmap and no Discord, but quickly picked up volume on secondary, and is currently at an entry point of around 0.2 ETH.

Again, this is an early mover, it’s attracted attention from Sartoshi (the creator of MFers), and pixel art may be due for a revival this year. Also, Tiny Dinos has triggered a flurry of copycats (there are Tiny Girls, Tiny Boys, and Omnifrogs, that I’m aware of) which is a sign that a project might be significant.

<h3 id="cc0“>CC0Both Gh0stly Gh0sts and Tiny Dinos utilize CC0 copyright licensing. CC0 (or creative commons) is the most permissive kind of licensing, meaning that anyone can utilize the NFT images however they like, without permission from either creator or owner.

In other media, this would be highly unusual, but it’s been applied before in NFT collections including MFers, Nouns and CrypToadz, and now in these two omnichain collections too. CC0 allows for anyone to get creative with the content being dropped, which can, potentially, result in explosions of activity and expanding network effects.

There’s no reason why omnichain projects in particular should use CC0, but it ties in with the feeling of openness and innovation, and might become something that sets NFTs, or omnichain NFTs in particular, apart from traditional media and art. Either way, along with omnichain, use of CC0 is a trend to be aware of.

CNFT Jungle

NFTs on the Cardano blockchain have been making moves lately, but when it comes to tools and analytics, the Cardano NFT world has felt sparse compared to everything available on Ethereum.

Helping to improve this situation is CNFT Jungle, which provides rarity rankings, analytics, information on future launches and current mints, and extensive sniping tools.

GO PREMIUM TO SEE THIS WEEK’S TOP 3 NFT MINTS

Final Notes

Thank you so much for your support, and I truly hope that today’s issue will give you insights needed to help you master your wealth.

If you are reading this it means you are on the free version of the Wealth Mastery Investor Report, which is great for news and tips on the crypto markets.

If you really want to take advantage of fastest growing asset class EVER, I highly recommend you join us in the Premium Investor Report.

You’ll immediately get access to:

- Deep dive Altcoin report & The Trending Coin Report

- Technical Analysis on the crypto large caps and overall market

- Token sales, Airdrops and DeFi Tutorials

- Updates on the NFT Ecosystem and new mints

- My Investment Portfolio Updates

See you next time!

Lark and the Wealth Mastery Team

Legal Disclaimer

TCL Publishing ltd (director Lark Davis, owner of Wealth Mastery) is not providing you individually tailored investment advice. Nor is TCL Publishing registered to provide investment advice, is not a financial adviser, and is not a broker-dealer. The material provided is for educational purposes only. TCL Publishing is not responsible for any gains or losses that result from your cryptocurrency investments. Investing in cryptocurrency involves a high degree of risk and should be considered only by persons who can afford to sustain a loss of their entire investment. Investors should consult their financial adviser before investing in cryptocurrency.