Best Countries for Crypto Taxes

TL;DR

Crypto holders and traders have a few certainties in life: their net worth is never the same from one day to the next. Another one is that the taxman knows where you live. But wait, what if you move? Indeed, there are huge differences between the way different countries tax crypto. A crucial component is how they deal with capital gains. Let’s have a look at the best countries for crypto taxes.

I’ll zoom in from a broad perspective. So let’s start with the question which countries, in general, are considered good home bases for asset holders? And then I’ll zoom in on crypto tax environments.

Capital Gains Tax in the US

As many readers of this piece are from the US, I’ll first talk a bit about that first. The United States is one of the few countries that taxes its citizens on worldwide income, regardless of where they live. This includes capital gains tax.

So, if you’re a US citizen, moving abroad won’t release you from the taxman (there are exceptions: US citizens can exclude part of their overseas earned income from taxation if they meet a physical presence test in the foreign country and paid taxes there).

What is Capital Gains Tax?

Capital gains tax, like people in the US and many other countries pay – is a type of tax on the profits earned from the sale of assets such as stocks, real estate, or a business.

In the United States, for example, if you’ve realized a profit on an investment in a taxable account, then you’ve earned a capital gain and you’ll have to pay tax on it. For example, if you buy 1000 dollars of Tesla stock in May and sell it in October for $1500, you’ll have to pay a percentage of your $500 gain to the IRS. If you’re in the 22 percent tax bracket, you must pay the IRS $110 of your $500 capital gains.

Short-Term and Long-Term Capital Gains Tax

The above example assumes you bought and sold within 12 months. But there’s a nuance. Capital gains taxes in the US are divided into two big groups, short-term and long-term, depending on how long you’ve held the asset.

- Short-term capital gains tax is a tax applied to profits from selling an asset you’ve held for less than a year. Short-term capital gains percentages are equal to the percentages of your income, such as wages.

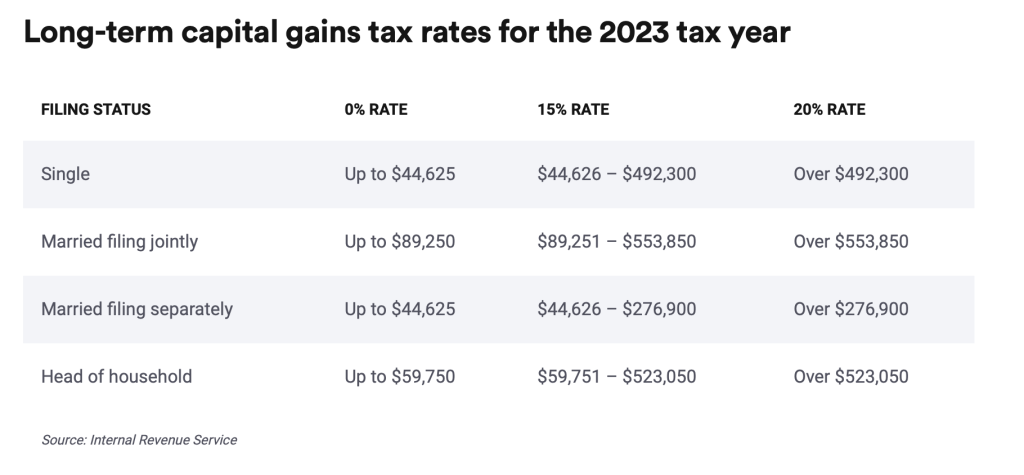

- Long-term capital gains tax in the US applies to assets held for more than a year. The long-term capital gains tax rates are 0%, 15%, and 20%, depending on your income.

Let’s continue the example. If you hold on to the Tesla stock until the following December and then sell – let’s say for $1700, it qualifies as a long-term capital gain. So what is the capital gains tax percentage you have to pay? If your total yearly income is $50,000, then you’ll fall in the 15% bracket for that long-term capital gain. Instead of paying $110, you’ll pay 0.15 x 700 = $105 – a lower tax on a higher gain.

Crypto assets in the US fall under this capital gains tax regime. If you sell your BTC, ETH or PEPE for a profit, you will pay capital gains taxes.

Capital Gains Tax Regimes per Country

A country could ‘favor’ a certain asset class over another, tax-wise. Some countries may have favorable tax treatment for specific types of income, such as long-term capital gains. The tax treatment of real estate investment gains, including capital gains and rental income, may differ from other types of investment.

Countries with Low or Zero Capital Gains Tax

No offense to zero capital gains tax countries such as Monaco, Singapore, Hong Kong, and the Cayman Islands, but let’s have a look at ‘real’ countries here that are also expat-friendly. In other words, the below list is not exclusive, but let’s say, realistic should you want to move.

- Switzerland: Unless you are trading for a living, Switzerland doesn’t tax capital gains on investments and stocks.

- Belgium: IF capital gains are part of the normal private management of personal assets, they are not taxed. Read: degenerate gamblers (on stocks too) might not be exempt. The definition of ‘normal’ is a tough one, of course, and up for debate.

- Malaysia: Generally, capital gains on assets held for more than six months are taxed at a lower rate.

- New Zealand: this country doesn’t impose a capital gains tax on the sale of equities or other investments.

- Thailand: zero capital gains taxes IF you sell assets outside of Thailand AND you wait one year before remitting them.

- United Arab Emirates: As a resident, you benefit from tax-free returns on all your investments, local or international.

Note that in two of the above countries, tax agencies treat trading and holding/selling with large intervals differently. Do you trade? Then the zero capital gains tax regime doesn’t even apply in these countries.

To apply for zero capital gains tax in these countries, there can be requirements. Check out this article for detailed info on these requirements.

Countries that are Crypto Tax-Friendly

Again, this is a list of countries that are rather expat-friendly and does not include microstates – except for two honorable mentions. And again, there is sometimes a distinction made between holding crypto longer term and trading crypto.

Switzerland

Bitcoin city Lugano and Switzerland’s crypto valley can flourish in part because of Switzerland’s lack of capital gains tax. It does levy a wealth tax (around 0.6% yearly, on your assets). Also, each canton (district) has its own tax rules. So, make sure to investigate those before you pack your bags – or sell your bags.

Germany

This country has a sort of hodl-bonus: if you sell your crypto after more than 12 months of holding, you won’t be subject to any tax. Also, short-term cryptocurrency gains of less than €600 are not taxed.

Portugal

Until recently, crypto was not subject to capital gains and income tax in Portugal. A lot of expats flocked there and were encouraged by a certain visa program that allows crypto industry pros in. Solana has hosted their conferences in Lisbon. However, Portugal’s tax regime has unfortunately slightly changed. Portugal introduced a 28% capital gains tax for cryptocurrency starting in the 2023 tax year. Still, like Germany, if you hold longer than a year, there is no capital gains tax on crypto.

Singapore

A tax haven for people and businesses alike, Singapore does not have a capital gains tax. That means you can sell your bags completely tax-free.

Malaysia

Like its neighbor Singapore, Malaysia does not tax capital gains and income from crypto – unless for pro crypto traders. They don’t view crypto as a store of value, so it’s not ‘capital’. Nice.

El Salvador

The first country to accept Bitcoin as legal tender in 2021, the country’s taxes related to ‘technological innovation’ have been removed. This includes capital gains tax, and property tax. There are also other perks, such as being able to buy real estate with Bitcoin.

United Arab Emirates

As mentioned, the United Arab Emirates doesn’t charge income or capital gains tax for individual investors. This also applies to crypto as well.

Honorable mention: Malta

With a population of only half a million, this is a borderline case and could be excluded because of the ‘microstate criterion’. But hey, it’s in the Mediterranean. And it gets an honorable mention because Bitcoin OG Adam Back lives there. Blockchain island. In Malta, there is no long-term capital gains tax for cryptocurrency.

Honorable mention: Cayman Islands

Even though it’s unlikely that the average reader would move there, I want to include this country. Cayman has no tax legislation for selling or trading crypto. So even pro traders wouldn’t pay taxes there. Also, no income taxes, no wealth taxes, no nada.

Other Factors to Take into Account

Obviously, before you want to become a resident of a crypto-friendly country, there are a ton of factors to take into consideration. Some are outside the scope of this article (family, work, religion, weather, etc). But some related matters I want to touch on here.

Keep in mind that there can be a reason that some countries want to attract rich crypto investors. And the fact that they attract them, means that the cost of living will go up there. So, it’s completely conceivable that your tax benefits will be offset by other higher costs.

Also:

- Constant changes to tax laws can make long-term investment planning a pain. It’s crucial to consult current local tax regulations or a tax advisor.

- Economic stability: Obviously, you want to err on the side of stable economies. Who cares for lower taxes if there are riots in the streets?

- VAT and Sales Tax: these cost-of-living taxes are worth looking into before you move.

A Second Passport?

As you may have seen, Lark Davis has bought second passports for his family, just in case. Now, these passports have nothing to do with crypto-favorable tax rules. Instead, they act as a ‘Plan B’ in case shit hits the fan on a global scale. It’s also worth noting that some people may qualify for citizenship by descent, based on their family history, potentially allowing them to acquire passports from countries within the EU or other places.

Conclusion

More than anything, this article was written to make you realize you have options. At least theoretically. In practice, it won’t always be easy to move countries. Of course, always consult a tax expert if you are considering a move. This article obviously isn’t official tax advice. Tax regimes change and you don’t want to move to a country that is about to revert its crypto-friendly status. Also, there’s more to life than paying low taxes…