Ethereum spot ETFs: Approval Likely, but Probably Not Soon

TL;DR We’re a little over two months removed from the final deadline for US approval of multiple Ethereum spot ETFs. From the lackluster engagement the SEC is showing, analysts agree that the odds against approval are growing. The consensus though is that ETH ETFs will come in the more distant future. If anything, a rejection could mean a buy-the-dip opportunity.

When big names such as BlackRock and Fidelity put their weight behind the approval of the spot Bitcoin ETFs, we knew the chances were high that approval was imminent. Especially as the court had just ruled in Grayscale’s favor when this trust fund challenged the Securities and Exchange Commission’s (SEC) refusal to convert their fund into an ETF. In August 2023, a bipartisan-appointed court unanimously decided the SEC had acted in an ‘arbitrary and capricious’ way, denying Grayscale the ETF.

Arbitrary and Capricious

Why arbitrary? Because the SEC (chairman Gary Gensler especially) had previously already approved futures(not spot) Bitcoin ETFs, even leveraged futures ETFs.

Futures trading is much more speculative than spot trading. And it is indeed very weird that you would allow trading in future prices of let’s say corn, but not allow the trading of physical corn!

There are other reasons why futures ETFs are inferior products compared to spot ETFs.

Futures ETFs have slippage fees that come with ‘rolling over’ the futures contracts. After all, they have expiration dates. People who want to stay exposed will need new contracts. If next month’s contract trades at a premium compared to the nearest expiry, this is called ‘contango’.

Also, futures ETFs can experience tracking error: that’s where the ETF performance deviates from the performance of the underlying asset.

So, the SEC was in effect forced by the court to approve Grayscale, and by extension other issuers, their spot Bitcoin ETF.

And the rest is history, as they say.

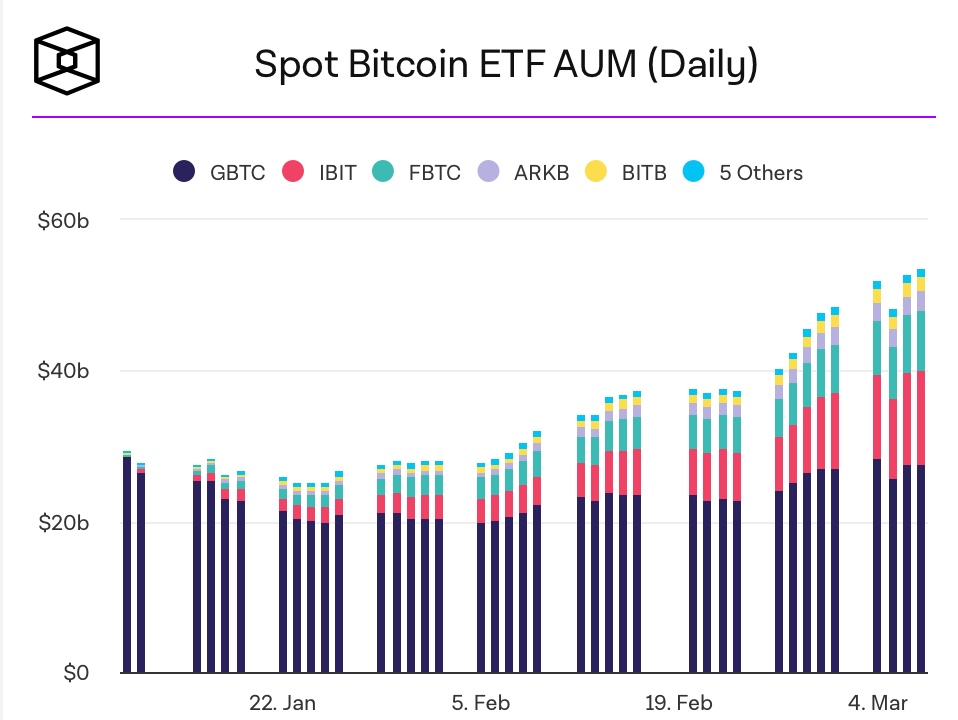

The spot BTC ETFs were a success beyond what even bullish analysts had considered reasonable to expect. The assets under management are at the time of writing going up with 500 million to 1 billion dollars per day!

Before I go into the implications for Ethereum spot ETFs, let’s first look at the issuers and timeline.

Issuers and Deadline for Approval

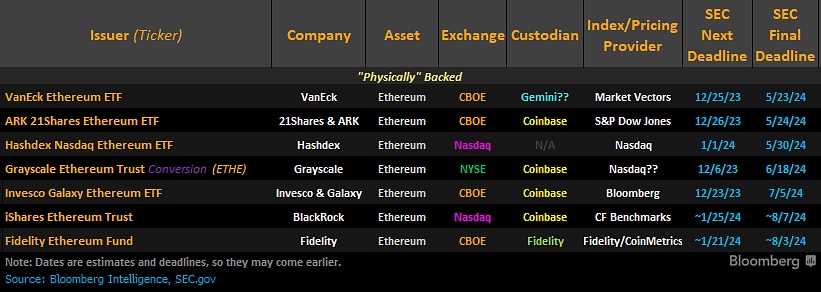

Eight issuers are standing in line for approval, awaiting launching their own Ethereum ETF. Heavyweight BlackRock is again among them, and Fidelity and ARK are other very reputable names.

VanEck is the first which see the SEC’s deadline to come with a yes or no approaching: May 23, 2024. Franklin Templeton is the most recent addition to the list of issuers (not yet included in below graph).

Arguments Pro May 2024 Approval

- Power games: what speaks for the impending approval is that heavyweight Blackrock has filed for one, and it got the Bitcoin spot ETF when it asked for it.

- Legal and regulatory pressure. The reasoning behind the court’s decision to call the SEC’s denial of a spot Bitcoin ETF arbitrary, can be copy-pasted on the Ethereum ETF. Also in the latter case, it is arbitrary that there’s already a futures ETF.

- It’s an election year and even staunch political opponents of crypto will feel less sure going heads-on with their electorate that is heavy in profit and loves crypto – for now 🙂

Arguments Con May 2024 Approval

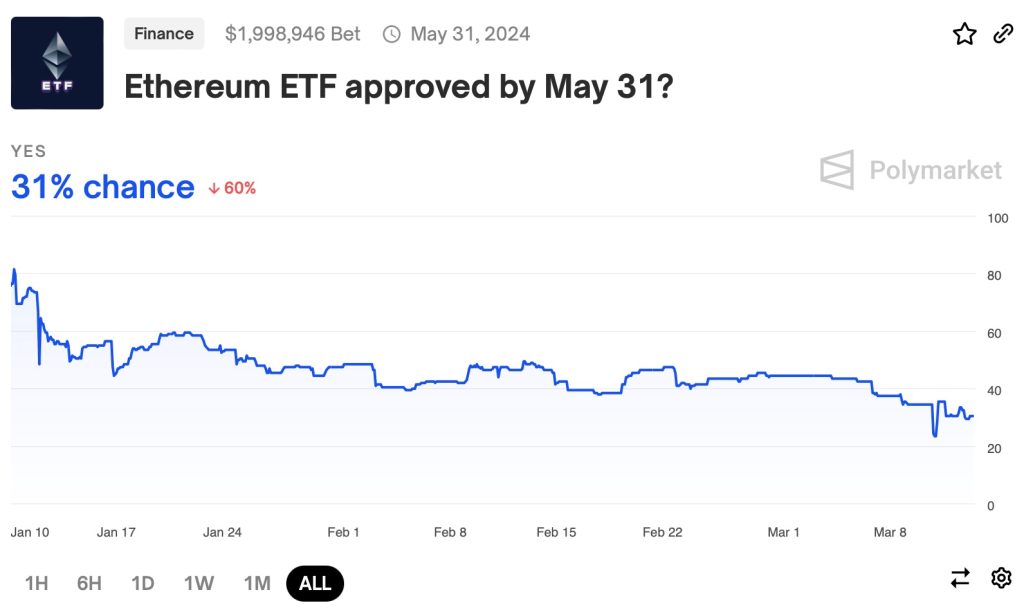

In recent weeks, more and more onlookers of the markets place the odds of an approval lower than 50%. It is also evidenced by market sentiment on platforms like Polymarket, where the approval odds dropped below 25% and are 31% at the time of writing.

What are the reasons and signs that point to a no?

- The lack of engagement from the SEC on critical issues related to the ETF. Fox Business journalist Eleanor Terrett: ‘Based on my conversations with people familiar, meetings in recent weeks have been very much one sided, with issuers and custodians trying to rally SEC staff to get the process rolling, but staff not really engaging in meaningful ways like they did with the BTC spot ETF applications.’

- Uncertain regulatory status of Ether the asset: The SEC’s Gary Gensler has often claimed that all cryptocurrencies, except Bitcoin, are securities. This would place Ethereum into a different regulatory category from Bitcoin. The SEC could use this as a ground for denial.

- Politics: The SEC has received blowback from figures such as Senator Elizabeth Warren for approving a spot Bitcoin ETF. Gary might want to please his political friends the time by at least managing to delay an Ethereum ETF approval.

- Technical differences: Some of the applications for a spot Ethereum ETF include a staking component, which the Bitcoin ETFs obviously don’t have. This complicates matters.

What if the Ethereum ETFs are Denied?

Should VanEck’s ETF be denied on May 23, this means that no other ETF has a chance this round. VanEck and/or the other issuers will probably go to court and likely book a victory there.

Such a victory will make it almost impossible for the SEC to deny a new round of applications. This process can take many months though. According to Valkyrie Chief Investment Officer Steven McClurg, a spot Ether ETF won’t be coming anytime soon, but it could come in the next year or two (quoted in an interview with The Block).

How Successful Will the Ethereum Spot ETFs Be?

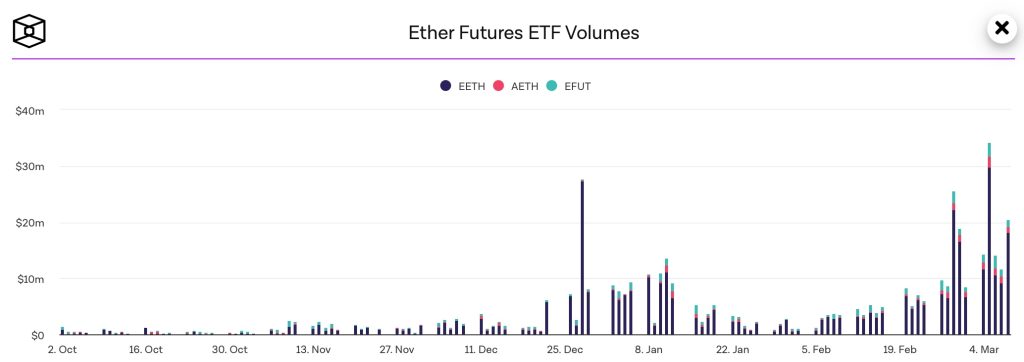

Here’s a graph (source: The Block) Ethereum Futures ETFs data.

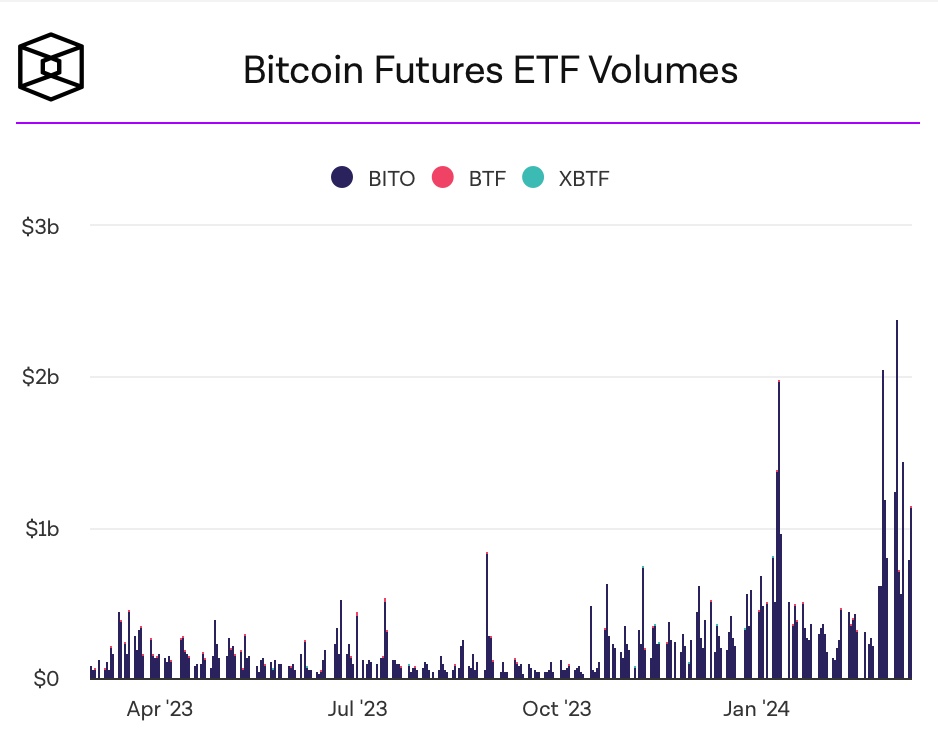

The volume of the futures ETFs was underwhelming in the first three months or so but has picked up quite a bit. But the 15 or so million volume per day in March is still a 65x lower than BTC futures ETFs with their 1 billion futures ETF volume in the same period (see below).

Roughly 80% of ETF volume for BTC has been taken up by the spot ETFs compared to the futures ETFs (see first graph of this article).

Applying this ratio to potential spot Ethereum ETFs would imply a roughly 100 million per day volume for Ethereum spot ETFs. On great days, it could be in the range of 250 – 500 million. Nothing to sniff at, but not in the same ballpark as Bitcoin’s ETF’s volumes.

Conclusion

Despite the crypto community’s high spirits earlier this year, recent developments explain the growing skepticism about the SEC’s approval of Ethereum ETFs in May. Analyst Jake Chervinsky sums it up: ‘The SEC has a legal argument that, even if wrong, likely passes the laugh test by enough to justify denial if it wants. And we know the SEC is willing to take wrong legal positions in court to satisfy political priorities.’ The consensus is that a rejection of Ethereum spot ETFs is more likely than a few months ago. But make no mistake: the ETH ETFs are coming. There’s no stopping this train. Courts are behind the ETFs. We might only need to get the chairman of the SEC out of the way. Potential news of rejection might send the markets lower for a while: view it as a dip buying opportunity.