Coinbase SWOT Analysis (COIN)

Coinbase, a leading cryptocurrency exchange platform, has significantly shaped the digital currency landscape since its inception. As it continues to expand its services and user base, understanding its strengths, weaknesses, opportunities, and threats (SWOT) is crucial for navigating the rapidly evolving cryptocurrency market.

This analysis aims to provide a comprehensive overview of Coinbase’s current market position, highlighting its competitive advantages and identifying potential challenges. Through this SWOT analysis, we will delve into the internal and external factors that could influence Coinbase’s future growth and sustainability.

What we think: Wall Street is Missing the Forest for the Trees. They just haven’t yet grasped how big crypto may one day become. Give the suits some time. They’ll get there. But once Wall Street does realize the asymmetric bet that is crypto, they’ll do a better job pricing COIN, given the air-tight correlation between it, crypto’s total market cap, and Coinbase’s revenues.

What Wall Street Thinks: Sell (25%) Hold (40%) Buy (33%). A slight plurality of Wall Street advisors are currently recommending a hold for COIN, with an average issued 12 month price target at $80.

Disclaimer: This is not financial advice. Money Mastery is simply reporting what some Wall Street firms are telling their clients.

Coinbase’s Company Profile

| Company: | Coinbase Global, Inc. (COIN) | Equity Style: | Mid-Cap Growth |

| Industry: | Financials | Last Stock Price: | $84.47 |

| Sub-Industry (SI): | Financial Exchanges and Data | P/E Ratio: | NM (SI avg. 31.9) |

| Market Cap: | $20.2 billion (SI avg. $9.6 billion) | ROE: | -22.1 (SI avg. -23.4) |

Coinbase is a cryptocurrency exchange platform in the United States. The company provides crypto trading, custodial, and data analytics services to both retail and institutional customers. Established in 2012, Coinbase went public in 2021. The company has no formal headquarters as the entire staff works remotely.

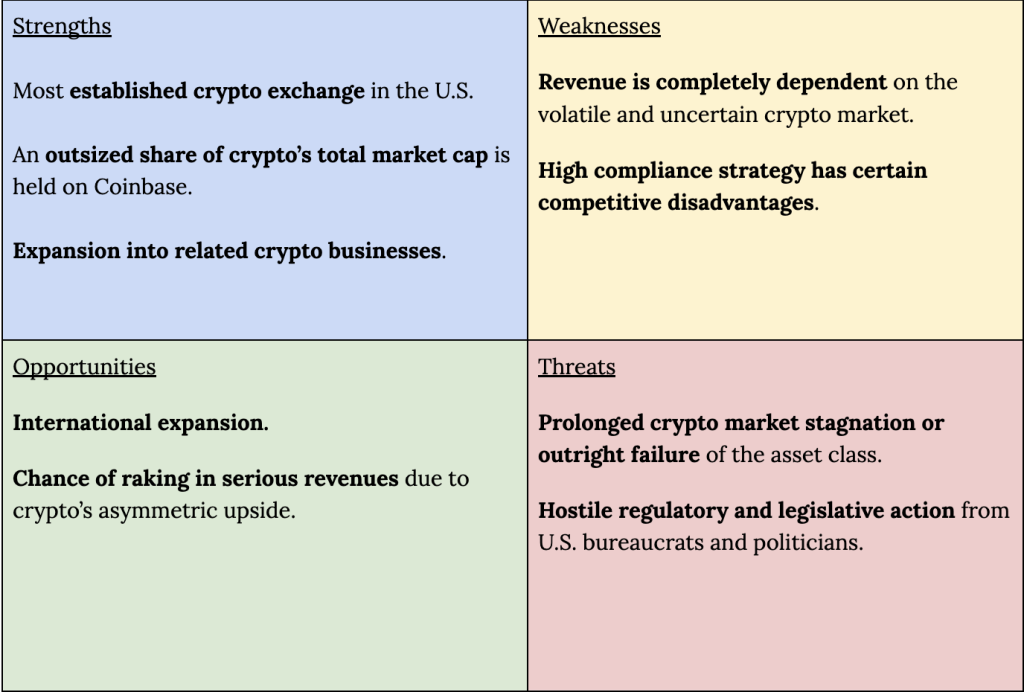

SWOT Analysis

Strengths

Coinbase is regarded as the most established crypto exchange in the United States. And it’s this reputation that helps maintain Coinbase’s large retail and institutional customer-base. Launched in 2012, the company has had a few years head-start compared to most of its U.S.-based competitors.

Coinbase is the U.S.’ most regulated crypto exchange, and this gives certain assurances to the segment of Coinbase’s client-base that might be a bit hesitant about crypto’s untraditional nature. As a public company, Coinbase adheres to a variety of U.S. securities laws, as well as the U.S.’ Bank Secrecy Act and various anti-money laundering laws. Coinbase implements “Know Your Customer” requirements for its customers, reports customer trade data to the IRS, and works with multiple other U.S. federal and state authorities.

Coinbase is regarded as a safe crypto exchange. The company utilizes industry-recognized protection measures and has a dedicated security team that works to stop hacks and data breaches. In 2021, 6,000 Coinbase customers lost funds in a hack, but the company reimbursed these losses. Not all exchanges have the resources to do this – but Coinbase does – and that provides additional comfort to its customers.

An outsized share of crypto’s total market cap is held on Coinbase. By the end of Q2 2022, Coinbase had $124 billion in crypto on its platform, which at the time was 11% of crypto’s total market cap. And this is why Coinbase is the U.S.’ largest crypto exchange by trading volume. Trading volume really matters to Coinbase because that’s primarily how the company makes money. In fact, as of 2022, 75% of Coinbase’s revenue came from crypto trading fees on the platform.

Retail holders and traders compose the majority of Coinbase’s customer base. Retail generally isn’t interested in splitting their crypto across multiple exchanges and wallets. Therefore, most of Coinbase’s customers keep all their crypto on the company’s platform as they’re cycling through their trades.

Coinbase has successfully expanded into related crypto businesses. The company has a minority stake in stable-coin issuer Circle, and therefore makes interest income on the U.S. treasuries that back USDC. Coinbase has a large institutional-side business, which provides advanced trading, custody, analytics, and other crypto services to institutions, companies, and hedge funds. They also have a developer-side business, which provides blockchain, cloud, and API services to software developers.

Weaknesses

Coinbase’s big weakness is the fact that its revenue is completely dependent on a volatile and uncertain crypto market.

As stated above, about 75% of Coinbase’s revenue comes from trading fees. Higher trading fees come from higher trading volume, and trading volume is positively correlated with crypto’s total market cap, the latter of which is extremely volatile. Compounding this is the fact that Coinbase’s retail customer-base is the herd. They pile in during the bull and run from the bear. So long story short, Coinbase’s revenues are volatile.

And the data backs this up. Coinbase’s revenues were $7.8 billion in the 2021 bull market. In the 2022 bear market, when trading volumes dropped 50%, Coinbase’s revenues dropped 59% to $3.2 billion.

Coinbase’s high compliance strategy has certain competitive disadvantages. Therefore, this strategy works as a double-edged sword for the company.

Because of the regulatory environment that Coinbase works in, the company can’t list certain tokens compared to their less-regulated or international competitors. One example is Ripple’s XRP, the fifth largest crypto by market cap. Coinbase had to remove XRP off its exchange in 2020 after the SEC sued Ripple for alleged securities violations. Thus, Coinbase’s $100 million trading volume revenues from XRP practically vanished overnight and went to their competitors. That’s just one example, and there are hundreds more.

Opportunities

Coinbase has an opportunity for some serious international expansion. As of 2022, only 16% of company revenues came from outside the U.S. So, it makes sense for the company to continue to push off U.S. shores.

Coinbase will have an advantage in jurisdictions that want a highly-regulated crypto environment, given their experience in the U.S. The company is currently expanding into the E.U., the U.K., Canada, Australia, Singapore, and Brazil.

CEO Brian Armstrong recently stated that Coinbase’s goal is to establish the same reputation and dominance in the E.U. as it currently has in the U.S. The company considers Singapore its Asian market hub, and Dubai is being floated as its Middle East and Africa base of operations.

Coinbase CEO Brian Armstrong at UK Fintech 2023

While the highly-regulated path has its challenges, it’s helped Coinbase plant roots in countries that have given its competitors the boot. One example is Germany, where Coinbase received proper licensing and began operations just as Binance exited the market due to onerous regulations.

Coinbase’s other big opportunity is the chance of raking in serious revenues, due to crypto’s asymmetric upside. And it’s here that Money Mastery really divergences from more traditional Wall Street analysts.

The link between Coinbase’s revenues and crypto’s total market cap is clear. But given crypto’s total market cap currently stands at a tiny $1.3 trillion, the asymmetric upside on Coinbase is huge because the upside on crypto is enormous.

We’re not going to put crypto market cap numbers out there, but just consider this one point. A lot of analysts are issuing COIN price targets at around $80 for twelve months from now. But given (1) the correlation between COIN’s price and the total crypto market cap, (2) the likelihood that multiple spot bitcoin ETFs are about to be approved by the SEC, and (3) the next bitcoin halving is set for April 2024, does that price target make any sense? No way.

We think the majority of Wall Street is still underestimating how large crypto can become; and therefore, they’re underestimating the potential price appreciation of COIN.

Threats

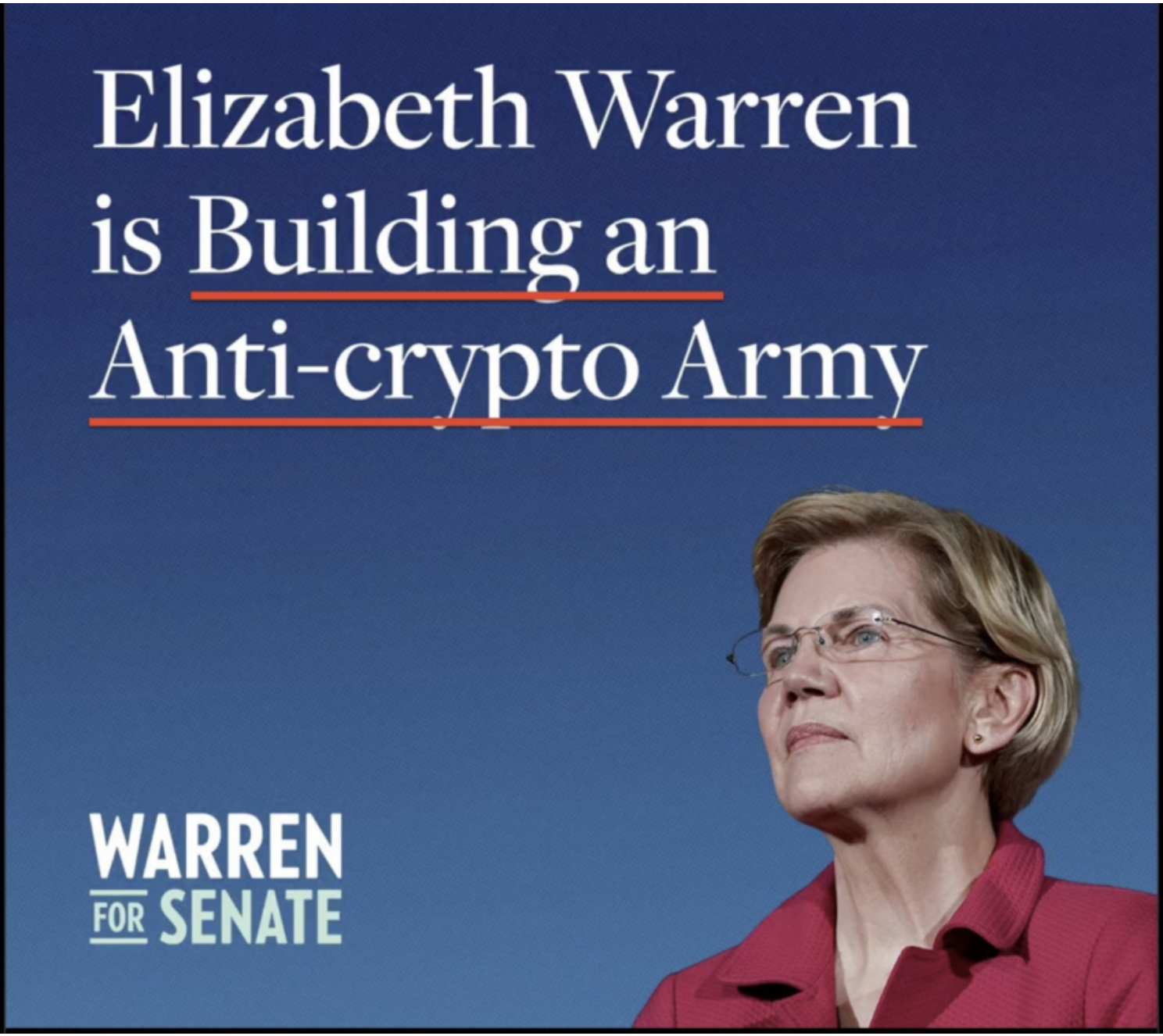

Coinbase’s serious threat is hostile regulatory and legislative action from U.S. bureaucrats and politicians. In fact, this isn’t so much a threat as it is a reality.

On the regulatory front, the SEC sued Coinbase in June of 2023 alleging that the company is operating an unregistered securities exchange. The two have been in a knock-down litigation war ever since. And while the SEC has lately been taking losses in court against other crypto companies, a win against Coinbase will really hurt the company.

On the legislative front, Senator Elizabeth Warren is building her “anti-crypto army” in an attempt to knee-cap the industry. Currently, Senator Warren is pushing the Digital Anti-Money Laundering Act. If the bill is signed into law as is, it would mandate AML requirements over segments of the crypto industry (miners) that aren’t structurally built to even comply with such laws. Such a law would be terrible for the crypto industry and therefore terrible for Coinbase.

Another major threat would be a prolonged crypto market stagnation or outright failure of the asset class.

Again, another double-edged sword to Coinbase’s SWOT analysis. Even though crypto offers Coinbase an asymmetric upside, there’s always the chance that in the short to medium term, the market stops repeating its four year exponential growth pattern, and enters into an extended bear market. Such an event would plunge COIN’s price south.

And it doesn’t take much thinking to figure out what would happen to Coinbase if say the bitcoin protocol was to somehow fail or become seriously compromised. Even though the odds of such an event are slim, it’s still possible.