Bitcoin Halving Just 360 Days Away… TICK TOCK!!!

In This Issue

- I share my thoughts on the next BTC halving, another bank in trouble, JP Morgan, Cathie Wood & Michael Saylor, Staked ETH & position updates.

- Rekt Capital has the latest technical analysis for you on the market.

- Erik has a report for you on ZKSync Era.

- Rebecca breaks down the latest news.

A comprehensive deep dive on altcoin investing

EXPLORE THE ALTCOIN COURSEThe News Now

Next BTC Halving: T-Minus 360 Days

Bitcoin’s fourth halving will occur in less than one year from now.

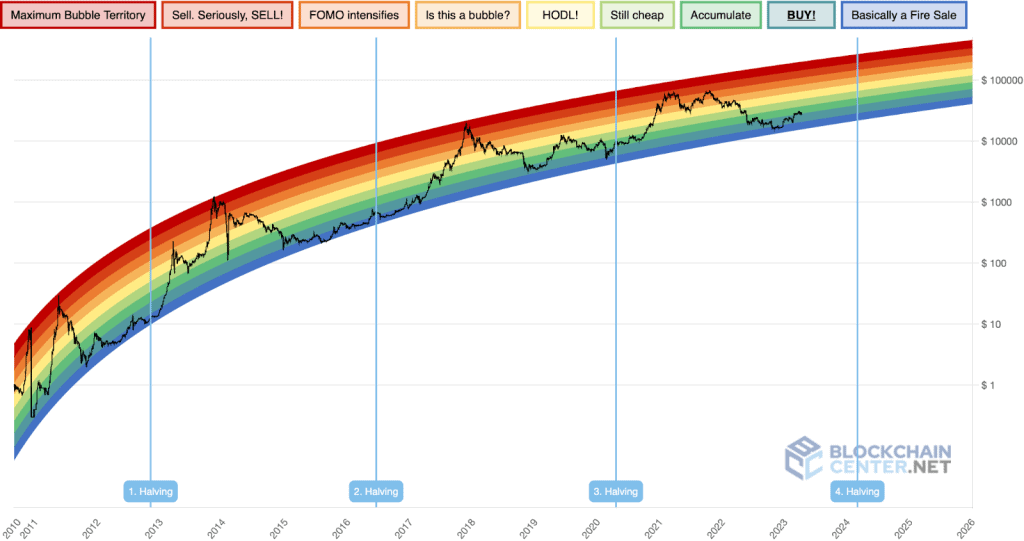

On or around April 27, 2024, at block 840,000, the amount of fresh BTC hitting the open market per block gets cut in half from 6.25 to 3.125. In case you’ve been living under a rock, here’s what happened to BTC’s price after the last three halving events:

- 1st Halving (Nov. 2012): BTC appreciated 9,766% in 1 year ($12 to $1,184).

- 2nd Halving (July 2016): BTC appreciated 2,877% in 1 year, 5 months ($649 to $19,326).

- 3rd Halving (May 2020): BTC appreciated 633% in 1 year, 6 months ($8,787 to $64,455).

If bitcoin’s fourth halving rhymes with the first three, we should be seeing a new all time high at some point in the latter half of 2025. And why does this pattern keep playing out with such predictability? It’s supply and demand, pure and simple.

Market participants gobble up BTC everyday. And that behavior doesn’t stop just because BTC’s supply gets severed. Thus, a steady demand for BTC with fewer coins hitting the market equals higher prices. Add to that the perception of scarcity, FOMO, and good ole market mania, and BTC blows its top. I don’t expect anything different this next time around.

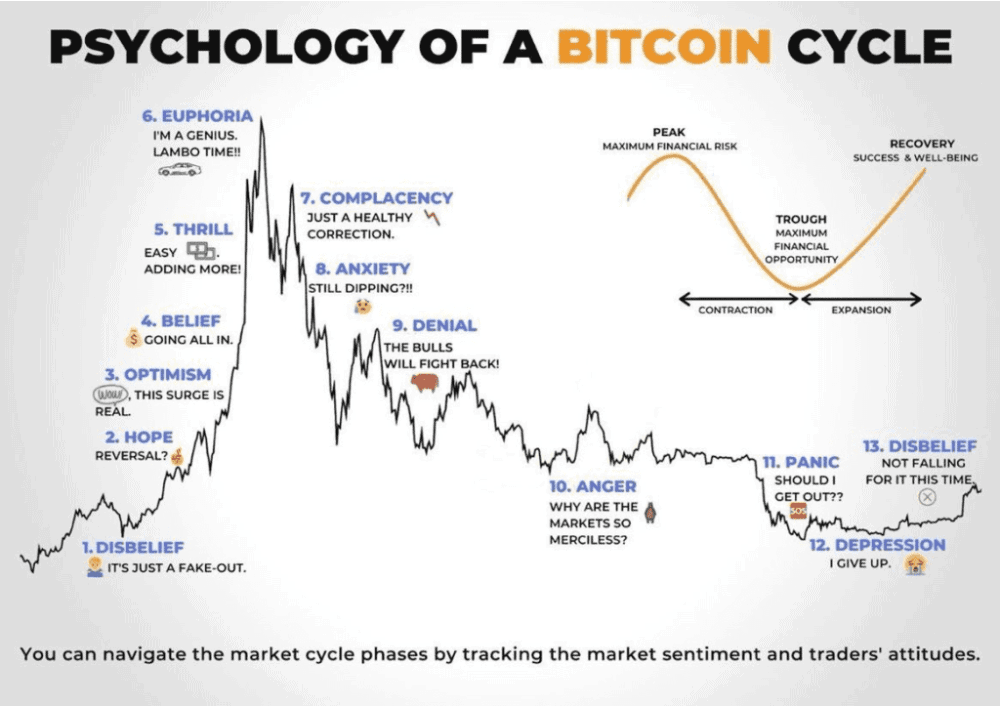

And what about BTC’s price action in the 1 year run-ups prior to each halving? In all three instances, BTC’s price did the slow grind up to each halving event. This data aligns with Lark’s opinion in Monday’s newsletter that bitcoin is in Stage 1 / 13 (“Disbelief”) of the market psychology cycle.

Also, keep in mind that bitcoin has never hit a new all time high in the months leading up to a halving. So unless some crazy macro event moons BTC early, I’m expecting slightly ascending price action over the next year.

Do what you will with this information.

Another Bank Under Uncle Sam’s Gun

It appears that another US bank might be in trouble with the Eye of Sauron.

This time, it’s Cross River Bank, Circle’s newish banking partner after the stablecoin issuer dropped Silicon Valley Bank. News broke this week of the FDIC’s order for Cross River Bank to “eliminate or correct, and prevent [ . . . ] unsafe or unsound banking practices related to its compliance with applicable fair lending laws.” Note that the FDIC actually issued this order on March 8th. Circle announced their transition to Cross River on March 12th.

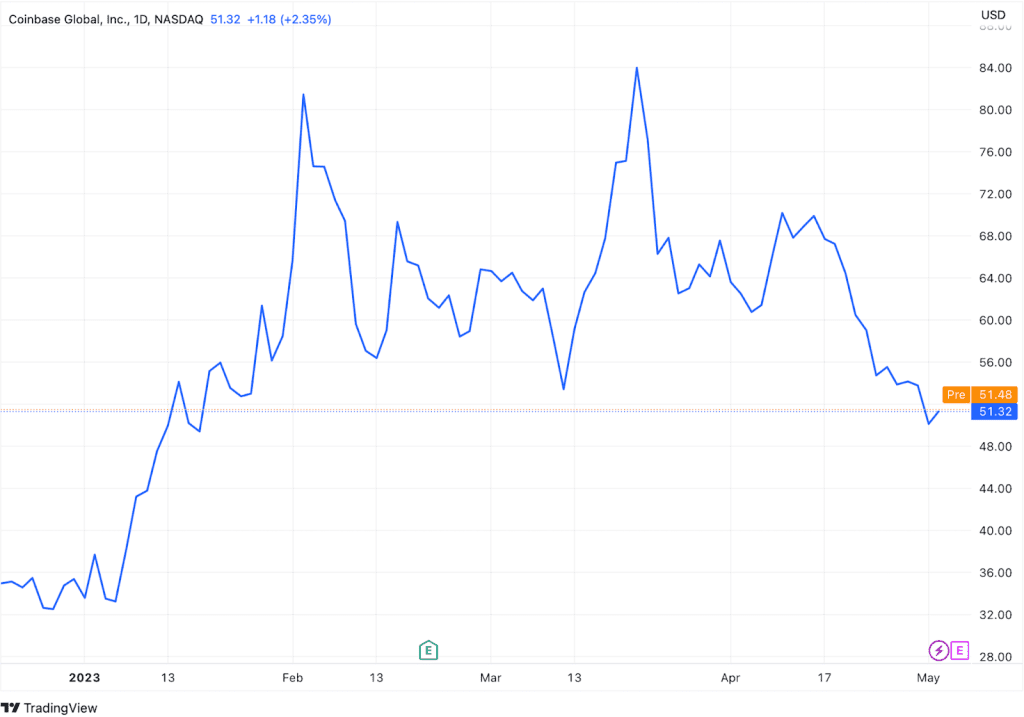

Cross River is one of the few remaining crypto-friendly banks left standing in the U.S. Besides Circle, CoinBase is one of the bank’s most prominent clients.

Is JP Morgan Too Big To Fail?

And speaking of the Eye of Sauron. JP Morgan now controls somewhere north of 10% of all US banking deposits in the US, after scooping up First Republic Bank. Yes. You read that right.

Remember that the First Republic collapse was the 2nd largest in US history (side note: their bread-n-butter was low interest rate mortgages). The number #1 spot goes to the 2008 collapse of Washington Mutual. And I bet you can guess who purchased that bank. Keep in mind that JP Morgan is purchasing these banks at a discount, courtesy of deal-specific US government subsidies.

It’s becoming clear that the US government needs JP Morgan as cover so that American taxpayers don’t think they’re ultimately covering the bill. But the taxpayers are covering the bill. At this point, I think JP Morgan is too big to fail. The US government won’t allow it. A new US central bank. Move over Jerome. Jamie Dimon gonna make the money printer go burrrrr if he gets into trouble.

Final point. On the same day that the back-room purchase of First Republic was being hammered out, bitcoin registered its highest ever number of processed daily transactions. All on-chain for the World to see.

Cathie Wood and Michael Saylor Continue the Lord’s Work

Cathie Wood and Michael Saylor aren’t going anywhere.

Ark Invest CEO, Cathie Wood, unfazed about CoinBase’s brewing regulatory showdown with the SEC, keeps scooping up CoinBase stock. Ark Invest purchased $7.5 million in CoinBase shares on May 2nd, and $8.4 million on May 1st. COIN is up 52% since the beginning of the year.

And what about the man with the biggest pair of melons on planet Earth?

Michael Saylor’s MicroStrategy booked a BTC impairment loss of only $18.9 million in Q1 of 2023. This compares to the company’s impairment loss of $197.6 million in Q4 of 2022. The change is due to BTC’s solid 3 month rally at the beginning of the year. MicroStrategy also purchased an additional 7,500 bitcoin in Q1, bringing the company’s grand total to 140,000, with an average purchase price at $29,803.

Long Live Michael Saylor.

Staked ETH Flows Out of Centralized Exchanges and Into Decentralized Liquid Staking Protocols

I called it y’all. 😉 (But for real, if you missed this article on Ethereum staking go back and give it a read!)

Since Ethereum’s Shanghai upgrade (April 12th), centralized exchanges have seen net outflows of staked ETH while decentralized liquid staking protocols have received net inflows. According to CoinDesk, $367 million and $340 million have flowed out of Coinbase and Binance, respectively, while Rocket Pool, Frax Finance, and Lido Finance have received $68 million, $56 million, and $28 million, respectively.

Decentralized liquid staking protocols allow users to stake crypto assets in exchange for derivative tokens. In order to retrieve the underlying staked assets, the derivative tokens must be returned to the protocol. Thus, the derivative tokens have a market value. This all means that stakers make more money with decentralized liquid staking protocols compared to the centralized alternatives. And that’s not to mention the de-risking benefits by going with a decentralized alternative that’s immune to regulatory pressures.

Interestingly, only Rocket Pool’s native token (RPL) is up since April 12th. Frax (FXS) and Lido’s (LDO) native tokens are both slightly down since this date.

Position Updates

Bid for Bitcoin at $25,100. This is a key area of price support.

Market Analysis by Rekt Capital

In today’s edition of the Rekt Capital Newsletter, the following 7 Altcoins will be analysed and discussed:

- Chainlink (LINK)

- Fantom (FTM)

- Crypto Com (CRO)

- Neo (NEO)

- Dogecoin (DOGE)

- UniSwap (UNI)

- Aave (AAVE)

Let’s dive in.

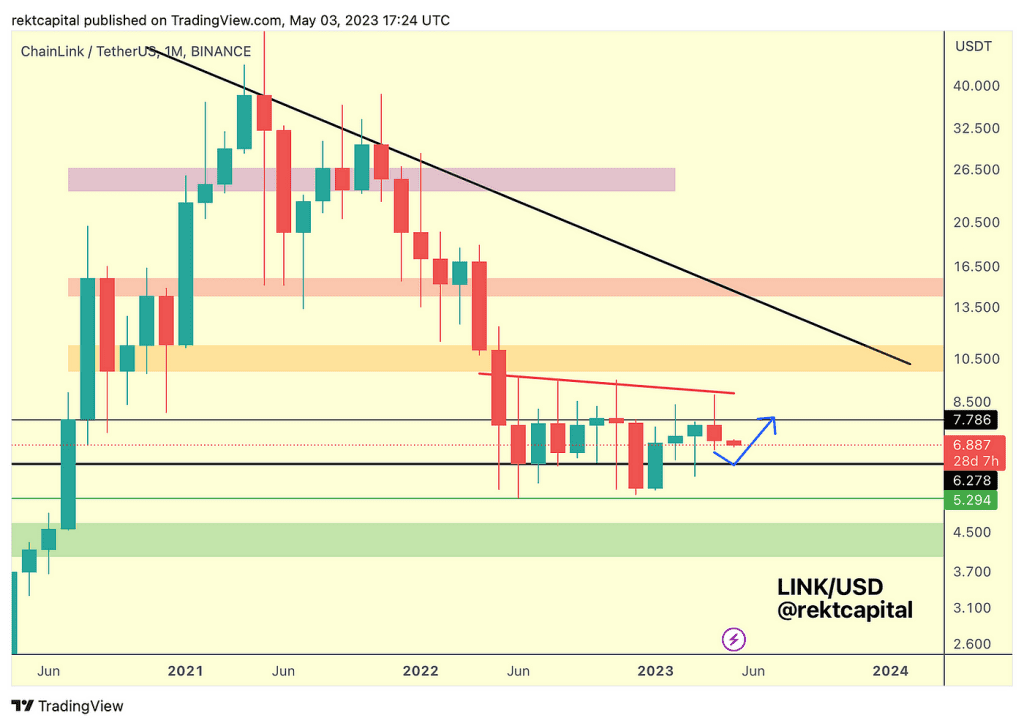

Chainlink — LINK/USDT

Macro-wise, nothing has changed in LINK’s price action for the past several months.

Price has merely been consolidating within this current black-black range.

Deviations to the upside beyond the Range High resistance happen sometimes and sometimes deviations to the downside below the Range Low support happen.

But generally, LINK is consolidating within what is most likely an Accumulation Range.

So while macro-wise, not much is going on — recently, LINK has rejected from the Range High area which makes it a possibility that price will drop to the Range Low area over time.

Finding support there would enable an over +20% move to revisit the Range High once again.

So short-term, LINK could drop to the Range Low area.

Mid-term, upon successfully retesting the Range Low are as support, price could then rebound to revisit the Range High.

And long-term, LINK will likely breakout from this Accumulation Range to enjoy a new macro uptrend over time.

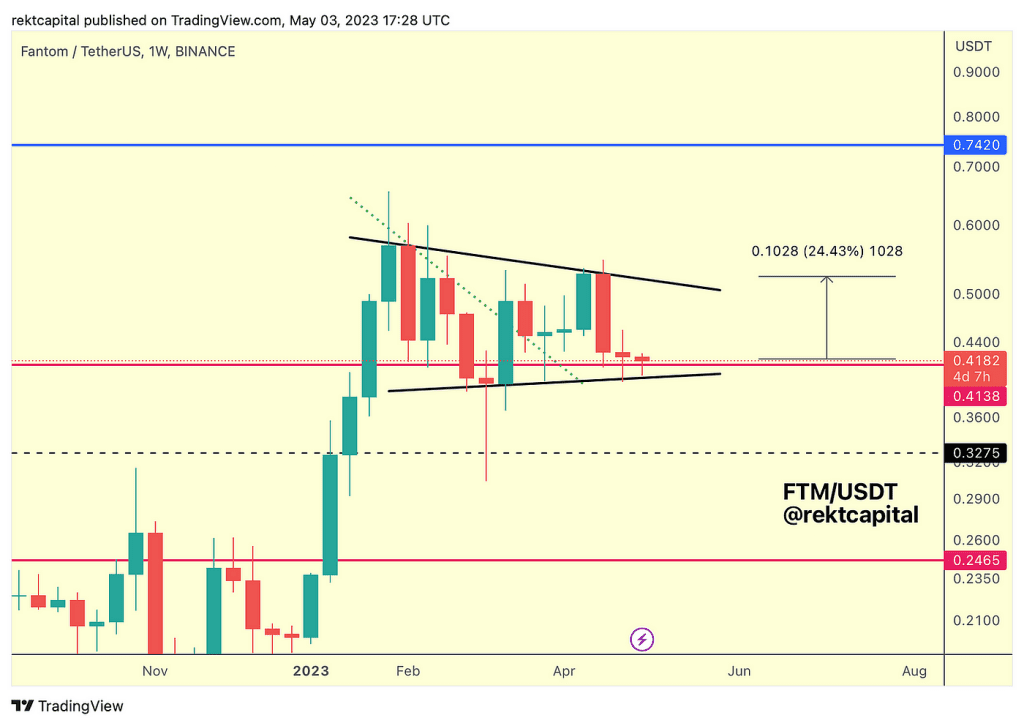

Fantom — FTM/USDT

FTM broke beyond the multi-month downtrend (green).

Then retested this downtrend as support.

It has challenged the immediate resistance post-retest.

Rejection occurred and price has since dropped but is still maintaining a Higher Low (black).

Continued stability here and we may see a wedging structure play out here.

Consolidation within the pattern is +24% wide.

FTM is showcasing signs of slowing in the momentum against the base of this pattern.

Hold here and FTM will be able to revisit the black highs of this pattern.

Go Premium to Keep Reading

Subscribe to the Wealth Mastery Premium Investor Report to read the rest of this article AND gain full access to the premium archives.

ZkSync Era by Erik

View zkSync Era as a Layer 2 ‘scaling and privacy engine’ for Ethereum, based on zero-knowledge proof technology. It is the first Layer 2 of its kind to launch – beating Polygon’s zkEVM by four days. Both are so-called zero-knowledge rollups that allow for faster and cheaper transactions while maintaining a high level of security. How does zkSync Era compare to other L2s?

Let’s take a step back for a moment. What is a Layer 2 (L2) on Ethereum? The second layer helps to offload work from Ethereum. While the assets remain on the Ethereum main chain, computation and transaction storage happen on the layer on top of Ethereum. This should give a high transaction rate while keeping the underlying safety of the Ethereum main chain.

ZkSync is Third in TVL

As with Arbitrum’s launch and subsequent airdrop, it’s no surprise that zkSync has seen a huge surge in activity. In fact, zkSyncEra now has the third largest total value locked ($260 million) among Layer 2’s that settle on Ethereum.

So, will this huge activity fizzle out after the airdrop? Not necessarily. Arbitrum has been going strong after its airdrop.

Delphi Digital tried to assess which of the current top 3 L2s (Arbitrum, Optimism, and zkSync Era) is the most profitable. They took the spread between the fee revenue generated by the L2 and the price the L2 pays to the L1 (L1 call data security costs), plus the verification costs for zk-rollups. It turns out that Arbitrum is the most profitable L2. For zkSync Era, Delphi argues the launch is too recent for a meaningful comparison. But it’s a metric to keep an eye on in the coming time, as demand for L2s will surge.

Difference Between Zk-rollups and Optimistic Rollups

A competing type of Layer 2 on Ethereum is called optimistic rollups. The current dominant L2s – Arbitrum and Optimism – are both optimistic rollups. Coinbase’s Base is another example. The ‘optimism’ part of optimistic roll-ups refers to the ‘optimistic’ assumption that transactions are valid until proven otherwise. But for the finality of transactions, you’ll have to wait a week or so on optimistic rollups. In contrast, on zero-knowledge rollups, you have near-instant finality, and you can bridge much faster back to Ethereum or to other rollup chains.

Zero-knowledge proofs in crypto are important for two reasons: privacy and data compression. Imagine that I can prove that I am the legitimate owner of a valid passport, without showing my passport to the clerk at customs, or to the car rental agency. Similarly, zero-knowledge proof technology enables cryptographic algorithms for verifying claims regarding the possession of data without having to reveal the data.

The Origin of ZkSync and ZkSync Era

The founders of Matter Labs, the company behind zkSync, viewed the scalability problem in Ethereum as the major hurdle standing in the way of adoption – until they discovered the existence of zero-knowledge proofs, and more specifically zk-snarks. The latter compresses computational structure into very short proofs that can be verified quickly.

ZkSync was launched in June 2020. Its iteration zkSync 2.0 was rebranded to zkSync Era and launched on March 24, 2023.

Matter Labs’s headquarters are in Berlin and its co-founder and CEO Alex Gluchowski keeps a rather low profile. That is intentional. In an interview with the Bankless podcast, Alex said:

‘We understand that this is a space where there is no margin for error. You can’t rush and you can’t cut corners, because one big mistake would throw the entire space years back […] so we’re taking security very seriously and we are anti-hype in this regard.”

Comparing Polygon’s ZkEVM with ZkSync Era

Polygon’s zkEVM launched only four days after zkSync Era. Both networks use zero-knowledge rollups. Interestingly, the Total Value Locked of zkSync Era was two orders of magnitude higher than Polygon’s at the time of writing (mid-April 2023). The likely reason is that the zkSync Era users are speculating on an airdrop – more on that below. Polygon, on the other hand, already has a token (MATIC) and has no allocation for a zkEVM airdrop.

The number of transactions on zkSync also outperforms that of Polygon’s zkEVM. The first averaged 5 transactions per second in the first few weeks, versus only one transaction per 20 seconds for Polygon’s zkEVM, per a research article in The Defiant.

More Than Just Higher Throughput and Lower Costs

With zk-rollup chains like zkSync Era, limitless scaling is on the horizon. Its instantaneous nature combined with increased composability – anyone can take existing functionality and build on top of it – will hopefully create an explosion of use cases.

In other words, L2s like zkSync Era are not just about increased transaction throughput and lower transaction costs. They are not just about making the horse faster, they are about creating an automobile industry. More oracles will become viable, more use cases will become viable. Account abstraction becomes viable. There can be cross-zk-EVM composability.

If we give the zkSync Era bulls their time in the sun, chains like zkSync Era hold the promise of transforming Ethereum into the internet of value for the entire world. From its current clunky ‘mainframe’ appearance, Ethereum could become a more accessible, user-friendly platform.

How Low Can Gas Fees Go?

According to the builders, zkEVM technology could make significantly lower gas fees possible compared to optimistic rollups. For some transaction types, the fees may be comparable. But for others, users might pay zero fees because contracts can subsidize these transactions. This is possible with native support of zk-tech for account abstraction.

How to Get a Potential ZkSync Era Airdrop

- Bridge funds to zkSync.

- Use dApps like Zig Zag to make a trade, Syncswap to provide liquidity, buy or sell an NFT on Mint Square, and do all kinds of stuff on SpaceFi.

- Do this consistently over time say at least once per month.

Maverick is another dex that might do an airdrop.

Mute Exchange

You can also play with swapping on the Mute Exchange: one of the few operational dapps on zkSync so far.

ZigZag Dex

ZigZag is a DEX built on zkSync and Starknet that has announced the upcoming launch of its new ZKAS token. An obvious airdrop opportunity.

Increment

Increment is a decentralized, algorithmic perpetual swaps protocol on zkSync 2.0, featuring automatically concentrated liquidity.

ZkSync Name Service

Another thing worth mentioning is zkSync’s Name Service, the first naming service on the zkSyncnetwork,powered by LayerZero. It will offer users the same domain services as Ethereum Name Service and similar projects. While no official airdrop has been announced, the community suspects that there will be incentives for purchasing a LayerZero .zk domain name. To have a chance at a future airdrop, you can Purchase Your Domain for as little as $5. Owning a domain would also make you eligible for any future LayerZero airdrops.

Conclusion

The L2 on Ethereum space is on fire. We like competition and the zkSync Era team mentioned they welcome it too. They seem to be a team that really cares about the mission of ‘scaling freedom’. In terms of adoption, they’re on the right track, considering the successful launch and the soaring number of users in the first month. Also, the bet on zero-knowledge technology, which they took years ago, seems to have been a smart one. The view that zero-knowledge tech is ‘the futu

In Case You Missed It by Rebecca

Here are my key takeaways from the trends this week and memecoin mania continues.

- Bitcoin is less than one year away from its next halving and the continued chaos during the banking crisis is also strengthening the case for Bitcoin.

- Litecoin is a Bitcoin fork that’s due its next halving event within 100 days and is expected to happen around August 3.

- Pepe is a memecoin on Ethereum that’s seen its token price skyrocket 90% after being listed on OKX, pushing it into the top 100 coins by market cap. Pepe is also celebrating 50,000 token holders after launching just 15 days ago.

- inSure DeFi is a decentralized insurance ecosystem that’s recently been listed on Hotbit and O3 Labs which has helped contribute to its surge in activity.

- tomiNet is a Web3 infrastructure company on Ethereum that’s been listed on CryptoCom and Bitget exchanges.

- Dynex is a neuromorphic computing platform that’s integrated with Liquid Mining app so users can mine DNX on their phones.

- ChainGPT is an AI model launched by Seedify that’s announced a new partnership with Baby Doge to develop new AI solutions. ChainGPT has also been listed on Bitget exchange.

- Arbitrum is an Ethereum Layer-2 scaling solution that’s launched its $120M airdrop to DAOs with leading recipients including GMX, Treasure DAO, SushiSwap, Dopex, and Radiant.

- Shiba Inu is a memecoin on Ethereum that’s announced a customized cold wallet is in the works. Shiba Inu has also been surpassed by Pepe in daily trading volume.

- XEN Crypto is an ERC-20 token that’s been one of the main contributors to the recent spike in gas fees on Ethereum. XEN has been consuming up to 90% of gas per block in single transactions.

- Ethereum gas fees recently surged due to the ongoing memecoin mania, pushing fees to a new 10-month high.

- FLOKI is a memecoin on Ethereum and Binance Smart Chain that’s been listed on Binance US. FLOKI has also partnered with Binance Charity to support earthquake efforts in Turkey.

- Aptos is a Layer-1 blockchain that’s partnered with Mastercard on its new Web3 solution to enhance user verification standards called “Mastercard Crypto Credential.”

- Injective is an L1 blockchain and DEX protocol that’s integrated with Polkadot parachain, Astar network. Injective has also integrated with Celer to enable cross-chain transfers. Binance has enabled institutional lending for Injective.

- Render is an image and video rendering protocol that’s gained 50% in two days after the community approved the network’s proposal to expand to Solana.

Follow Rebecca on Twitter and Instagram.

Final Notes

Big Bitcoin news, PEPE updates, and the FED rate hikes. Don’t miss out. Watch the video below!

Thank you so much for your support, and I truly hope that today’s issue will give you insights needed to help you master your wealth.

If you are reading this it means you are on the free version of the Wealth Mastery Investor Report, which is great for news and tips on the crypto markets.

If you really want to take advantage of fastest growing asset class EVER, I highly recommend you to check out my new Altcoin course: Mastering Altcoin Investing

In this course we’ll teach you all about how to spot, choose and acquire the winning altcoins of the next bull market.

Learn how to build your portfolio so that growth is ensured and risk is mitigated. Let me help you build a strategy that’ll change your life forever in the upcoming bull run.

Are you ready to make it?

See you next time!

Lark and the Wealth Mastery Team

Recommended Services

💰 BINANCE: BEST EXCHANGE FOR BUYING CRYPTO IN THE WORLD 👉 10% OFF FEES & $600 BONUS

🚀 BYBIT: #1 EXCHANGE FOR TRADING 👉 GET EXCLUSIVE FEE DISCOUNTS & BONUSES

🔒 BEST CRYPTO WALLET TO KEEP YOUR ASSETS SAFE 👉 BUY LEDGER WALLET HERE

Legal Disclaimer

Wealth Mastery (Lark Davis, and the Wealth Mastery writing team) are not providing you individually tailored investment advice. Nor is Wealth Mastery registered to provide investment advice, is not a financial adviser, and is not a broker-dealer. The material provided is for educational purposes only. Wealth Mastery is not responsible for any gains or losses that result from your cryptocurrency investments. Investing in cryptocurrency involves a high degree of risk and should be considered only by persons who can afford to sustain a loss of their entire investment. Investors should consult their financial adviser before investing in cryptocurrency.

You can find a full disclosure of all my crypto & venture investments here.