BTC Reserves Running Dry

GM friends.

In all seriousness, things are getting real out here. We need to have a frank discussion about the bitcoin supply shock that’s happening right now.

Pour a cup of coffee and take that chair, because here’s your mid-week BTC supply shock update. ☕️📰

Here’s what’s in today’s issue:

- David shares his thoughts on BTC reserves running dry, Ethereum’s Duncan upgrade, Coinbase selling $1B in bonds, Jamie Diamond defending the right to buy BTC & Drake posting a Michael Saylor video.

- Rekt Capital has the latest technical analysis for you on the market.

- Erik has an article on Ethereum spot ETFs: Approval likely, but probably not soon.

- In case you missed it by Rebecca.

Step 1: Sign up using this link

Step 2: Fund your account with $100 or more

Step 3: Claim your bonus and free trade

BTC Reserves Running Dry

Ladies and gentlemen, we are running out of bitcoin.

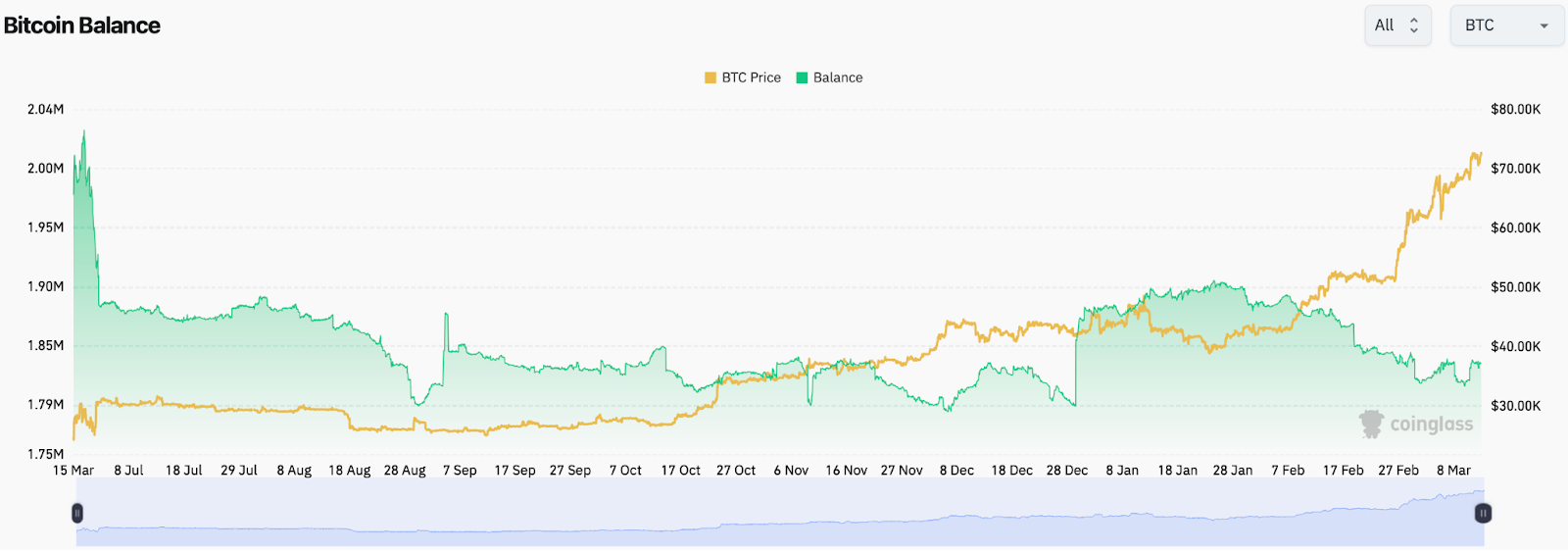

According to coinglass data, there’s only 1.84 million bitcoin available across all major exchanges. That’s a 4% decrease in less than two months, when there was 1.9 million bitcoin on exchanges in late January.

Now, you might think this decrease is insignificant, but if we look at what’s happening behind the scenes, it’s clear we are in the beginning stages of a massive bitcoin supply shock.

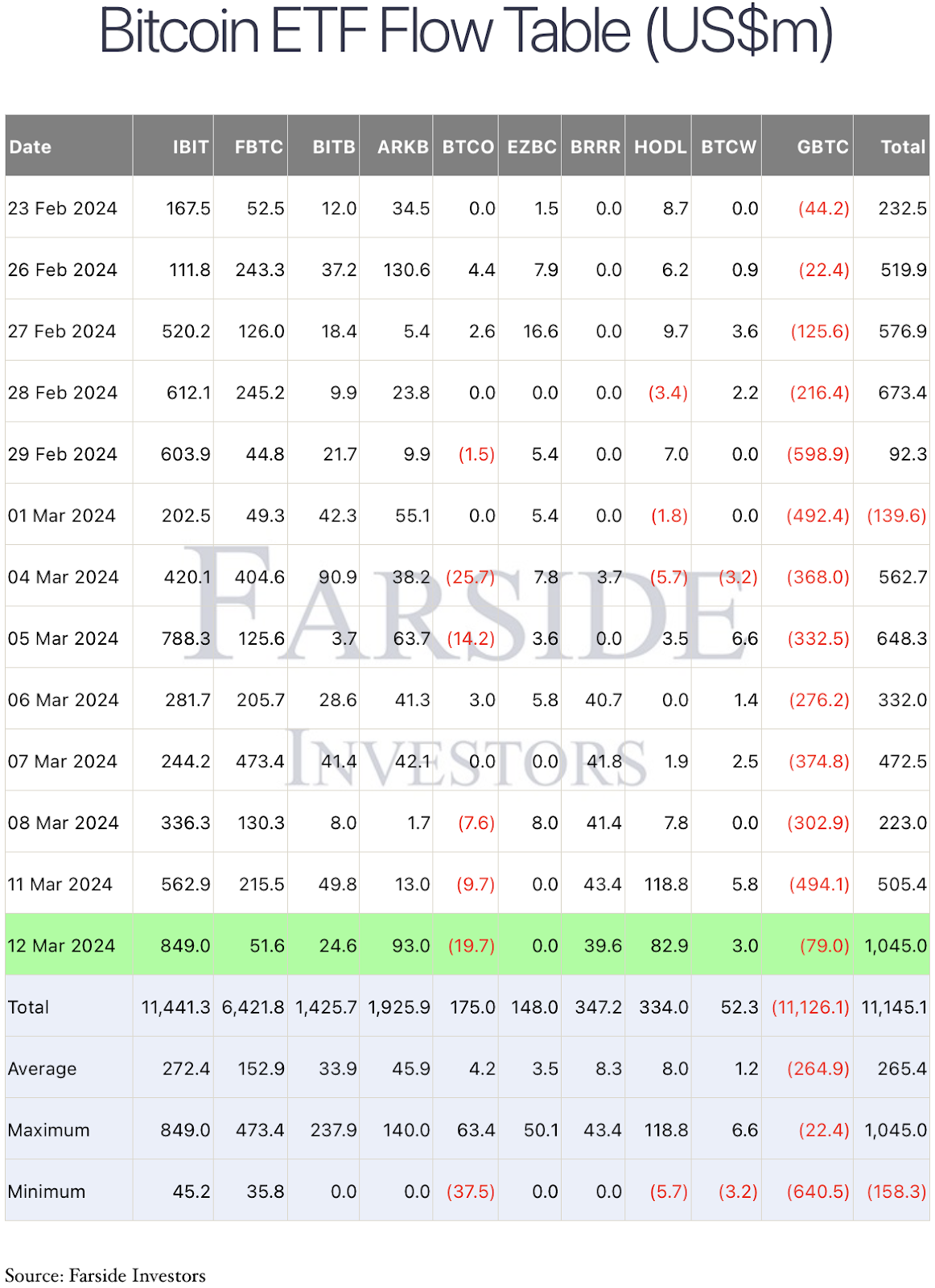

Spot ETF Net Inflows over $1B on Tuesday

Let’s start with the spot bitcoin ETFs. Take a look at the net inflows for Tuesday, March 12th.

Yes. You read that correctly. $1.04 billion in one day. A new record.

$1.04B in inflows translates to 14,800 bitcoin getting pulled into the ETFs. That means on just Tuesday alone, the US ETFs ate up 16 days of bitcoin mining production.

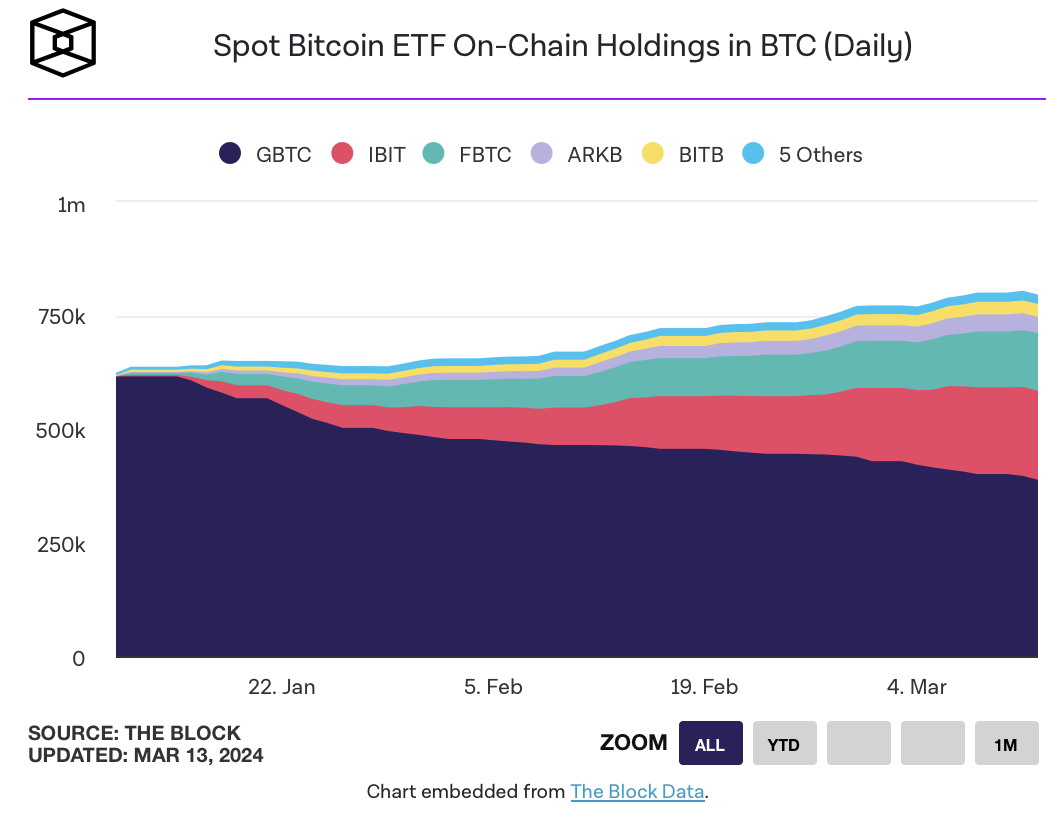

And due to the huge net inflows on Monday and Tuesday, BlackRock’s ETF now holds approximately 215K bitcoin, or 1.02% of all bitcoin to ever be mined.

Zooming further out, all the US spot ETFs combined now hold approximately 808K bitcoin, or 3.8% of bitcoin’s max supply.

MicroStrategy Buys 12,000 Bitcoin

We reported last week and over the weekend about MicroStrategy’s announcement to raise $700 million in convertible debt offerings to buy more bitcoin.

Well, they didn’t waste any time doing it.

The company ended up putting together $821 million in cash for the purchase of 12,000 bitcoin. It appears that the purchase occurred this past weekend.

Microstrategy now holds 205K bitcoin, or 5K bitcoin shy of 1% of bitcoin’s max supply.

CryptoQuant Predicts “Liquidity Crisis” by September

All the data above has Ki Young Ju, the founder of the on-chain analytics platform CryptoQuant, predicting a bitcoin “sell-side liquidity crisis” within the next six months.

According to Young Ju – if the institutional inflows continue – there simply won’t be enough bitcoin available to meet demand, when accounting the total amount of bitcoin held on exchanges, plus the amounts held by miners and what’s scheduled to be mined.

Now, you might be looking at all this and wondering why there’s only a 4% drop in bitcoin on all exchanges, given the massive ETF inflows and other big acquisitions.

The reason is because these purchases are happening on over-the-counter desks. Meaning, the sellers are likely large miners and other whales who don’t have bitcoin on exchanges.

But make no mistake about it, once these OTC desks are cleaned out, these purchasers will be forced to buy spot off the exchanges. And when that happens, that 1.84M in bitcoin will be driven south and the price will skyrocket up.

Prepare accordingly.

Ethereum’s Dencun Upgrade Initiated

On Wednesday morning, around 10:00 am EST, Ethereum’s highly anticipated Dencun Upgrade was initiated. The Dencun Upgrade is considered to be the most significant to occur for the network within the past 12 months.

At a high level, Dencun slashes transaction fees for L2 networks that operate on top of the mainchain. It does this through an improvement called “proto-danksharding”, which basically improves the mainchain’s ability to communicate with and receive data from its L2 networks.

It’s believed that L2s like Arbitrum, Optimism, and Polygon will benefit the most from Dencun.

It’s not clear exactly how much fees will be reduced for Ethereum L2s. Previous estimates have stated that the savings could be between 50% to 90%. We will have a better idea of the upgrade’s performance metrics after a few weeks of processing.

Coinbase Selling $1B in Bonds

Coinbase is taking a page out of MicroStrategy’s playbook.

On Tuesday, the publicly traded crypto exchange announced it will be raising $1 billion in cash via convertible debt offerings. Convertible debt offerings are bonds that also give holders the option to convert their bonds into stock shares.

While there was some dubious speculation that Coinbase might be buying bitcoin with the money, the company stated that the funds will be used for repaying other debts and possibly for acquiring other companies.

Jamie Dimon Defends Right to Buy Bitcoin

JPMorgan Chase CEO Jamie Dimon is no fan of bitcoin.

For years the CEO has publicly criticized the asset. At a Davos meeting in the beginning of the year, Dimon called bitcoin a “pet rock”, and during Senate testimony last year, he said he would “close down” bitcoin if he were the government.

Given his bank operates next to and in conjunction with the U.S. money printer, his opinions aren’t surprising. But I digress.

Anyways, eyebrows were raised this week when Dimon appeared to somewhat soften his stance on the digital asset. That’s because on Tuesday, during an appearance at the Australian Financial Review business summit, Dimon said the following: “I don’t know what the bitcoin is used for, but I defend your right to smoke a cigarette, I’ll defend your right to buy a bitcoin.”

This slight softening is interesting, especially given the fact that JPMorgan is one of the authorized participants for BlackRock’s spot bitcoin ETF. This means that the bank trades bitcoin with the ETF in order to help keep the ETF shares appropriately backed with bitcoin.

Drake Posts Michael Saylor Video to 146M Instagram Followers

Canadian rap superstar, Drake, posted a clip of a Michael Saylor interview to his 146M Instagram followers on Tuesday.

The clip in question was an interview Saylor did on Monday with CNBC, where Saylor said that bitcoin would “eat gold.”

Given Drake’s massive following, such an endorsement could bring the retail masses back into bitcoin. Even though we are at all time highs, the general consensus – at least in Crypto Twitter – is that retail has not yet moved back into the asset.

In today’s edition of the Newsletter, the following cryptocurrencies will be analysed & discussed:

- UniSwap (UNI)

- Theta Token (THETA)

- Coti (COTI)

- Chiliz (CHZ)

- Crypto Com (CRO)

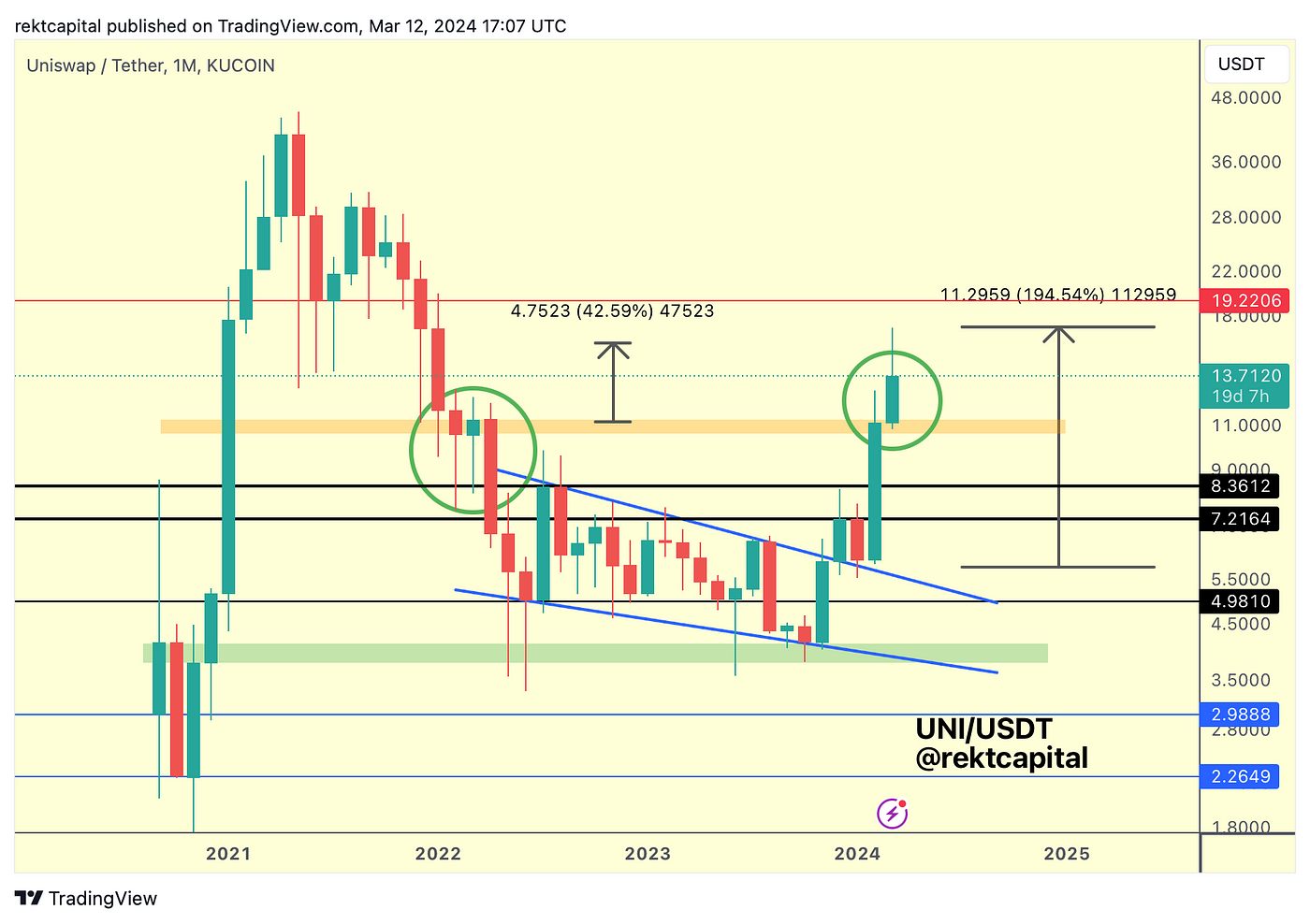

UniSwap — UNI/USDT

UniSwap has come a long way since retesting its macro market structure:

Here is today’s chart:

UNI has broken beyond this orange resistance area (which has acted as support in the early 2022 Bear Market but eventually lapsed as one).

Technically, UNI is positioned for a reclaim of this old orange resistance into new support.

After all, UNI has broken into a wide range that is represented by the orange Range Low and the red Range High at $19.22.

Any pullbacks into the orange region will constitute a retest attempt in an effort to prepare UNI for further upside into the Range High over time.

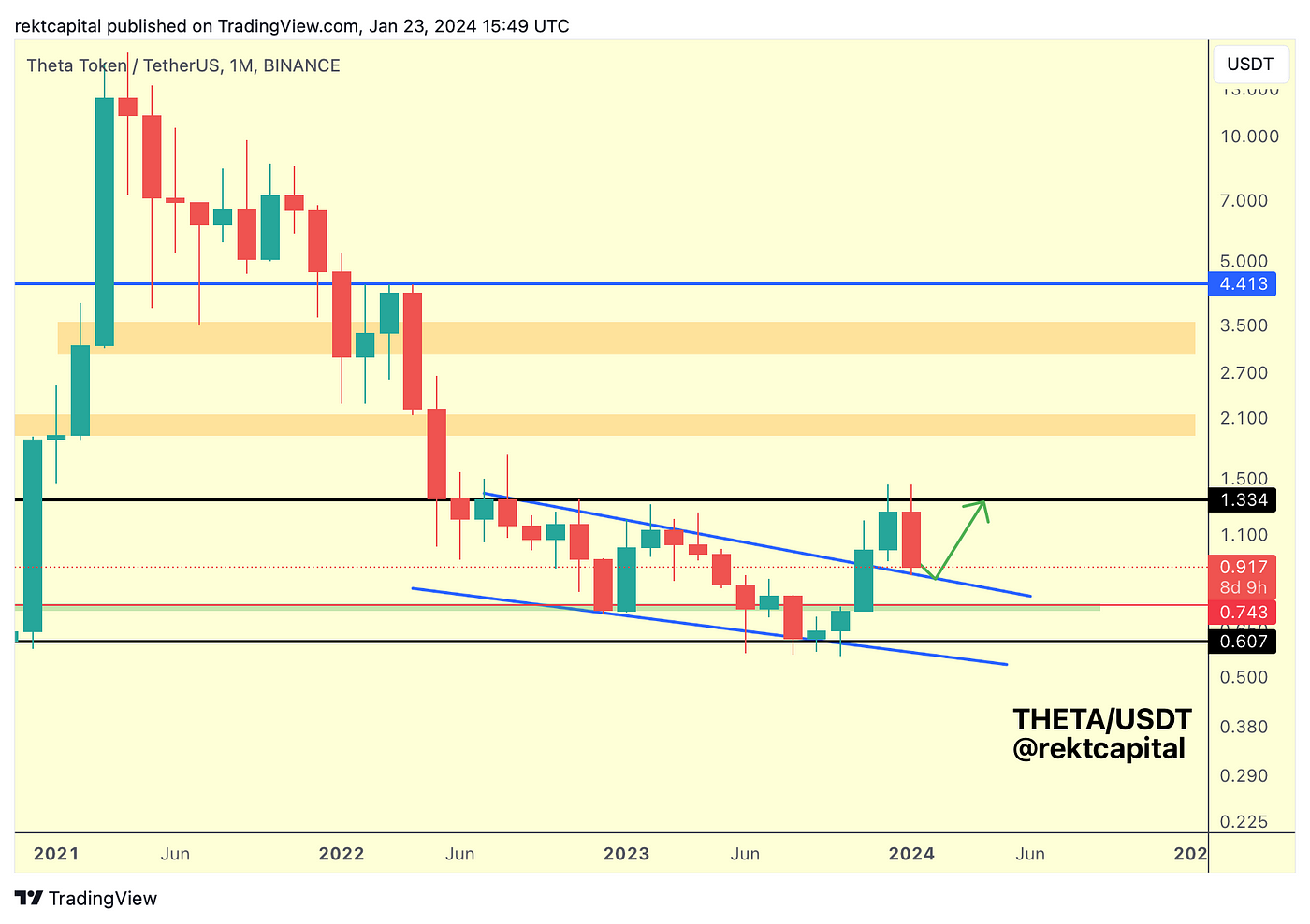

Theta Token — THETA/USDT

THETA has been on this list for a long time, mainly because it shares the same market structure with UNI and thus both were expected to perform well following their retests of their breakout patterns.

Here is the THETA chart we shared in late January:

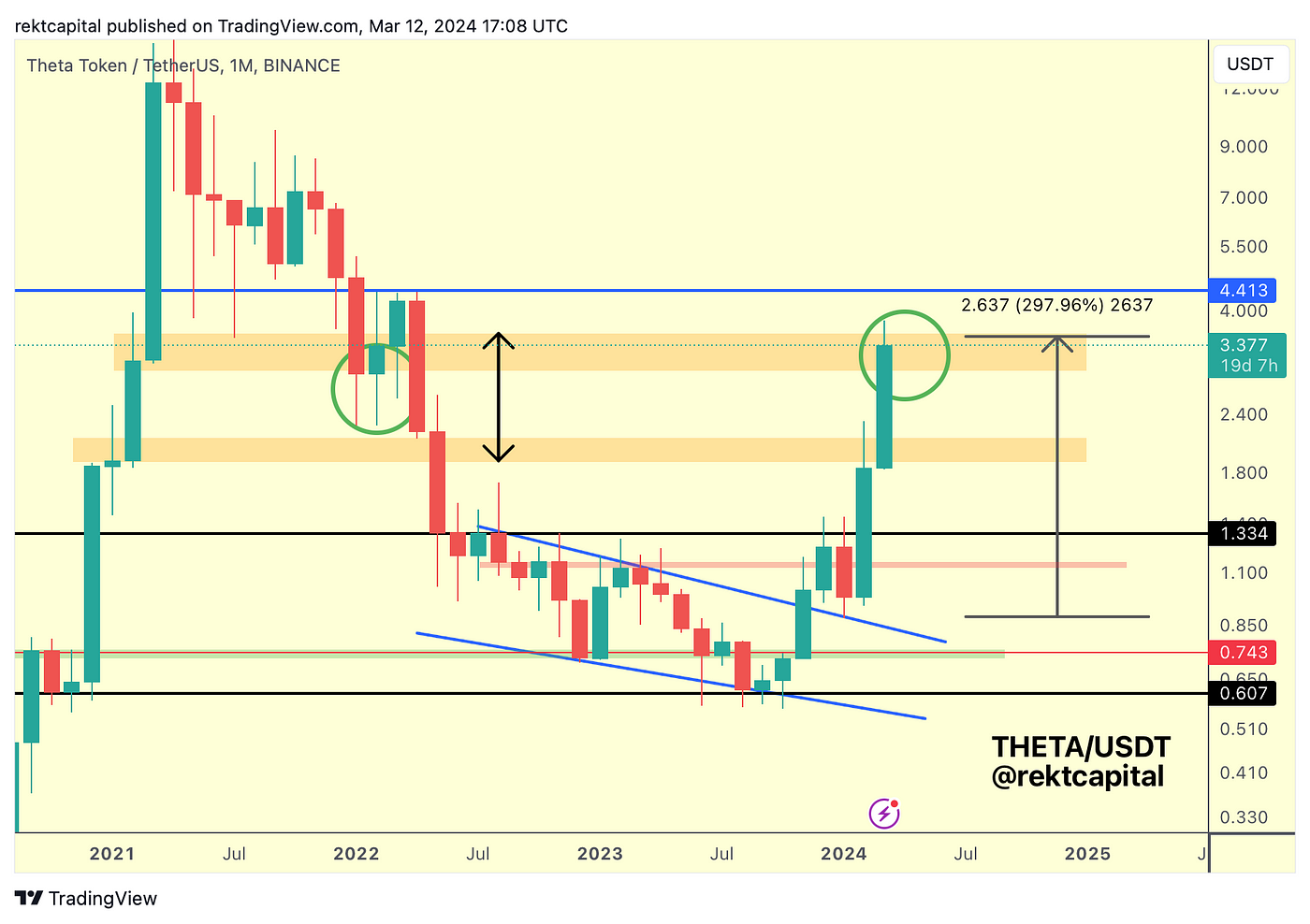

Here’s today’s update:

THETA has rallied an extraordinary amount, essentially rallying over +300% since the retest of the top of the blue pattern.

With THETA now at these highs, it looks like a macro range may be developing (orange-orange), with price hovering at the Range Highs.

However, even though price is at these highs, THETA could still technically retest this orange boxed resistance area into new support, in a similar vein to what it did in early 2022 (green circle).

Should THETA indeed pullback for that retest of this local orange area, the retest itself could be quite a volatile one, akin to the early 2022 downside wicks.

Even in early 2022, this retest of the orange area has been a prerequisite for revisiting the blue highs at $4.41.

CLICK HERE to go Premium and read the rest of this week’s Market Analysis – Premium subs can read Rekt capital’s full report.

Ethereum spot ETFs: Approval Likely, but Probably Not Soon

We’re a little over two months removed from the final deadline for US approval of multiple Ethereum spot ETFs. From the lackluster engagement the SEC is showing, analysts agree that the odds against approval are growing. The consensus though is that ETH ETFs will come in the more distant future. If anything, a rejection could mean a buy-the-dip opportunity.

Crypto Market News

- Drake shared a clip of Michael Saylor’s CNBC interview on his Instagram account to his 146M followers. Source

- Balaji says Bitcoin will save the world when the US government steals everyone’s money. Source

- Billionaire investor Bill Ackman shared his thoughts on Bitcoin in a post on X saying, “Maybe I should buy some Bitcoin.” Source

- London’s stock exchange will start accepting applications for crypto exchange-traded notes (ETNs) from Q2 2024. Source

- MicroStrategy completed its planned raise with over $800M in convertible notes allowing 12,000 Bitcoins to be bought bringing its total holdings to 205,000 BTC. Source

- Bitcoin mining revenue hit an all-time high of $68.28 million over a rolling 7-day period on March 9. Source

- Bitcoin miner Hut 8 is closing its mining site in Alberta, Canada, due to rising energy costs and power disruptions. Source

- Bitcoin miner Bitfarms has bought an additional 51,908 ASIC mining machines. Source

- Digital Currency Group (DCG) has filed a motion to dismiss the $3 billion lawsuit by the New York Attorney General’s Office (NYAG). Source

- BlockFi has settled with FTX and Alameda Research for $874.5M. Source

- Revolut has integrated with MetaMask to allow direct crypto buys for UK and European Economic Area (EAA) customers. Source

- Arizona’s State Senate is considering adding Bitcoin ETFs to its retirement portfolio. Source

- VanEck is going to cut its spot ETF fees to 0% until March 31 2025, unless it hits $1.5 billion in assets before that date. Source

- Grayscale has filed with the Securities and Exchange Commission (SEC) for a “mini” spot Bitcoin ETF which would offer investors tax-free exposure to Bitcoin. Source

- Chloë Grace Moretz and Lewis Pullman are set to star in the movie “Dutch & Razzlekhan” about a real-life couple who were arrested for laundering over $8 billion in Bitcoin. Source

- The SEC has delayed a decision on allowing options to be traded on BlackRock’s spot Bitcoin ETF. Source

- Arkham Intelligence has claimed it has identified Bitcoin addresses for Tesla and SpaceX with combined holdings of 19,794 BTC worth over $1.3 billion. Source

- Ark Invest has sold yet more COIN shares bringing its total to almost $150M in the past week. Source

- Coinbase stock has been upgraded to neutral as Goldman Sachs ends its negative stance. Source

- AI crypto market cap has doubled from $10 billion to $20 billion in 20 days. Source

Coins and Projects

- Bitcoin Ordinals wallet Oyl has raised $3 billion in funding from investors including Arthur Hayes. Source

- Bitcoin could skyrocket to $300K at the peak of the current bull market based on historical patterns according to Tether’s co-founder. Source

- Ethereum’s Dencun upgrade could result in almost zero fees for Layer-2 blockchains according to Fidelity. Source

- Bloomberg ETF analysts have dropped the probability of a spot Ethereum ETF approval in May from 60-70% to 30%. Source

- Vitalik Buterin said in a blog post that a simple hard fork could be enough to avoid a quantum attack on Ethereum. Source

- Tether’s USDT stablecoin is coming to the Celo blockchain after announcing a strategic partnership with the network. Source

- Tether has helped the US Department of Justice (DOJ) and the FBI recover $1.4 billion in USDT. Source

- Singaporean fintech company SafePal has launched a USDC-powered Visa card. Source

- MetaMask is testing a Mastercard payment card that will be the first entirely on-chain card. Source

- Ethereum and Solana staking ETPs are set to be listed on the SIX Swiss Exchange by Figment Europe and Apex Group. Source

- Ethereum could skyrocket to $10,000 and beyond in 2024 due to several catalysts, according to Bitwise. Source

- Pantera Capital is raising money to buy Solana tokens from the FTX estate for its Solana Fund. Source

- Solana-based DeFi protocol Kamino will launch its KMNO token airdrop in April. Source

- Avalanche has deployed its Durango upgrade and launched Teleporter to boost communication within its subnet ecosystem. Source

- Injective has launched its inEVM Layer-2 network on the mainnet. Source

- Fetch.ai has announced a $100M infrastructure program and GPU rewards for token holders. Source

- Astar has launched its zkEVM to become the first Layer-2 network to integrate into Polygon’s AggLayer. Source

- Telegram’s new advertising platform has gone live and Mirana Ventures has bought $8M of Toncoin tokens intended for product development within the ecosystem. Source

- Worldcoin has been ordered to stop collecting data in Spain and has been issued a 3-month temporary ban on its operations. Source

- Dogwifhat’s community is raising $650K to put the meme on the Vegas Sphere. Source

Macro News

- The US jobs report beat estimates, but the unemployment rate rose to 3.9%. Source

- The annual US inflation rate has unexpectedly increased from 3.1% to 3.2% in February. Source

- Fed Chair Jerome Powell has said the US is “nowhere near” issuing a CBDC and wouldn’t use it to spy on people. Source

- Jerome Powell has said the Fed is “not far” away from cutting interest rates but needs more confidence inflation will return to 2%. Source

- Sam Altman has returned to the OpenAI board of directors alongside three new members. Source

- The UK is establishing a regulatory approach that will allow cryptocurrencies, stablecoins and CBDCs to coexist. Source

- Sweden’s central bank chief has said Bitcoin is based on pure speculation and wants as little as possible in the country’s financial system. Source

- Hong Kong is set to launch Project Ensemble which is a wholesale CBDC to support tokenization. Source

- The Central Bank of Nigeria has partnered with blockchain infrastructure company Gluwa to promote its CBDC. Source

Thank you so much for your support, and I truly hope that today’s issue will give you insights needed to help you master your wealth.

If you are reading this it means you are on the free version of the Wealth Mastery Investor Report, which is great for news and tips on the crypto markets.

If you really want to take advantage of fastest growing asset class EVER, I highly recommend that you check out my new altcoin course: Mastering Altcoin Investing

In this course we’ll teach you all about how to spot, choose and acquire the winning altcoins of the next bull market.

Learn how to build your portfolio so that growth is ensured and risk is mitigated. Let me help you build a strategy that’ll change your life forever in the upcoming bull run.

See you next time!

Lark and the Wealth Mastery Team

💰 BINANCE: BEST EXCHANGE FOR BUYING CRYPTO IN THE WORLD 👉 10% OFF FEES & $600 BONUS

🚀 BYBIT: #1 EXCHANGE FOR TRADING 👉 GET EXCLUSIVE FEE DISCOUNTS & BONUSES

🔒 BEST CRYPTO WALLET TO KEEP YOUR ASSETS SAFE 👉 BUY LEDGER WALLET HERE

📈 TRADING VIEW: BEST CHARTING SOFTWARE ON THE INTERNET 👉 JOIN NOW

1️⃣ COINLEDGER: #1 CRYPTO TAX SOFTWARE 👉 IF YOU OWN OR TRADE CRYPTO YOU NEED THIS

Wealth Mastery (Lark Davis, and the Wealth Mastery writing team) are not providing you individually tailored investment advice. Nor is Wealth Mastery registered to provide investment advice, is not a financial adviser, and is not a broker-dealer. The material provided is for educational purposes only. Wealth Mastery is not responsible for any gains or losses that result from your cryptocurrency investments. Investing in cryptocurrency involves a high degree of risk and should be considered only by persons who can afford to sustain a loss of their entire investment. Investors should consult their financial adviser before investing in cryptocurrency.

You can find a full disclosure of all my crypto & venture investments here.