Chainlink CCIP: the Future TCP/IP of Finance?

TL;DR

Chainlink’s Cross-Chain Interoperability Protocol (CCIP) is incredibly ambitious and could indeed become a big deal. Chainlink’s new brainchild is destined to become a cross-chain standard, allowing different blockchains to safely move value across. It would make risky cross-chain bridges obsolete and put an end to fragmented liquidity across crypto. Besides crypto projects like Aave and Synthetix, tradfi banking giant Swift is running tests. Talking about ambition…

Introduced at the Ethereum Community Conference in Paris in mid-July 2023, the Cross-Chain Interoperability Protocol has entered the Mainnet Early Access phase. On Avalanche, Ethereum, Optimism, and Polygon.

According to Chainlink founder Sergey Nazarov, you can view CCIP as a protocol like TCP/IP for the internet. Just like TCP/IP decades ago, it unites a fragmented space, allowing developers to build cross-chain applications on top of it.

Solving Bridge Hacks

This solves a huge problem. Currently, the crypto landscape is characterized by a plethora of disjointed chains (or chain ecosystems) that largely function in isolation. CCIP’s goal is to establish a global standard that enables communication between these networks, allowing them to securely transfer data, assets, and smart-contract functionalities. This would be a relief to anyone who has ever bridged coins from one chain to the other. Bridge hacks have been a big problem in the recent bull market: roughly 2 billion dollars have been lost.

What is Chainlink Again?

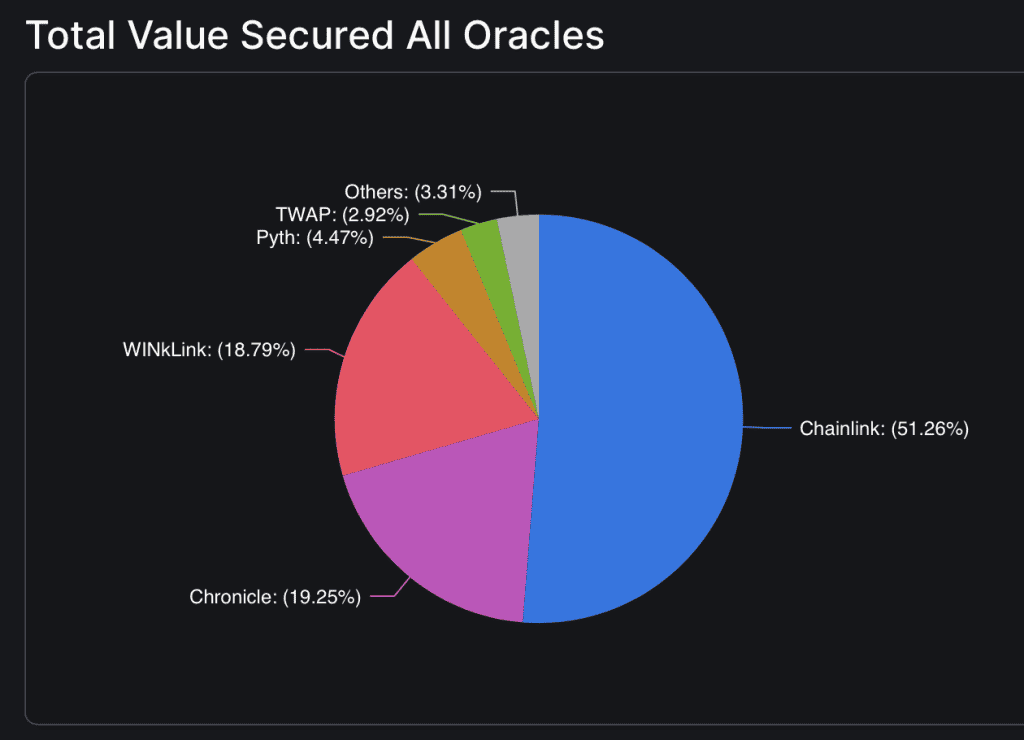

Chainlink is the best-known Oracle, or data provider, in the world of crypto. It is an information gatherer. It aims to support all blockchains with smart contract capability, by providing them with reliable, real-world data.

As you can see in the diagram below, it is by far the biggest oracle in terms of total value locked.

But Chainlink is more than just an oracle. With a nice war chest of LINK tokens, the Chainlink team has been continuously grinding out new projects. A big one that went live in closed beta in spring 2023 was Chainlink Functions. With it, Chainlink wants to connect decentralized blockchain applications (dApps) to Web2 applications (the ‘old’ internet). An example of a Chainlink Functions use case would be to pay musicians based on their stream counts.

And now there is CCIP: yet another example of Chainlink’s goal to integrate the world of blockchain and the real world.

Use Cases

In the blog post launching CCIP, the author names a list of use cases. Three pop out:

- Cross-chain tokenized assets: Transfer tokens across blockchains without having to build your own bridge solution.

- Cross-chain collateral: Launch cross-chain lending apps that allow users to deposit collateral on one blockchain and borrow assets on another.

- Cross-chain NFTs: Users can now mint an NFT on one blockchain and receive it on another chain.

Low Barrier to Entry

Since CCIP is built on the same foundation as existing Chainlink services, the barrier to entry is low. If a dApp already relies on Chainlink for price Feeds, then relying on CCIP for cross-chain interactions is an obvious choice.

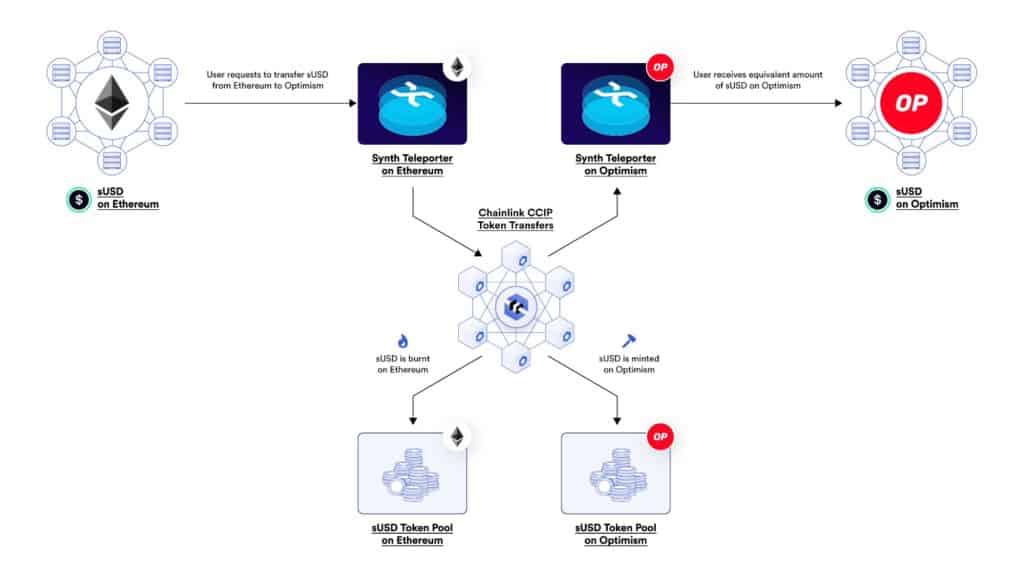

In fact, Synthetix is one of those dApps that has integrated CCIP.

Example: Token Transfers on Synthetix

Synthetix is a DeFi protocol that provides liquidity for an ecosystem of on-chain financial apps.

With the Synth Teleporter, it provides users with a streamlined method for transferring Synth liquidity between chains. This feature operates by burning sUSD (the protocol’s unit of account) on the source chain, then minting an equivalent amount of sUSD on the destination chain.

Synthetix is using CCIP to do this: transfer tokens across chains via a burn-and-mint model. With CCIP, Synth Teleporters now enable Synthetix liquidity to flow toward areas of highest demand, bypassing the constraints of traditional token bridges.

Tests with Swift – Will it Pump Our Bags?

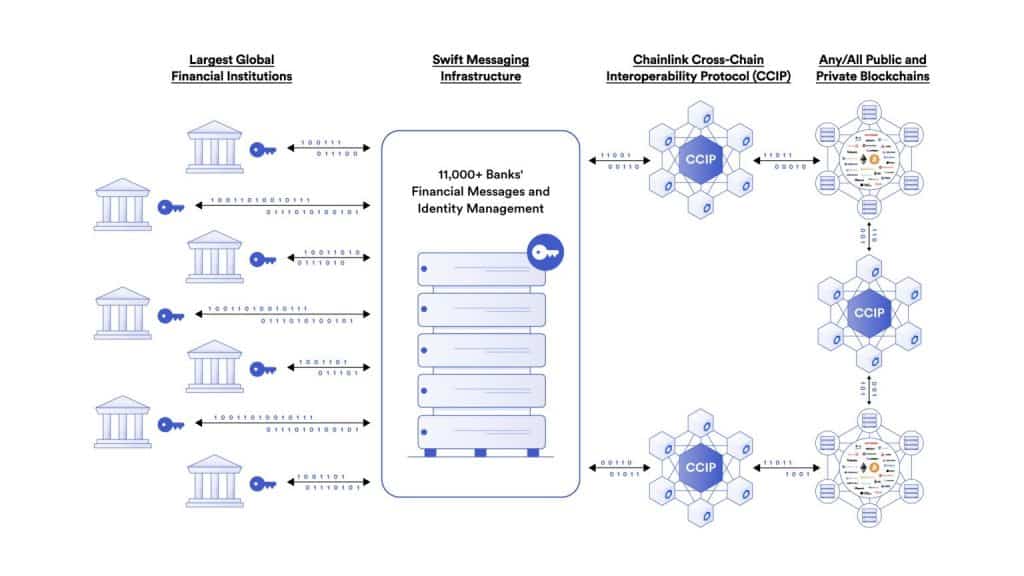

CCIP as a standard is applicable beyond public blockchains like Ethereum. Also, private blockchains, used by institutions, can use the technology. And that’s why the worldwide bank messaging system Swift has launched a test in partnership with Chainlink. Say what?

The tests build on existing Swift infrastructure, which powers the messages sent among global financial firms (more than 11.000 financial institutions worldwide are members). Chainlink’s technology will be used to move value between the institution’s private blockchains. But also between private and public chains like Ethereum. Participants in the testing will include Citi Bank, BNP Paribas, and BNY Mellon.

As you can see in this diagram, Chainlink’s new protocol is the interoperability layer between Swift’s messaging infrastructure and any blockchain.

“It’ll accelerate the amount of value that flows from banks into public chains, which will naturally increase the value within them, which should increase the total global market cap of our industry by trillions—and eventually tens of trillions,” Nazarov told Fortune.

Note that CCIP supports fee payments in LINK and in alternative assets, which currently take the form of native coins and their ERC20 wrapped version. In future upgrades, assets will be auto-converted to LINK. Will we see a world in which Citi Bank has to buy a stack of LINK to pay for their CCIP usage? It seems like a possibility.

If you are rubbing your eyes in disbelief, check out Swift’s own blog post about the collaboration: Swift explores blockchain interoperability to remove friction from tokenized asset settlement. In the post, two of the key assumptions are:

- The financial world is on a path to the tokenization of assets.

- Fragmentation of these assets across different blockchains is an issue that needs to be tackled.

Conclusion

Could CCIP become the most widely used connectivity standard? Not just for crypto but also for banks? In Chainlink’s founder Sergey Nazarov’s vision, CCIP will eventually merge these two large ecosystems into a single on-chain financial system that secures the world’s value.

These are huge ambitions, comparable to Amazon 25 years ago. Amazon started out as an online bookstore, Chainlink as a data provider for blockchain projects. But just like Amazon branched out beyond selling books and ended up selling cloud storage, so Chainlink’s ambitions go much beyond its original use case. It will be competing to become a dominant and irreplaceable part of the fabric of the crypto economy.

Will Chainlink pull it off? Will CCIP become a standard that the whole industry can embrace? The hard part of introducing a standard is to get it accepted. What Chainlink has going for it that is that it already built the industry-defining secure standard for Data in Web3. It is held in high esteem. If Chainlink pulls it off, building this standard, there is no going back and Chainlink and its LINK token will be set for life.