Bitcoin as a Central Bank Reserve Asset?

TLDR: Owning Bitcoin as a reserve asset is no longer unthinkable for nation-states that want to become more sovereign. A recent proposal in Switzerland to put BTC on the central bank balance sheet again brought this to our attention. A Harvard research paper suggests that, from a risk-reward perspective, putting BTC in central bank’s treasuries can be beneficial, especially for countries that might face sanctions.

Before you click away because of the apparent absurdity of such a statement, think about the following: many countries already hold Bitcoin. Even though, for example, the United States doesn’t have a strategy to acquire Bitcoin, they sometimes hold Bitcoin for longer stretches of time. After seizure in law enforcement actions, for example, they will often postpone auctioning off the confiscated BTC for quite long.

This signifies something. After all, they won’t auction off batches of confiscated cocaine – they will unceremoniously destroy those. The fact that they don’t have the same policy with BTC tells you something: it’s viewed as a legitimate financial asset. But that doesn’t automatically make it a reserve asset.

Background of Reserve Assets

Central banks of Russia, Iran, Syria, North Korea, and Venezuela are under US sanctions. You might agree or not. But the fact remains that the ability of fiat reserve issuers to freeze transactions calls into question fiat reserve currencies’ status as ‘safe-haven’ assets and thus reserve assets. No central bank likes to see the US ‘push a button’ and nullify their US dollar holdings.

But how did we even get to a situation where central banks of many countries hold US dollars as a reserve asset?

Nations have traditionally (since the post-World War 2 era) held dollars or US Treasuries as a reserve asset. Why? In the early post-WW2 decades, these dollars could be exchanged for a fixed amount of gold. After the Nixon shock in 1971 – the de-pegging of the dollar from gold – the dollar became – unofficially – backed by oil. Oil was priced in dollars and the US guaranteed that the oil from Arab nations could keep flowing in abundance. So nations were comfortably holding dollars: it was an ‘energy currency’ that could be ‘exchanged for oil’ at a more or less fixed rate. This is called the petrodollar era.

But then, in the early stage of the Russia-Ukraine war in 2022, US President Joe Biden announced the seizure of foreign exchange reserves of the Central Bank of Russia. It was an aggressive – and many would argue thoughtless – move to weaponize the US dollar system.

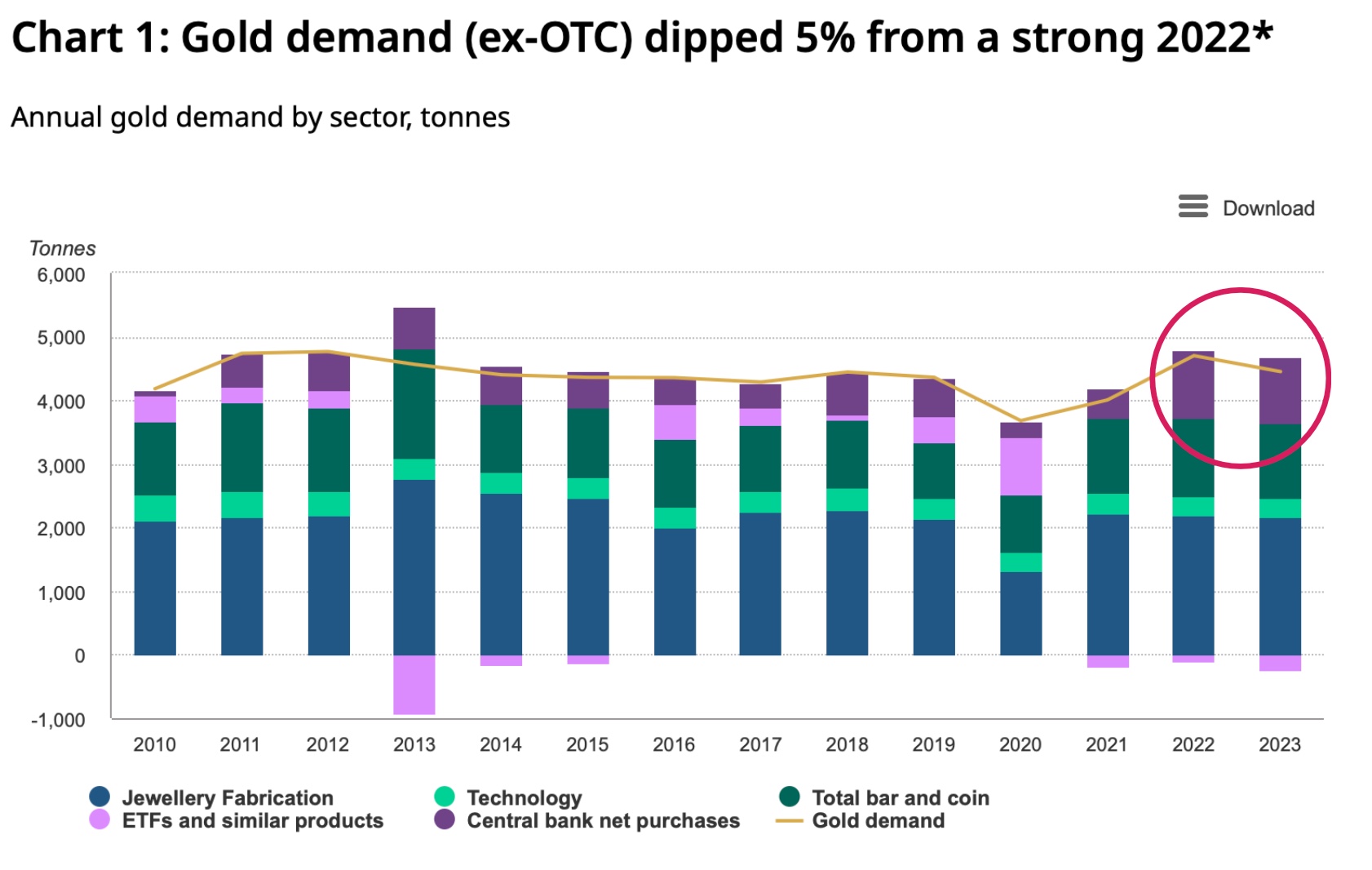

Why thoughtless? Because it will undermine the US dollar’s nature as a global reserve currency. Many powers will no doubt have scratched their heads: what are our dollars worth if our relationship with the USA sours? Will they freeze their reserves for political reasons in the future? Maybe it’s no wonder that net gold inflows to central banks spiked dramatically in 2022 and 2023…

Nation States Already into BTC

So what about Bitcoin, ‘digital gold’ after all? Well, on the mining front things are in flux. Countries such as Bhutan, the UAE, El Salvador, and Russia are leading the charge in state-sponsored Bitcoin mining. But, as far as we know, it’s not in their central bank reserves.

Recently came the tantalizing announcement of pro-Bitcoin advocates in Switzerland petitioning the Swiss National Bank (SNB) – to include Bitcoin as a reserve asset.

The initiative is led by the founder and chairman of 2B4CH, a Swiss pro-Bitcoin think tank. They have tried this before, in 2022, and it isn’t very likely that the Swiss government will take them up on their advice. But it’s worth considering that for Switzerland of all European countries, it would probably make the most sense. It has historically prided itself on its sovereignty and Bitcoin is the tool for sovereign entities.

El Salvador

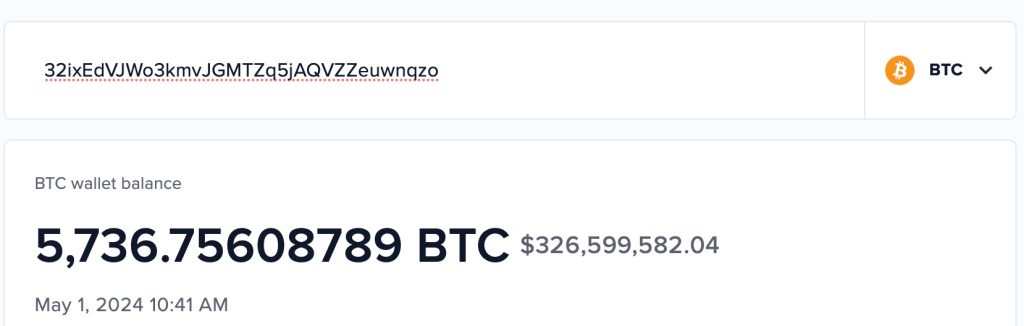

Famously, there is currently one country that openly and strategically holds Bitcoin: El Salvador. President Bukele in March 2024 said his country’s bitcoin holdings had been moved to cold storage and published the address of its bitcoin wallet. That wallet currently shows 5736 BTC. The country purchases one bitcoin per day, and also adds coins via, for example, the sale of passports.

El Salvador also introduced a law in December granting citizenship to Bitcoin investors who make a donation to the government.

Ferranti’s Paper Modelling BTC in Reserves of Central Banks

Of course, most nation-states won’t just ape into Bitcoin. They need some backing by research. Maybe they can have a look at what Harvard Ph.D. Candidate Matthew Ferranti wrote: Hedging Sanctions Risk: Cryptocurrency in Central Bank Reserves.

“Central banks may shift their international reserve holdings in order to protect themselves ex-ante against the risk of financial sanctions by fiat reserve currency issuers.”

The thesis argues that in an age of increasing monetary sanctions, central banks of countries want to rely less on US treasuries and dollars and more on gold. After all, these dollars can be made worthless by the USA, as we talked about above.

So why should these governments care for Bitcoin, or crypto in general? Can’t other governments sanction wallet addresses? Yes, they can. But: ‘As long as the issuers of fiat currency do not control the blockchain itself, sanctioned individuals can continue to send cryptocurrency from one wallet to another.’

Based on variables like the level of sanctions risk, risk aversion and estimated returns of gold and Bitcoin, the author proposes some portfolio allocations for central banks.

BTC Percentages in Different Portfolios

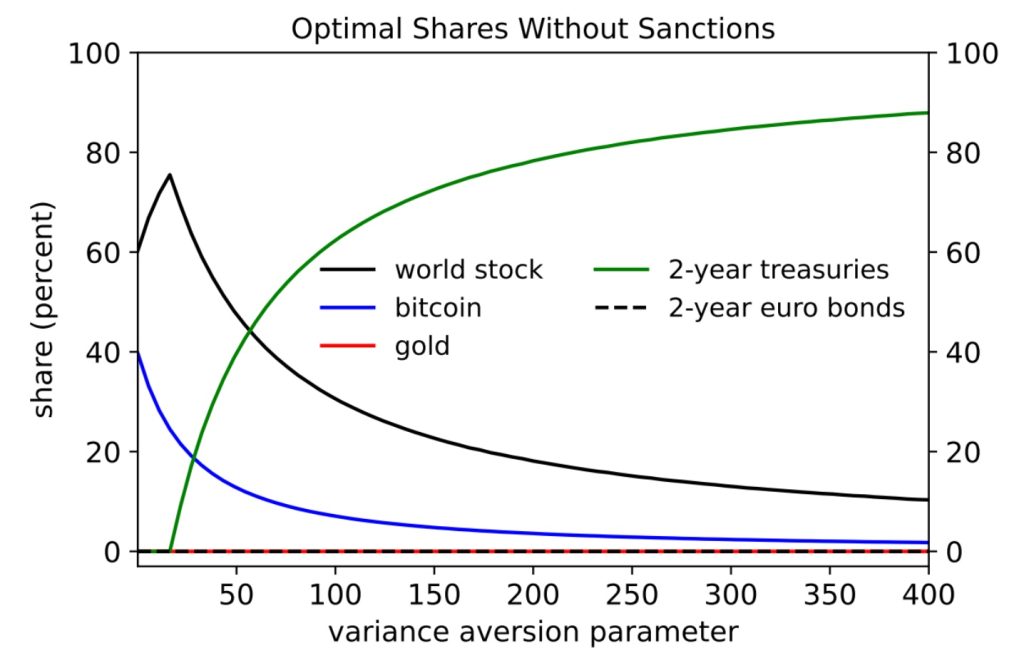

In the final part of the paper Ferranti discusses the results of portfolio optimization analyses with and without sanctions, utilizing different risk measures to evaluate optimal asset allocations for a central bank.

He considers five potential reserve assets:

- Bitcoin

- Gold

- 2-year US Treasury bonds

- 2-year Euro bonds

- A global market capitalization-weighted stock index.

The analysis shows that without the threat of sanctions, central banks would according to this model prefer a mix of safe assets like US Treasuries and risky assets (stocks and cryptocurrencies) with no allocations to Euro bonds or gold, provided Treasuries offer a positive real rate. Central banks that are not risk-averse could opt for a BTC allocation of higher than 10%. And even highly risk-averse investors maintain a small percentage in Bitcoin (see figure below).

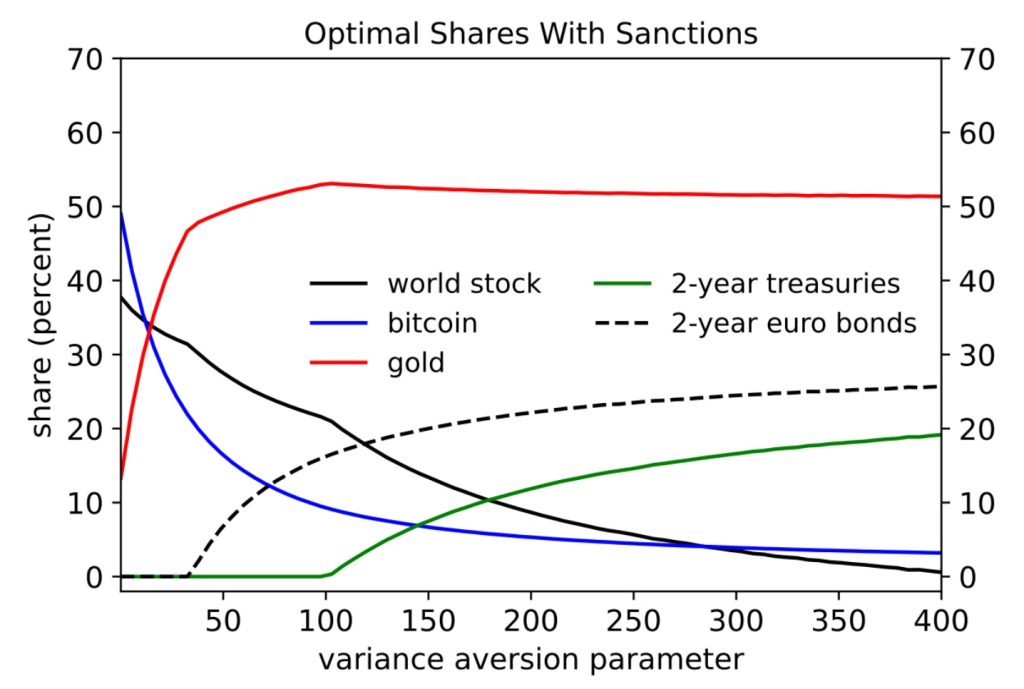

When at risk of sanctions, central banks according to this model would significantly diversify their portfolios to include all asset types, showing a preference for gold and increasing allocations in Euro bonds over US Treasuries due to lower sanctions risk. Bitcoin allocation also increases, reflecting its perceived utility as a hedge against sanctions.

Central banks of high sanctions-risk countries, provided they are fine with volatility, might opt for a BTC allocation as high as 40-50%! And even volatility-averse central banks in these ‘risky’ countries could settle for a BTC allocation as high as 5% or so.

The models show that reserve management in a politically unstable global environment suggests diversification into digital assets could be a strategic move for central banks facing high sanctions risk.

Hash Wars Between Nation States?

A somewhat related line of thinking, but taking it a step further, comes from Jason Lowery, employed at MIT and the United States Space Force. He looks at the invention of Bitcoin from the perspective of someone who is in the military. In his thesis: Soft war: How Bitcoin could create an unprecedented era of peace by creating an unprecedented form of war he argues that Bitcoin has national strategic security benefits.

He envisions a path towards hyperbitcoinization. In such a world, where Bitcoin is the world reserve currency, the only logical choice for countries would be to engage in a peaceful arms race, mining as much Bitcoin as they can. In this view, wars will be fought no longer in the physical space but in the virtual world. Deploying computer power instead of shooting rockets. Very speculative, of course. Read more in my article: Soft war or Limp War: How Likely is it that Nation States Will Engage in Hash Wars?

Conclusion

While it remains to be seen if more central banks will put BTC in their reserves, it is becoming clear that discussions are being normalized. The mere idea of putting BTC on a bank balance sheet would have been preposterous only a year or five ago, at least in the eyes of ‘respectable’ analysts. Viewed through the lens of an increasingly unstable world with a higher risk of sanctions for an increasing number of countries, traditional central bank reserve assets will have to be reconsidered. Central banks of countries that are more likely to bear the brunt of sanctions could, according to Ferranti’s modeling, increase their holdings of gold and BTC. Even if they are averse to volatility, a 5% or so allocation to BTC is modeled to be beneficial for countries with a high sanctions risk.