Crypto Index Funds: How to Get Exposure to Crypto in Traditional Markets

TL;DR

We all love buying coins on our favorite exchange or dex, hopefully even self-custody part or all of it. But buying coins is not for everyone (hi dad!). What are our traditional options to get exposure to the rising tides of the crypto ecosystem? Here’s an overview of the options, ranging from single stocks to crypto-minded ETFs and crypto index funds.

Even for seasoned crypto natives, there are good reasons to invest part of your portfolio in funds through your tradfi broker. Buying a coin is like picking a stock. But sometimes you are agnostic and just want exposure to the industry. Buying a crypto fund is like buying a stock index fund, a strategy that has proven profitable for stocks. It’s hard to beat the index.

Also, it makes strategic sense to avoid a single point of failure. Sure, self-custodying your crypto is a good idea. But it is also common sense to maybe not trust yourself with the entirety of your coins. Exchanges then? But these can blow up too, as we know all too well. Whereas a publicly traded stock or ETF can give you exposure to crypto prices in a regulated environment, with regulatory oversight.

We won’t discuss the BTC spot ETF here but will focus on other vehicles: stocks and ETFs.

Stocks with Highest Crypto Exposure

Let’s start with old-fashioned stocks. In the way that gold mining companies will benefit from rising gold prices, companies that mine BTC will benefit from a bull market. Bitcoin miners are the obvious category of companies that benefit from rising crypto prices. Another category is exchanges. Coinbase is the only US-listed crypto exchange.

Morningstar analysts distinguishes six categories by virtue of which companies can be involved in crypto:

- Technology provider (for example, Alphabet)

- Fintech (For example, Coinbase)

- Payment platforms (for example, PayPal)

- Mining (for example, Marathon Digital)

- Hardware (for example, Taiwan Semiconductor)

- Asset owners (for example, MicroStrategy)

For every major stock, Morningstar analyzed to which degree it is exposed to crypto in one or more of the above ways.

Publicly Listed Stocks COIN, MSTR

Before we dive into funds, we should briefly pause at two stocks in particular: Coinbase and MicroStrategy. The reason is that these NASDAQ-listed stocks offer far from watered-down exposure to the crypto market. On the contrary: they can even offer outsized returns.

Why? Let’s start with Coinbase (COIN). Owning Coinbase stock is somewhat like owning a cryptocurrency index fund. As Coinbase benefits from trading activity in 200+ coins, its revenue benefits from pumps in all coins. As an exchange, Coinbase performs best in bull markets. In 2023 it was up 450%, more than BTC and more than the crypto market as a whole.

MSTR

MicroStrategy is acting a bit like a leveraged Bitcoin ETF. It outperforms BTC, especially in times of rising prices. MicroStrategy (MSTR) is a Nasdaq-listed software company that owns a shit ton of Bitcoin.

Since the adoption of its BTC strategy, its share price has had a higher correlation with Bitcoin’s price than with its industry peers (software companies). Why is it a levered bet and why are the price spikes to both the upside and downside higher? A part of the reason is that MSTR buys BTC with its profits, shares and debt. This means that buying a share means buying more than Bitcoin: it means buying a strategy to buy as much BTC as possible in the future.

Another reason that MSTR outperforms BTC in uptrends is that until the spot BTC ETF approval, institutional exposure to Bitcoin was only available through a few vehicles: The Grayscale Bitcoin Trust (GBTC) and MicroStrategy

There is of course a caveat with owning individual stocks in order to get exposure to crypto. Very simply put: they can go broke. They can go to zero, even if crypto moons.

Equity ETFs with Exposure to Digital Assets

Now let’s move from stocks to funds. There are tons of ETFs with exposure to digital assets, Web3, crypto, blockchain, you name it. They can be a really decent bet, as we’ll see.

When you inspect the holdings of some Web3/Blockchain/Digital Assets ETFs, you’ll at first scratch your head. They’re very vanilla for investors who are used to buying coins. Sure, they often include Coinbase in their portfolio, but you will also find names such as SAP, IBM and Accenture. Why is that?

Well, these funds have a much broader view of what constitutes exposure to blockchain technology than you and I would. Take the fund with the ticker BLOK (the Amplify Transformational Data Sharing ETF):

“BLOK does not invest directly in blockchain technology, but invests in companies actively involved in the development and utilization of blockchain technology.”

IBM, for example, apparently holds many patents related to blockchain technology. That qualifies it for being included.

How has BLOK done in the recent uptrend, since the 2022 bear market bottom?

The BLOK ETF has done nicely, actually. It hasn’t kept up with BTC (orange) but has outperformed the Nasdaq by a 2x. Very decent. Looking at the top 3 holdings of BLOK, you’ll understand why. It holds:

- Coinbase

- Microstrategy

- Marathon Digital

Morningstar’s Classification of Traditional Funds with Crypto Exposure

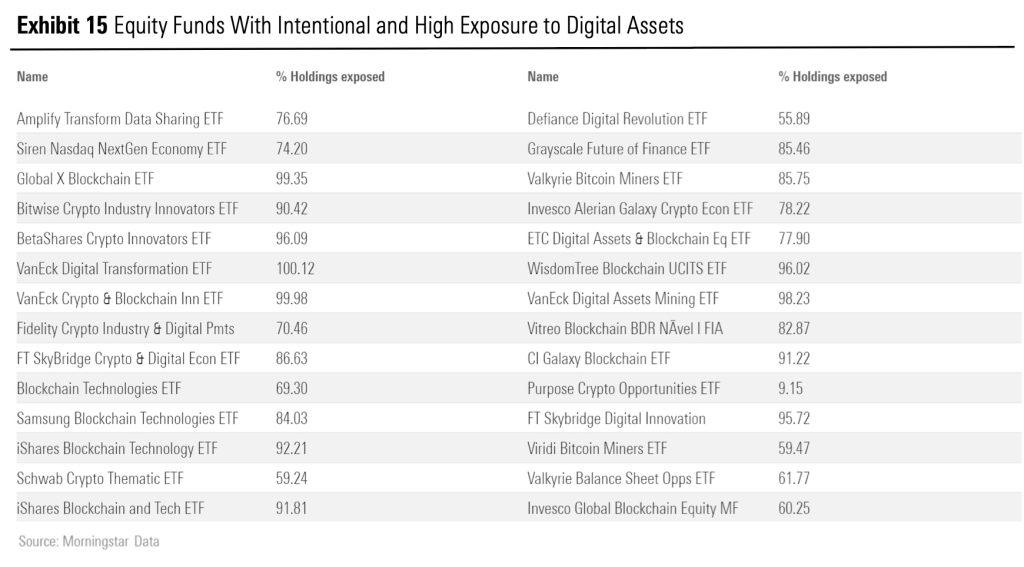

BLOK was just an example of a crypto-minded ETF. Financial services firm Morningstar identified more than two dozen ETFs with intentional exposure to digital assets—that is, funds that explicitly have stated it as their fund name and strategy that they want exposure to crypto/Web3.

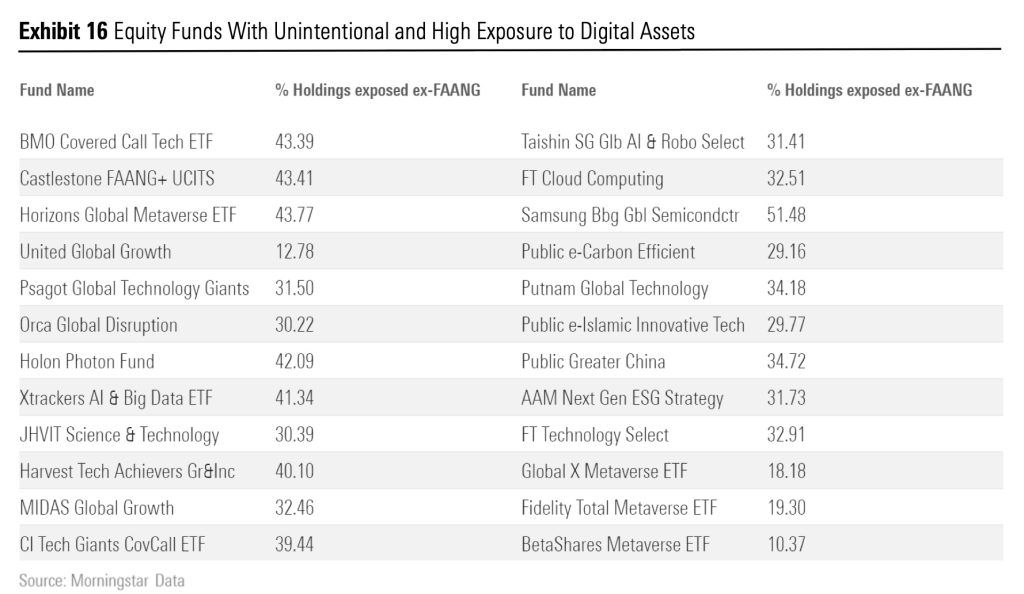

Morningstar also made a list of funds with a high but unintentional/unstated exposure to digital assets. In these cases, the funds have a high exposure to digital assets without being explicit about it.

Here’s the list. The percentages shown are the exposure of these funds to crypto after subtracting their investment in the FAANG stocks (Facebook, Amazon, Apple, Netflix, Google).

So, these are funds that invest in technology stocks beyond FAANG. But also, metaverse ETFs that track a metaverse index.

Crypto Indices

So far, we haven’t really gotten close to actually buying coins. Are there ETFs that track crypto prices directly? Well, it isn’t for a lack of crypto indices.

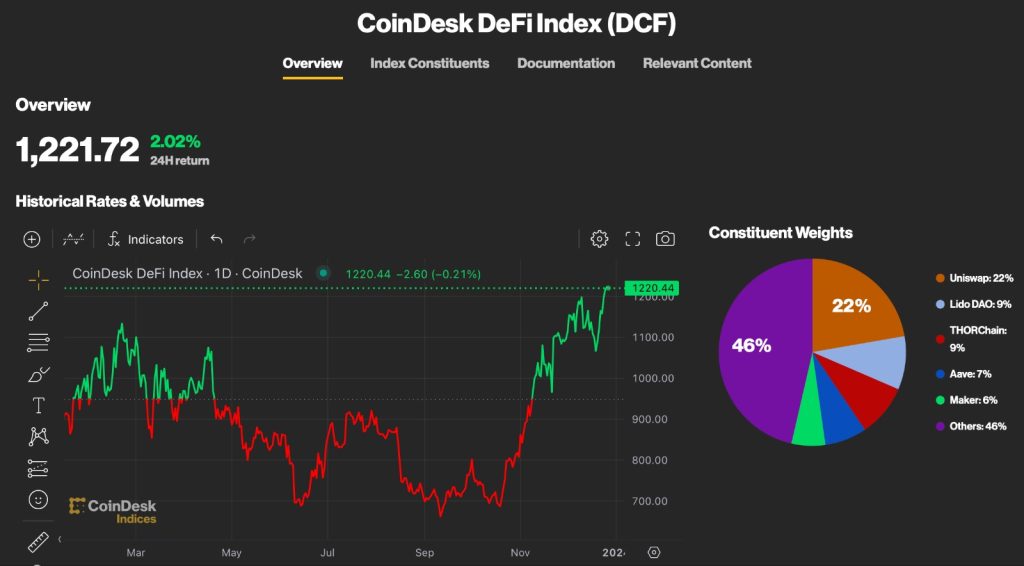

Take the Coindesk indices. Media company Coindesk has a family of indices. Besides the broad market index, there are subindices that can help investors ‘measure sector exposures […] versus their benchmarks […]. Moreover, the sector subindices seek to measure performance of sector-focused funds that can be used to build sector rotation strategies.”

For example, you can have a look at the following Coindesk subindices:

- Coindesk DeFi Index (DCF): top holdings are UNI, LDO and RUNE.

- Coindesk Computing Index (CPU): designed to measure the market capitalization-weighted performance of computing protocols. The top 3 holdings are LINK, FILE and RNDR.

Crypto Index Funds

So, plenty of indices. You would expect – or at least hope – to be able to buy dozens of crypto index funds tracking these indices through your tradfi account. After all, we’re used to buying sector-specific ETFs for stocks.

But this is unfortunately not the case for crypto. You can’t buy into a fund, for example, that tracks one of the above Coindesk indices. Funds such as Galaxy Crypto Index Fund exist, but they are for accredited investors. The same goes for the Nasdaq Crypto Index Fund (NCI).

It turns out there are no publicly traded crypto index funds for the American market.

Bitwise 10 Crypto Index Fund

A prominent cryptocurrency index fund is the Bitwise 10 Crypto Index Fund (BITW). At the time of writing, it has 700 million dollars under management. With 2.5%, the expense ratio is high. BITW holds the top 10 coins excluding stablecoins. The fund is rebalanced on a monthly basis.

Bitpanda’s Crypto Index, eToro’s Smart Portfolios

Let’s go out of scope a bit.

If you trust crypto exchanges and trading platforms with your investments, there are yet other ways to get exposure to a basket of coins. eToro is an example, EU crypto exchange Bitpanda is another. Fintech app EmberFund is a third. These offer let’s say synthetic crypto funds. They aren’t subject to the same regulatory requirements as the publicly traded BITW crypto index fund.

Bitpanda offers the Bitpanda Crypto Index, which is an easy and automated way to invest in the entire crypto market. The index automatically adjusts its weighting over time (monthly), according to data provided by MarketVector Indexes. So Bitpanda Crypto Index is not an ETF but behaves like one.

Trading and investing app for stocks and crypto eToro offers a proxy to crypto index fund, namely Smart Portfolios. They let you allocate to a basket of coins curated by eToro. They rebalance yearly, which isn’t so often. eToro has for example a general crypto portfolio, which has 20 coins. As it only rebalances once per year, the December 2023 portfolio still contains coins such as QNT and ETC, which have fallen out of the top 20. Still, this portfolio will track the total crypto market cap pretty accurately. And there are no fees. eToro also has thematic portfolios such as a DeFi portfolio and a Metaverse portfolio. The latter is a blend of stocks and crypto investments.

EmberFund does something similar. It’s a crypto/fintech app that lets you not only invest in coins but also in their crypto indices. Fees are 3%.

Conclusion

There are quite a few ways to get exposure to the growing crypto market without buying coins on an exchange. You can buy individual stocks, ETFs that have crypto-minded stocks in their portfolio, and, only for accredited investors, there are crypto ETF that tracks a crypto index.